The NFT market fell apart. Brands are still paying the price

The NFT market crash has a long tail. In the late 2010s, crypto enthusiasts and web3 advocates celebrated the arrival of digital art. Non-Fungible Tokens, they argued, could offer the permanence and investment value of a traditional painting. Not anymore: even amid President Trump’s memecoin surge, NFT valuations continue to hit new lows. The market has been in free fall for nearly two years, with no bottom in sight. While NFTs may be dead, NFT lawsuits are alive and well. Corporate suppliers are beginning to regret their blockchain experiments. The NFT lawsuit boom Most recently, buyers of Nike’s NFTs sued the retailer for $5 million. Nike had acquired the virtual sneaker shop RTFKT in 2021, generating nearly $200 million in NFT sales. But in 2024, Nike began winding the operation down. The lawsuit alleges that the shutdown destroyed demand for RTFKT’s NFTs, effectively causing “the rug to be pulled out from under” buyers, according to Reuters. Some RTFKT NFTs even briefly displayed error messages during the turmoil. The online sportsbook DraftKings also ventured into the NFT space, only to shut down its Reignmakers NFT marketplace in July 2024. Meanwhile, a 2023 lawsuit alleged that DraftKings sold NFTs as unlicensed securities, reaping “the full benefit” of initial sales and a 5% commission on secondary sales. That case has since been settled, with DraftKings agreeing to pay out $10 million in February to those who purchased NFTs between 2021 and the shutdown. NFT buyers have also gone after the celebrities who hawked their fast-declining digital assets. Shaquille O’Neal’s 2023 lawsuit recently concluded, with the former NBA player agreeing to pay out $11 million (plus $2.9 million in attorney’s fees) to buyers of his Astrals Project NFTs. Meanwhile, the MAGA-friendly Nelk Boys are still battling their own lawsuit, which claims the YouTubers promised additional perks with their NFT sales that were never fulfilled. For corporations and celebrities, NFTs were a side business. But for companies dedicated solely to producing digital assets, these lawsuits are far more threatening. Dapper Labs—which partners with companies like Disney and the NFL to build branded NFTs—recently settled for $4 million over claims that its NBA Top Shot “moments” were unregistered securities. Yuga Labs, meanwhile, has been stuck in court for years fighting copyright battles over its Bored Ape Yacht Club. Recently, it even petitioned for access to a copying artist’s crypto wallet. How NFTs became a bad corporate bet Just a few years ago, major companies from Nike to Coca-Cola were racing to launch web3 ventures. Some are still ongoing; many have flamed out. And with the barrage of lawsuits now hitting NFT suppliers, these blockchain bets are looking increasingly risky. They may also fail to deliver value. NFTs were meant to serve as brand extensions—especially for luxury companies, which sold highly expensive goods in digital form. But according to a recent study in the Journal of the Association for Consumer Research, NFT availability may actually have a negative effect on consumer sentiment. The researchers found that for goods with web3 iterations, the physical counterparts were perceived as less luxurious—and thus less worth spending on. NFTs have lost their value to major companies. They’re not effective brand extensions, they’re not sustainable investments, and they’re barely even good cash grabs anymore. All they’re left with is a mess of lawsuits.

The NFT market crash has a long tail.

In the late 2010s, crypto enthusiasts and web3 advocates celebrated the arrival of digital art. Non-Fungible Tokens, they argued, could offer the permanence and investment value of a traditional painting. Not anymore: even amid President Trump’s memecoin surge, NFT valuations continue to hit new lows. The market has been in free fall for nearly two years, with no bottom in sight.

While NFTs may be dead, NFT lawsuits are alive and well. Corporate suppliers are beginning to regret their blockchain experiments.

The NFT lawsuit boom

Most recently, buyers of Nike’s NFTs sued the retailer for $5 million. Nike had acquired the virtual sneaker shop RTFKT in 2021, generating nearly $200 million in NFT sales. But in 2024, Nike began winding the operation down. The lawsuit alleges that the shutdown destroyed demand for RTFKT’s NFTs, effectively causing “the rug to be pulled out from under” buyers, according to Reuters. Some RTFKT NFTs even briefly displayed error messages during the turmoil.

The online sportsbook DraftKings also ventured into the NFT space, only to shut down its Reignmakers NFT marketplace in July 2024. Meanwhile, a 2023 lawsuit alleged that DraftKings sold NFTs as unlicensed securities, reaping “the full benefit” of initial sales and a 5% commission on secondary sales. That case has since been settled, with DraftKings agreeing to pay out $10 million in February to those who purchased NFTs between 2021 and the shutdown.

NFT buyers have also gone after the celebrities who hawked their fast-declining digital assets. Shaquille O’Neal’s 2023 lawsuit recently concluded, with the former NBA player agreeing to pay out $11 million (plus $2.9 million in attorney’s fees) to buyers of his Astrals Project NFTs. Meanwhile, the MAGA-friendly Nelk Boys are still battling their own lawsuit, which claims the YouTubers promised additional perks with their NFT sales that were never fulfilled.

For corporations and celebrities, NFTs were a side business. But for companies dedicated solely to producing digital assets, these lawsuits are far more threatening. Dapper Labs—which partners with companies like Disney and the NFL to build branded NFTs—recently settled for $4 million over claims that its NBA Top Shot “moments” were unregistered securities. Yuga Labs, meanwhile, has been stuck in court for years fighting copyright battles over its Bored Ape Yacht Club. Recently, it even petitioned for access to a copying artist’s crypto wallet.

