10 Must-Have Fintech APIs and Tools for Developers in 2025

The fintech industry continues to explode with innovation in 2025, transforming how people manage money, pay bills, invest, and secure their financial data. At the heart of this revolution are fintech APIs — powerful building blocks that enable developers to quickly add payment processing, identity verification, account aggregation, and much more into their apps. Fintech APIs simplify complex financial processes by exposing ready-to-use endpoints that connect your application to banks, payment gateways, fraud detection services, and regulatory compliance tools. However, integrating and managing multiple APIs can quickly become a headache without solid documentation, testing, and monitoring. This is where having the right tools to handle API docs and testing becomes critical. In this article, we explore 10 essential fintech APIs and tools every developer should know about in 2025. We’ll also highlight how Apidog can streamline your fintech API workflow by providing a powerful all-in-one platform to test, document, and collaborate on APIs How Apidog Helps Fintech Teams Build Better APIs Before diving into the top fintech APIs, let’s talk about Apidog — a tool designed to meet the exact needs of fintech developers working with multiple APIs. Why Apidog? Auto-generated API Docs — Generate clean, interactive documentation instantly, which is crucial for onboarding teams and stakeholders or sharing with partners. Mock Servers & Automated Testing — Simulate API responses and create test cases to validate your fintech app workflows before going live. Version Control and Change Logs — Track API changes efficiently, helping you stay compliant and avoid surprises from provider updates. Collaboration Features — Share API collections and testing environments with your team to ensure consistency and speed. Unified Interface — Easily test API endpoints from various fintech providers in one place without switching tools. How this helps fintech developers: Fintech APIs often involve sensitive data and require strict compliance. Apidog’s ability to organize, test, and document your API connections ensures you build reliable integrations that meet security and regulatory standards while reducing manual effort. Top 10 Fintech APIs and Tools for Developers in 2025 Top 10 Fintech APIs and Tools for Developers in 2025 1. Plaid Use Case: Connect bank accounts, retrieve transactions, verify identity, and manage payments securely. Key Features: Access data from thousands of banks and financial institutions Real-time balance and transaction updates Identity verification and asset reports Docs: https://plaid.com/docs Plaid is the go-to API for fintech apps requiring secure bank data access. Whether building budgeting apps, lending platforms, or investment tools, Plaid provides a robust foundation for financial data aggregation. 2. Stripe API Use Case: Seamless payment processing and billing infrastructure for online and in-app payments. Key Features: Support for credit cards, bank transfers, wallets (Apple Pay, Google Pay), and more Subscription billing and invoicing Fraud prevention and dispute management Docs: https://stripe.com/docs/api Stripe powers millions of businesses worldwide, offering a comprehensive, developer-friendly API to handle complex payment workflows with ease. 3. TrueLayer Use Case: Open banking APIs for accessing account data, making payments, and confirming account ownership. Key Features: PSD2 compliant and secure Instant account verification and payment initiation Rich transaction history and categorization Docs: https://truelayer.com/docs TrueLayer is a leading European open banking API provider, helping developers integrate banking data and payment services with strict regulatory compliance. 4. Currencylayer Use Case: Real-time and historical exchange rates for 168 world currencies. Key Features: JSON API with up-to-date Forex rates Historical data for back-testing and analysis Supports currency conversion in apps Docs: https://currencylayer.com/documentation Currencylayer is essential for fintech apps dealing with cross-border payments, global commerce, and financial analysis requiring accurate currency data. 5. Yodlee Use Case: Financial data aggregation and account verification for personal finance and wealth management. Key Features: Connects to thousands of financial institutions worldwide Aggregates investment, loan, credit, and insurance data Offers risk and compliance analytics Docs: https://developer.yodlee.com/docs Yodlee’s mature platform is trusted by many major financial institutions, making it perfect for apps that need comprehensive financial data integration. 6. Dwolla Use Case: ACH payment API for bank transfers, mass payouts, and custom payment flows. Key Features: Fast, secure ACH transactions with tokenization Support for KYC/AML compliance Scalable payouts for marketplaces an

The fintech industry continues to explode with innovation in 2025, transforming how people manage money, pay bills, invest, and secure their financial data. At the heart of this revolution are fintech APIs — powerful building blocks that enable developers to quickly add payment processing, identity verification, account aggregation, and much more into their apps.

Fintech APIs simplify complex financial processes by exposing ready-to-use endpoints that connect your application to banks, payment gateways, fraud detection services, and regulatory compliance tools. However, integrating and managing multiple APIs can quickly become a headache without solid documentation, testing, and monitoring.

