Decentralized Finance (DeFi) Revolutionizes Financial Systems

Decentralized Finance, or DeFi in its abbreviation, is a system that enables users to interact with financial services with the absence of intermediaries, such as banks and financial institutions, by using blockchain technology. It seeks to make the financial system open, transparent, and permissionless and thus available to any user who has access to the internet. What is DeFi? DeFi is a suite of financial applications and protocols that run on blockchain networks, primarily Ethereum. The applications use smart contracts—self-executing contracts with the rules of the contract written directly into lines of code on the blockchain—to automate financial transactions. Unlike traditional finance, DeFi is decentralized and doesn't rely on central authorities. Key Features of DeFi Transparency: All the transactions are recorded on a public blockchain to ensure complete transparency. Accessibility: Anyone with an internet connection can access DeFi platforms without needing approval from a centralized entity. Interoperability: Many DeFi applications can interact seamlessly with each other, creating a vast financial ecosystem. Permissionless: No credit checks or account approvals are required, empowering users globally. Control: Users retain full control over their assets without relying on third parties. Popular DeFi Use Cases Lending and Borrowing: One can lend their assets through Aave and Compound for interest or borrow against one's crypto collateral without traditional credit checks. Decentralized Exchanges: Examples include Uniswap and SushiSwap, which offer direct, peer-to-peer trades of cryptocurrencies without the use of an intermediary. Stablecoins: DAI is a cryptocurrency that keeps its value stable by pegging its price into fiat currencies to offer stability in this highly volatile market. Yield Farming: A reward, usually in additional tokens, can be earned by providing one's assets to a liquidity pool. Insurance: Providing Decentralized Insurance for several risks of the DeFi ecosystem, through platforms such as Nexus Mutual. Tokenization of Assets: Tokenization of physical real estates can easily be traded on this, thus increasing liquidness and gaining easy accessibility. Advantages of DeFi Financial Inclusion: DeFi opens financial opportunities to the underbanked and unbanked populations across the world. Reduced Costs: Without intermediaries, DeFi lowers fees related to financial transactions. Convenience/Flexibility: A single platform allows users to access multiple financial products and services. Challenges and Risks Smart Contract Vulnerabilities: Bugs and hacks in smart contracts can lead to losses. Volatility: The value of crypto assets can fluctuate dramatically, posing risks to users. Regulatory Uncertainty: Governments are still grappling with how to regulate DeFi, creating uncertainty for users and developers. The Future of DeFi DeFi is on the verge of changing the face of the financial world by offering innovative solutions to very old problems in traditional finance. While blockchain technology is continuously improving in scalability, interoperability, and security, the rate of adoption for DeFi will grow exponentially. If DeFi wants to attain mainstream acceptance, it needs to overcome the existing challenges and offer a much safer and more user-friendly experience. DeFi is more than a trend; it's a movement that's reshaping the financial landscape. Be it for the tech enthusiast, investor, or the curious learner, DeFi is critical in understanding the future of finance.

Decentralized Finance, or DeFi in its abbreviation, is a system that enables users to interact with financial services with the absence of intermediaries, such as banks and financial institutions, by using blockchain technology. It seeks to make the financial system open, transparent, and permissionless and thus available to any user who has access to the internet.

What is DeFi?

