OKX Legally Launches US Crypto Exchange Only 2 Months After $505M Settlement

Seychelles-based OKX has legally launched a centralised crypto exchange in the United States, less than two months after settling with the Justice Department by paying $504 million for previously operating in the country without authorisation. It has now set up a regional headquarters in San Jose, California.A New US CEOThe exchange also appointed Roshan Robert as CEO of its US operations. Robert was a Director at Barclays for around eight years and later became a Partner and Group COO and CCO at crypto prime broker Hidden Road, where he worked for over four years. Recently, Ripple acquired Hidden Road for $1.25 billion.Alongside the centralised exchange, OKX has launched a crypto wallet for its US users.“Over the past eight months, I worked alongside some of the most talented and dedicated people in the digital asset industry as we built OKX US,” Robert wrote in a LinkedIn post. “This is more than just a product launch — it’s the start of a new chapter for the firm as we bring our world-class platform and Web3 ecosystem to the world’s largest financial market.”From Illegal to LegalAs Financemagnates.com reported earlier, OKX previously pleaded guilty to offering services to US-based clients without obtaining a money transmitter licence and paid more than $504 million in the settlement, of which $84 million was a penalty. The remaining amount reflected fees the exchange earned from its US customers.According to the US Justice Department, OKX had onboarded US clients since at least 2017, despite having an official policy aimed at “preventing U.S. persons from transacting on its exchange.” The platform served both retail and institutional clients in the US from around 2018 until early 2024, processing over a trillion dollars’ worth of crypto transactions.The relaunch comes at a time when the US is also moving towards easing restrictions on the cryptocurrency sector. The Securities and Exchange Commission (SEC) has dropped multiple high-profile lawsuits and investigations into crypto firms. The regulator’s incoming Chair, Paul Atkins, is also seen as more favourable to crypto and reportedly holds around $6 million in investments with crypto exposure.“Our entry into America is more than a market expansion — it’s a commitment to responsible growth,” OKX said in its latest announcement. “As regulations evolve, OKX is working closely with US regulators and policymakers to ensure we operate transparently and compliantly.” This article was written by Arnab Shome at www.financemagnates.com.

Seychelles-based OKX has legally launched a centralised crypto exchange in the United States, less than two months after settling with the Justice Department by paying $504 million for previously operating in the country without authorisation. It has now set up a regional headquarters in San Jose, California.

A New US CEO

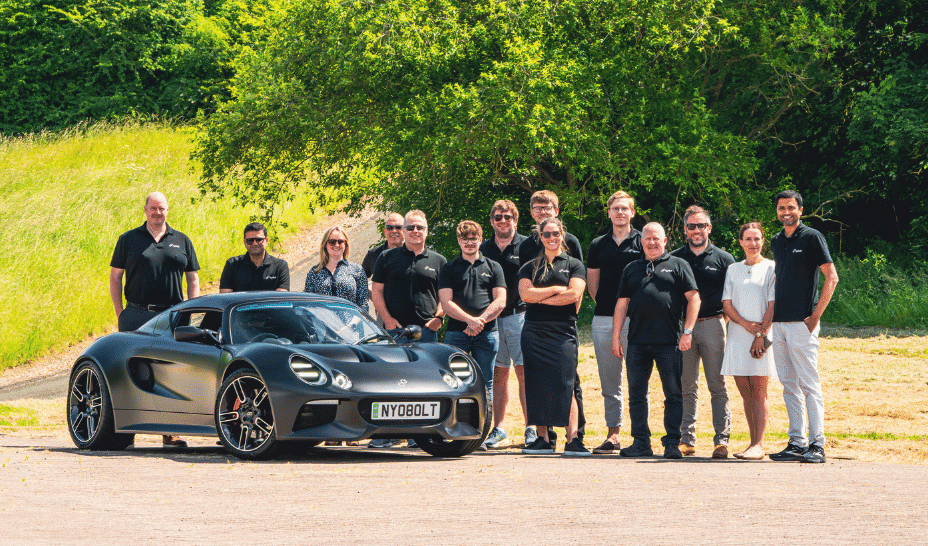

The exchange also appointed Roshan Robert as CEO of its US operations. Robert was a Director at Barclays for around eight years and later became a Partner and Group COO and CCO at crypto prime broker Hidden Road, where he worked for over four years. Recently, Ripple acquired Hidden Road for $1.25 billion.