This is where having the right tools to handle API docs and testing becomes critical. In this article, we explore 10 essential fintech APIs and tools every developer should know about in 2025. We’ll also highlight how Apidog can streamline your fintech API workflow by providing a powerful all-in-one platform to test, document, and collaborate on APIs

How Apidog Helps Fintech Teams Build Better APIs

Before diving into the top fintech APIs, let’s talk about Apidog — a tool designed to meet the exact needs of fintech developers working with multiple APIs.

Why Apidog?

Auto-generated API Docs — Generate clean, interactive documentation instantly, which is crucial for onboarding teams and stakeholders or sharing with partners.

- Mock Servers & Automated Testing — Simulate API responses and create test cases to validate your fintech app workflows before going live.

- Version Control and Change Logs — Track API changes efficiently, helping you stay compliant and avoid surprises from provider updates.

- Collaboration Features — Share API collections and testing environments with your team to ensure consistency and speed.

- Unified Interface — Easily test API endpoints from various fintech providers in one place without switching tools.

How this helps fintech developers:

Fintech APIs often involve sensitive data and require strict compliance. Apidog’s ability to organize, test, and document your API connections ensures you build reliable integrations that meet security and regulatory standards while reducing manual effort.

Top 10 Fintech APIs and Tools for Developers in 2025

Top 10 Fintech APIs and Tools for Developers in 2025

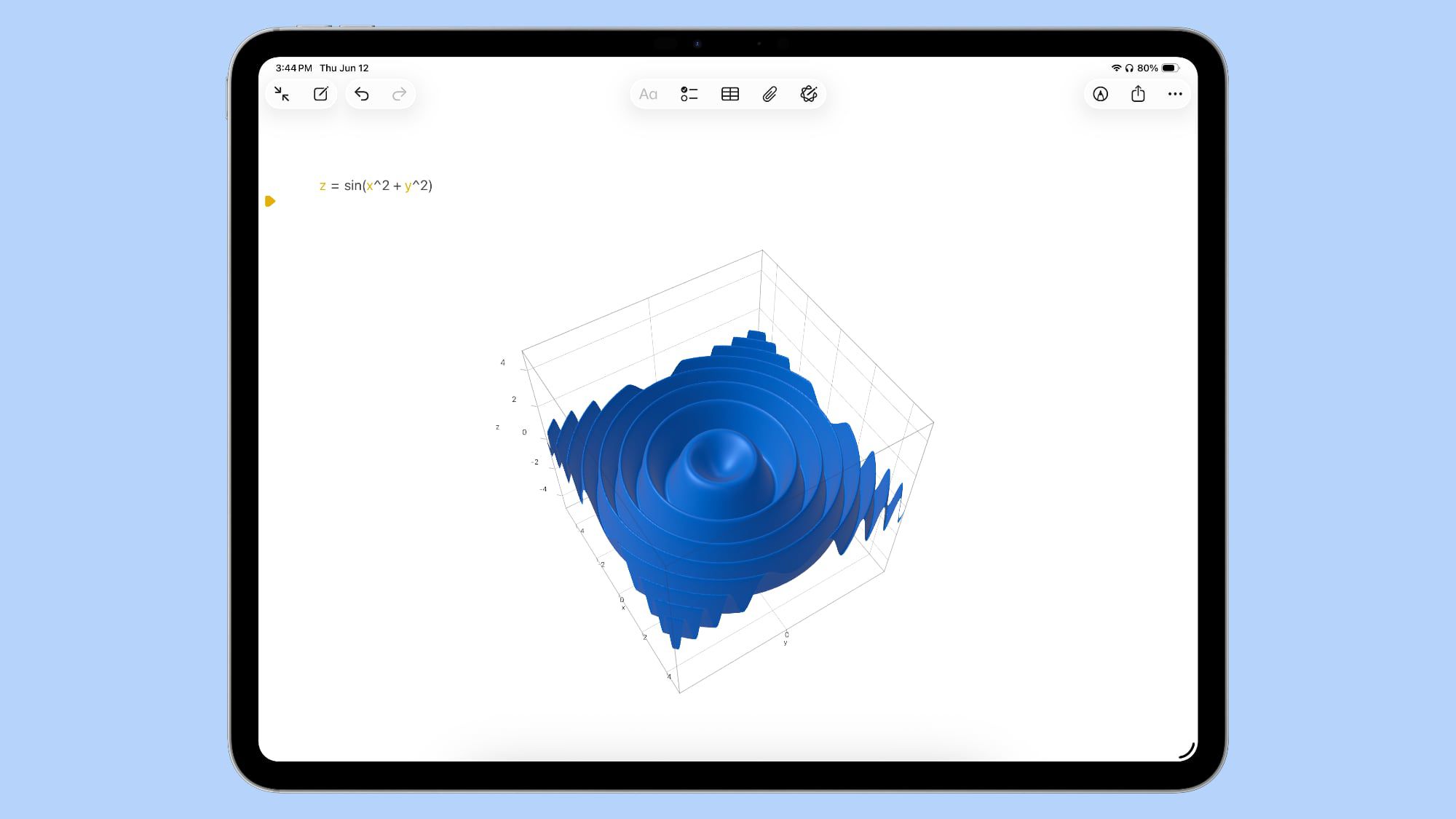

1. Plaid

Use Case: Connect bank accounts, retrieve transactions, verify identity, and manage payments securely.

Key Features:

