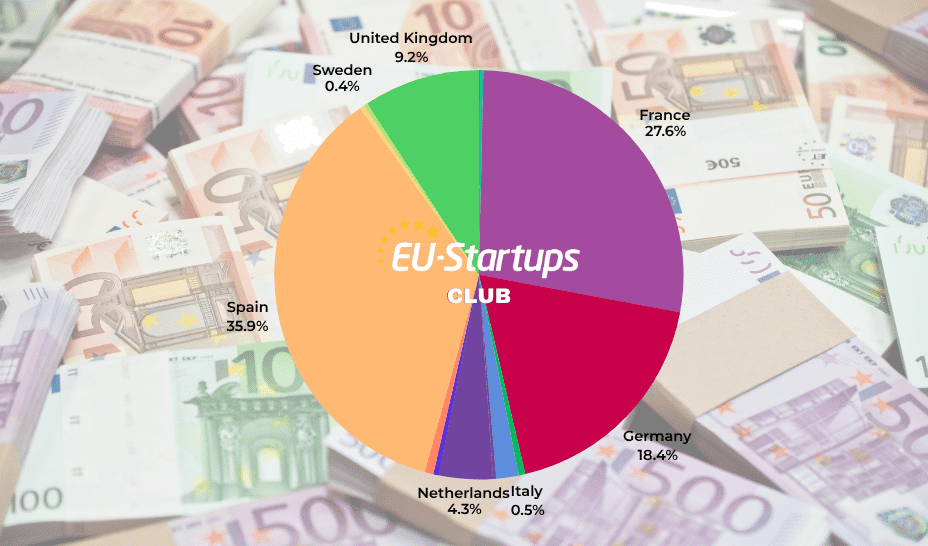

With over 45 startups already funded, Czech VC fund KAYA secures €70 million to back more Founders from CEE

Prague-based VC fund KAYA announces today they have raised nearly €70 million for a fifth fund to support Founders from the CEE region – expecting to support up to 25 startups from the pre-Seed stage to Series A. A typical initial investment from KAYA ranges from one to three million Euro. For companies that are […] The post With over 45 startups already funded, Czech VC fund KAYA secures €70 million to back more Founders from CEE appeared first on EU-Startups.

Prague-based VC fund KAYA announces today they have raised nearly €70 million for a fifth fund to support Founders from the CEE region – expecting to support up to 25 startups from the pre-Seed stage to Series A.

A typical initial investment from KAYA ranges from one to three million Euro. For companies that are on a promising path to realising their potential, the fund keeps a capital reserve for follow-on rounds and through syndication with select investors, where it can allocate up to €20 million to a single company.

“The last decade has shown that there is a growing pool of technology talent in Central and Eastern Europe that has contributed to a number of global success stories – and KAYA has been behind many of them for almost fifteen years. We look for Founders with big dreams and the courage to go global, and we want to be their first partners and long-term supporters: we enter at an early stage and stay on as the company grows into a truly global, impactful company,” says Tomas Obrtac, one of the four equal partners of the fund.

Founded in 2010, Kaya is a VC fund that has backed over 45 different ventures across Czechia, Poland, Slovakia, and the general CEE region. The team is spread out across the world, with key members present in London, San Francisco, Warsaw and Budapest.

KAYA not only invests in technology, but also actively uses it to improve its own operations. Since 2018, it has been developing a data platform that monitors the global startup scene in real time and helps capture early signals from promising companies. The platform has gradually become an important tool for identifying new opportunities.

KAYA’s investors include Central European entrepreneurs, repeat founders, as well as multinational funds, major institutions and regional banks.

“Across the CEE region today, we see Founders who are no longer just thinking locally. Whether in Hungary, Bulgaria, Croatia or Slovenia, we find strong technical teams with the ambition to build global products. That’s why we’ve already expanded our investments beyond the Czech Republic and Poland in our fourth fund and are continuing to do so in our fifth fund. We believe that the most interesting CEE stories are still only emerging,” adds Obrtac.

