Navigating Blockchain Project Funding and Scalability Challenges

Abstract This blog post dives deep into the twin challenges of funding and scalability in blockchain projects. We explore diverse funding models like ICOs, STOs, venture capital, and community-driven DAOs while examining technical scalability hurdles and innovative solutions such as Layer 2 protocols, sharding, and consensus mechanism enhancements. By merging historical context with future outlooks, we offer real-world applications, a detailed framework of challenges and opportunities, and actionable insights for developers, investors, and policymakers in the blockchain ecosystem. Introduction Blockchain technology stands as a transformative force, promising enhanced security, decentralization, and transparency across countless industries. However, for blockchain projects to fully realize their potential, two critical issues need to be addressed: securing sustainable funding and overcoming significant scalability challenges. In this post, we explore the multifaceted landscape of blockchain project funding alongside the technical and infrastructural hurdles that impact scalability. By leveraging both traditional and innovative models, we aim to guide stakeholders through the evolving blockchain ecosystem—with insights backed by authoritative sources like what is blockchain and real-world case studies. Background and Context Blockchain technology emerged as a decentralized data ledger system, initially popularized by Bitcoin. Over time, this innovation has evolved into a robust ecosystem characterized by a range of funding mechanisms and technical solutions that drive innovation, security, and decentralization. The evolution of funding—from Initial Coin Offerings (ICOs) to Security Token Offerings (STOs) and decentralized autonomous organizations (DAOs)—mirrors the maturation of the technology itself. Traditional funding avenues like venture capital and private equity have increasingly recognized blockchain’s potential and have contributed both capital and strategic advisory support. At the same time, public funding from initiatives such as the European Union's Horizon 2020 has bolstered transparency and innovation in this space. As blockchain projects continue to evolve, the integration of diverse funding models with enhanced technical scalability solutions is critical for their mainstream adoption. Core Concepts and Features Funding Models for Blockchain Projects Blockchain projects typically rely on several funding models, each with its benefits and risks: Initial Coin Offerings (ICOs) ICOs allowed projects to raise funds by issuing tokens, providing early-stage capital but also exposing investors to high volatility and regulatory challenges. More information can be found on the ICO boom. Security Token Offerings (STOs) STOs are more regulatory-compliant as they integrate traditional financial structures with blockchain, ensuring that tokens are legally backed by assets. Venture Capital and Private Equity Investors from these sectors often bring capital alongside strategic guidance and industry connections. For an introduction to venture capital, check out this article on venture capital. Grants and Public Funding Governments and institutions fund blockchain research and development projects to encourage innovation and maintain transparency. Decentralized Autonomous Organizations (DAOs) DAOs revolutionize funding by allowing community-driven investment decisions—a prime example of blockchain’s decentralizing influence. Below is a table summarizing these funding models: Funding Model Pros Cons ICOs Quick capital raise, global reach Regulatory risks, high volatility STOs Regulatory compliance, asset-backed More complex and costly Venture Capital Strategic support, industry connections Investor influence may limit creative freedom Grants/Public Funding Non-dilutive, promotes innovation Often limited in amount and subject to public policy changes DAOs Community-driven, decentralized decision-making Governance challenges and potential for inefficiency Scalability Challenges and Technical Features Scalability is a primary technical hurdle for blockchain networks. As the number of users and transactions increases, networks like Bitcoin and Ethereum face congestion that leads to slow processing times and high fees. Major concepts include: Layer 2 Solutions Protocols such as the Lightning Network (for Bitcoin) and Plasma (for Ethereum) work off-chain to handle many transactions, easing the burden on the main chain. Sharding This process divides the network into smaller, more manageable segments (shards) that process transactions in parallel, a key feature anticipated in Ethereum 2.0. Consensus Mechanism Innovations Transitioning from the energy-intensive Proof-of-Work (PoW) to alternatives like Proof-of-Stake (PoS) enhances transaction speed and scalability. Interoperability Solutions such as Polkadot and Cosmos are desi

Abstract

This blog post dives deep into the twin challenges of funding and scalability in blockchain projects. We explore diverse funding models like ICOs, STOs, venture capital, and community-driven DAOs while examining technical scalability hurdles and innovative solutions such as Layer 2 protocols, sharding, and consensus mechanism enhancements. By merging historical context with future outlooks, we offer real-world applications, a detailed framework of challenges and opportunities, and actionable insights for developers, investors, and policymakers in the blockchain ecosystem.

