Financial and Banking Application Programming

Financial technology (FinTech) has revolutionized how we manage money, invest, and perform banking operations. For developers, programming financial and banking applications involves a unique set of skills, tools, and compliance considerations. This post explores the essential concepts and technologies behind building secure and robust financial applications. Types of Financial Applications Banking Apps: Enable account management, transfers, and payments. Investment Platforms: Allow users to trade stocks, ETFs, and cryptocurrencies. Budgeting & Expense Trackers: Help users monitor spending and savings. Loan Management Systems: Handle loan applications, payments, and interest calculations. Payment Gateways: Facilitate secure online transactions (e.g., Stripe, PayPal). Key Features of Financial Software Security: End-to-end encryption, two-factor authentication (2FA), and fraud detection. Real-time Data: Updates for balances, transactions, and market prices. Compliance: Must adhere to financial regulations like PCI DSS, KYC, AML, and GDPR. Transaction Logging: Transparent, auditable logs for user actions and payments. Integration: APIs for banking systems, stock markets, and payment processors. Popular Technologies Used Frontend: React, Flutter, Angular for responsive and mobile-first interfaces. Backend: Node.js, Django, .NET, Java (Spring Boot) for high-performance services. Databases: PostgreSQL, MongoDB, Redis for transaction tracking and caching. APIs: Plaid, Yodlee, Open Banking APIs for data aggregation and bank access. Security Tools: JWT, OAuth 2.0, TLS encryption, secure token storage. Basic Architecture of a Banking App Frontend: User dashboard, transaction view, forms. API Layer: Handles business logic and authentication. Database: Stores user profiles, transaction history, account balances. Integration Services: Connect to payment processors and banking APIs. Security Layer: Encrypts communication, verifies users, logs events. Regulatory Compliance PCI DSS: Payment Card Industry Data Security Standard. KYC: Know Your Customer procedures for identity verification. AML: Anti-Money Laundering laws and automated detection. GDPR: Ensures data protection for EU citizens. SOX: U.S. Sarbanes-Oxley Act compliance for financial reporting. Sample: Python Code to Fetch Transactions (Plaid API) import plaid from plaid.api import plaid_api from plaid.model import TransactionsGetRequest client = plaid_api.PlaidApi(plaid.Configuration( host=plaid.Environment.Sandbox, api_key={'clientId': 'your_client_id', 'secret': 'your_secret'} )) request = TransactionsGetRequest( access_token='access-sandbox-123abc', start_date='2024-01-01', end_date='2024-04-01' ) response = client.transactions_get(request) print(response.to_dict()) Best Practices for FinTech Development Always encrypt sensitive data at rest and in transit. Use tokenization for storing financial credentials. Perform regular security audits and penetration testing. Use test environments and sandboxes before live deployment. Stay updated with financial laws and API updates. Conclusion Financial and banking software development is a specialized domain that requires technical precision, regulatory awareness, and security-first design. With proper tools and best practices, developers can build impactful financial applications that empower users and institutions alike.

Financial technology (FinTech) has revolutionized how we manage money, invest, and perform banking operations. For developers, programming financial and banking applications involves a unique set of skills, tools, and compliance considerations. This post explores the essential concepts and technologies behind building secure and robust financial applications.

Types of Financial Applications

- Banking Apps: Enable account management, transfers, and payments.

- Investment Platforms: Allow users to trade stocks, ETFs, and cryptocurrencies.

- Budgeting & Expense Trackers: Help users monitor spending and savings.

- Loan Management Systems: Handle loan applications, payments, and interest calculations.

- Payment Gateways: Facilitate secure online transactions (e.g., Stripe, PayPal).

