Artha India Ventures to make final close for growth fund as commitments cross Rs 400 Cr

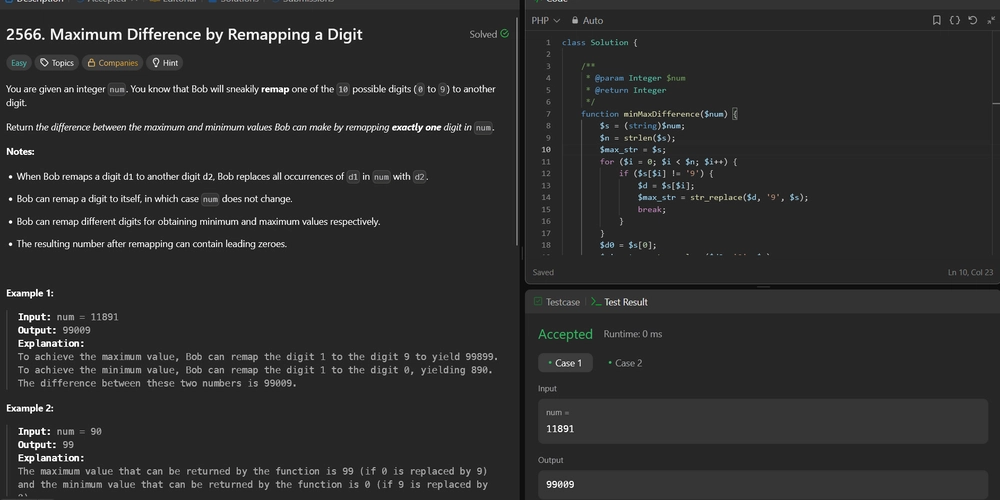

The micro VC’s Artha Select Fund will make follow-on growth investments in select portfolio companies, with a ticket size of $2.5 million.

Artha India Ventures, which has backed companies including OYO and Purplle, is set to announce the final close of Artha Select Fund. The fund has received commitments for Rs 400 crore, Artha’s director Anirudh A Damani told YourStory.

According to Damani, the firm is currently in discussions with a few family offices to close a Rs 50 crore commitment and is expected to raise between Rs 400-450 crore for the fund’s final close.

The Artha Select Fund (ASF) will make follow-on investments in the portfolio from its flagship fund, Artha Ventures Fund I, and will participate in Series B and Series C rounds, writing cheques of $2.5 million in each round.

