PhonePe acquires Gupshup's voice, SMS payments tools to enable UPI on feature phones

PhonePe aims to launch its own feature phone-based UPI payment mobile application over the next few quarters, according to a statement by the company.

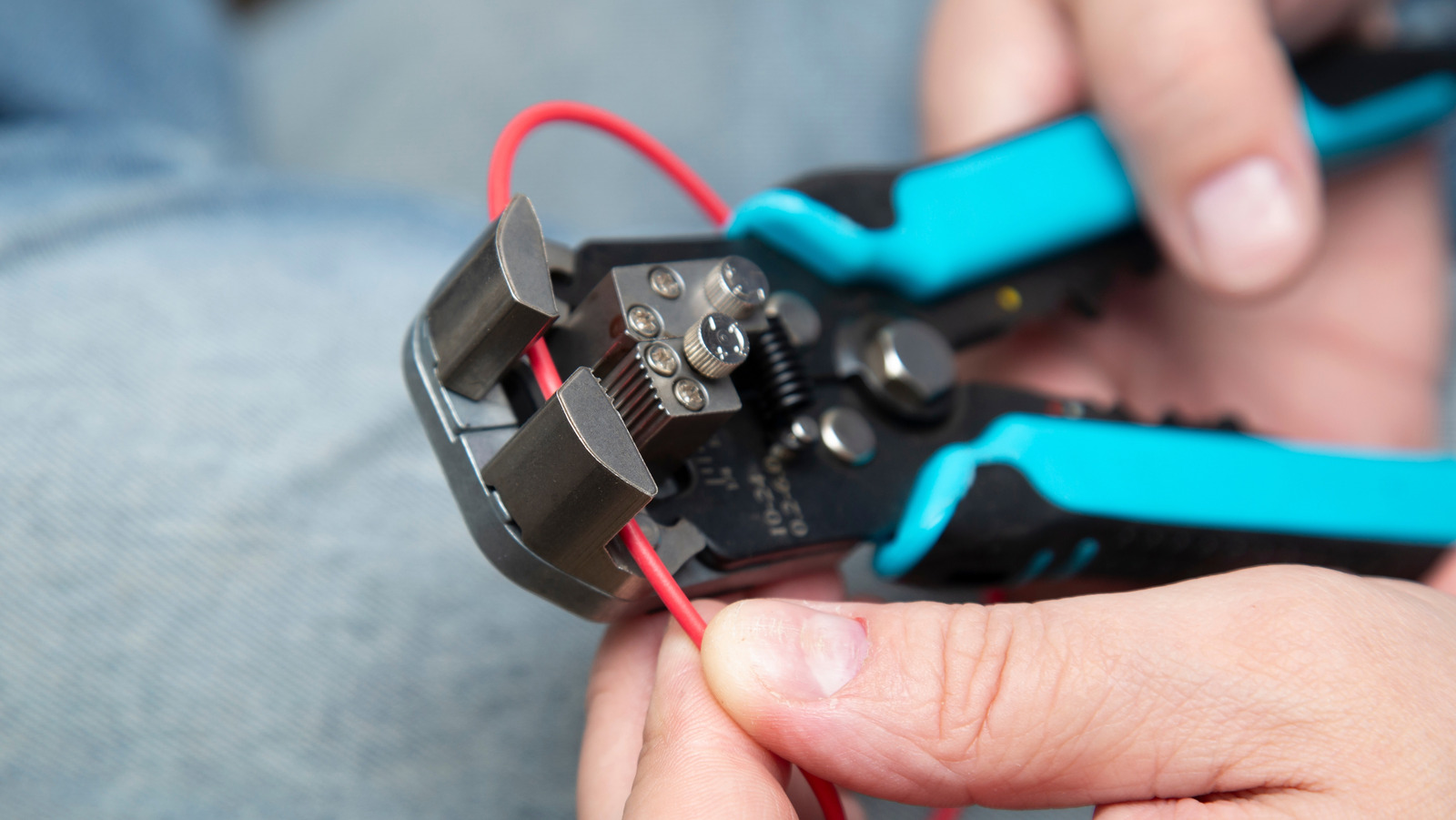

Fintech company PhonePe has acquired the GSPay technology stack from GupShup, a conversational engagement platform, to enable UPI-based payments for feature phone users in India.

The company plans to customise the recently-acquired GSPay intellectual property (IP) and launch its own feature phone-based UPI payment mobile application over the next few quarters, according to a statement by the company.

GSPay is a mobile application built on top of the National Payments Corporation of India's (NPCI) UPI payment solution for feature phones, known as UPI 123PAY. PhonePe aims to provide basic UPI features, including peer-to-peer transfers, offline QR payments, and money receiving capabilities.

"We are excited about acquiring the GSPay technology stack and using it to bring UPI payments to India's extensive feature phone user base," said Sameer Nigam, Co-founder and CEO at PhonePe.

"This segment of users has been historically underserved by the digital financial industry and the broader startup ecosystem. We hope we can enable crores of these feature phone customers to participate in India's burgeoning digital payments market."

India had approximately 240 million feature phone users in 2024, with an additional 150 million feature phone shipments expected over the next five years, according to industry data cited by PhonePe.

The Bengaluru-headquartered company, which launched its digital payments app in August 2016, reported having over 600 million registered users as of April 2025.

PhonePe processes over 330 million transactions daily with an annualised total payment value exceeding Rs 150 trillion, according to the company. Its digital payments acceptance network spans over 40 million merchants across India.

Walmart-backed PhonePe has started preparing for its initial public offering (IPO) on the Indian stock exchanges.

As part of its listing preparation it has appointed banking veteran Zarin Daruwala to its board of directors as the Walmart-backed company prepares for its initial public offering.

The appointment comes months after Daruwala concluded her nine-year tenure as Chief Executive Officer of Standard Chartered Bank's India operations in March 2025.

Daruwala brings 35 years of banking experience to PhonePe, including her previous role as President of Wholesale Banking at ICICI Bank, where she managed one of India's largest corporate banking portfolios.

Edited by Megha Reddy

_.png)

![[The AI Show Episode 151]: Anthropic CEO: AI Will Destroy 50% of Entry-Level Jobs, Veo 3’s Scary Lifelike Videos, Meta Aims to Fully Automate Ads & Perplexity’s Burning Cash](https://www.marketingaiinstitute.com/hubfs/ep%20151%20cover.png)

![From electrical engineering student to CTO with Hitesh Choudhary [Podcast #175]](https://cdn.hashnode.com/res/hashnode/image/upload/v1749158756824/3996a2ad-53e5-4a8f-ab97-2c77a6f66ba3.png?#)

.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

_Michael_Vi_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![watchOS 26 May Bring Third-Party Widgets to Control Center [Report]](https://www.iclarified.com/images/news/97520/97520/97520-640.jpg)

![AirPods Pro 2 On Sale for $169 — Save $80! [Deal]](https://www.iclarified.com/images/news/97526/97526/97526-640.jpg)