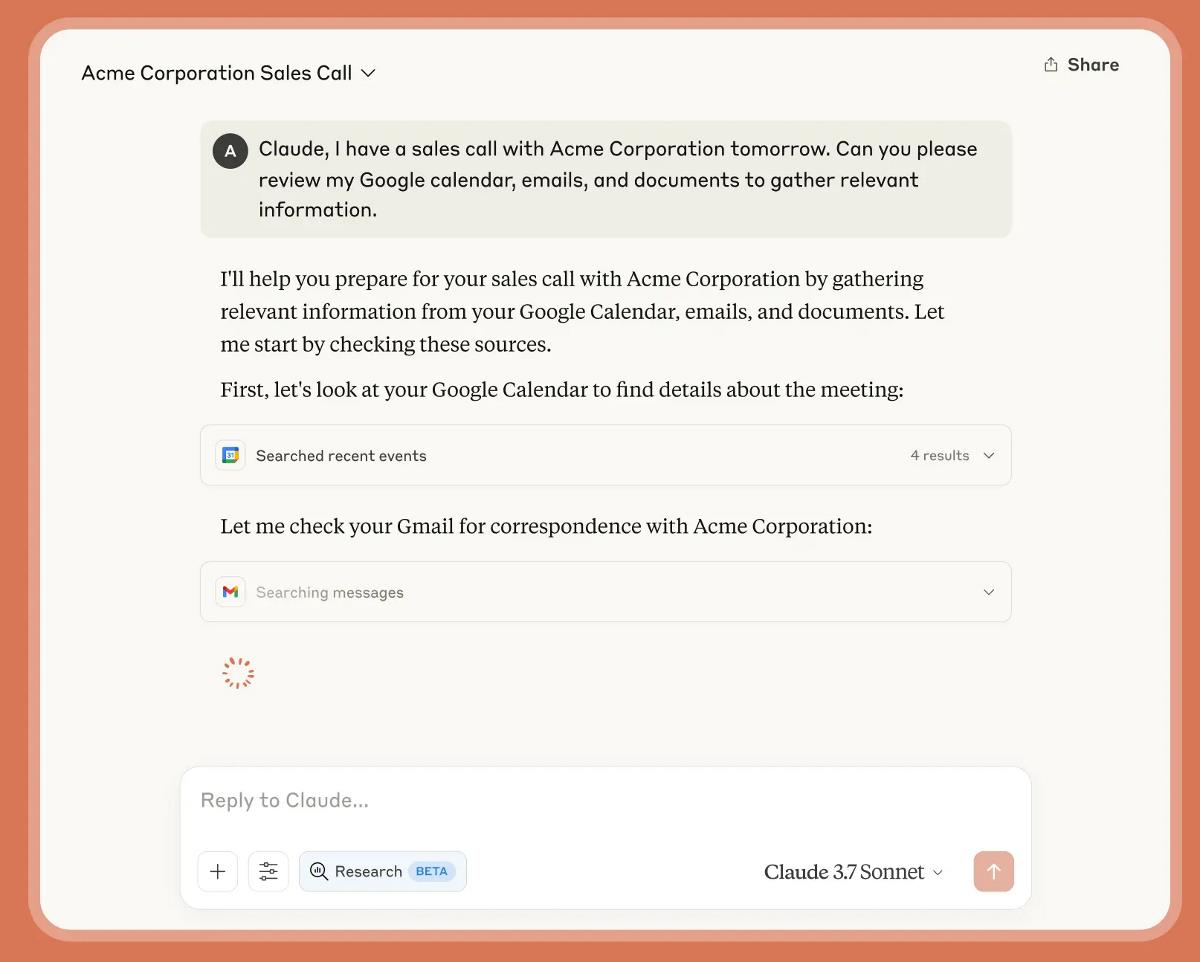

Alongside the centralised exchange, OKX has launched a crypto wallet for its US users.

“Over the past eight months, I worked alongside some of the most talented and dedicated people in the digital asset industry as we built OKX US,” Robert wrote in a LinkedIn post. “This is more than just a product launch — it’s the start of a new chapter for the firm as we bring our world-class platform and Web3 ecosystem to the world’s largest financial market.”

From Illegal to Legal

As Financemagnates.com reported earlier, OKX previously pleaded guilty to offering services to US-based clients without obtaining a money transmitter licence and paid more than $504 million in the settlement, of which $84 million was a penalty. The remaining amount reflected fees the exchange earned from its US customers.

According to the US Justice Department, OKX had onboarded US clients since at least 2017, despite having an official policy aimed at “preventing U.S. persons from transacting on its exchange.” The platform served both retail and institutional clients in the US from around 2018 until early 2024, processing over a trillion dollars’ worth of crypto transactions.

The relaunch comes at a time when the US is also moving towards easing restrictions on the cryptocurrency sector. The Securities and Exchange Commission (SEC) has dropped multiple high-profile lawsuits and investigations into crypto firms. The regulator’s incoming Chair, Paul Atkins, is also seen as more favourable to crypto and reportedly holds around $6 million in investments with crypto exposure.

“Our entry into America is more than a market expansion — it’s a commitment to responsible growth,” OKX said in its latest announcement. “As regulations evolve, OKX is working closely with US regulators and policymakers to ensure we operate transparently and compliantly.” This article was written by Arnab Shome at www.financemagnates.com.

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

![Blue Archive tier list [April 2025]](https://media.pocketgamer.com/artwork/na-33404-1636469504/blue-archive-screenshot-2.jpg?#)

.png?#)

.webp?#)

![CVE security program used by Apple and others has funding removed [U]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2025/04/CVE-security-program-used-by-Apple-and-others-under-immediate-threat.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Apple to Split Enterprise and Western Europe Roles as VP Exits [Report]](https://www.iclarified.com/images/news/97032/97032/97032-640.jpg)

![Nanoleaf Announces New Pegboard Desk Dock With Dual-Sided Lighting [Video]](https://www.iclarified.com/images/news/97030/97030/97030-640.jpg)

![Apple's Foldable iPhone May Cost Between $2100 and $2300 [Rumor]](https://www.iclarified.com/images/news/97028/97028/97028-640.jpg)

![Daredevil Born Again season 1 ending explained: does [spoiler] show up, when does season 2 come out, and more Marvel questions answered](https://cdn.mos.cms.futurecdn.net/i8Lf25QWuSoxWKGxWMLaaA.jpg?#)