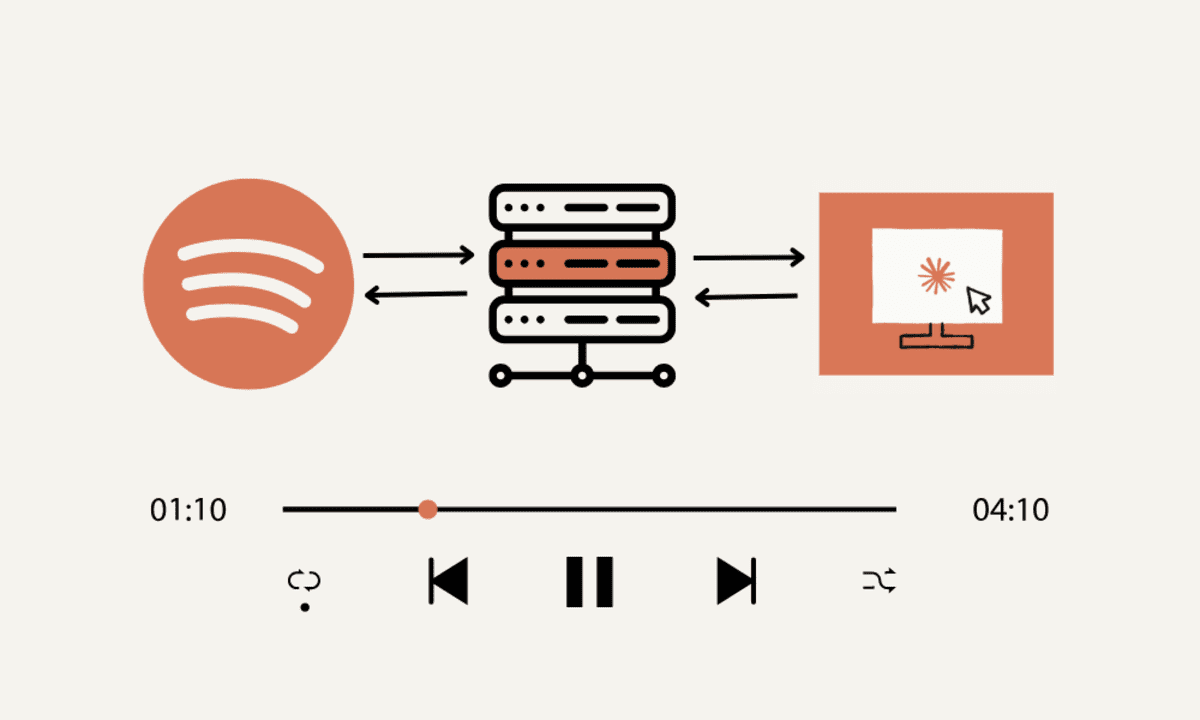

DeFi is a suite of financial applications and protocols that run on blockchain networks, primarily Ethereum. The applications use smart contracts—self-executing contracts with the rules of the contract written directly into lines of code on the blockchain—to automate financial transactions. Unlike traditional finance, DeFi is decentralized and doesn't rely on central authorities.

Key Features of DeFi

- Transparency: All the transactions are recorded on a public blockchain to ensure complete transparency.

