The U.S. must ramp up domestic battery manufacturing

The Fast Company Impact Council is an invitation-only membership community of leaders, experts, executives, and entrepreneurs who share their insights with our audience. Members pay annual dues for access to peer learning, thought leadership opportunities, events and more. Tariffs, trade, imports, exports, prioritization, energy, and dominance are all words that have been flooding the headlines lately. In this world of globalization, it is an equilibrium of exchanges, ensuring we have enough of something but not too much. We see this balance come to life in supply and demand graphs of critical minerals, often in the context of batteries or energy dominance. The supply and demand of materials required to support growing energy-related technology and sectors, such as energy storage needs, plays a crucial role in the critical minerals market, both in the United States and globally. Today, the U.S. imports a large number of batteries that are used in consumer devices, vehicles, military, and grid storage. And the demand for batteries is set to continue growing quickly based on current policy settings, estimated to rise by more than four times by 2030 and by at least seven-fold by 2035. This growth is a clear sign that the owner of the critical minerals source will hold more control over the supply chain. This is why a diversified approach to critical minerals is vital. Battery recycling is a key to that strategy—becoming a major source of domestically manufactured critical materials. China’s control in the lithium-ion battery manufacturing industry is expected to decline between now and 2034, which can be attributed to cell manufacturing operations coming online in other regions. To further highlight this shift in the global marketplace, the U.S. battery recycling market size was estimated at $374.28 million in 2023, and is estimated to grow at a compound annual growth rate of 38.1% from 2024 to 2030. Diversify and stabilize domestic supply chains Original equipment manufacturers and battery cell manufacturers are not slowing down their production timelines and the global demand for large-format batteries will continue to rise. The U.S. must capitalize on these opportunities to diversify and stabilize domestic supply chains, all while becoming a leading producer of critical minerals. Materials from recycled content will play an increasingly important part in meeting this demand, with predictions that battery recycling could meet 20-30% of lithium, nickel, and cobalt demand by 2050. Reuse of critical minerals is necessary to diversify and domesticate our supply chains and is work that is already being done. To further the need for increasing battery recycling capacity, the critical minerals market will begin to experience an undersupply in the form of black mass (the output of end-of-life and scrap batteries that have been recycled and processed that is put back into the supply chain), as early as 2026. For example, by 2030, lithium will see a supply and demand gap that is considered high risk, according to the International Energy Agency, due to price volatility and high geopolitical risk factors in the countries it’s currently sourced from. The expected growth, combined with supply gaps, is why the U.S. needs to continue its focus on enhancing our domestic critical minerals supply chains, with a heavy emphasis on recycled content. Recycling is important The U.S. has developed a large battery recycling capacity in anticipation of the large number of end-of-life batteries predicted to enter the market. Fueled by public and private investments, the United States’ battery recycling and critical mineral refinement sectors are fundamental to becoming a divergent player and seriously competing with those in Asia for the limited supplies of black mass. To encourage the build-out of battery recycling capacity, we must recognize that it aligns with domestic priorities related to the sourcing of critical materials. Strengthening our domestic supply chains will position the U.S. as a leading producer of critical minerals; it furthers the National Defense Stockpile sources to reduce the nation’s mineral reliance on foreign entities of concern; and it accelerates access to domestically sourced critical minerals, enhancing national security and global competitiveness. The largest operating mine of critical minerals is in our pockets, offices, garages, on the roads, and supplying energy to data centers and power grids. Recycling these materials at their end-of-life is a must. David Klanecky is CEO and president of Cirba Solutions.

The Fast Company Impact Council is an invitation-only membership community of leaders, experts, executives, and entrepreneurs who share their insights with our audience. Members pay annual dues for access to peer learning, thought leadership opportunities, events and more.

Tariffs, trade, imports, exports, prioritization, energy, and dominance are all words that have been flooding the headlines lately. In this world of globalization, it is an equilibrium of exchanges, ensuring we have enough of something but not too much. We see this balance come to life in supply and demand graphs of critical minerals, often in the context of batteries or energy dominance.

The supply and demand of materials required to support growing energy-related technology and sectors, such as energy storage needs, plays a crucial role in the critical minerals market, both in the United States and globally. Today, the U.S. imports a large number of batteries that are used in consumer devices, vehicles, military, and grid storage. And the demand for batteries is set to continue growing quickly based on current policy settings, estimated to rise by more than four times by 2030 and by at least seven-fold by 2035. This growth is a clear sign that the owner of the critical minerals source will hold more control over the supply chain. This is why a diversified approach to critical minerals is vital. Battery recycling is a key to that strategy—becoming a major source of domestically manufactured critical materials.

China’s control in the lithium-ion battery manufacturing industry is expected to decline between now and 2034, which can be attributed to cell manufacturing operations coming online in other regions. To further highlight this shift in the global marketplace, the U.S. battery recycling market size was estimated at $374.28 million in 2023, and is estimated to grow at a compound annual growth rate of 38.1% from 2024 to 2030.

Diversify and stabilize domestic supply chains

Original equipment manufacturers and battery cell manufacturers are not slowing down their production timelines and the global demand for large-format batteries will continue to rise. The U.S. must capitalize on these opportunities to diversify and stabilize domestic supply chains, all while becoming a leading producer of critical minerals.

Materials from recycled content will play an increasingly important part in meeting this demand, with predictions that battery recycling could meet 20-30% of lithium, nickel, and cobalt demand by 2050. Reuse of critical minerals is necessary to diversify and domesticate our supply chains and is work that is already being done.

