"Financial Education And Why It Matters...

Financial Education and Why It Matters By JaysWebDev83 PART 1 Chapter 1: What Is Financial Education? Financial education is the ability to understand and manage money wisely. It's about gaining the knowledge and skills to make smart decisions related to earning, spending, saving, borrowing, investing, and planning for the future. While it might sound technical, it’s actually practical and essential for everyday life. You don’t need to be wealthy or an economist to be financially educated. You just need to understand how money works — and how to make it work for you. Key Aspects of Financial Education: Budgeting – Knowing where your money is going each month. Saving – Setting money aside for goals and emergencies. Debt Management – Understanding interest and repayment strategies. Investing – Learning how to grow wealth through assets like stocks and real estate. Retirement Planning – Preparing financially for your later years. Risk Protection – Using insurance and emergency funds to reduce vulnerability. Goal Setting – Aligning your money choices with your personal values and future. Think of financial education as learning to drive — you don’t need to know everything under the hood, but you do need to steer safely and avoid crashes. Chapter 2: Why Financial Literacy Matters Being financially literate changes lives. It reduces stress, increases independence, and allows you to make choices based on goals, not fear or desperation. Here’s Why It Matters: You Make Smarter Decisions You’ll compare mortgage options, understand how credit works, and read financial terms with confidence. You’re Ready for the Unexpected Whether it's a job loss, car repair, or hospital bill, financially literate people are better prepared to respond — not panic. You Stress Less About Money Financial insecurity is one of the biggest causes of stress. Knowing you’re in control improves mental well-being. You Build Long-Term Wealth With basic financial knowledge, even low earners can start to save, invest, and build security over time. You Break the Cycle For families stuck in generational poverty, financial education is a way out — especially when shared across generations. Money isn’t everything — but knowing how to manage it gives you the freedom to focus on what truly matters. Chapter 3: Barriers to Financial Literacy If financial education is so powerful, why do so many people lack it? Because many systems are stacked against it. The Most Common Barriers: Lack of Early Education Most schools don’t teach personal finance. Young people enter adulthood without knowing how to budget, use credit, or file taxes. Too Much (or Bad) Information The internet is flooded with financial advice — but much of it is outdated, wrong, or trying to sell something. Feeling Overwhelmed or Ashamed Many people avoid learning about money out of fear or embarrassment. They think it’s “too late” or “too complicated.” Predatory Practices From payday loans to unclear bank fees, many financial systems profit from people’s confusion or desperation. Systemic Inequality Marginalized communities often lack access to safe banking, fair credit, and trustworthy financial education. The good news? No matter your age or background, you can start learning today. Chapter 4: Getting Started with Financial Education You don’t need to be perfect to begin — you just need to start. Financial literacy is a journey, and the best way to learn is step by step. Practical First Steps: Track Your Spending for 30 Days Use a notebook or app to write down every expense. Awareness is the first step to control. Read One Beginner Finance Book or Blog Suggestions: The Psychology of Money by Morgan Housel Rich Dad Poor Dad by Robert Kiyosaki Blogs like NerdWallet or The Financial Diet Download a Budgeting App Try Mint, YNAB, or PocketGuard Start an Emergency Fund Aim for $500 to start. Keep it separate from your checking account. Watch or Follow Free Educators Follow people like Graham Stephan (YouTube), Clever Girl Finance, or Khan Academy's personal finance series. Take a Free Online Course Sites like Coursera or Khan Academy offer beginner-friendly, free content. Don’t worry about doing it all at once. Start with what you can today. Every small step counts. PART 2 Chapter 5: Recommended Resources There’s no shortage of excellent (and free!) financial resources out there. Here are some top picks to build your knowledge without overwhelm: Books (Beginner-Friendly & Powerful) The Millionaire Next Door by Thomas J. Stanley – Lessons from people who quietly build wealth. I Will Teach You to Be Rich by Ramit Sethi – A straightforward system for managing money and living life on your terms. Broke Millennial by Erin Lowry – A modern finance guide for people who feel overwhelmed by adulting. Websites

Financial Education and Why It Matters

By JaysWebDev83

PART 1

Chapter 1: What Is Financial Education?

