The Future of Blockchain Funding and Decentralized Exchanges

Abstract: This post explores the evolving landscape of blockchain funding and decentralized exchanges (DEXs). We will delve into traditional methods and modern innovations such as ICOs, STOs, IEOs, and DAOs, then examine the technological breakthroughs powering DEXs. With a focus on interoperability, Layer 2 and Layer 3 scaling, regulatory changes, and even AI integration, we paint a holistic picture of how blockchain is reshaping financial ecosystems. In addition to insights from the original article on blockchain project funding and decentralized exchanges, we incorporate additional perspectives on governance models, sustainability challenges, and cutting-edge trends from trusted sources. Introduction Blockchain technology has revolutionized industries beyond finance. Today, its impact extends into project funding and decentralized exchanges, reshaping how capital is raised and assets traded. Traditional funding methods are being challenged by innovative mechanisms like Initial Coin Offerings (ICOs), Security Token Offerings (STOs), Initial Exchange Offerings (IEOs), and community-funded Decentralized Autonomous Organizations (DAOs). Meanwhile, DEXs powered by smart contracts offer security, privacy, and control. In this post, we explore these topics in depth, discuss how interoperability and scaling innovations are paving the way for the future, and examine practical use cases as well as challenges that both blockchain funding and DEXs must overcome. With our discussion enriched by content from trusted sources and industry experts, readers will gain a comprehensive understanding of the paradigm shift taking place in the decentralized finance world. Background and Context Blockchain emerged as a groundbreaking technology that underpins cryptocurrencies like Bitcoin. Over time, its decentralized and secure nature provided the foundation for creating innovative financial mechanisms. Funding via blockchain now presents an alternative to the traditional venture capital model. Projects can now bypass conventional investment roadblocks by raising funds through token sales and community-driven governance. Key Definitions: Initial Coin Offerings (ICOs): A fundraising method where projects issue tokens directly to investors. More insights can be found on Investopedia’s explanation of ICOs. Security Token Offerings (STOs): STOs operate in regulated environments, offering asset-backed tokens that comply with securities law. For a deeper dive into the differences between ICOs and STOs, refer to The Block’s article. Initial Exchange Offerings (IEOs): By partnering with established exchanges, IEOs bring due diligence and wider investor reach to the fundraising process. For more information, visit CoinDesk’s guide on IEOs. Decentralized Autonomous Organizations (DAOs): DAOs use smart contracts to manage project funding and governance without traditional barriers. Forbes provides a solid introduction on DAO fundamentals. Blockchain’s decentralized nature has turned funding on its head by: Removing traditional intermediaries. Offering transparency through smart contracts. Empowering communities with governance and decision-making power. Core Concepts and Features Blockchain Funding Mechanisms Blockchain funding is evolving by harnessing the transparency and security of the underlying technology. Here are the primary mechanisms used today: ICOs: How They Work: Projects issue tokens representing a future utility or asset. Benefits: Democratized access, faster capital raise, and global investor reach. Downsides: Regulatory uncertainties and potential scams pose risks. STOs: Features: These use compliance measures to secure investor trust by issuing asset-backed tokens that follow securities regulations. More details are available on STOs for blockchain projects. IEOs: Collaboration with Exchanges: By utilizing the due diligence processes of exchanges, IEOs often mitigate risks. This model also increases project credibility and provides easier access for retail investors. DAOs: Community Governance: Fundraising moves beyond mere capital inflows—token holders collectively guide project development. Visit DAO funding for blockchain projects for more examples on decentralized governance. Decentralized Exchanges (DEXs) DEXs have redefined asset trading by eliminating the need for a centralized authority. Key features include: Smart Contract-Powered Trading: With smart contracts as the backbone, DEXs ensure peer-to-peer transactions, enhancing security and reducing counterparty risk. Learn more about the inner workings via Binance’s guide to DEXs. Advantages of DEXs: Enhanced Privacy: No compulsory KYC procedures in many cases. Censorship Resistance: Open markets free from centralized interference. Security: Minimizes hack risks by limiting centralized holdings. Challenges: Despite their potential, DEXs confront issues

Abstract:

This post explores the evolving landscape of blockchain funding and decentralized exchanges (DEXs). We will delve into traditional methods and modern innovations such as ICOs, STOs, IEOs, and DAOs, then examine the technological breakthroughs powering DEXs. With a focus on interoperability, Layer 2 and Layer 3 scaling, regulatory changes, and even AI integration, we paint a holistic picture of how blockchain is reshaping financial ecosystems. In addition to insights from the original article on blockchain project funding and decentralized exchanges, we incorporate additional perspectives on governance models, sustainability challenges, and cutting-edge trends from trusted sources.