- Access data from thousands of banks and financial institutions

- Real-time balance and transaction updates

- Identity verification and asset reports Docs: https://plaid.com/docs

Plaid is the go-to API for fintech apps requiring secure bank data access. Whether building budgeting apps, lending platforms, or investment tools, Plaid provides a robust foundation for financial data aggregation.

2. Stripe API

Use Case: Seamless payment processing and billing infrastructure for online and in-app payments.

Key Features:

- Support for credit cards, bank transfers, wallets (Apple Pay, Google Pay), and more

- Subscription billing and invoicing

- Fraud prevention and dispute management

- Docs: https://stripe.com/docs/api

Stripe powers millions of businesses worldwide, offering a comprehensive, developer-friendly API to handle complex payment workflows with ease.

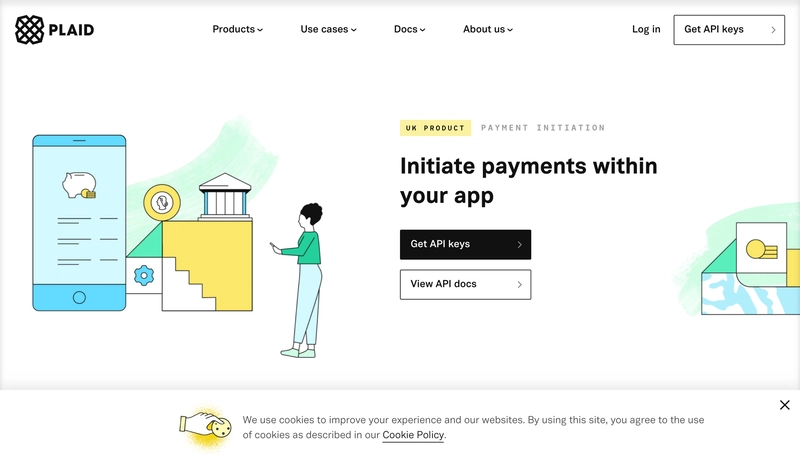

3. TrueLayer

Use Case: Open banking APIs for accessing account data, making payments, and confirming account ownership.

Key Features:

- PSD2 compliant and secure

- Instant account verification and payment initiation

- Rich transaction history and categorization

- Docs: https://truelayer.com/docs

TrueLayer is a leading European open banking API provider, helping developers integrate banking data and payment services with strict regulatory compliance.

4. Currencylayer

Use Case: Real-time and historical exchange rates for 168 world currencies.

Key Features:

- JSON API with up-to-date Forex rates

- Historical data for back-testing and analysis

- Supports currency conversion in apps

- Docs: https://currencylayer.com/documentation

Currencylayer is essential for fintech apps dealing with cross-border payments, global commerce, and financial analysis requiring accurate currency data.