Financial education is the ability to understand and manage money wisely. It's about

gaining the knowledge and skills to make smart decisions related to earning, spending,

saving, borrowing, investing, and planning for the future. While it might sound

technical, it’s actually practical and essential for everyday life.

You don’t need to be wealthy or an economist to be financially educated. You just need to

understand how money works — and how to make it work for you.

Key Aspects of Financial Education:

Budgeting – Knowing where your money is going each month.

Saving – Setting money aside for goals and emergencies.

Debt Management – Understanding interest and repayment strategies.

Investing – Learning how to grow wealth through assets like stocks and real estate.

Retirement Planning – Preparing financially for your later years.

Risk Protection – Using insurance and emergency funds to reduce vulnerability.

Goal Setting – Aligning your money choices with your personal values and future.

Think of financial education as learning to drive — you don’t need to know everything

under the hood, but you do need to steer safely and avoid crashes.

Chapter 2: Why Financial Literacy Matters

Being financially literate changes lives. It reduces stress, increases independence, and

allows you to make choices based on goals, not fear or desperation.

Here’s Why It Matters:

You Make Smarter Decisions

You’ll compare mortgage options, understand how credit works, and read financial terms

with confidence.

You’re Ready for the Unexpected

Whether it's a job loss, car repair, or hospital bill, financially literate people are

better prepared to respond — not panic.

You Stress Less About Money

Financial insecurity is one of the biggest causes of stress. Knowing you’re in control

improves mental well-being.

You Build Long-Term Wealth

With basic financial knowledge, even low earners can start to save, invest, and build

security over time.

You Break the Cycle

For families stuck in generational poverty, financial education is a way out — especially

when shared across generations.

Money isn’t everything — but knowing how to manage it gives you the freedom to focus

on what truly matters.

Chapter 3: Barriers to Financial Literacy

If financial education is so powerful, why do so many people lack it? Because many

systems are stacked against it.

The Most Common Barriers:

Lack of Early Education

Most schools don’t teach personal finance. Young people enter adulthood without knowing

how to budget, use credit, or file taxes.

Too Much (or Bad) Information

The internet is flooded with financial advice — but much of it is outdated, wrong, or

trying to sell something.

Feeling Overwhelmed or Ashamed

Many people avoid learning about money out of fear or embarrassment. They think it’s “too

late” or “too complicated.”

Predatory Practices

From payday loans to unclear bank fees, many financial systems profit from people’s

confusion or desperation.

Systemic Inequality

Marginalized communities often lack access to safe banking, fair credit, and trustworthy

financial education.

The good news? No matter your age or background, you can start learning today.

Chapter 4: Getting Started with Financial Education

You don’t need to be perfect to begin — you just need to start. Financial literacy is a

journey, and the best way to learn is step by step.

Practical First Steps:

Track Your Spending for 30 Days

Use a notebook or app to write down every expense. Awareness is the first step to

control.

Read One Beginner Finance Book or Blog

Suggestions:

The Psychology of Money by Morgan Housel

Rich Dad Poor Dad by Robert Kiyosaki

Blogs like NerdWallet or The Financial Diet

Download a Budgeting App

Try Mint, YNAB, or PocketGuard

Start an Emergency Fund

Aim for $500 to start. Keep it separate from your checking account.

Watch or Follow Free Educators

Follow people like Graham Stephan (YouTube), Clever Girl Finance, or Khan Academy's

personal finance series.

Take a Free Online Course

Sites like Coursera or Khan Academy offer beginner-friendly, free content.

Don’t worry about doing it all at once. Start with what you can today. Every small

step counts.

PART 2

Chapter 5: Recommended Resources

There’s no shortage of excellent (and free!) financial resources out there. Here are some

top picks to build your knowledge without overwhelm:

Books (Beginner-Friendly & Powerful)

The Millionaire Next Door by Thomas J. Stanley – Lessons from people who quietly build

wealth.

I Will Teach You to Be Rich by Ramit Sethi – A straightforward system for managing money

and living life on your terms.

