The Evolution of Crypto Trading Tournaments: From Forum Posts to Institutional Spectacles

In 2012, trading a full Bitcoin for a pizza was considered normal. Fast forward to 2025, and we're witnessing crypto trading tournaments that rival traditional sports in prize pools, audience engagement, and production value. The transformation of these competitions isn’t just cultural—it reflects deeper changes in crypto market maturity, product design, user behavior, and platform growth strategy. Era One: Bootstrapping User Activity (2010–2016) In the early years, liquidity was sparse and user trust was minimal. Exchanges and communities turned to basic reward mechanisms to incentivize participation. Coinbase offered 0.1 BTC per referral to stimulate onboarding. Bitcointalk hosted community-led contests with prizes like 0.5 BTC for algorithmic trading bots. These rudimentary campaigns were sufficient to drive early adoption. From a developer’s standpoint, minimal infrastructure was required beyond a basic referral and payout logic. Gamification was secondary to simply proving that people would trade. Era Two: Structured Growth via Gamification (2016–2019) As exchanges matured, so did their approach to user acquisition and retention. Trading competitions became strategic levers for both liquidity and token price movement. Binance launched its ENJ trading competition with strict on-exchange holding requirements. ENJ experienced a near 5x price movement, and its market cap almost doubled mid-campaign. BitMEX initiated spread-based challenges like the $100K NEO Giveaway. The result was an 18% price increase and a $1.3B market cap boost. During this era, developer involvement shifted toward building in-app dashboards, ranking systems, and competition modules. Event-driven data collection and performance tracking became baseline requirements for exchange platforms. Era Three: Team-Based Campaigns & Audience Segmentation (2019–2025) The introduction of teams and themes turned trading into a community-driven experience. OKX and Bybit launched competitions involving thousands of users, with prize pools ranging from $150K to over $10M. MEXC managed to involve 50K participants and achieved a $7.7M market cap increase post-competition. While price movements were smaller in some cases, the value came from extended engagement. Developers were tasked with supporting team creation, real-time updates, and anti-manipulation monitoring. By this point, marketing and tech departments had to collaborate closely. Features like volume-based leaderboards, rPnL (realized profit and loss) tracking, and API integrations became standard. Era Four: Institutionalization and Broadcast Integration (2025–) The upcoming International Crypto Trading Cup (ICTC) hosted by WhiteBIT reflects the culmination of a decade of evolution: $5M total prize pool, with $1M for the top trading score. Incentives for performance, squad leadership, volume, and viewer participation. Partnerships with platforms like TradingView and media outlets like Bitcoinist and The Coin Republic. From a product development perspective, this requires real-time data streaming, high-throughput analytics, identity verification, fraud detection, and broadcast-quality UX. The stakes are higher. Platform downtime, inaccurate scoring, or poor user interface design could impact both trust and financial outcomes. Key Takeaways for Developers and Platform Engineers Gamification must scale: What worked for 500 users in 2013 doesn't work for 50,000 in 2025. Data architecture is critical: You need resilient systems for real-time ranking, rPnL tracking, and dispute resolution. Security must evolve: Anti-sybil protections, KYC enforcement, and API rate-limiting are table stakes. UX isn’t secondary: Clarity, transparency, and visual feedback influence engagement more than prize money alone. What began as simple community experiments has now become a core marketing and growth strategy for top-tier exchanges. Trading tournaments are no longer fringe activities—they’re brand-defining, user-retaining, and revenue-generating operations. For developers, this means higher expectations around performance, reliability, and adaptability. These events aren't just about who's trading the most—they're about which platform can handle high-visibility, high-volume events without breaking under pressure. Disclaimer: This article is for informational purposes only and does not constitute investment advice or an offer to trade in any product or service. Market data cited from CoinMarketCap was accurate at the time of writing. Always conduct your own research before engaging in financial activity involving digital assets. Read the full article: https://coinmarketcap.com/community/articles/681a224edceabf11ddfc7c49/

In 2012, trading a full Bitcoin for a pizza was considered normal. Fast forward to 2025, and we're witnessing crypto trading tournaments that rival traditional sports in prize pools, audience engagement, and production value.

The transformation of these competitions isn’t just cultural—it reflects deeper changes in crypto market maturity, product design, user behavior, and platform growth strategy.

Era One: Bootstrapping User Activity (2010–2016)

In the early years, liquidity was sparse and user trust was minimal. Exchanges and communities turned to basic reward mechanisms to incentivize participation.

