CRED raises $72M from GIC, RTP, and others

GIC had also led CRED’s previous major funding round in 2022, when the company raised $140 million through a mix of primary and secondary capital.

Fintech unicorn CRED has raised $72 million (Rs 617 crore) in fresh funding from multiple investors, according to regulatory filings sourced from the Registrar of Companies (RoC).

According to the filings, Singapore’s sovereign wealth fund GIC led the round through its Lathe Investment arm with an investment of $41 million (Rs 354.4 crore).

Other participants included RTP Global with $8.75 million (Rs 74.9 crore), Sofina Ventures with $3 million (Rs 25.8 crore), and QED Innovation Labs — the family office of CRED founder Kunal Shah — which invested $19 million (Rs 162 crore).

Entrackr was the first to report the development last month.

The round will come at a sharp reset in the company’s valuation—from $6.4 billion in 2022 to a reported $3.5 billion, sources familiar with the development told YourStory. Some of the other prominent backers include Peak XV Partners, Ribbit Capital, Tiger Global, and DST Global.

GIC had also led CRED’s previous major funding round in 2022, when the company raised $140 million through a mix of primary and secondary capital.

Over the past two to three years, the members-only credit card bill payment platform has expanded its business model beyond its core offering, venturing into new verticals such as wealth management and vehicle-related services. Key to this evolution has been the launch of CRED Garage and CRED Money, alongside strategic acquisitions like that of the wealth management platform Kuvera.

Launched in September 2023, CRED Garage is a vehicle management platform that helps users streamline car ownership by offering a unified dashboard to track documents, recharge FASTag, monitor fuel expenses, and more.

The Bengaluru-based firm has also partnered with CARS24 to enable the selling of used cars via its app.

Last year, CRED reported that its total revenue surged by 66% to Rs 2,473 crore in FY24 from Rs 1,484 crore in FY23.

Meanwhile, its operating losses narrowed by 41% to Rs 609 crore from 1,024 crore. CRED’s user base grew significantly in FY24, with a large portion of customer acquisition coming from organic channels. Over 75% of its new users were acquired organically, which helped reduce customer acquisition costs by 40%. The company stated it did not spend big on advertising during the fiscal year.

Edited by Jyoti Narayan

![Top Features of Vision-Based Workplace Safety Tools [2025]](https://static.wixstatic.com/media/379e66_7e75a4bcefe14e4fbc100abdff83bed3~mv2.jpg/v1/fit/w_1000,h_884,al_c,q_80/file.png?#)

![[The AI Show Episode 152]: ChatGPT Connectors, AI-Human Relationships, New AI Job Data, OpenAI Court-Ordered to Keep ChatGPT Logs & WPP’s Large Marketing Model](https://www.marketingaiinstitute.com/hubfs/ep%20152%20cover.png)

![[DEALS] Microsoft Visual Studio Professional 2022 + The Premium Learn to Code Certification Bundle (97% off) & Other Deals Up To 98% Off](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

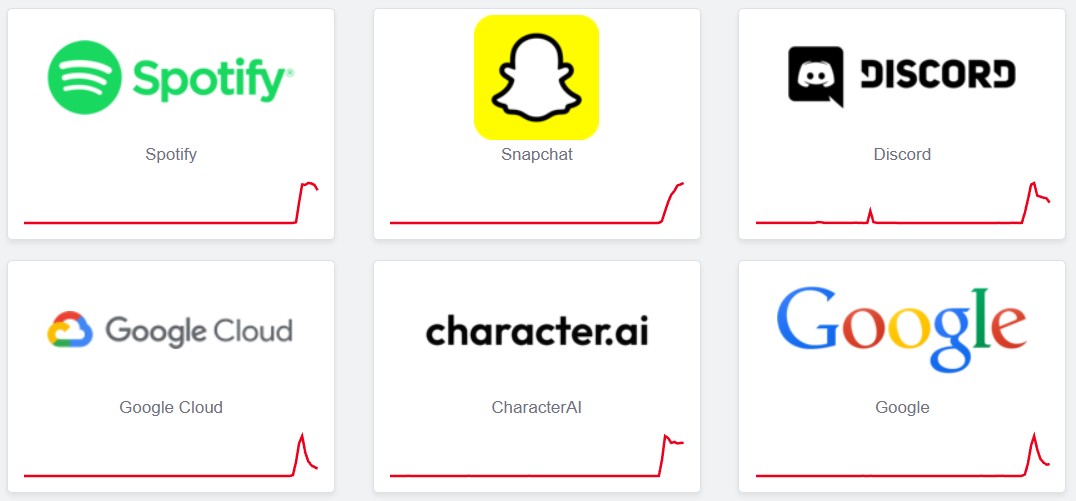

![PSA: Widespread internet outage affects Spotify, Google, Discord, Cloudflare, more [U: Fixed]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2024/07/iCloud-Private-Relay-outage-resolved.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Apple Shares Teaser Trailer for 'The Lost Bus' Starring Matthew McConaughey [Video]](https://www.iclarified.com/images/news/97582/97582/97582-640.jpg)