OYO targets $6–$7B valuation, preps for third IPO attempt

The SoftBank-backed firm has invited pitches from investment bankers next week and is aiming to file its draft red herring prospectus between August and September of this year.

SoftBank-backed OYO is back in the market for its third attempt to list on public bourses, a source familiar with the matter told YourStory.

Oravel Stays, the parent entity of the company, has invited pitches from investment bankers next week and is targeting to file its draft red herring prospectus (DRHP) between August and September of this year, the source added.

Additionally, the company is targeting a valuation of $6 to $7 billion for the public offering.

PTI was the first to report on this development.

The company will hold discussions with its board and SoftBank in June during its scheduled board meeting in London, the source said.

In May, Bloomberg had reported that the hotel aggregator had pushed back its public listing plans after facing setbacks from SoftBank, the company’s largest investor. OYO was reportedly asked to push back its IPO until it showed stronger financial improvement.

According to Tracxn data, SoftBank holds a 40.5% stake in the company.

The renewed push to list on Indian stock exchanges comes weeks after OYO’s founder Ritesh Agarwal told employees that the company had become the most profitable Indian startup with a profit after tax of Rs 623 crore in the 2024-2025 financial year, PTI had reported.

Additionally, Bloomberg had reported that Agarwal had pushed for a quick IPO to meet the conditions of a restructured $2.2 billion loan he had secured in 2019 to increase the stake in his firm.

The Gurugram-based company had made its first attempt to list back in 2021. It had made one more attempt to list, only to withdraw its draft IPO papers in May last year.

OYO’s attempt to list comes amidst a rising line of venture-backed firms looking to list on public bourses, which includes Urban Company and omnichannel jewellery retailer BlueStone, among others.

Edited by Jyoti Narayan

![[The AI Show Episode 150]: AI Answers: AI Roadmaps, Which Tools to Use, Making the Case for AI, Training, and Building GPTs](https://www.marketingaiinstitute.com/hubfs/ep%20150%20cover.png)

![[The AI Show Episode 149]: Google I/O, Claude 4, White Collar Jobs Automated in 5 Years, Jony Ive Joins OpenAI, and AI’s Impact on the Environment](https://www.marketingaiinstitute.com/hubfs/ep%20149%20cover.png)

![[DEALS] The All-in-One CompTIA Certification Prep Courses Bundle (90% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![How to Survive in Tech When Everything's Changing w/ 21-year Veteran Dev Joe Attardi [Podcast #174]](https://cdn.hashnode.com/res/hashnode/image/upload/v1748483423794/0848ad8d-1381-474f-94ea-a196ad4723a4.png?#)

_ArtemisDiana_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Satechi launches OnTheGo 3-in-1 charger with compact design & Qi2 support [Video]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2025/04/ONTHEGO_3in1_APLUS_MODULE4_Banner2_Sand_desktop.jpeg?resize=1200%2C628&quality=82&strip=all&ssl=1)

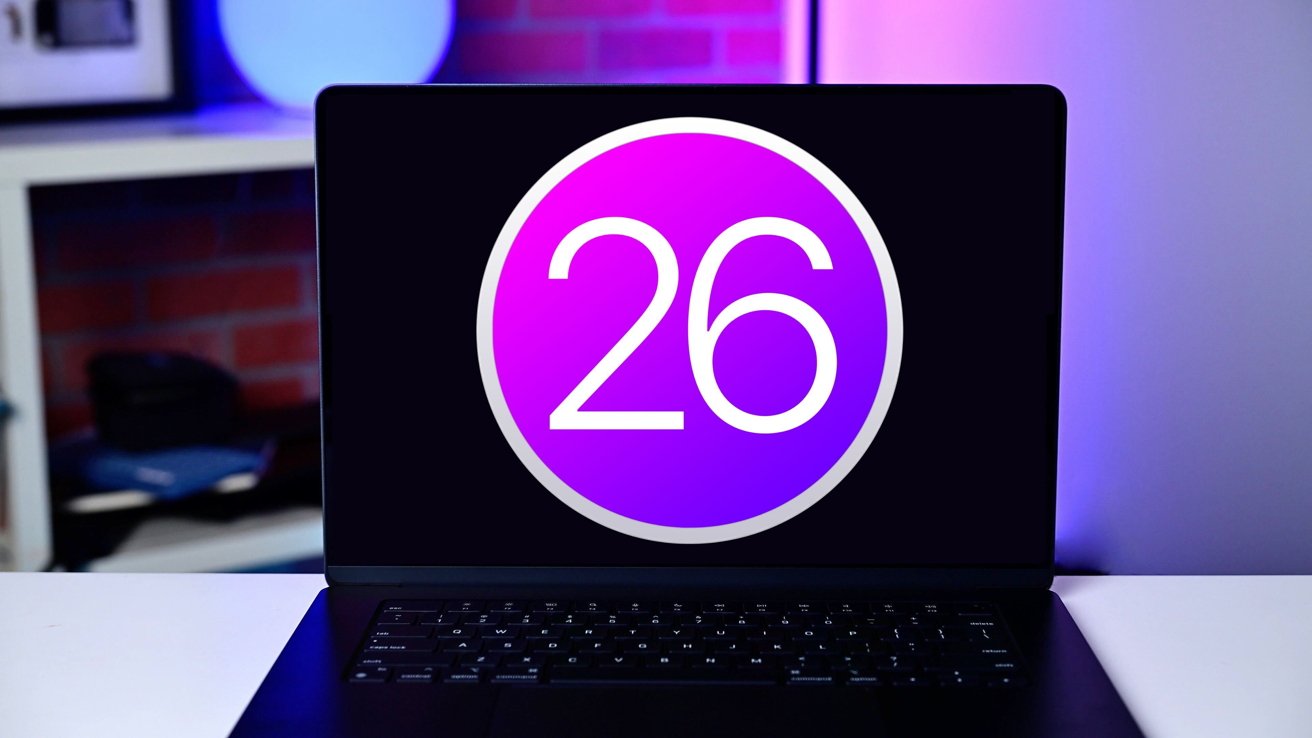

![Apple to Name Next macOS 'Tahoe,' Switch to Year-Based OS Names Like 'macOS 26' [Report]](https://www.iclarified.com/images/news/97471/97471/97471-640.jpg)

![Sonos Father's Day Sale: Save Up to 26% on Arc Ultra, Ace, Move 2, and More [Deal]](https://www.iclarified.com/images/news/97469/97469/97469-640.jpg)