- Coinbase offered 0.1 BTC per referral to stimulate onboarding.

- Bitcointalk hosted community-led contests with prizes like 0.5 BTC for algorithmic trading bots.

These rudimentary campaigns were sufficient to drive early adoption. From a developer’s standpoint, minimal infrastructure was required beyond a basic referral and payout logic. Gamification was secondary to simply proving that people would trade.

Era Two: Structured Growth via Gamification (2016–2019)

As exchanges matured, so did their approach to user acquisition and retention. Trading competitions became strategic levers for both liquidity and token price movement.

- Binance launched its ENJ trading competition with strict on-exchange holding requirements. ENJ experienced a near 5x price movement, and its market cap almost doubled mid-campaign.

- BitMEX initiated spread-based challenges like the $100K NEO Giveaway. The result was an 18% price increase and a $1.3B market cap boost.

During this era, developer involvement shifted toward building in-app dashboards, ranking systems, and competition modules. Event-driven data collection and performance tracking became baseline requirements for exchange platforms.

Era Three: Team-Based Campaigns & Audience Segmentation (2019–2025)

The introduction of teams and themes turned trading into a community-driven experience.

- OKX and Bybit launched competitions involving thousands of users, with prize pools ranging from $150K to over $10M.

- MEXC managed to involve 50K participants and achieved a $7.7M market cap increase post-competition.

While price movements were smaller in some cases, the value came from extended engagement. Developers were tasked with supporting team creation, real-time updates, and anti-manipulation monitoring.

By this point, marketing and tech departments had to collaborate closely. Features like volume-based leaderboards, rPnL (realized profit and loss) tracking, and API integrations became standard.

Era Four: Institutionalization and Broadcast Integration (2025–)

The upcoming International Crypto Trading Cup (ICTC) hosted by WhiteBIT reflects the culmination of a decade of evolution:

- $5M total prize pool, with $1M for the top trading score.

- Incentives for performance, squad leadership, volume, and viewer participation.

- Partnerships with platforms like TradingView and media outlets like Bitcoinist and The Coin Republic.

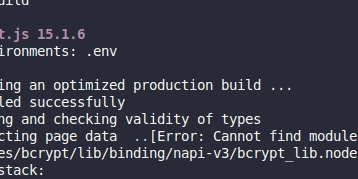

From a product development perspective, this requires real-time data streaming, high-throughput analytics, identity verification, fraud detection, and broadcast-quality UX.

The stakes are higher. Platform downtime, inaccurate scoring, or poor user interface design could impact both trust and financial outcomes.

Key Takeaways for Developers and Platform Engineers

- Gamification must scale: What worked for 500 users in 2013 doesn't work for 50,000 in 2025.

- Data architecture is critical: You need resilient systems for real-time ranking, rPnL tracking, and dispute resolution.

- Security must evolve: Anti-sybil protections, KYC enforcement, and API rate-limiting are table stakes.