Broke Millennial by Erin Lowry – A modern finance guide for people who feel overwhelmed

by adulting.

Websites

Investopedia – Excellent for clear definitions and how-tos.

NerdWallet – Reviews and comparison tools for credit cards, savings, loans, and more.

Clever Girl Finance – A great platform (especially for women) covering budgeting,

investing, and wealth-building.

Podcasts

The Ramsey Show – Focuses on debt-free living and budgeting.

ChooseFI – Fire up your path to financial independence.

Afford Anything – Learn about smart money habits and intentional living.

Free Courses

Khan Academy Personal Finance

Coursera Financial Planning Courses

Bookmark what interests you and build a routine — even 15 minutes a day makes a

difference.

Chapter 6: Budgeting – The Foundation of Financial Control

A budget is simply a plan for your money. It helps you understand your income, control

your expenses, and align your spending with your goals.

Why Budgeting Matters:

Prevents overspending

Reduces debt

Helps build savings

Shows you what matters most

Gives you control instead of stress

The Basic Budget Formula:

Income – Expenses = What’s Left

That remainder is your power: use it to save, invest, or crush debt.

How to Create a Simple Budget:

List your monthly income (after taxes)

List all your fixed expenses (rent, utilities, loan payments)

List your variable expenses (groceries, fun, shopping)

Track what you actually spend

Compare and adjust

Budgeting Tips:

Use the 50/30/20 Rule:

50% Needs

30% Wants

20% Savings/Debt

Try free apps like YNAB, Mint, or EveryDollar

Review weekly, not just monthly

Optional Tool:

Want a starter spreadsheet? Ask and I’ll provide a printable or editable version!

Budgeting isn’t restriction — it’s permission to spend wisely and without guilt.

Chapter 7: Managing Debt Wisely

Not all debt is bad — but unmanaged debt is dangerous. Whether it’s student loans, credit

cards, or car payments, smart debt management helps you stay in control.

Types of Debt:

Good Debt: Can help build wealth (e.g., student loans, home loans — when used wisely)

Bad Debt: High-interest consumer debt (credit cards, payday loans)

The Real Cost of Debt:

A $3,000 credit card balance at 20% interest can take years to pay off if you only make

minimum payments

Interest = money you’re paying for nothing but time

Smart Strategies to Pay It Down:

Debt Snowball – Pay smallest balances first for momentum

Debt Avalanche – Pay highest interest rate first to save more

Balance Transfers – Shift balances to lower-rate cards (watch for fees!)

Consolidation Loans – Combine debts into one payment at a lower rate

Watch Out For:

Payday loans

Rent-to-own financing

Buy now, pay later traps

Making only minimum payments

Always know your interest rate. It’s the “cost” of your debt.

Chapter 8: Building Credit and Understanding Credit Scores

Your credit score affects your ability to borrow, rent, or even get a job. It’s like a

report card for how well you manage debt.

What Is a Credit Score?

A 3-digit number (from 300 to 850) that shows your creditworthiness.

Factors That Impact Your Score:

Payment History (35%) – Always pay on time

Credit Utilization (30%) – Keep balances under 30% of your limit

Credit Age (15%) – Longer history = better

Credit Mix (10%) – A mix of loan types can help

New Credit (10%) – Too many applications = red flag

How to Build Good Credit:

Open a secured credit card or use a credit-builder loan

Pay your bill in full and on time every month

Keep old accounts open to lengthen history

Limit hard inquiries (avoid frequent loan or card apps)

Common Credit Myths:

You need debt to have credit → You need activity, not debt

Closing cards helps your score → It may actually lower it

Checking your credit hurts your score → Only hard pulls do

How to Check Your Score:

Credit Karma or Credit Sesame

Or get a free annual report at AnnualCreditReport.com

Credit is a tool. Use it wisely and it opens doors; misuse it and it can close them.

PART 3

Chapter 9: Investing Basics – Let Your Money Work for You

Investing is the process of putting your money into things that can grow over time — like

stocks, bonds, real estate, or your own business. It’s how you turn saving into wealth.

You don’t need to be rich to start investing — you need knowledge, consistency, and time.