How NFTs became a bad corporate bet

Just a few years ago, major companies from Nike to Coca-Cola were racing to launch web3 ventures. Some are still ongoing; many have flamed out. And with the barrage of lawsuits now hitting NFT suppliers, these blockchain bets are looking increasingly risky.

They may also fail to deliver value. NFTs were meant to serve as brand extensions—especially for luxury companies, which sold highly expensive goods in digital form. But according to a recent study in the Journal of the Association for Consumer Research, NFT availability may actually have a negative effect on consumer sentiment. The researchers found that for goods with web3 iterations, the physical counterparts were perceived as less luxurious—and thus less worth spending on.

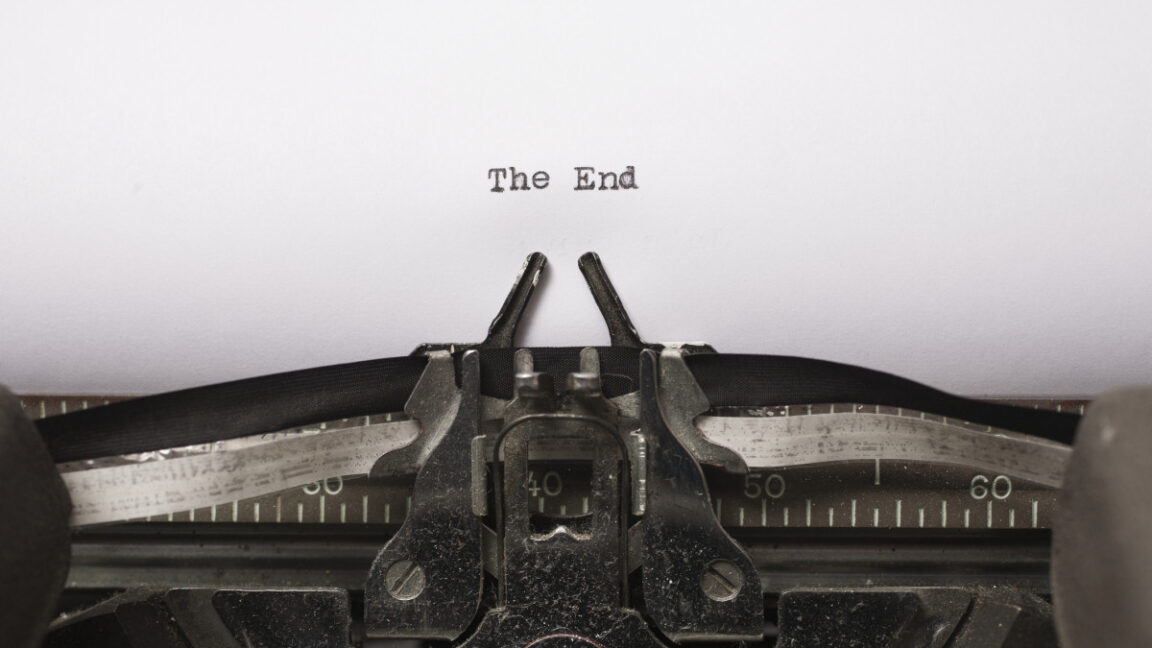

NFTs have lost their value to major companies. They’re not effective brand extensions, they’re not sustainable investments, and they’re barely even good cash grabs anymore. All they’re left with is a mess of lawsuits.

![[Free Webinar] Guide to Securing Your Entire Identity Lifecycle Against AI-Powered Threats](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjqbZf4bsDp6ei3fmQ8swm7GB5XoRrhZSFE7ZNhRLFO49KlmdgpIDCZWMSv7rydpEShIrNb9crnH5p6mFZbURzO5HC9I4RlzJazBBw5aHOTmI38sqiZIWPldRqut4bTgegipjOk5VgktVOwCKF_ncLeBX-pMTO_GMVMfbzZbf8eAj21V04y_NiOaSApGkM/s1600/webinar-play.jpg?#)

![[The AI Show Episode 145]: OpenAI Releases o3 and o4-mini, AI Is Causing “Quiet Layoffs,” Executive Order on Youth AI Education & GPT-4o’s Controversial Update](https://www.marketingaiinstitute.com/hubfs/ep%20145%20cover.png)

_Jochen_Tack_Alamy.png?width=1280&auto=webp&quality=80&disable=upscale#)

![New Hands-On iPhone 17 Dummy Video Shows Off Ultra-Thin Air Model, Updated Pro Designs [Video]](https://www.iclarified.com/images/news/97171/97171/97171-640.jpg)

![Apple Shares Trailer for First Immersive Feature Film 'Bono: Stories of Surrender' [Video]](https://www.iclarified.com/images/news/97168/97168/97168-640.jpg)

![Apple Restructures Global Affairs and Apple Music Teams [Report]](https://www.iclarified.com/images/news/97162/97162/97162-640.jpg)

![New iPhone Factory Goes Live in India, Another Just Days Away [Report]](https://www.iclarified.com/images/news/97165/97165/97165-640.jpg)