What's Happening in Developer Tools? (OpenAI Just Bought Windsurf for $3B)

Disclosure: I work at JetBrains, a competitor in this space, and all comments are my own. Yesterday it was announced that OpenAI was buying Windsurf, an AI-first code editor, for $3 billion. This is a pretty amazing feat considering that Windsurf has only been Windsurf since November 2024, a long seven months ago. Before that, it was Codeium, an AI-complete tool that plugged into existing IDEs like VS Code and JetBrains. And before that, way back in 2021, it was founded as Exafunction, which focused on optimizing GPU usage for Machine Learning workloads. A $3B acquisition is indeed extreme, considering Windsurf's annualized recurring revenue (ARR) is reportedly $40m, which makes it a 75x acquisition premium. For context, a typical premium for a mature Software-as-a-Service (SaaS) business is 3-7x, for high-growth, 8-15x, and for hypergrowth, 15-25x. When Microsoft bought GitHub in 2018, it was at a reported 25x premium. Windsurf's 75x multiple is literally off the charts. And remember, this is revenue, not profit. Most of Windsurf's revenue is directly related to LLM usage, ie. collecting money from customers and using that to buy tokens from LLM providers like OpenAI or Anthropic. OpenAI just raised $40B at a $300B valuation, meaning they acquired Windsurf for 1% of their current value. But at the same time, OpenAI reportedly lost $5B in 2024, and their own coding agent, codex, has had middling success. Clearly they were feeling pressure to "do something." It has been widely reported that they were interested in acquiring Cursor, the leading startup AI-powered coding editor, yet the price was too high. Cursor was founded in 2022 and just raised a $900m Series C round at a $9B valuation on the back of doubling its ARR from $100m to $200m over the last two months. Clearly, something is afoot! The Current Developer Tooling Ecosystem At the moment, the developer tooling ecosystem contains a dizzying mix of companies, products, and goals. Let's try to break it down and see where all these forces interact. Part 1: LLM Models First, there are the LLM models powering the current craze: ChatGPT from OpenAI, Claude from Anthropic, Gemini from Google, and many more. Some of these models are proprietary, others like DeepSeek and Facebook's Llama are "somewhat open," and others like Mistral and Phi-3 from Microsoft are truly open. Amongst the general public, ChatGPT has the headstart and the branding, yet Claude by Anthropic is the clear leader amongst developers who are willing to pay real money for it. Thus, even as ChatGPT has been succeeding in growth, it has not managed to tap into what is currently the most lucrative part of the market. Claude's advantage means that it gets something even more valuable: data. When a developer uses a cloud LLM, they send their context (aka their coding files/projects/etc) to the LLM provider, who can evaluate how successful the responses were, retrain the model, and so on. This also means an LLM can slice and dice its customer base to find out what types of developers and companies use what. If LLMs eventually start adding ad-supported tiers—and I think it is inevitable that they will, given that search is clearly broken-then they will want to harvest as much customer data as possible for targeting. It is likely that the current emphasis on result quality will face pressures around revenue, and so on. But that's a separate thread. The more immediate issue is that it is unclear currently whether the hundreds of billions of dollars invested into LLMs will result in truly proprietary models that can charge a premium or whether the space will be eventually commoditized. There are even newer smaller models focused just on a specific task; for example, JetBrains just open-sourced Mellum, its own coding LLM. The fact that DeepSeek's launch in January led to a $1T (that's trillion, by the way, with a T) stock market loss speaks to fears that maybe all this investment in proprietary LLM models costing billions of dollars isn't an infinite pile of cash to collect. Perhaps only a few million dollars is needed. And what if your competitor gives away the model for free? Part 2: Apps Then there are the apps. These days, almost every startup and company is "AI-powered," a deliberately broad term that deserves unpacking. But for this analysis, let's focus on text editors like Windsurf, that sell AI-powered coding editors to developers. Microsoft's Visual Studio Code is a free code editor that relies on community plugins for support across various languages and frameworks. It also has an AI offering, Copilot, that provides code completion and it just added its own agent. VSCode supports multiple LLMs, but initially, there seemed to be a preference for ChatGPT, in part given its early lead and no doubt influenced by the fact Microsoft was an early investor in it. However, that relationship seems to be fraying. Cursor and Windsurf are forks of VSCode,

Disclosure: I work at JetBrains, a competitor in this space, and all comments are my own.