Why Invest?

Beating Inflation: If your money isn’t growing, it’s shrinking in value.

Building Wealth: Savings grow slowly, but investments compound.

Achieving Goals: Investing helps you retire, buy a home, or fund big dreams.

Common Investment Options:

Stocks – Ownership in a company. High growth, high risk.

Bonds – Loans to governments or companies. Lower risk, lower reward.

Mutual Funds – Pools of money invested in many stocks/bonds.

ETFs (Exchange-Traded Funds) – Like mutual funds, but traded on stock exchanges.

Real Estate – Property investment or rental income.

Key Investing Principles:

Start early: Time is your biggest advantage due to compound interest.

Diversify: Don’t put all your eggs in one basket.

Invest consistently: Monthly contributions beat one-time guessing.

Think long-term: Avoid panic selling during downturns.

Tools to Get Started:

Apps: Fidelity, Vanguard, Robinhood, Acorns

Robo-advisors: Automated investment based on your goals (e.g., Betterment, Wealthfront)

You don’t need to be rich to invest. You need to invest to become financially free.

Chapter 10: Protecting Your Financial Future – Insurance & Emergency Funds

Life is unpredictable. Financial protection is about preparing for the unexpected, so one

crisis doesn’t destroy your progress.

Emergency Fund

A stash of cash for real emergencies: job loss, medical bills, car repairs.

Tips:

Start with $500, then aim for 3–6 months of expenses.

Keep it in a separate, easy-to-access savings account.

Don’t invest it — it needs to be liquid (available fast).

Types of Insurance to Consider:

Health Insurance – Essential to avoid financial ruin from medical bills.

Renters/Homeowners Insurance – Protects your belongings and property.

Auto Insurance – Legally required, protects you from liability.

Life Insurance – Important if you have dependents.

Disability Insurance – If you can’t work, it replaces income.

Why Insurance Matters:

A small monthly premium can prevent a massive financial disaster.

Not having coverage is a gamble — and most people lose eventually.

Emergency funds and insurance are your financial seat belts.

Chapter 11: Retirement Planning – Start Early, Sleep Better Later

Retirement may feel far away, but the sooner you plan, the easier (and richer) it will

be. Time + compounding = freedom later.

Why It Matters:

Social Security alone isn’t enough.

Pensions are rare today — your retirement is your responsibility.

Delaying just a few years can cost hundreds of thousands in lost growth.

Common Retirement Accounts:

401(k) – Employer-sponsored; often includes matching contributions.

IRA (Individual Retirement Account) – Personal retirement account; traditional or Roth.

Roth IRA – Contributions are taxed now; withdrawals are tax-free in retirement.

Tips:

Contribute enough to get your employer match (it’s free money!)

Use compound interest calculators to see long-term benefits.

Aim to save at least 10–15% of your income for retirement.

Don’t withdraw early — you’ll pay penalties and lose growth.

Investing for retirement is a gift you give to your future self.

Chapter 12: Teaching Kids and Teens About Money

Financial habits start early. Teaching children about money gives them a head start in

life and breaks generational cycles of financial stress.

What to Teach by Age:

Ages 3–7:

Money comes from work

Save before you spend

Use clear jars or piggy banks

Ages 8–12:

Set savings goals

Use a simple allowance system (e.g. Earn → Save → Spend)

Introduce needs vs. wants

Ages 13–18:

Open a student checking/savings account

Teach them how to track spending

Talk about debit vs. credit cards

Discuss college costs and budgeting

Practical Ideas:

Let them earn money through chores or projects

Involve them in budgeting for groceries or trips

Let them make small spending mistakes while the stakes are low

Tools for Teaching:

Apps: Greenlight, GoHenry (for supervised spending and saving)

Games: Monopoly, The Game of Life

Books: Money Ninja, Finance 101 for Kids, or Rich Dad Poor Dad for Teens

If we don’t teach our kids about money, the world will — and it might not be kind.

