This Dutch Exchange Debuts First EU-Regulated Crypto Perpetuals, Targets Retail Traders Next

One Trading has introduced the European Union's first MiFID II-regulated trading venue for crypto perpetual futures, initially for institutional investors with plans to extend access to eligible retail clients in the coming weeks.One Trading Launches First EU-Regulated Crypto Perpetual Futures PlatformThe Amsterdam-based firm's platform, operating under an Organized Trading Facility (OTF) license from the Dutch Authority for Financial Markets (AFM), offers BTC/EUR and ETH/EUR perpetual futures trading pairs, marking the first regulated cash-settled perpetual futures platform in Europe."The launch of our perpetual futures platform is a major milestone in our three-year journey," said One Trading CEO Joshua Barraclough. "From the start, our goal has been to simplify trading by making markets more accessible, transparent, and cost-effective."According to the company, the platform achieves real-time settlement of derivative positions 24/7 with sub-1-minute settlement times. The system reportedly processes over 1 million orders per second with execution latencies under 70 microseconds.Last year, One Trading secured funding to expand its offering from SC Ventures, the investment arm of Standard Chartered. At the same time, it also obtained regulatory approvals to operate as a cryptocurrency business.Until June 2023, One Trading operated as Bitpanda Pro, an independent division of the popular trading platform Bitpanda, tailored to more experienced users. However, the exchange announced a rebranding following the successful completion of a €30 million funding round.Dutch Exchange Debuts Institutional TradingOne Trading claims to be the only regulated exchange that integrates derivatives product creation and trading without external clearing requirements, potentially reducing costs by eliminating traditional post-trade processes.Following an extensive testing phase, several market participants are now active on the platform providing liquidity. The company plans to announce the expansion to eligible retail clients in the coming weeks.Barraclough added, "Today, we are delivering on that vision with the launch of a fully regulated, vertically integrated onshore exchange for perpetual futures. Customers will no longer need to pay vast fees in margin to get access to leverage, trade CFDs or need to trade on unregulated offshore venues."Thank you, New York!

One Trading has introduced the European Union's first MiFID II-regulated trading venue for crypto perpetual futures, initially for institutional investors with plans to extend access to eligible retail clients in the coming weeks.

One Trading Launches First EU-Regulated Crypto Perpetual Futures Platform

The Amsterdam-based firm's platform, operating under an Organized Trading Facility (OTF) license from the Dutch Authority for Financial Markets (AFM), offers BTC/EUR and ETH/EUR perpetual futures trading pairs, marking the first regulated cash-settled perpetual futures platform in Europe.

"The launch of our perpetual futures platform is a major milestone in our three-year journey," said One Trading CEO Joshua Barraclough. "From the start, our goal has been to simplify trading by making markets more accessible, transparent, and cost-effective."