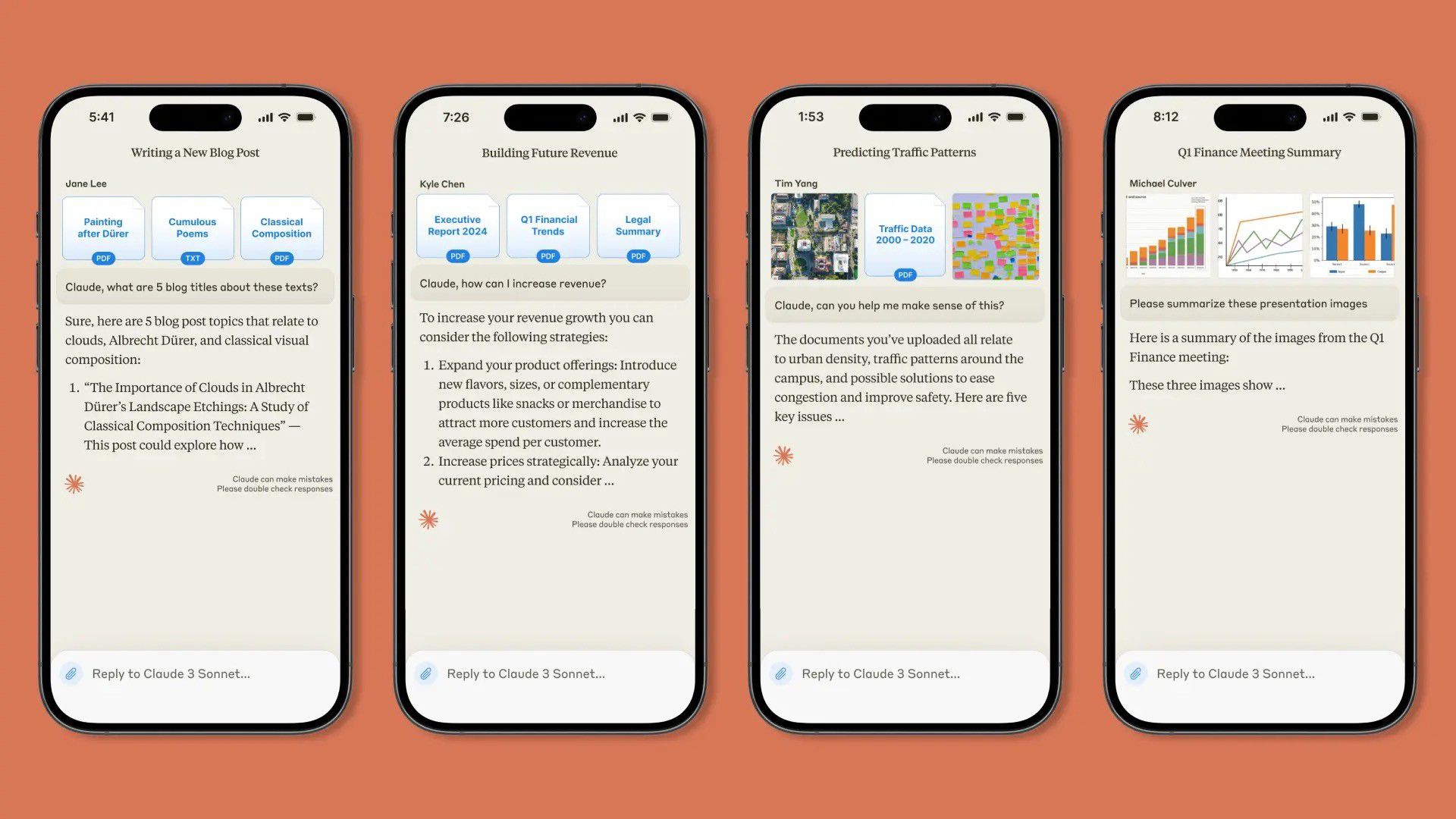

- Accessibility: Anyone with an internet connection can access DeFi platforms without needing approval from a centralized entity.