Introduction

Blockchain technology has revolutionized industries beyond finance. Today, its impact extends into project funding and decentralized exchanges, reshaping how capital is raised and assets traded. Traditional funding methods are being challenged by innovative mechanisms like Initial Coin Offerings (ICOs), Security Token Offerings (STOs), Initial Exchange Offerings (IEOs), and community-funded Decentralized Autonomous Organizations (DAOs). Meanwhile, DEXs powered by smart contracts offer security, privacy, and control.

In this post, we explore these topics in depth, discuss how interoperability and scaling innovations are paving the way for the future, and examine practical use cases as well as challenges that both blockchain funding and DEXs must overcome. With our discussion enriched by content from trusted sources and industry experts, readers will gain a comprehensive understanding of the paradigm shift taking place in the decentralized finance world.

Background and Context

Blockchain emerged as a groundbreaking technology that underpins cryptocurrencies like Bitcoin. Over time, its decentralized and secure nature provided the foundation for creating innovative financial mechanisms. Funding via blockchain now presents an alternative to the traditional venture capital model. Projects can now bypass conventional investment roadblocks by raising funds through token sales and community-driven governance.

Key Definitions:

- Initial Coin Offerings (ICOs): A fundraising method where projects issue tokens directly to investors. More insights can be found on Investopedia’s explanation of ICOs.

- Security Token Offerings (STOs): STOs operate in regulated environments, offering asset-backed tokens that comply with securities law. For a deeper dive into the differences between ICOs and STOs, refer to The Block’s article.

- Initial Exchange Offerings (IEOs): By partnering with established exchanges, IEOs bring due diligence and wider investor reach to the fundraising process. For more information, visit CoinDesk’s guide on IEOs.

- Decentralized Autonomous Organizations (DAOs): DAOs use smart contracts to manage project funding and governance without traditional barriers. Forbes provides a solid introduction on DAO fundamentals.

Blockchain’s decentralized nature has turned funding on its head by:

- Removing traditional intermediaries.

- Offering transparency through smart contracts.

- Empowering communities with governance and decision-making power.

Core Concepts and Features

Blockchain Funding Mechanisms

Blockchain funding is evolving by harnessing the transparency and security of the underlying technology. Here are the primary mechanisms used today:

ICOs:

How They Work: Projects issue tokens representing a future utility or asset.

Benefits: Democratized access, faster capital raise, and global investor reach.

Downsides: Regulatory uncertainties and potential scams pose risks.STOs:

Features: These use compliance measures to secure investor trust by issuing asset-backed tokens that follow securities regulations.

More details are available on STOs for blockchain projects.IEOs:

Collaboration with Exchanges: By utilizing the due diligence processes of exchanges, IEOs often mitigate risks. This model also increases project credibility and provides easier access for retail investors.DAOs:

Community Governance: Fundraising moves beyond mere capital inflows—token holders collectively guide project development. Visit DAO funding for blockchain projects for more examples on decentralized governance.

Decentralized Exchanges (DEXs)

DEXs have redefined asset trading by eliminating the need for a centralized authority. Key features include:

Smart Contract-Powered Trading:

With smart contracts as the backbone, DEXs ensure peer-to-peer transactions, enhancing security and reducing counterparty risk. Learn more about the inner workings via Binance’s guide to DEXs.-

Advantages of DEXs:

- Enhanced Privacy: No compulsory KYC procedures in many cases.

- Censorship Resistance: Open markets free from centralized interference.

- Security: Minimizes hack risks by limiting centralized holdings.

Challenges:

Despite their potential, DEXs confront issues like liquidity constraints, user experience hurdles, and evolving regulatory compliance. Explore further insights on blockchain regulation.Leading Platforms:

Some prominent names in the DEX realm include Uniswap, SushiSwap, and PancakeSwap.