PART 4

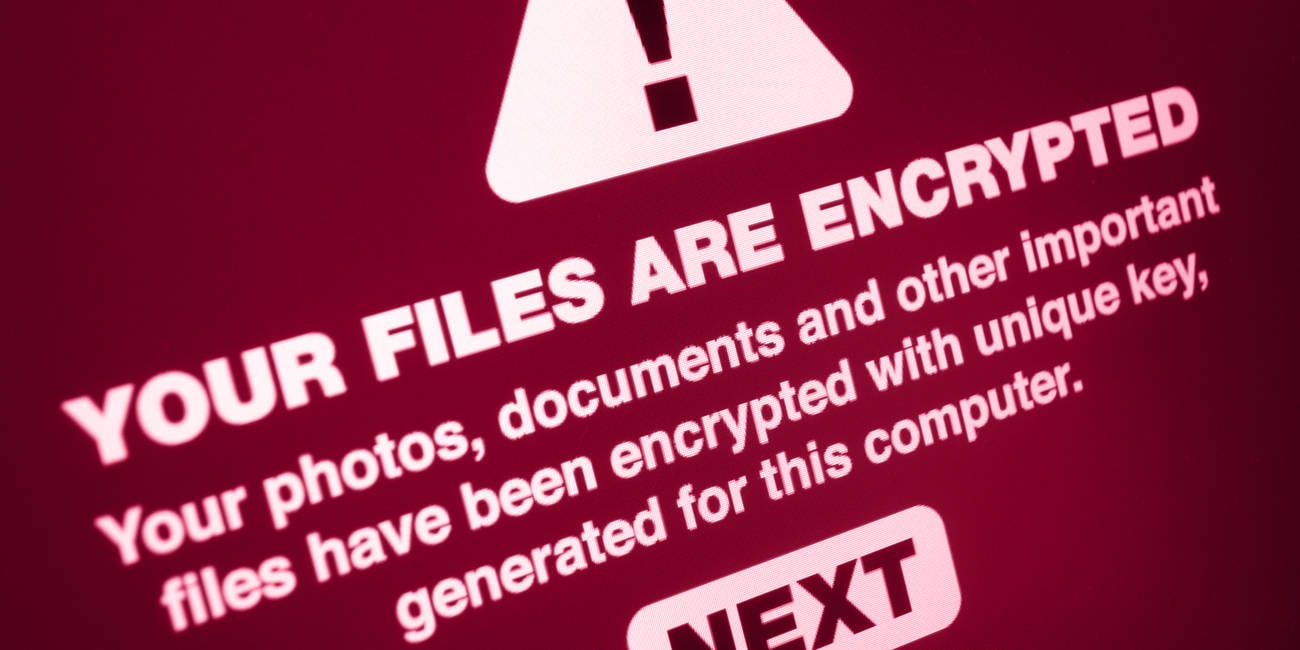

Chapter 13: Avoiding Scams and Financial Pitfalls in the Digital Age

As the financial world becomes more digital, so do the risks. Scammers and shady

companies are constantly evolving their tactics — especially online.

Common Scams to Watch Out For:

Phishing Emails & Texts – Fake messages pretending to be your bank, asking for login

info.

Fake Job Offers – Especially remote jobs that require you to "pay" to start.

Crypto & Trading Scams – Promising guaranteed returns or secret investment tips.

Romance Scams – Someone pretends to care, then asks for money.

"Too Good to Be True" Offers – If it sounds like a scam... it probably is.

Red Flags:

You’re asked to pay upfront for a prize, loan, or job.

You're pressured to “act now” or lose the deal.

Poor grammar, vague emails, or strange URLs.

Requests to pay via gift cards, wire transfer, or cryptocurrency only.

Protect Yourself:

Use strong, unique passwords + 2-factor authentication.

Monitor your credit report regularly at AnnualCreditReport.com.

Avoid clicking unknown links or downloading shady files.

Educate yourself. Scammers target confusion and fear.

Trust your gut. If something feels off — pause and verify before acting.

Chapter 14: Financial Goal-Setting and Mindset

Financial success starts in the mind. If you want to master your money, you need to first

believe you can — and build the habits to prove it.

Why Mindset Matters:

Scarcity Thinking: “I’ll always be broke.”