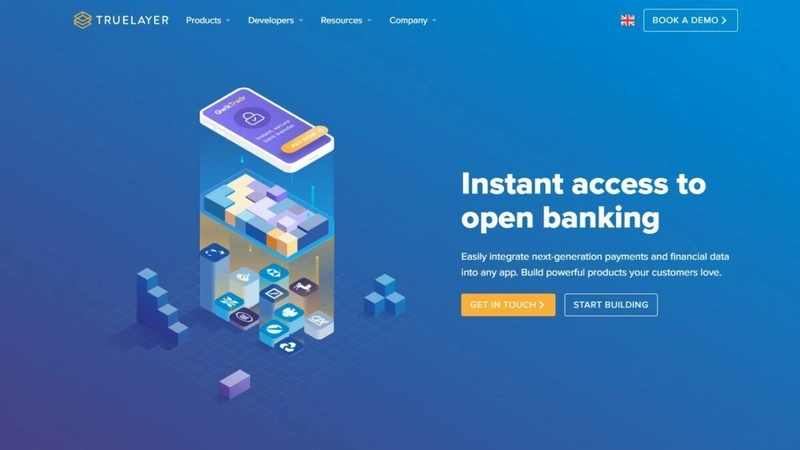

5. Yodlee

Use Case: Financial data aggregation and account verification for personal finance and wealth management.

Key Features:

- Connects to thousands of financial institutions worldwide

- Aggregates investment, loan, credit, and insurance data

- Offers risk and compliance analytics

- Docs: https://developer.yodlee.com/docs

Yodlee’s mature platform is trusted by many major financial institutions, making it perfect for apps that need comprehensive financial data integration.

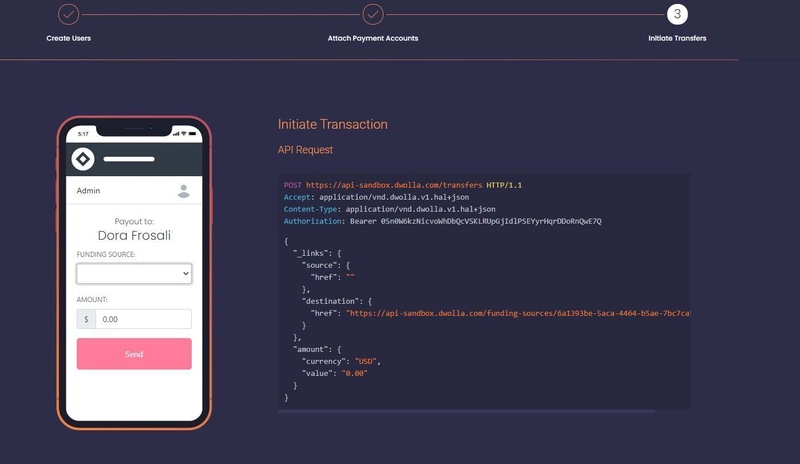

6. Dwolla

Use Case: ACH payment API for bank transfers, mass payouts, and custom payment flows.

Key Features:

- Fast, secure ACH transactions with tokenization

- Support for KYC/AML compliance

- Scalable payouts for marketplaces and platforms

- Docs: https://developers.dwolla.com

Dwolla simplifies bank-to-bank payments in the US, helping fintech developers build seamless payment experiences that comply with financial regulations.

7. MX

Use Case: Data aggregation and enhanced money management tools.

Key Features:

- Clean, categorized transaction data

- Budgeting, savings goals, and alerts

- API supports identity verification and account opening

- Docs: https://developer.mx.com/docs

MX offers APIs that enable fintechs to deliver personalized financial experiences powered by clean and actionable financial data.

8. Tink

Use Case: Open banking and payment initiation services across Europe.

Key Features:

- Access to accounts, transactions, and balances

- Payment initiation with instant settlement

- Enriched data insights and user authentication

- Docs: https://docs.tink.com

Tink is a powerful open banking platform enabling European fintechs to build next-gen financial apps with trusted banking data.

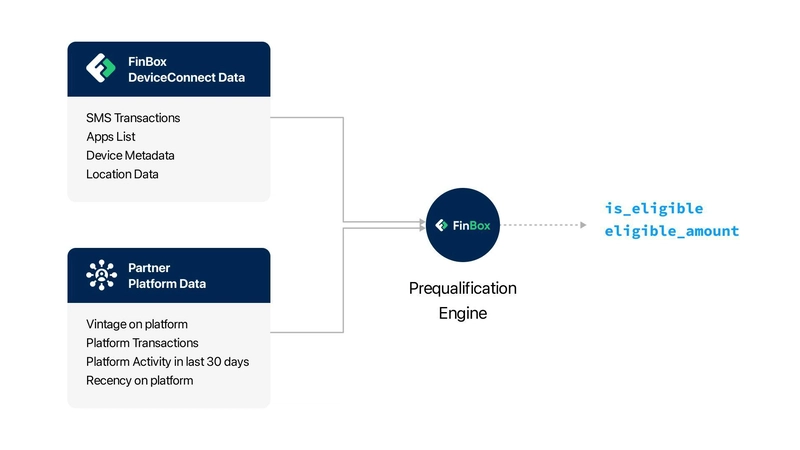

9. Finbox

Use Case: Credit data and scoring APIs for lending platforms and credit risk analysis.