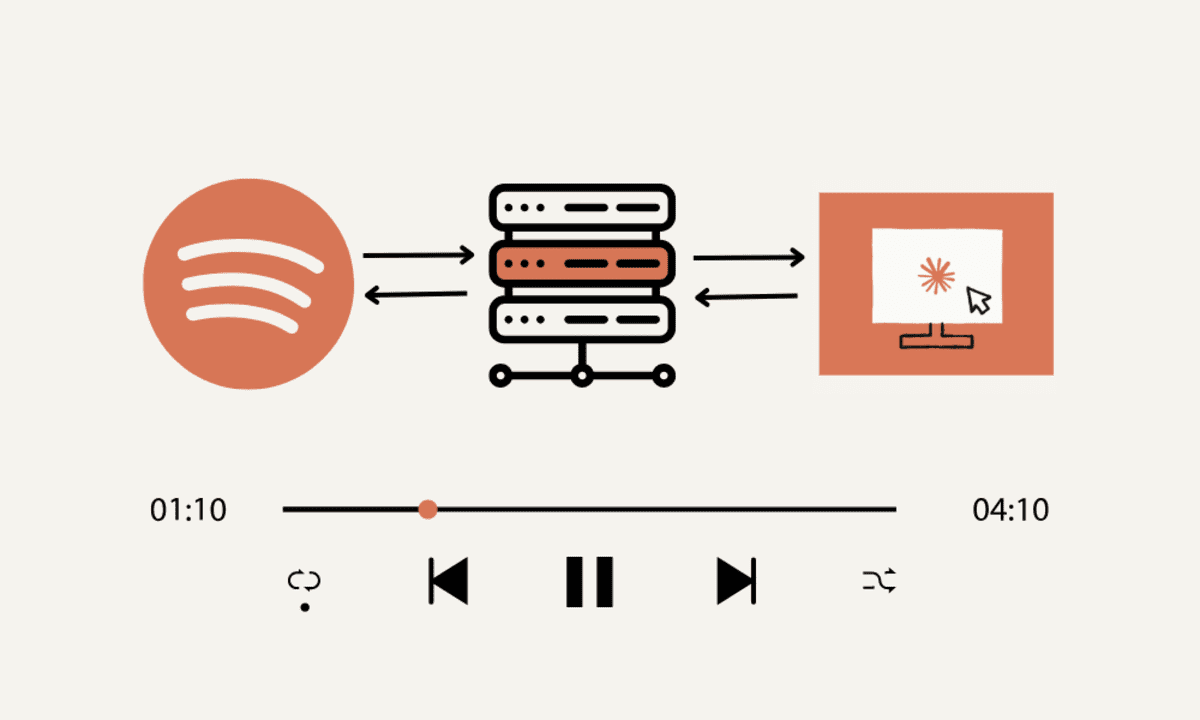

According to the company, the platform achieves real-time settlement of derivative positions 24/7 with sub-1-minute settlement times. The system reportedly processes over 1 million orders per second with execution latencies under 70 microseconds.

Last year, One Trading secured funding to expand its offering from SC Ventures, the investment arm of Standard Chartered. At the same time, it also obtained regulatory approvals to operate as a cryptocurrency business.

Until June 2023, One Trading operated as Bitpanda Pro, an independent division of the popular trading platform Bitpanda, tailored to more experienced users. However, the exchange announced a rebranding following the successful completion of a €30 million funding round.

Dutch Exchange Debuts Institutional Trading

One Trading claims to be the only regulated exchange that integrates derivatives product creation and trading without external clearing requirements, potentially reducing costs by eliminating traditional post-trade processes.

Following an extensive testing phase, several market participants are now active on the platform providing liquidity. The company plans to announce the expansion to eligible retail clients in the coming weeks.

Barraclough added, "Today, we are delivering on that vision with the launch of a fully regulated, vertically integrated onshore exchange for perpetual futures. Customers will no longer need to pay vast fees in margin to get access to leverage, trade CFDs or need to trade on unregulated offshore venues."

Thank you, New York!

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

![Blue Archive tier list [April 2025]](https://media.pocketgamer.com/artwork/na-33404-1636469504/blue-archive-screenshot-2.jpg?#)

.png?#)

.webp?#)

![CVE security program used by Apple and others has funding removed [U]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2025/04/CVE-security-program-used-by-Apple-and-others-under-immediate-threat.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Apple to Split Enterprise and Western Europe Roles as VP Exits [Report]](https://www.iclarified.com/images/news/97032/97032/97032-640.jpg)

![Nanoleaf Announces New Pegboard Desk Dock With Dual-Sided Lighting [Video]](https://www.iclarified.com/images/news/97030/97030/97030-640.jpg)

![Apple's Foldable iPhone May Cost Between $2100 and $2300 [Rumor]](https://www.iclarified.com/images/news/97028/97028/97028-640.jpg)

![Daredevil Born Again season 1 ending explained: does [spoiler] show up, when does season 2 come out, and more Marvel questions answered](https://cdn.mos.cms.futurecdn.net/i8Lf25QWuSoxWKGxWMLaaA.jpg?#)