Key Features of Financial Software

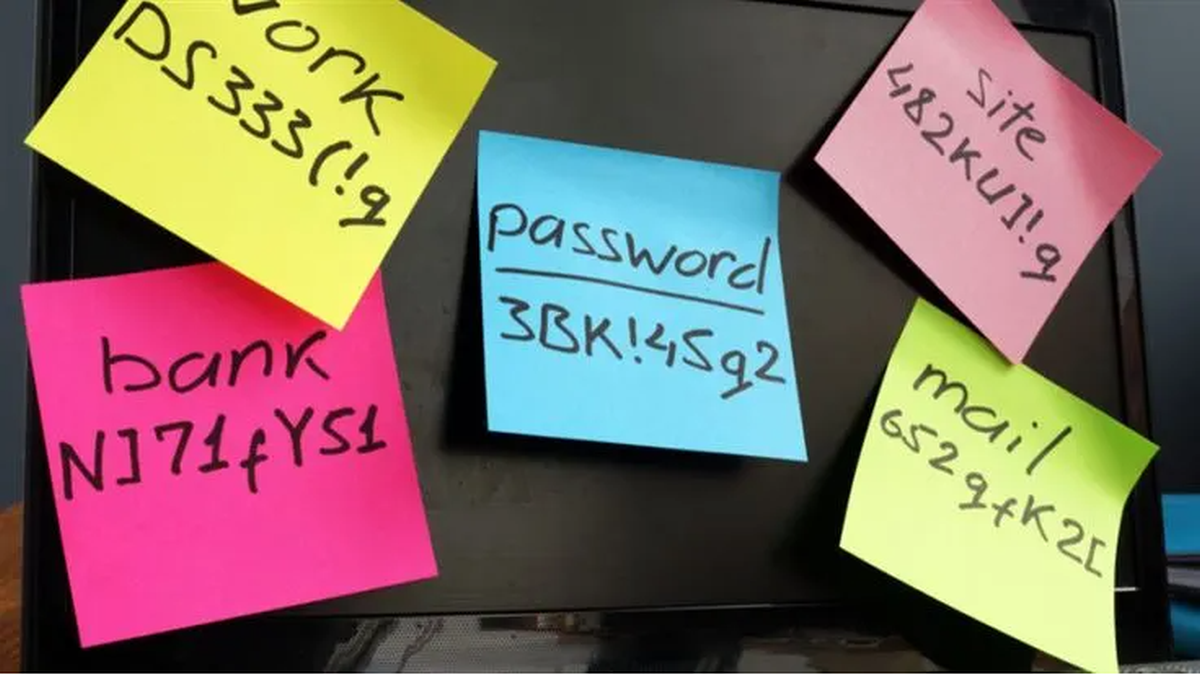

- Security: End-to-end encryption, two-factor authentication (2FA), and fraud detection.

- Real-time Data: Updates for balances, transactions, and market prices.

- Compliance: Must adhere to financial regulations like PCI DSS, KYC, AML, and GDPR.

- Transaction Logging: Transparent, auditable logs for user actions and payments.

- Integration: APIs for banking systems, stock markets, and payment processors.

Popular Technologies Used

- Frontend: React, Flutter, Angular for responsive and mobile-first interfaces.

- Backend: Node.js, Django, .NET, Java (Spring Boot) for high-performance services.

- Databases: PostgreSQL, MongoDB, Redis for transaction tracking and caching.

- APIs: Plaid, Yodlee, Open Banking APIs for data aggregation and bank access.

- Security Tools: JWT, OAuth 2.0, TLS encryption, secure token storage.

Basic Architecture of a Banking App

- Frontend: User dashboard, transaction view, forms.

- API Layer: Handles business logic and authentication.

- Database: Stores user profiles, transaction history, account balances.

- Integration Services: Connect to payment processors and banking APIs.

- Security Layer: Encrypts communication, verifies users, logs events.

Regulatory Compliance

- PCI DSS: Payment Card Industry Data Security Standard.

- KYC: Know Your Customer procedures for identity verification.

- AML: Anti-Money Laundering laws and automated detection.

- GDPR: Ensures data protection for EU citizens.

- SOX: U.S. Sarbanes-Oxley Act compliance for financial reporting.