Additional Innovations in Blockchain Ecosystems

The blockchain ecosystem is highly dynamic. Here are some key innovations influencing the future:

Interoperability and Cross-Chain Functionality:

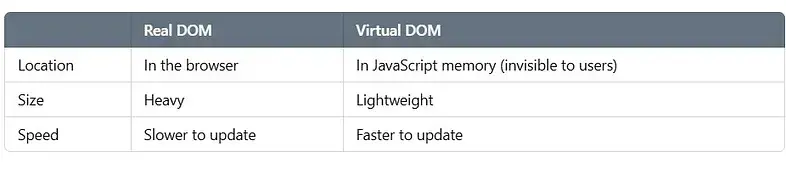

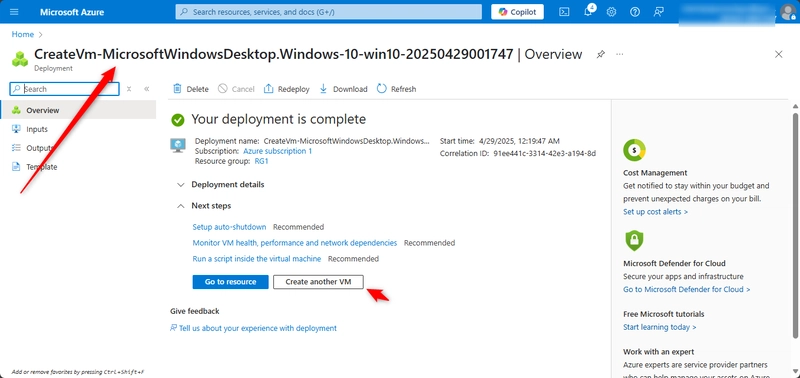

Projects are focusing on interconnecting different blockchains. For instance, blockchain interoperability paves the way for seamless token exchanges across networks.Layer 2 and Layer 3 Solutions:

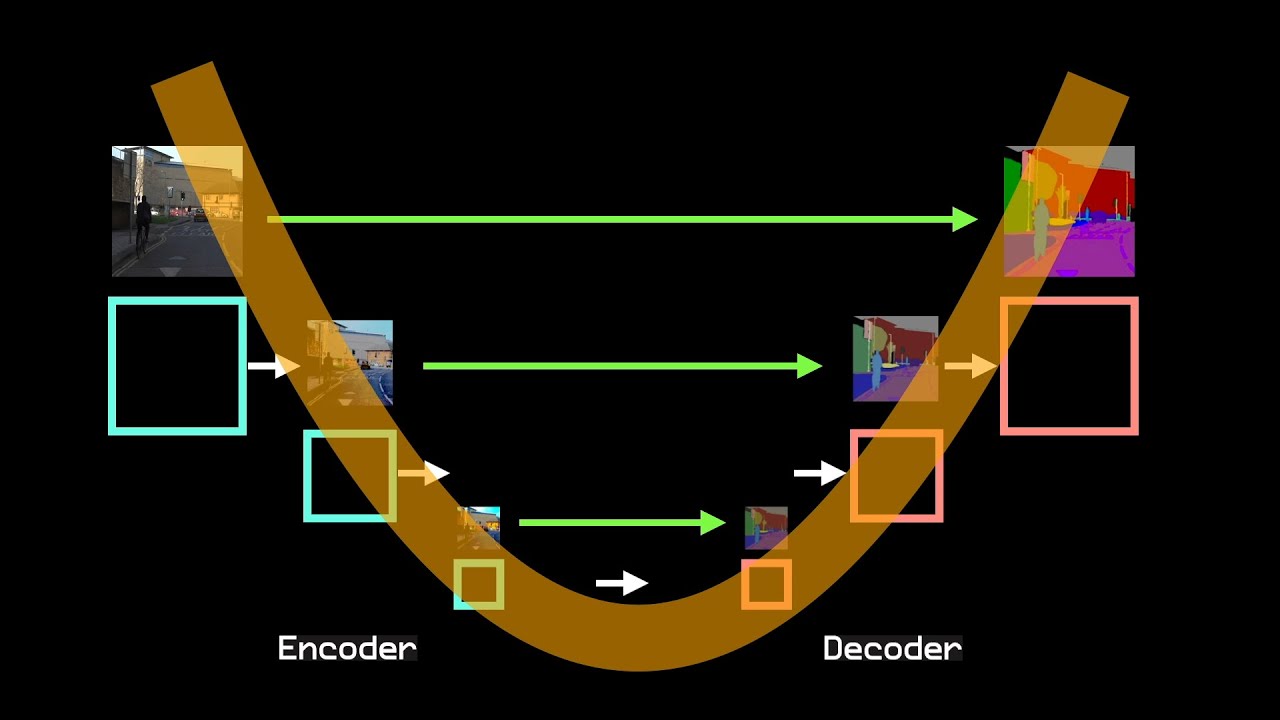

As transaction volumes surge, Layer 2 solutions help reduce fees and boost throughput by processing transactions off the main chain. Emerging Layer 3 solutions promise even further optimizations.Integration of Artificial Intelligence (AI):

AI is poised to enhance investment strategies and optimize trading on decentralized platforms. By analyzing market trends, AI can help predict price movements and improve decision-making.Regulatory Advancements:

As the ecosystem matures, regulations evolve to provide both security for investors and the flexibility needed for innovation. Balancing investor protection and open markets is paramount.

Applications and Use Cases

Blockchain funding and DEXs have wide-ranging practical applications with real-world impact. Here are a few examples:

1. Startup Funding in Emerging Markets

Traditional venture capital can be exclusive, especially for startups in emerging markets. Using blockchain funding methods like ICOs and DAOs, startups can:

- Attract Global Investors: A startup can issue tokens via an ICO and gain access to a vast network of investors from around the world.

- Community Governance: Token holders have a say in the project’s direction, creating a transparent ecosystem with shared ownership.

2. Decentralized Trading Platforms

Decentralized exchanges provide a new way to trade cryptocurrencies securely:

- User-Controlled Assets: Traders retain their private keys and have full custody of their funds, reducing vulnerability to hacks.

- Reduced Trade Fees: By bypassing centralized intermediaries, DEXs often offer lower trading fees, appealing to active traders.

3. Cross-Chain Financial Products

Innovations in interoperability enable cross-chain financial products that combine assets from various blockchains:

- DEX Aggregators: These platforms consolidate liquidity from multiple blockchains, ensuring better pricing and reduced slippage.

- Enhanced Yield Options: Integrating with protocols like Arbitrum and DeFi yield solutions allows investors to benefit from diversified yields.

Challenges and Limitations

Despite significant progress, the blockchain ecosystem must navigate several challenges:

Liquidity and User Experience on DEXs:

While decentralized platforms offer many benefits, they often struggle with liquidity pooling and making interfaces intuitive for new users. Overcoming these hurdles is essential for broader adoption.Regulatory Uncertainties:

Rapid innovation sometimes outpaces regulatory frameworks. There remains a delicate balance between fostering innovation and ensuring investor protection. Comprehensive guidelines, like those under discussion on blockchain regulation, are needed.Security Concerns:

While smart contracts increase transparency, bugs or vulnerabilities in code can lead to significant losses. Regular audits and community-driven reviews are crucial for maintaining secure ecosystems.Scalability Issues:

Transaction speed and network congestion remain concerns. Scaling solutions, such as Layer 2 and Layer 3 innovations, are actively being developed to address these issues.Adoption Barriers:

Traditional financial institutions and regulatory bodies may resist rapid changes, causing friction in integrating blockchain solutions into existing systems.

Future Outlook and Innovations

The future of blockchain funding and DEXs is filled with promise and innovation. Here are some trends and advancements that are on the horizon:

Interoperability and Cross-Chain Technology

One of the most exciting trends in blockchain today is cross-chain interoperability. Projects are actively working to integrate multiple blockchains for:

Seamless Token Transfers:

Elimination of silos allows tokens to move more freely. For example, check out Arbitrum and blockchain interoperability as an example of how networks can work together.Enhanced Liquidity Aggregation:

Cross-chain systems will improve liquidity on DEXs by combining pools across various networks.

Scaling and Layer Solutions

Layer 2 and upcoming Layer 3 solutions are set to reduce transaction fees and improve speed:

Lower Gas Fees:

Innovations such as Arbitrum and Ethereum gas price solutions can significantly reduce costs for both users and developers.Optimized Throughput:

With these advancements, blockchain networks can handle more transactions per second, paving the way for mainstream adoption.