Yesterday it was announced that OpenAI was buying Windsurf, an AI-first code editor, for $3 billion. This is a pretty amazing feat considering that Windsurf has only been Windsurf since November 2024, a long seven months ago. Before that, it was Codeium, an AI-complete tool that plugged into existing IDEs like VS Code and JetBrains. And before that, way back in 2021, it was founded as Exafunction, which focused on optimizing GPU usage for Machine Learning workloads.

A $3B acquisition is indeed extreme, considering Windsurf's annualized recurring revenue (ARR) is reportedly $40m, which makes it a 75x acquisition premium. For context, a typical premium for a mature Software-as-a-Service (SaaS) business is 3-7x, for high-growth, 8-15x, and for hypergrowth, 15-25x. When Microsoft bought GitHub in 2018, it was at a reported 25x premium. Windsurf's 75x multiple is literally off the charts.

And remember, this is revenue, not profit. Most of Windsurf's revenue is directly related to LLM usage, ie. collecting money from customers and using that to buy tokens from LLM providers like OpenAI or Anthropic.

OpenAI just raised $40B at a $300B valuation, meaning they acquired Windsurf for 1% of their current value. But at the same time, OpenAI reportedly lost $5B in 2024, and their own coding agent, codex, has had middling success. Clearly they were feeling pressure to "do something." It has been widely reported that they were interested in acquiring Cursor, the leading startup AI-powered coding editor, yet the price was too high. Cursor was founded in 2022 and just raised a $900m Series C round at a $9B valuation on the back of doubling its ARR from $100m to $200m over the last two months. Clearly, something is afoot!

The Current Developer Tooling Ecosystem

At the moment, the developer tooling ecosystem contains a dizzying mix of companies, products, and goals. Let's try to break it down and see where all these forces interact.

Part 1: LLM Models

First, there are the LLM models powering the current craze: ChatGPT from OpenAI, Claude from Anthropic, Gemini from Google, and many more. Some of these models are proprietary, others like DeepSeek and Facebook's Llama are "somewhat open," and others like Mistral and Phi-3 from Microsoft are truly open.

Amongst the general public, ChatGPT has the headstart and the branding, yet Claude by Anthropic is the clear leader amongst developers who are willing to pay real money for it. Thus, even as ChatGPT has been succeeding in growth, it has not managed to tap into what is currently the most lucrative part of the market. Claude's advantage means that it gets something even more valuable: data. When a developer uses a cloud LLM, they send their context (aka their coding files/projects/etc) to the LLM provider, who can evaluate how successful the responses were, retrain the model, and so on. This also means an LLM can slice and dice its customer base to find out what types of developers and companies use what.

If LLMs eventually start adding ad-supported tiers—and I think it is inevitable that they will, given that search is clearly broken-then they will want to harvest as much customer data as possible for targeting. It is likely that the current emphasis on result quality will face pressures around revenue, and so on. But that's a separate thread.

The more immediate issue is that it is unclear currently whether the hundreds of billions of dollars invested into LLMs will result in truly proprietary models that can charge a premium or whether the space will be eventually commoditized. There are even newer smaller models focused just on a specific task; for example, JetBrains just open-sourced Mellum, its own coding LLM.

The fact that DeepSeek's launch in January led to a $1T (that's trillion, by the way, with a T) stock market loss speaks to fears that maybe all this investment in proprietary LLM models costing billions of dollars isn't an infinite pile of cash to collect. Perhaps only a few million dollars is needed. And what if your competitor gives away the model for free?

Part 2: Apps

Then there are the apps. These days, almost every startup and company is "AI-powered," a deliberately broad term that deserves unpacking. But for this analysis, let's focus on text editors like Windsurf, that sell AI-powered coding editors to developers.

Microsoft's Visual Studio Code is a free code editor that relies on community plugins for support across various languages and frameworks. It also has an AI offering, Copilot, that provides code completion and it just added its own agent. VSCode supports multiple LLMs, but initially, there seemed to be a preference for ChatGPT, in part given its early lead and no doubt influenced by the fact Microsoft was an early investor in it. However, that relationship seems to be fraying.

Cursor and Windsurf are forks of VSCode, which means the developers copied the open-source VSCode code base and then modified it on their own to add AI and other features. That's why relatively small startup teams of recent college graduates could make such progress, taking an existing and relatively mature project and focusing on just the AI integration.