Key Features:

- Access to credit bureau data and alternative data

- Real-time credit scoring and risk assessments

- Fraud detection and KYC services

- Docs: https://finbox.com/developers

Finbox is ideal for fintechs building lending, underwriting, or credit decisioning solutions that rely on robust risk data.

10. Coinbase API

Use Case: Cryptocurrency wallet integration, trading, and payments.

Key Features:

- Buy, sell, and store cryptocurrencies securely

- Real-time market data and price alerts

- Supports multiple coins and tokens

- Docs: https://docs.cdp.coinbase.com/coinbase-app/docs/welcome

Coinbase API lets fintech apps tap into the crypto economy, enabling users to transact and manage digital assets easily.

Tips for Working with Fintech APIs

- Security First: Use encryption, tokenization, and follow PCI DSS and GDPR guidelines to protect user data.

- Rate Limits: Respect API request limits to avoid throttling and service interruptions.

- Compliance: Understand regulatory requirements such as PSD2, AML, and KYC relevant to your region.

- Monitoring: Continuously monitor API health and performance to ensure a smooth user experience.

- Versioning: Track changes in API versions carefully and update your integration accordingly.

Conclusion

Fintech APIs are transforming how financial services are built, making it easier for developers to innovate quickly and securely. Whether you’re building payment systems, wealth management apps, or crypto wallets, these 10 APIs provide a solid foundation to jumpstart your projects in 2025.

Equally important is the tooling around these APIs. Apidog stands out as a must-have platform for fintech developers — combining powerful API testing, documentation, and collaboration features in one seamless interface. By using Apidog, your team can ensure faster development cycles, better compliance, and more reliable fintech integrations.

![[The AI Show Episode 152]: ChatGPT Connectors, AI-Human Relationships, New AI Job Data, OpenAI Court-Ordered to Keep ChatGPT Logs & WPP’s Large Marketing Model](https://www.marketingaiinstitute.com/hubfs/ep%20152%20cover.png)

![[DEALS] Microsoft Visual Studio Professional 2022 + The Premium Learn to Code Certification Bundle (97% off) & Other Deals Up To 98% Off](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

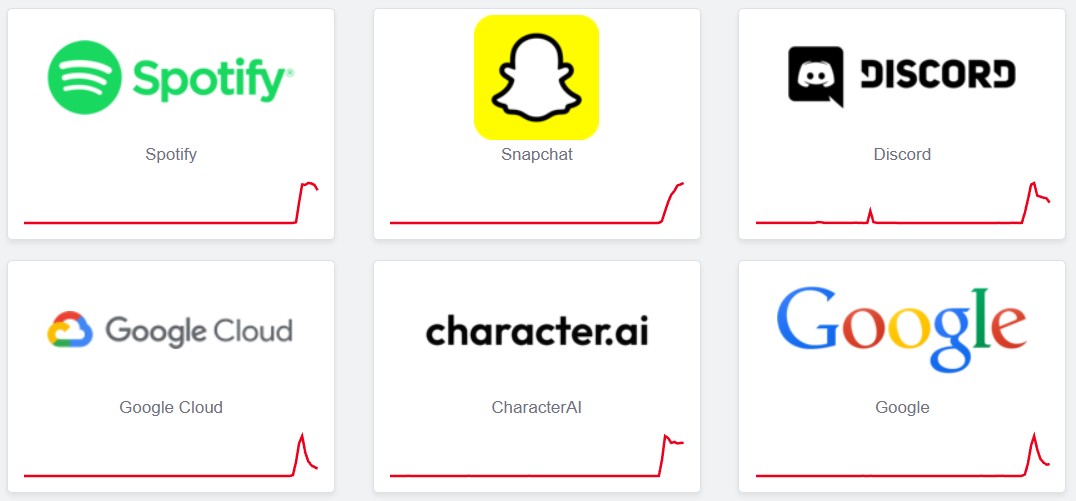

![PSA: Widespread internet outage affects Spotify, Google, Discord, Cloudflare, more [U: Fixed]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2024/07/iCloud-Private-Relay-outage-resolved.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Apple Shares Teaser Trailer for 'The Lost Bus' Starring Matthew McConaughey [Video]](https://www.iclarified.com/images/news/97582/97582/97582-640.jpg)