Introduction

Blockchain technology stands as a transformative force, promising enhanced security, decentralization, and transparency across countless industries. However, for blockchain projects to fully realize their potential, two critical issues need to be addressed: securing sustainable funding and overcoming significant scalability challenges. In this post, we explore the multifaceted landscape of blockchain project funding alongside the technical and infrastructural hurdles that impact scalability. By leveraging both traditional and innovative models, we aim to guide stakeholders through the evolving blockchain ecosystem—with insights backed by authoritative sources like what is blockchain and real-world case studies.

Background and Context

Blockchain technology emerged as a decentralized data ledger system, initially popularized by Bitcoin. Over time, this innovation has evolved into a robust ecosystem characterized by a range of funding mechanisms and technical solutions that drive innovation, security, and decentralization. The evolution of funding—from Initial Coin Offerings (ICOs) to Security Token Offerings (STOs) and decentralized autonomous organizations (DAOs)—mirrors the maturation of the technology itself.

Traditional funding avenues like venture capital and private equity have increasingly recognized blockchain’s potential and have contributed both capital and strategic advisory support. At the same time, public funding from initiatives such as the European Union's Horizon 2020 has bolstered transparency and innovation in this space. As blockchain projects continue to evolve, the integration of diverse funding models with enhanced technical scalability solutions is critical for their mainstream adoption.

Core Concepts and Features

Funding Models for Blockchain Projects

Blockchain projects typically rely on several funding models, each with its benefits and risks:

Initial Coin Offerings (ICOs)

ICOs allowed projects to raise funds by issuing tokens, providing early-stage capital but also exposing investors to high volatility and regulatory challenges. More information can be found on the ICO boom.Security Token Offerings (STOs)

STOs are more regulatory-compliant as they integrate traditional financial structures with blockchain, ensuring that tokens are legally backed by assets.Venture Capital and Private Equity

Investors from these sectors often bring capital alongside strategic guidance and industry connections. For an introduction to venture capital, check out this article on venture capital.Grants and Public Funding

Governments and institutions fund blockchain research and development projects to encourage innovation and maintain transparency.Decentralized Autonomous Organizations (DAOs)

DAOs revolutionize funding by allowing community-driven investment decisions—a prime example of blockchain’s decentralizing influence.

Below is a table summarizing these funding models:

| Funding Model | Pros | Cons |

|---|---|---|

| ICOs | Quick capital raise, global reach | Regulatory risks, high volatility |

| STOs | Regulatory compliance, asset-backed | More complex and costly |

| Venture Capital | Strategic support, industry connections | Investor influence may limit creative freedom |

| Grants/Public Funding | Non-dilutive, promotes innovation | Often limited in amount and subject to public policy changes |

| DAOs | Community-driven, decentralized decision-making | Governance challenges and potential for inefficiency |

Scalability Challenges and Technical Features

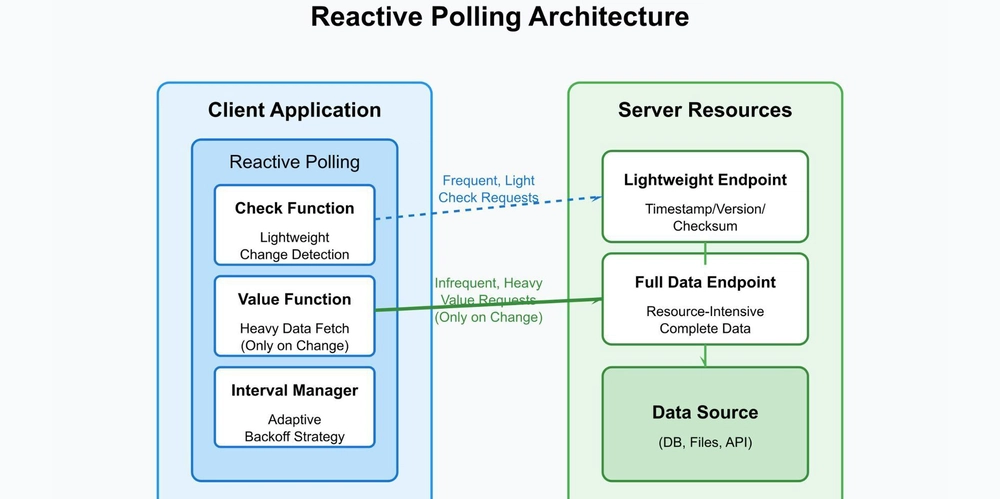

Scalability is a primary technical hurdle for blockchain networks. As the number of users and transactions increases, networks like Bitcoin and Ethereum face congestion that leads to slow processing times and high fees. Major concepts include:

Layer 2 Solutions

Protocols such as the Lightning Network (for Bitcoin) and Plasma (for Ethereum) work off-chain to handle many transactions, easing the burden on the main chain.Sharding

This process divides the network into smaller, more manageable segments (shards) that process transactions in parallel, a key feature anticipated in Ethereum 2.0.Consensus Mechanism Innovations

Transitioning from the energy-intensive Proof-of-Work (PoW) to alternatives like Proof-of-Stake (PoS) enhances transaction speed and scalability.Interoperability

Solutions such as Polkadot and Cosmos are designed to promote seamless interaction between different blockchains, driving efficiency and scalability.Regulatory and Community Engagement Enhancements

Tools such as smart contract audits and decentralized security measures ensure that scaling solutions maintain security without compromising the network.

