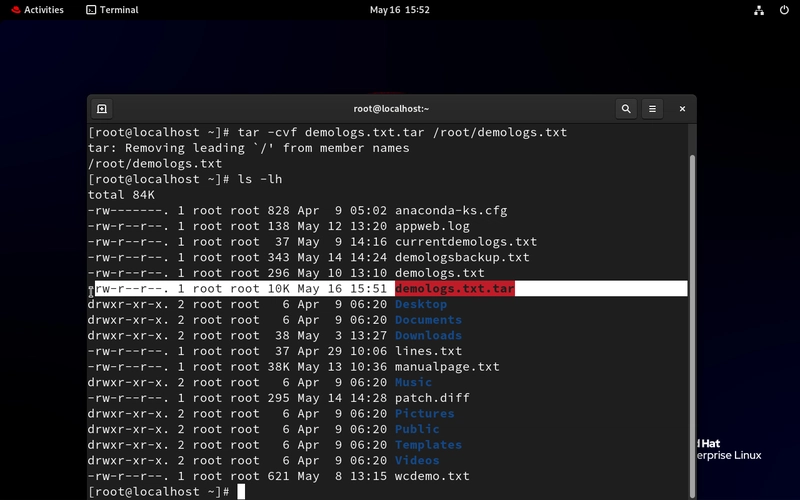

Real-World Asset Tokenization: Introduction

Hello, everybody! At Info-Polus, we see the opportunities RWA tokenization presents. Today, let's dive into it! The crypto bull market is not only driving up the large, established cryptocurrencies such as Bitcoin and Ethereum. Memecoins such as Dogecoin (DOGE), Pepe, and Shiba Inu, which have a lower market capitalization and are particularly volatile, have recently attracted great attention with impressive price rallies. By contrast, the increases in real world assets (RWA) have attracted less public attention - although many experts believe this crypto segment has excellent prospects… So what lies in RWA? As the name itself suggests, Real World Assets represent tangible and other assets existing in the “real world” (real estate, exchange-traded commodities, art objects) tokenized for use in the DeFi segment. The growing interest in tokenizing real-world assets stems from the promise of greater transparency, security, and global market reach. Let the numbers speak for themselves: the DeFi industry has boomed over the past few years, peaking at $181.22 billion in total value locked (TVL) on December 2, 2021. According to DefiLlama, RWA is steadily carving out its space in this ecosystem, with a TVL exceeding $8 billion in January 2025. Interested in what the future of RWA holds for us? Read more in our blog here!

Hello, everybody! At Info-Polus, we see the opportunities RWA tokenization presents. Today, let's dive into it!

The crypto bull market is not only driving up the large, established cryptocurrencies such as Bitcoin and Ethereum. Memecoins such as Dogecoin (DOGE), Pepe, and Shiba Inu, which have a lower market capitalization and are particularly volatile, have recently attracted great attention with impressive price rallies.

By contrast, the increases in real world assets (RWA) have attracted less public attention - although many experts believe this crypto segment has excellent prospects…

So what lies in RWA?

As the name itself suggests, Real World Assets represent tangible and other assets existing in the “real world” (real estate, exchange-traded commodities, art objects) tokenized for use in the DeFi segment. The growing interest in tokenizing real-world assets stems from the promise of greater transparency, security, and global market reach.

Let the numbers speak for themselves: the DeFi industry has boomed over the past few years, peaking at $181.22 billion in total value locked (TVL) on December 2, 2021. According to DefiLlama, RWA is steadily carving out its space in this ecosystem, with a TVL exceeding $8 billion in January 2025.

Interested in what the future of RWA holds for us? Read more in our blog here!

![Epic Games: Fortnite is offline for Apple devices worldwide after app store rejection [updated]](https://helios-i.mashable.com/imagery/articles/00T6DmFkLaAeJiMZlCJ7eUs/hero-image.fill.size_1200x675.v1747407583.jpg)

![[The AI Show Episode 146]: Rise of “AI-First” Companies, AI Job Disruption, GPT-4o Update Gets Rolled Back, How Big Consulting Firms Use AI, and Meta AI App](https://www.marketingaiinstitute.com/hubfs/ep%20146%20cover.png)

.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

![[Virtual Event] Strategic Security for the Modern Enterprise](https://eu-images.contentstack.com/v3/assets/blt6d90778a997de1cd/blt55e4e7e277520090/653a745a0e92cc040a3e9d7e/Dark_Reading_Logo_VirtualEvent_4C.png?width=1280&auto=webp&quality=80&disable=upscale#)

-xl-(1)-xl-xl.jpg)

![‘Apple in China’ book argues that the iPhone could be killed overnight [Updated]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2025/05/Apple-in-China-review.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![What’s new in Android’s May 2025 Google System Updates [U: 5/16]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2025/01/google-play-services-1.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![iPhone 17 Air Could Get a Boost From TDK's New Silicon Battery Tech [Report]](https://www.iclarified.com/images/news/97344/97344/97344-640.jpg)

![Vision Pro Owners Say They Regret $3,500 Purchase [WSJ]](https://www.iclarified.com/images/news/97347/97347/97347-640.jpg)

![Apple Showcases 'Magnifier on Mac' and 'Music Haptics' Accessibility Features [Video]](https://www.iclarified.com/images/news/97343/97343/97343-640.jpg)

![Sony WH-1000XM6 Unveiled With Smarter Noise Canceling and Studio-Tuned Sound [Video]](https://www.iclarified.com/images/news/97341/97341/97341-640.jpg)

![Apple Stops Signing iPadOS 17.7.7 After Reports of App Login Issues [Updated]](https://images.macrumors.com/t/DoYicdwGvOHw-VKkuNvoxYs3pfo=/1920x/article-new/2023/06/ipados-17.jpg)

![Apple Pay, Apple Card, Wallet and Apple Cash Currently Experiencing Service Issues [Update: Fixed]](https://images.macrumors.com/t/RQPLZ_3_iMyj3evjsWnMLVwPdyA=/1600x/article-new/2023/11/apple-pay-feature-dynamic-island.jpg)