→ Leads to avoidance, bad decisions, and self-sabotage.

Abundance Thinking: “I can learn this. I can grow.”

→ Leads to confidence, action, and results.

Set SMART Financial Goals:

Specific – “Save £5,000 for an emergency fund”

Measurable – Track progress monthly

Achievable – Make sure it fits your budget

Realistic – Don’t try to do too much too fast

Time-bound – Set a target date (e.g., 6 months)

Example Goals:

Pay off one credit card in 3 months

Save £1,000 for a vacation

Increase income by starting a side hustle

Invest £50/month in an index fund

Build Systems:

Automate savings and bill payments

Track spending weekly (apps or journals)

Review goals monthly and adjust as needed

Discipline beats motivation. Systems beat willpower.

Chapter 15: Putting It All Together – Your Financial Action Plan

Knowledge is power — but action turns knowledge into change. It’s time to create your

Financial Action Plan.

Step-by-Step Checklist:

Understand Your Current Situation

Income vs. expenses

Total debt

Savings balance

Credit score

Build a Monthly Budget

Choose a method (app, spreadsheet, or notebook)

Track for 30 days, then adjust

Start or Grow Your Emergency Fund

Begin with £500

Add a little each month

Make a Debt Repayment Plan

Choose snowball or avalanche method

Prioritize high-interest balances

Set One Financial Goal

Use SMART framework

Write it down and track it

Begin Investing (If Ready)

Use a trusted platform or robo-advisor

Start small and focus long-term

Continue Learning

Pick 1 new book, blog, or podcast this month

Sample Goal Template:

Goal Why It Matters Deadline First Step

Save £1,000 Build emergency fund 4 months Auto-transfer £250/month

Pay off credit card Reduce stress + fees 3 months Pay £100/week

Start investing Grow wealth long-term Ongoing Open account & fund

You don’t need to do everything today. Just take the next right step.

Chapter 16: Bonus – Real-Life Stories & Case Studies

Nothing inspires like real results. Here are a few short stories of everyday people

transforming their finances:

Story 1: Sam, 28 – From Paycheck to Planner

Sam used to run out of money days before payday. After tracking his expenses and using a

50/30/20 budget, he saved £3,000 in six months — and booked his first vacation in years.

Story 2: Layla, 35 – Debt-Free and Confident

Layla had £15,000 in credit card debt. She used the snowball method and worked a weekend

side hustle. Two years later, she’s debt-free and saving for a home.

Story 3: Jordan, 19 – Starting Early

Jordan took a free finance course and opened a Roth IRA while still in college. Now he

invests £100/month and understands more than most adults twice his age.

Story 4: The Williams Family – Teaching the Next Generation

They created a “family finance night” once a month. Now their kids know how to save, use

cash wisely, and talk openly about money — setting the whole family up for long-term

success.

Your story can be next. You don’t need to be perfect — just committed.

Ps, feel free to leave a comment, conversation starts with a lovely cup of tea and/or coffee. ;D

![[The AI Show Episode 151]: Anthropic CEO: AI Will Destroy 50% of Entry-Level Jobs, Veo 3’s Scary Lifelike Videos, Meta Aims to Fully Automate Ads & Perplexity’s Burning Cash](https://www.marketingaiinstitute.com/hubfs/ep%20151%20cover.png)

![[DEALS] FileJump 2TB Cloud Storage: Lifetime Subscription (85% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![From electrical engineering student to CTO with Hitesh Choudhary [Podcast #175]](https://cdn.hashnode.com/res/hashnode/image/upload/v1749158756824/3996a2ad-53e5-4a8f-ab97-2c77a6f66ba3.png?#)

_sleepyfellow_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![watchOS 26 May Bring Third-Party Widgets to Control Center [Report]](https://www.iclarified.com/images/news/97520/97520/97520-640.jpg)

![AirPods Pro 2 On Sale for $169 — Save $80! [Deal]](https://www.iclarified.com/images/news/97526/97526/97526-640.jpg)

![Apple Shares Official Trailer for 'The Wild Ones' [Video]](https://www.iclarified.com/images/news/97515/97515/97515-640.jpg)