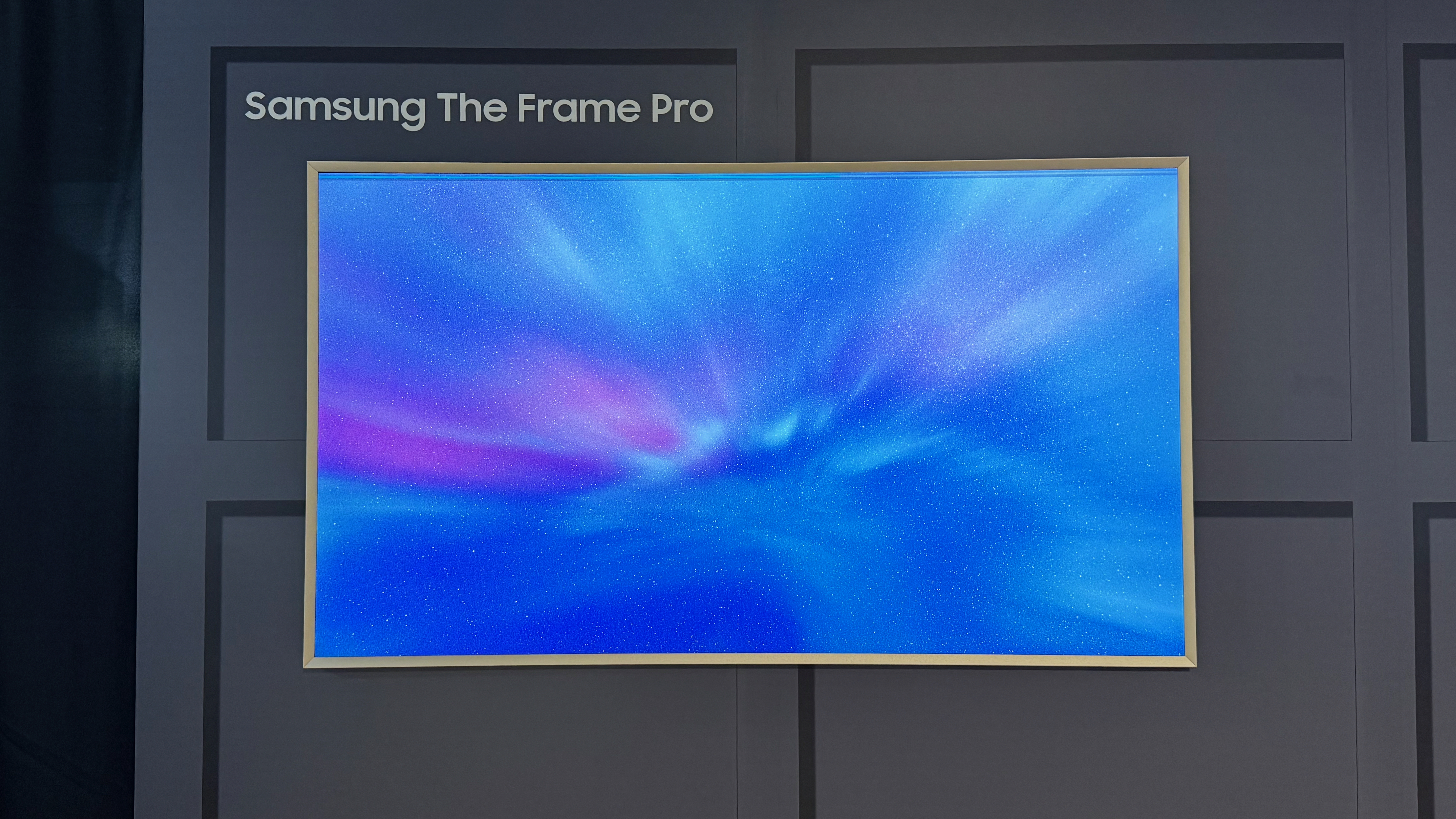

- UX isn’t secondary: Clarity, transparency, and visual feedback influence engagement more than prize money alone.

What began as simple community experiments has now become a core marketing and growth strategy for top-tier exchanges. Trading tournaments are no longer fringe activities—they’re brand-defining, user-retaining, and revenue-generating operations.

For developers, this means higher expectations around performance, reliability, and adaptability. These events aren't just about who's trading the most—they're about which platform can handle high-visibility, high-volume events without breaking under pressure.

Disclaimer: This article is for informational purposes only and does not constitute investment advice or an offer to trade in any product or service. Market data cited from CoinMarketCap was accurate at the time of writing. Always conduct your own research before engaging in financial activity involving digital assets.

Read the full article: https://coinmarketcap.com/community/articles/681a224edceabf11ddfc7c49/

![[The AI Show Episode 146]: Rise of “AI-First” Companies, AI Job Disruption, GPT-4o Update Gets Rolled Back, How Big Consulting Firms Use AI, and Meta AI App](https://www.marketingaiinstitute.com/hubfs/ep%20146%20cover.png)

![[DEALS] The Premium Python Programming PCEP Certification Prep Bundle (67% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

_Aleksey_Funtap_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

_Sergey_Tarasov_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Apple Foldable iPhone to Feature New Display Tech, 19% Thinner Panel [Rumor]](https://www.iclarified.com/images/news/97271/97271/97271-640.jpg)

![Apple Developing New Chips for Smart Glasses, Macs, AI Servers [Report]](https://www.iclarified.com/images/news/97269/97269/97269-640.jpg)

![Apple Shares New Mother's Day Ad: 'A Gift for Mom' [Video]](https://www.iclarified.com/images/news/97267/97267/97267-640.jpg)

![Apple Shares Official Trailer for 'Stick' Starring Owen Wilson [Video]](https://www.iclarified.com/images/news/97264/97264/97264-640.jpg)