A useful bullet list highlighting common blockchain scalability challenges:

- Transaction congestion due to limited processing capacity.

- High transaction fees during peak usage periods.

- Energy consumption associated with PoW.

- Interoperability issues between different blockchain ecosystems.

- Latency and network instability when processing high volumes.

Innovative Features in Scalability Solutions

Emerging innovations such as Layer 3 solutions and consensus mechanism improvements further enhance the scalability performance:

- Hybrid Funding Models: These combine traditional venture capital with decentralized funding (e.g., DAOs) for more resilient project financing.

- Interoperability Protocols: Projects are increasingly leveraging multi-chain frameworks to overcome data siloing and latency.

- Smart Contract Audits: Ensuring contracts are secure is imperative when deploying scaling solutions.

- Community Governance: Increased community involvement through DAOs helps in the self-regulation and progressive evolution of blockchain networks.

For deeper insights into regulatory and technical challenges, read about arbitrum challenges and arbitrum and regulatory compliance.

Applications and Use Cases

The practical applications of effective project funding and improved scalability extend beyond cryptocurrency transactions. Here are a few notable examples:

Decentralized Finance (DeFi)

DeFi projects use blockchain to offer financial services such as lending, borrowing, and yield farming. Funding through venture capital, STOs, and DAOs has allowed these projects to innovate rapidly. Projects in this realm often rely on solutions like arbitrum-and-de-fi-yield to minimize transaction costs and improve efficiency.Supply Chain Management

Blockchain is used to enhance supply chain transparency by tracking the provenance of goods. Here, scalability solutions like sharding are critical to process thousands of transactions simultaneously, ensuring real-time updates.Digital Identity and Data Sovereignty

Blockchain empowers individuals to manage their digital identities with superior security. Deployed at scale, these applications need robust funding models and reliable, fast networks to handle sensitive data transactions seamlessly.Enterprise Blockchain Applications

Large corporations integrate blockchain for data integrity and improved operational transparency. Institutional funding, accompanied by robust regulatory clarity, fuels the enterprise adoption of blockchain technology.

For additional context on sustainability and blockchain trends, check out the insights on sustainable blockchain practices and blockchain project funding trends.

Challenges and Limitations

Even with innovative funding models and technological advancements, challenges remain in both securing investment and scaling blockchain networks. Below are some critical issues:

Regulatory Uncertainty

Unclear global regulatory frameworks hinder investment and risk management. Regulatory clarity is vital to protect investors and ensure sustainable growth.Security Vulnerabilities

As blockchain networks scale, the potential attack surface increases. Security measures, such as smart contract audits and decentralized governance, become increasingly important.Network Congestion and High Fees

Increasing network usage can lead to transaction backlogs and elevated fees, discouraging participation. Layer 2 and sharding remain promising strategies but require further refinement and mass adoption.Interoperability

Bridging multiple blockchain ecosystems remains a technical hurdle. Despite advancements, full interoperability is a long-term goal still facing significant technical challenges.Community and Investor Sentiment

Investor and developer confidence can be shaken by market volatility and high-profile failures. Sustained education and transparent communication are key to maintaining trust.Scalability Trade-offs

Some scaling solutions may compromise decentralization or security, presenting a critical balancing act for developers and network architects.

Future Outlook and Innovations

The future of blockchain funding and scalability is promising, with trends pointing toward both increased regulatory clarity and rapid technological innovation. Anticipated developments include:

Decentralized Funding Models with Hybrid Structures

A convergence of traditional financing (venture capital, grants) and decentralized funding (DAOs, yield farming) is expected to produce more resilient financial ecosystems. Innovative models such as token-based community investments are emerging as powerful tools to drive project success.Next-Generation Layer Solutions

Beyond Layer 2, emerging solutions like Layer 3 protocols promise even greater throughput and flexibility. These solutions are designed to handle complex inter-chain interactions while maintaining high security.Enhanced Consensus Mechanisms

As sustainability becomes paramount, the transition from PoW to greener mechanisms like PoS and beyond will likely become quicker. These mechanisms inherently offer improved scalability and energy efficiency.Interoperability Pioneers and Open-Source Collaborations