Sample: Python Code to Fetch Transactions (Plaid API)

import plaid

from plaid.api import plaid_api

from plaid.model import TransactionsGetRequest

client = plaid_api.PlaidApi(plaid.Configuration(

host=plaid.Environment.Sandbox,

api_key={'clientId': 'your_client_id', 'secret': 'your_secret'}

))

request = TransactionsGetRequest(

access_token='access-sandbox-123abc',

start_date='2024-01-01',

end_date='2024-04-01'

)

response = client.transactions_get(request)

print(response.to_dict())

Best Practices for FinTech Development

- Always encrypt sensitive data at rest and in transit.

- Use tokenization for storing financial credentials.

- Perform regular security audits and penetration testing.

- Use test environments and sandboxes before live deployment.

- Stay updated with financial laws and API updates.

Conclusion

Financial and banking software development is a specialized domain that requires technical precision, regulatory awareness, and security-first design. With proper tools and best practices, developers can build impactful financial applications that empower users and institutions alike.

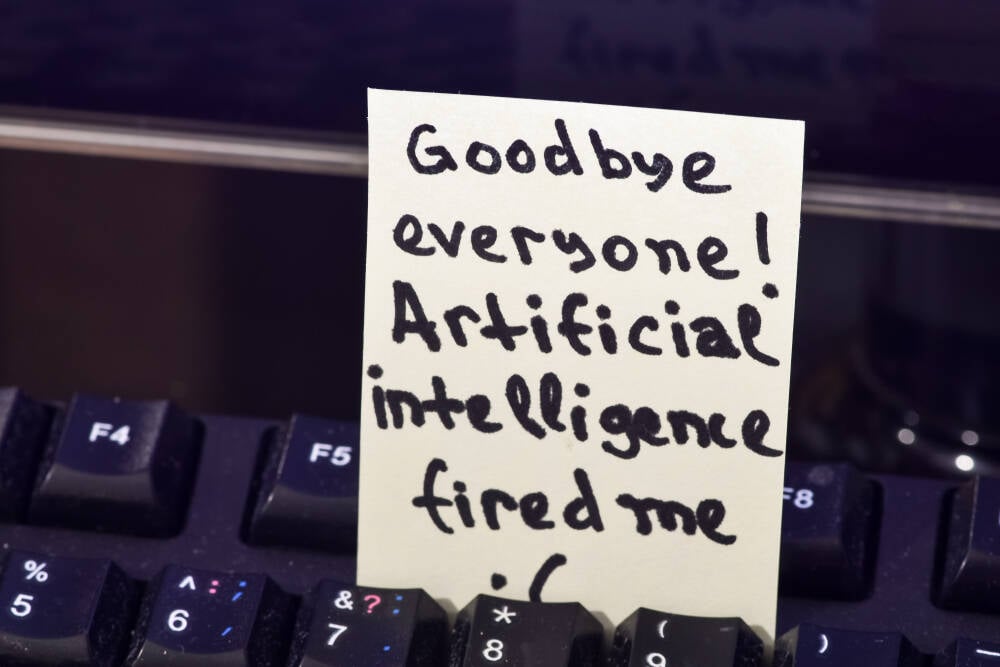

![[The AI Show Episode 146]: Rise of “AI-First” Companies, AI Job Disruption, GPT-4o Update Gets Rolled Back, How Big Consulting Firms Use AI, and Meta AI App](https://www.marketingaiinstitute.com/hubfs/ep%20146%20cover.png)

![[DEALS] The Premium Python Programming PCEP Certification Prep Bundle (67% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

_Aleksey_Funtap_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

_Sergey_Tarasov_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Apple Foldable iPhone to Feature New Display Tech, 19% Thinner Panel [Rumor]](https://www.iclarified.com/images/news/97271/97271/97271-640.jpg)

![Apple Developing New Chips for Smart Glasses, Macs, AI Servers [Report]](https://www.iclarified.com/images/news/97269/97269/97269-640.jpg)

![Apple Shares New Mother's Day Ad: 'A Gift for Mom' [Video]](https://www.iclarified.com/images/news/97267/97267/97267-640.jpg)

![Apple Shares Official Trailer for 'Stick' Starring Owen Wilson [Video]](https://www.iclarified.com/images/news/97264/97264/97264-640.jpg)