To further the need for increasing battery recycling capacity, the critical minerals market will begin to experience an undersupply in the form of black mass (the output of end-of-life and scrap batteries that have been recycled and processed that is put back into the supply chain), as early as 2026. For example, by 2030, lithium will see a supply and demand gap that is considered high risk, according to the International Energy Agency, due to price volatility and high geopolitical risk factors in the countries it’s currently sourced from. The expected growth, combined with supply gaps, is why the U.S. needs to continue its focus on enhancing our domestic critical minerals supply chains, with a heavy emphasis on recycled content.

Recycling is important

The U.S. has developed a large battery recycling capacity in anticipation of the large number of end-of-life batteries predicted to enter the market. Fueled by public and private investments, the United States’ battery recycling and critical mineral refinement sectors are fundamental to becoming a divergent player and seriously competing with those in Asia for the limited supplies of black mass.

To encourage the build-out of battery recycling capacity, we must recognize that it aligns with domestic priorities related to the sourcing of critical materials. Strengthening our domestic supply chains will position the U.S. as a leading producer of critical minerals; it furthers the National Defense Stockpile sources to reduce the nation’s mineral reliance on foreign entities of concern; and it accelerates access to domestically sourced critical minerals, enhancing national security and global competitiveness.

The largest operating mine of critical minerals is in our pockets, offices, garages, on the roads, and supplying energy to data centers and power grids. Recycling these materials at their end-of-life is a must.

David Klanecky is CEO and president of Cirba Solutions.

![[The AI Show Episode 145]: OpenAI Releases o3 and o4-mini, AI Is Causing “Quiet Layoffs,” Executive Order on Youth AI Education & GPT-4o’s Controversial Update](https://www.marketingaiinstitute.com/hubfs/ep%20145%20cover.png)

.jpg?#)

_NicoElNino_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Craft adds Readwise integration for working with book notes and highlights [50% off]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2025/04/craft3.jpg.png?resize=1200%2C628&quality=82&strip=all&ssl=1)

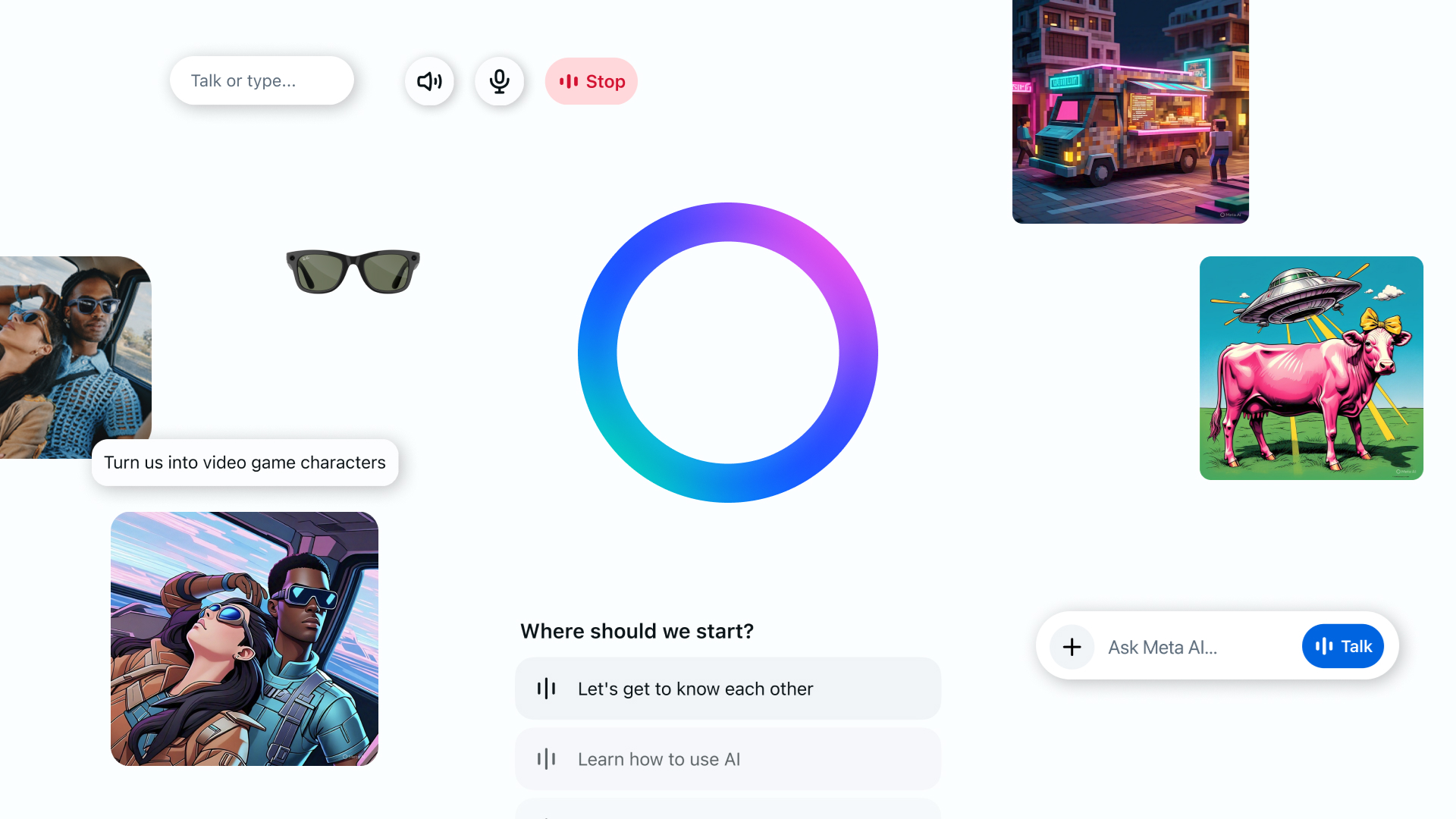

![Standalone Meta AI App Released for iPhone [Download]](https://www.iclarified.com/images/news/97157/97157/97157-640.jpg)