Projects such as arbitrum-and-ethereum-interoperability pave the way for seamless integration between disparate blockchains. Open-source initiatives are crucial; for example, a recent dev.to post on open-source licensing highlights how smart contracts are reshaping traditional funding models.Community Governance and Decentralized Innovation

As more projects turn to DAOs for governance, community engagement becomes central to accelerating scalability improvements and sustaining ecosystem growth. Transparency in governance will also build trust among investors and users.Sustainable Blockchain Practices

There is growing concern regarding the environmental footprint of blockchain networks. Research into sustainable blockchain practices, as discussed in related articles like blockchain scalability solutions, demonstrate industry-wide commitment to addressing environmental challenges.

For more fresh insights on future trends, consider reading an analysis on blockchain scalability and funding challenges and a comparative analysis on Arbitrum networks.

Summary

In summary, the twin challenges of funding and scalability are at the heart of blockchain innovation today. While the funding environment has diversified—from ICOs and STOs to venture capital, governmental grants, and DAOs—scalability issues continue to push developers toward Layer 2 solutions, sharding, and enhanced interoperability protocols. The roadmap for the future includes converging hybrid funding models and next-generation technical solutions that promise to address these challenges head-on.

Key Insights:

- Blockchain funding has evolved into a multifaceted ecosystem that mixes traditional and decentralized methods.

- Scalability challenges such as network congestion, interoperability issues, and high transaction fees remain primary hurdles.

- Future trends point to hybrid funding models, innovative Layer 3 solutions, and more environmentally sustainable blockchain practices.

- Community governance and robust regulatory frameworks are essential in creating secure and scalable systems.

Additional Resources and Links

For more detailed explorations of related topics, consider visiting:

- What is Blockchain?

- Initial Coin Offerings

- European Union Horizon 2020

- Bitcoin Lightning Network

- Ethereum 2.0

- Polkadot Network

Additionally, explore these curated resources on Arbitrum and open-source funding:

- Arbitrum and DeFi Yield

- Arbitrum and Ethereum Interoperability

- Arbitrum and Layer 3 Solutions

- Arbitrum and Regulatory Compliance

- Arbitrum Challenges

For perspectives from the developer community, check out these dev.to insights:

- Unveiling the OpenSSL License – A Deep Dive into Open Source Security

- Exploring the Intel Open Source License – A Deep Dive

- Arbitrum One vs Arbitrum Nova: Comparative Analysis and Future Insights

Final Thoughts

Navigating blockchain project funding and scalability challenges requires a delicate balance between technical innovation and economic strategy. By combining traditional investment frameworks with smart, decentralized financial ecosystems, the blockchain community can overcome these obstacles and push toward mainstream adoption. As regulation becomes clearer and technical solutions like Layer 2 enhancements and sharding mature, the future looks bright for blockchain—a future where innovation and sustainability coexist to empower industries and individuals alike.

Whether you are a developer seeking to optimize your decentralized application, an investor looking for safe entry points in the rapidly evolving blockchain market, or a policymaker striving for robust yet flexible regulation, understanding these dual challenges is essential. The journey ahead is complex, but with collaborative innovation, transparent governance, and shared knowledge, blockchain technology is poised to reshape our digital and financial landscapes for the better.

Embrace the change, explore innovative funding models, and contribute to building scalable blockchain networks for a decentralized tomorrow.

Happy innovating!

![[Free Webinar] Guide to Securing Your Entire Identity Lifecycle Against AI-Powered Threats](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjqbZf4bsDp6ei3fmQ8swm7GB5XoRrhZSFE7ZNhRLFO49KlmdgpIDCZWMSv7rydpEShIrNb9crnH5p6mFZbURzO5HC9I4RlzJazBBw5aHOTmI38sqiZIWPldRqut4bTgegipjOk5VgktVOwCKF_ncLeBX-pMTO_GMVMfbzZbf8eAj21V04y_NiOaSApGkM/s1600/webinar-play.jpg?#)

![[The AI Show Episode 145]: OpenAI Releases o3 and o4-mini, AI Is Causing “Quiet Layoffs,” Executive Order on Youth AI Education & GPT-4o’s Controversial Update](https://www.marketingaiinstitute.com/hubfs/ep%20145%20cover.png)

_XFkvNLu.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

_Tanapong_Sungkaew_via_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Apple Restructures Global Affairs and Apple Music Teams [Report]](https://www.iclarified.com/images/news/97162/97162/97162-640.jpg)

![New iPhone Factory Goes Live in India, Another Just Days Away [Report]](https://www.iclarified.com/images/news/97165/97165/97165-640.jpg)