In addition to the announcement, Founder Karel Zheng is joining Kaya as a new partner. Zheng has been with Kaya since 2018, barring a period when he ran his own startup.

“As a representative of Generation Z, I hope to bring a fresh perspective of someone who ‘grew up online,’ is connected to global communities, and intuitively understands how today’s Founders think about product, culture, and impact. We want to be able to recognise emerging trends more quickly within the team without losing the discipline and experience of our senior partners. It is the combination of these generational perspectives that I believe gives KAYA a competitive advantage and will help us find other exceptional companies,” said Zheng.

KAYA has two unicorns in its portfolio: the Czech startup Rohlik and Polish Docplanner. The former is a fast-growing European e-grocer, the latter is a leading healthcare booking platform. According to Kaya, there is also a soon-to-be unicorn too – Poland’s Booksy, which crossed €100 million in revenue last year.

Other promising startups in their portfolio include Better Stack, SensibleBio, Upheal, TopK, E2B, Superlinked, Jutro Medical, Yoneda Labs, and ZetaLabs. Currently, KAYA has more than forty-five companies in its portfolio, amounting to €350 million in value.

“The life cycle of a VC fund usually lasts more than ten years, so we already know that our first three funds are delivering exceptional returns. As we launch the fifth generation of funds, we have a good feel for how to right-size the fund, so that it is appropriate for the number of investment opportunities available in the market while at the same time delivering strong returns to investors. We are working with a stable investor base and due to new names having been added, the aggregate interest in the fund was higher than we expected,” adds Tomas Pacinda, General Partner at KAYA who joined in 2015.

Fourteen years of experience in the market taught KAYA that companies need help in two areas in particular.

- The access to experts who can effectively advise Founders on a range of topics. KAYA offers its portfolio companies access to experts who have experience running their own businesses or building and scaling global companies. This network includes, for example, entrepreneur Tomas Cupr who founded first Czech unicorn Rohlik, AI expert and Founder of EquiLibre Technologies Martin Schmid, Juraj Masar and Veronika Kolejak from Better Stack, Michal Valko who worked with Mark Zuckerberg on Llama 3, and Jakub Jurovych from Deepnote.

- The second is to secure follow-on investments. As the process of building relationships and trust is a lengthy one, KAYA helps investee companies accelerate discussions with funds whom it knows well and with whom it has co-invested with in the past. These investors include, for example, the British-American Index Ventures, the European Creandum and Goldman Sachs, as well as global funds such as EQT.

KAYA believes that the key to their success has been to not specialise in any particular industry or business vertical.

“Our goal is to constantly think about the technologies and trends of the future. When we invested in Rohlik, the company was not understood and almost written off by traditional software investors, which we didn’t want to be the case for us. That’s also why we are actively looking at various less traditional VC sectors, such as biotechnology, new materials, healthcare, and others. We consider ourselves ‘generalists’, i.e. a fund that is not tied to any specific domain. We believe that we understand the sentiment of entrepreneurs coming from CEE and we want to support them wherever in the world they may be,” says Martin Rajcan, General Partner at KAYA.

The post With over 45 startups already funded, Czech VC fund KAYA secures €70 million to back more Founders from CEE appeared first on EU-Startups.

![[The AI Show Episode 155]: The New Jobs AI Will Create, Amazon CEO: AI Will Cut Jobs, Your Brain on ChatGPT, Possible OpenAI-Microsoft Breakup & Veo 3 IP Issues](https://www.marketingaiinstitute.com/hubfs/ep%20155%20cover.png)

.jpg?#)

.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

_Vladimir_Stanisic_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

_Design_Pics_Inc_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Apple Considers LX Semicon and LG Innotek Components for iPad OLED Displays [Report]](https://www.iclarified.com/images/news/97699/97699/97699-640.jpg)

![Apple Releases New Beta Firmware for AirPods Pro 2 and AirPods 4 [8A293c]](https://www.iclarified.com/images/news/97704/97704/97704-640.jpg)