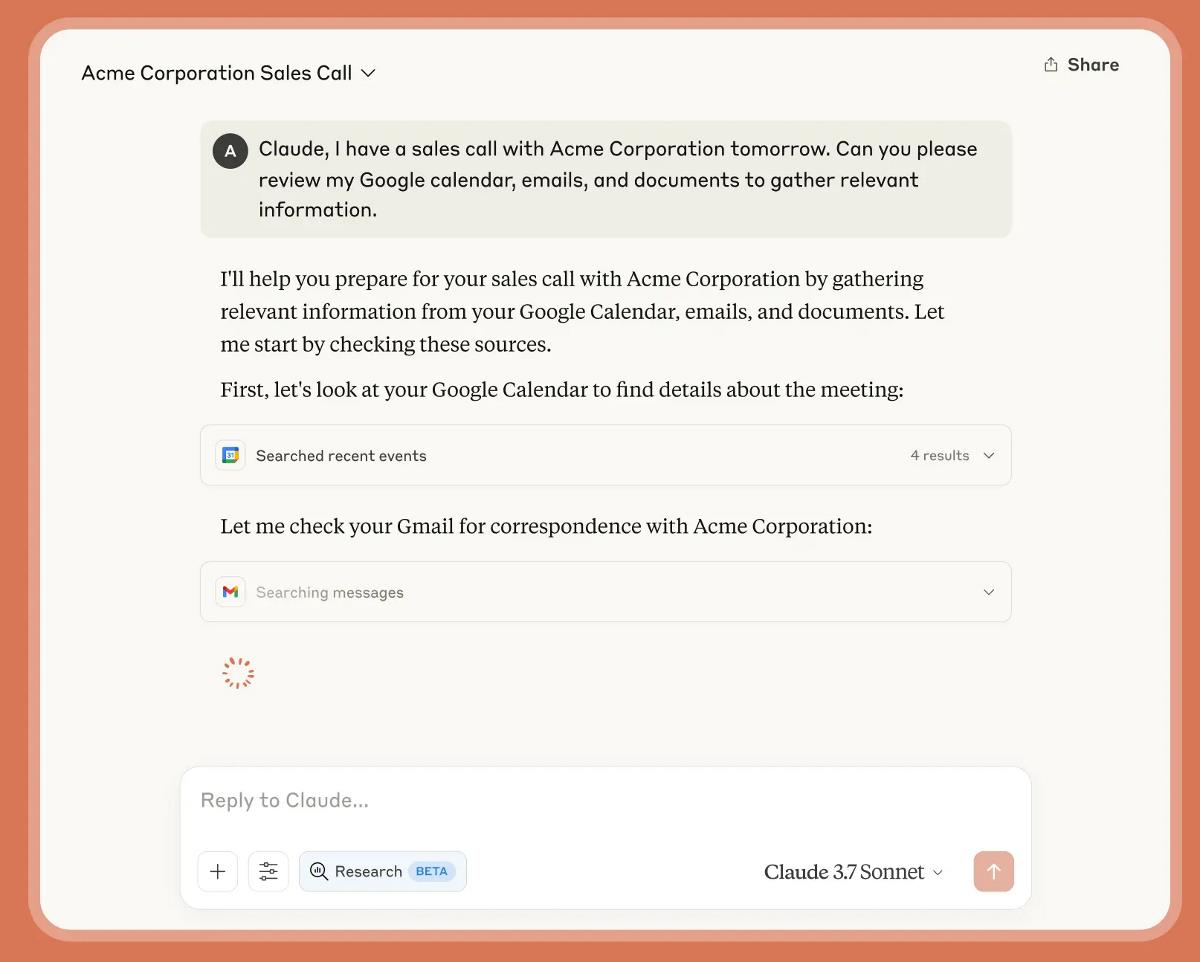

- Interoperability: Many DeFi applications can interact seamlessly with each other, creating a vast financial ecosystem.

- Permissionless: No credit checks or account approvals are required, empowering users globally.

- Control: Users retain full control over their assets without relying on third parties.

Popular DeFi Use Cases

- Lending and Borrowing: One can lend their assets through Aave and Compound for interest or borrow against one's crypto collateral without traditional credit checks.

- Decentralized Exchanges: Examples include Uniswap and SushiSwap, which offer direct, peer-to-peer trades of cryptocurrencies without the use of an intermediary.

- Stablecoins: DAI is a cryptocurrency that keeps its value stable by pegging its price into fiat currencies to offer stability in this highly volatile market.

- Yield Farming: A reward, usually in additional tokens, can be earned by providing one's assets to a liquidity pool.

- Insurance: Providing Decentralized Insurance for several risks of the DeFi ecosystem, through platforms such as Nexus Mutual.

- Tokenization of Assets: Tokenization of physical real estates can easily be traded on this, thus increasing liquidness and gaining easy accessibility.

Advantages of DeFi

- Financial Inclusion: DeFi opens financial opportunities to the underbanked and unbanked populations across the world.

- Reduced Costs: Without intermediaries, DeFi lowers fees related to financial transactions.

- Convenience/Flexibility: A single platform allows users to access multiple financial products and services.

Challenges and Risks

- Smart Contract Vulnerabilities: Bugs and hacks in smart contracts can lead to losses.

- Volatility: The value of crypto assets can fluctuate dramatically, posing risks to users.

- Regulatory Uncertainty: Governments are still grappling with how to regulate DeFi, creating uncertainty for users and developers.

The Future of DeFi

DeFi is on the verge of changing the face of the financial world by offering innovative solutions to very old problems in traditional finance. While blockchain technology is continuously improving in scalability, interoperability, and security, the rate of adoption for DeFi will grow exponentially. If DeFi wants to attain mainstream acceptance, it needs to overcome the existing challenges and offer a much safer and more user-friendly experience.

DeFi is more than a trend; it's a movement that's reshaping the financial landscape. Be it for the tech enthusiast, investor, or the curious learner, DeFi is critical in understanding the future of finance.

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

![Blue Archive tier list [April 2025]](https://media.pocketgamer.com/artwork/na-33404-1636469504/blue-archive-screenshot-2.jpg?#)

.png?#)

.webp?#)

![CVE security program used by Apple and others has funding removed [U]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2025/04/CVE-security-program-used-by-Apple-and-others-under-immediate-threat.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Apple to Split Enterprise and Western Europe Roles as VP Exits [Report]](https://www.iclarified.com/images/news/97032/97032/97032-640.jpg)

![Nanoleaf Announces New Pegboard Desk Dock With Dual-Sided Lighting [Video]](https://www.iclarified.com/images/news/97030/97030/97030-640.jpg)

![Apple's Foldable iPhone May Cost Between $2100 and $2300 [Rumor]](https://www.iclarified.com/images/news/97028/97028/97028-640.jpg)

![Daredevil Born Again season 1 ending explained: does [spoiler] show up, when does season 2 come out, and more Marvel questions answered](https://cdn.mos.cms.futurecdn.net/i8Lf25QWuSoxWKGxWMLaaA.jpg?#)