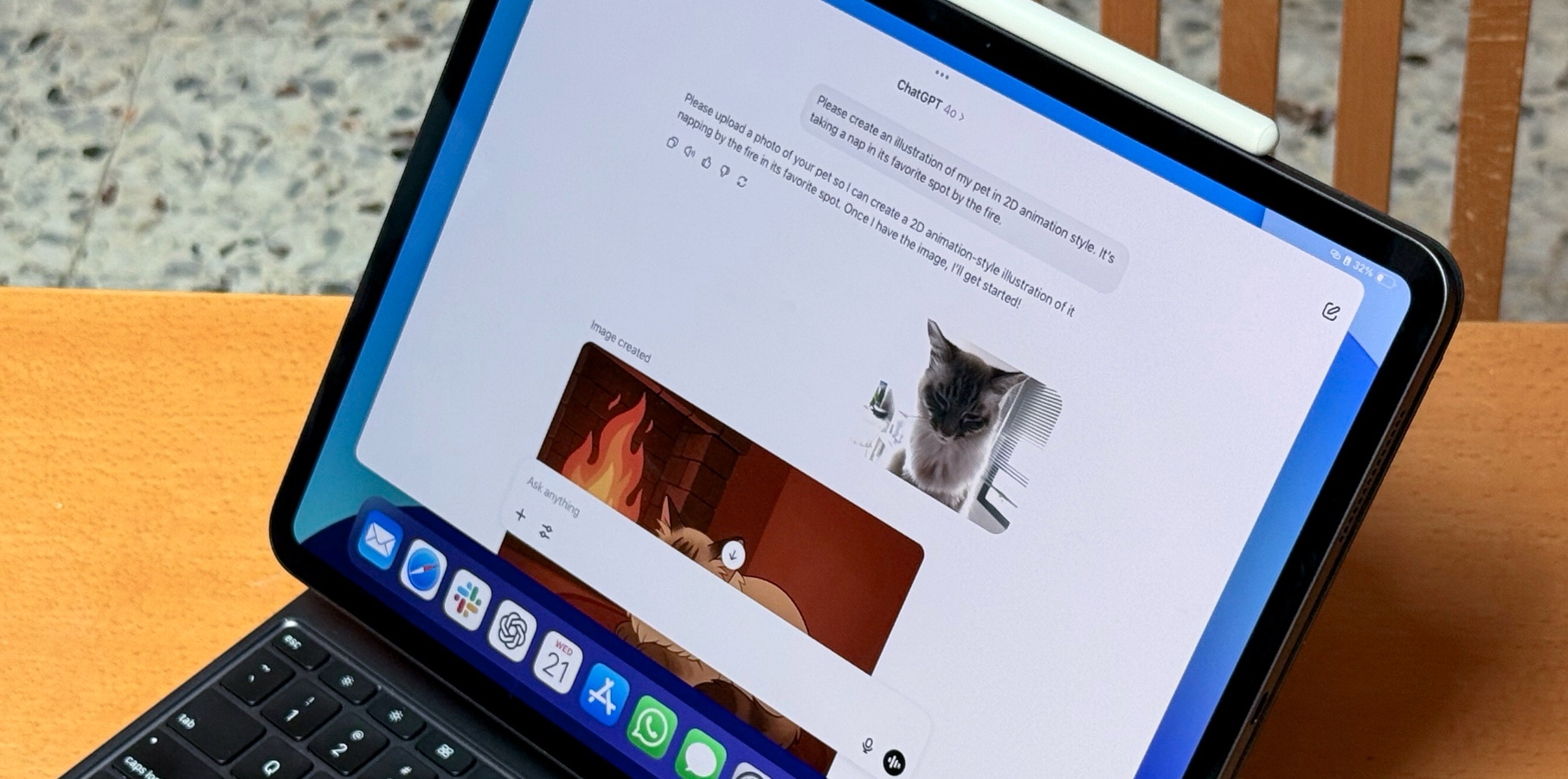

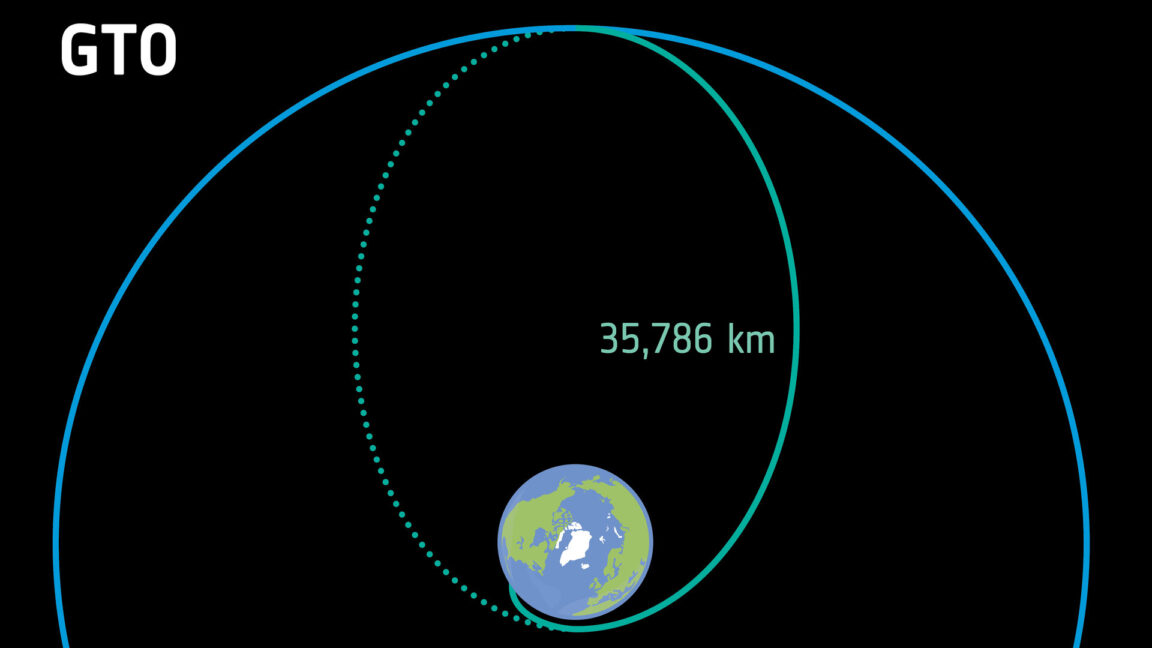

The Mumbai-based firm has already written its first cheque from ASF of $2.4 million as part of space tech startup Agnikul Cormos’ Series B fundraise, according to data from Tracxn.

Artha announced ASF's first close of Rs 330 crore in March this year.

Portfolio companies will be rigorously vetted at each stage of the funding round, according to the firm’s SCOUT^E ™ framework and only those with potential will receive follow-on investments, Damani clarified.

The framework, used by the firm as a template to track the performance of its portfolio companies, weighs in several factors. It looks at whether the company is solving a real human problem, if the firm is a category winner, if it's optimising unit economics, whether it is being headed by a founder with the right mindset and proven ability, and whether the company is tech-enabled or tech-first. It also considers opportunities to scale.

“We love tech-enabled companies. We don't like tech-first businesses, “ Damani added.

He also noted that while considering topping up its investment in a company, Artha writes a note to its investment committee explaining how the company still is up to par with its SCOUT^E ™ framework. “If at any point we feel in our follow-on round that SCOUT^E ™ is not being matched, then we look to exit the company.”

Additionally, the company has also begun warehousing startups as it looks to raise its next flagship fund, Artha Ventures Fund II.

Earlier this month, Artha Ventures Fund I (AVF1)—the VC’s flagship fund that makes seed-stage investments—reported an internal rate of return (IRR) of 61%. This key metric measures the profitability of an investment over its lifespan.