Somewhat predictably, though, Microsoft has started to restrict access to the VSCode Marketplace and popular extensions. Presumably, Cursor and Windsurf have the resources to recreate and manage these things. Still, it is a lot less glamorous than focusing on the fun AI parts and will consume company attention and money. This is just the latest iteration of Microsoft's famous "Embrace, extend, and extinguish" strategy, first seen in the United States government's antitrust legal case against it in the 1990s:

- Embrace - Development of open source software and standards

- Extend - Add features, creating inoperability problems

- Extinguish - When extensions become de facto standards, marginalize competitors

There are other AI agents and text editors out there, including Replit, Zed, and many others, but if you say AI text editor at the moment, most people will think of Cursor/Windsurf/VSCode.

A fourth option in this space is my employer, JetBrains, a privately held European company that has been around for over 20 years and creates popular free and paid tools for developers. JetBrains has been aggressively improving its own AI offerings, including AI Assistant that integrates chat mode with leading LLM models and its own coding agent, Junie.

It is worth pointing out that JetBrains does not have the same funding pressures as VC-backed startups. It does not have an expensive LLM model to maintain and market. It does not have a $2T market cap and other offerings like Microsoft. JetBrains is focused solely on developer tools, primarily text editors.

Part 3: The Future

So where does this analysis of current models and apps leave us? Are we in a bubble or a new age where developer tools are worth tens of billions of dollars?

One possibility is that the total market for developer tools has greatly expanded now that "vibe coders," aka non professional programmers who want to build software, can now do so with the help of AI. I think there is a definite limit to how much a non-technical person can build, but there's no question they can do a lot more than before and they are willing to pay for it.

But even if the total market has grown and doesn't contract in the future, I'm still somewhat skeptical that the current pace is sustainable. After all, where will we be in just 2-3 years if OpenAI and Anthropic, both VC-backed and losing billions, have failed to either greatly improve their models to ChatGPT 5 levels and/or stop losing money? And what about Google, which has its own Gemini model but no coding editor to speak of? Given its current valuation, it seems the natural--and, indeed, the only--company capable of buying Cursor.

But how much value is there in the app compared to the underlying LLM model? I'm partial to the hypothesis that smaller, potentially local, and maybe even "free" models will win out. That puts the emphasis back on the integration with the text editor.

A final point is that AI certainly has a place in software development and will only grow in the future. But is it a total replacement or just a new tool developers must adopt? I agree with Tim O'Reilly here, who wrote a fantastic piece called The End of Programming as We Know It that provides some historical context for the current hype, pointing out that there have been radical changes in the recent past, from desktop to internet programming, from compiled to interpreted languages, and so on.