The Rs 225-crore fund was launched in FY19 and closed in July 2021. It has deployed over Rs 175 crore across 32 seed-stage startups.

Damani said the VC firm is looking to deploy the remaining amount over the next 12 months. He added that Artha’s initial plan was to fund 40 companies at the seed stage, 20 at the pre-Series A stage, and 10 at the Series A stage.

However, the firm saw a lot more breakout winners than it had pre-empted, leading it to invest in 32 seed-stage startups, 16 pre-Series A startups, and eight Series A startups.

“We have another four or five companies that are going to raise Series A rounds in the next 10-12 months, and that is where the bulk of the remaining capital will go,” he said.

Artha is also gearing up to exit its fifth portfolio company in the next 15-20 days. Since December, the firm has exited four companies. “Our hit rate on exits is very high,” Damani added.

Edited by Kanishk Singh

![[The AI Show Episode 152]: ChatGPT Connectors, AI-Human Relationships, New AI Job Data, OpenAI Court-Ordered to Keep ChatGPT Logs & WPP’s Large Marketing Model](https://www.marketingaiinstitute.com/hubfs/ep%20152%20cover.png)

.jpg?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

_designer491_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![3DMark Launches Native Benchmark App for macOS [Video]](https://www.iclarified.com/images/news/97603/97603/97603-640.jpg)

![Craig Federighi: Putting macOS on iPad Would 'Lose What Makes iPad iPad' [Video]](https://www.iclarified.com/images/news/97606/97606/97606-640.jpg)