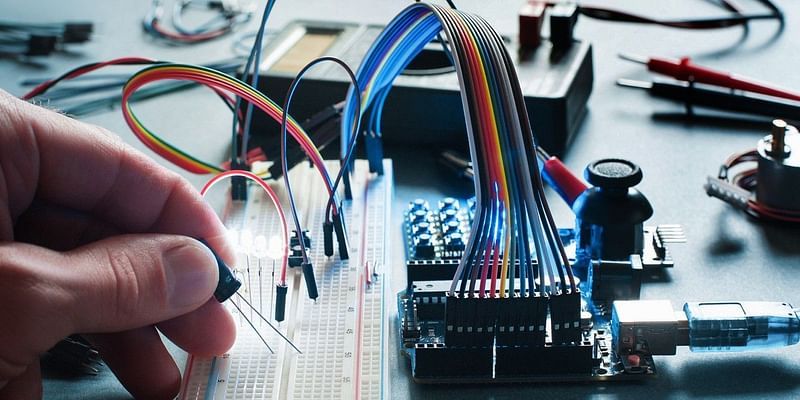

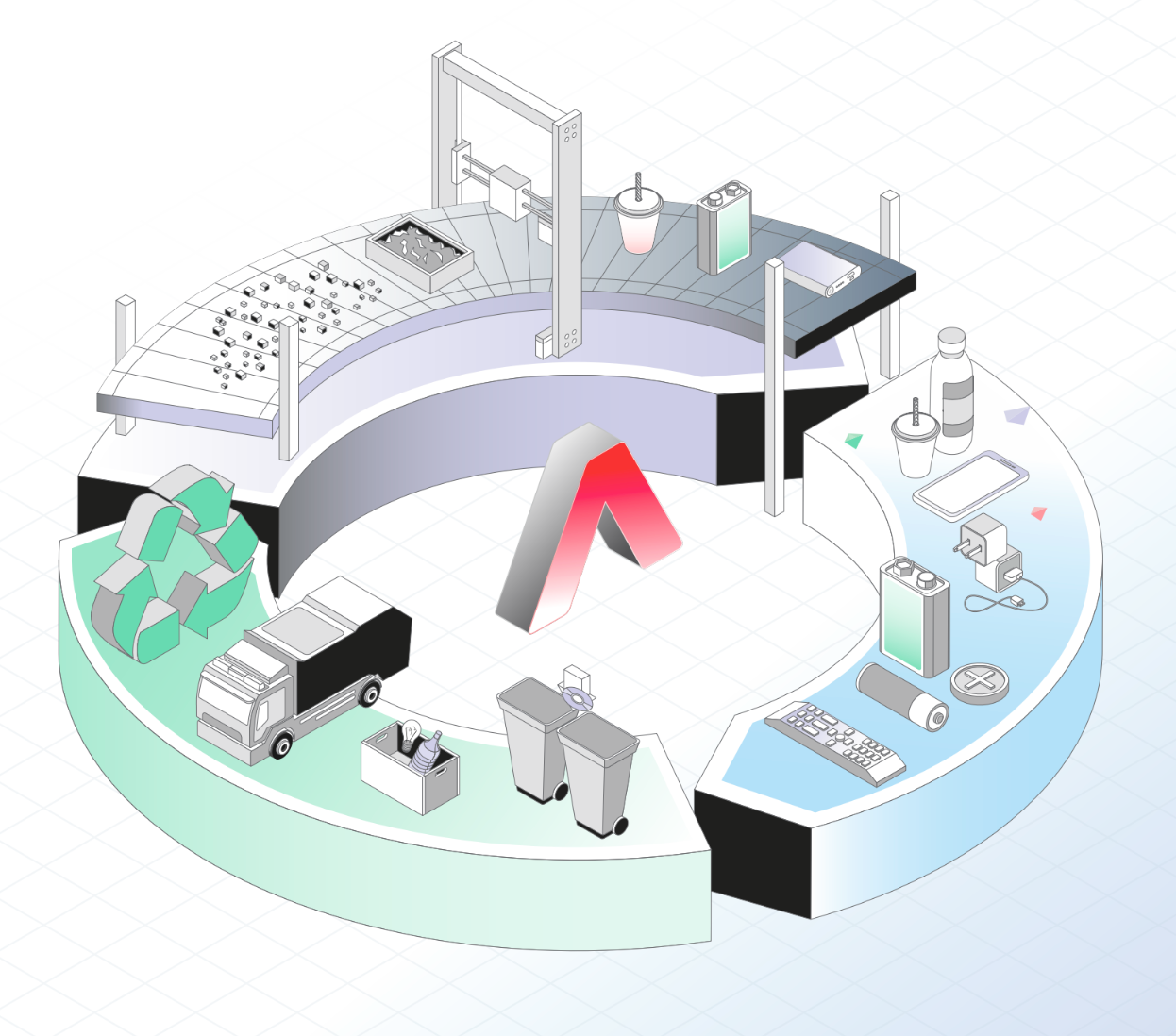

Marie-Alice Blete has a wonderful graphic illustration of the current AI engineering landscape.

If there is one person I personally look to for insight into what's coming, it is Simon Willison, who writes regularly and knowledgeably about these trends. In January, he posted an annual My AI/LLM predictions for the next 1, 3, and 6 years that provides a fantastic analysis of what might occur.

![[The AI Show Episode 146]: Rise of “AI-First” Companies, AI Job Disruption, GPT-4o Update Gets Rolled Back, How Big Consulting Firms Use AI, and Meta AI App](https://www.marketingaiinstitute.com/hubfs/ep%20146%20cover.png)

![[DEALS] The Premium Python Programming PCEP Certification Prep Bundle (67% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![Honor 400 series officially launching on May 22 as design is revealed [Video]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2025/05/honor-400-series-announcement-1.png?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Beats Studio Pro Wireless Headphones Now Just $169.95 - Save 51%! [Deal]](https://www.iclarified.com/images/news/97258/97258/97258-640.jpg)