Enhanced Governance and Community Models

Decentralization empowers users not only in funding but also in governance:

Community-Driven Decisions:

DAOs and tokenized governance systems enable collective decision-making. This approach is further explored in articles such as Arbitrum and community governance.Innovative Funding Platforms:

New models that combine the benefits of decentralized funding and open-source sponsorship are emerging. For instance, Transforming Project Funding with Decentralized Finance on Dev.to outlines promising trends in this area.

Integration of Artificial Intelligence

AI technologies combined with blockchain are set to redefine trading and asset management:

Optimized Trading Strategies:

Data-driven insights and machine learning algorithms can enhance user trading experience on DEXs.Smart Contract Efficiency:

AI integration could support dynamic adjustments in smart contract parameters, making decentralized solutions more adaptable to market changes.

Regulatory Evolution

Governments and regulatory institutions are gradually evolving to support these innovations:

- Balanced Frameworks: Future regulations are expected to strike a balance between investor protection and the freedom required for innovation.

- Global Standards: As best practices emerge, countries can collaborate to set common standards for blockchain governance and funding.

Table: Comparison of Key Blockchain Funding Methods

| Funding Method | Key Characteristics | Advantages | Challenges |

|---|---|---|---|

| ICOs | Token sales to a wide investor base | Democratizes fundraising; fast capital raise | Regulatory uncertainty; risk of scams |

| STOs | Asset-backed tokens under securities laws | Increased investor trust; compliance | Higher legal complexity; slower process |

| IEOs | Token sales conducted via exchanges | Due diligence by exchanges; wider reach | Dependence on exchange integrity |

| DAOs | Community-driven funding and governance | Transparency; decentralized decision-making | Coordination and scaling of governance |

Bullet List: Key Innovations Shaping the Future

- Interoperability: Seamless asset transfers across blockchains.

- Layer 2/Layer 3 Solutions: Reduced transaction fees and improved throughput.

- Community Governance: Enhanced decision-making through DAOs.

- AI Integration: Data-driven smart contracts and trading optimizations.

- Regulatory Advancements: Balanced policies to foster innovation.

Additional Perspectives from the Ecosystem

In addition to the core topics discussed above, several emerging trends and external viewpoints contribute to our understanding of open-source funding and blockchain innovation:

Arbitrum's Role in Scaling:

Platforms like Arbitrum are not only helping reduce gas prices but are also exploring solutions for Layer 3 scalability. This ensures that as blockchain projects grow, they can maintain efficiency and speed.Open-Source and Fair Code:

There is an ongoing discussion about how open-source projects can be financially sustainable without compromising on freedom. Articles such as Navigating the Complex Terrain of Sustainable Funding for Open Source offer a deeper dive into these challenges.Developer and Community Funding Models:

Platforms that support open-source and blockchain initiatives often rely on community sponsorship and decentralized funding models. For further insights on open-source monetization models, check out Unveiling the WxWidgets License – A Deep Dive into Freedom, Fairness, and Flexibility.

Summary

In summary, the future of blockchain funding and decentralized exchanges is bright, dynamic, and rapidly evolving. Innovations such as ICOs, STOs, IEOs, and DAOs are transforming how projects secure capital. At the same time, DEXs led by advanced smart contracts are providing secure, user-friendly environments for trading digital assets.

Looking forward, interoperability, Layer 2/3 enhancements, improved governance structures through DAOs, AI integration, and a balanced regulatory framework will drive the industry forward. By understanding both the applications and challenges of these new models, stakeholders can better navigate this brave, decentralized future.

For a detailed overview of these topics, you can revisit the original article on blockchain project funding and decentralized exchanges.

Looking Ahead

Blockchain funding and DEXs are not just buzzwords; they reflect an ongoing evolution in how we think about finance, innovation, and governance. Looking ahead, consider the following:

Continued Evolution:

As technical and regulatory frameworks improve, blockchain applications are likely to achieve mainstream adoption.Collaborative Ecosystem:

The interplay between developers, investors, and regulators will create an ecosystem where innovation thrives but risks are managed.Emerging Use Cases:

From decentralized gaming to global supply chain management, the implications of these innovations extend far beyond traditional finance.

The convergence of these technologies and funding mechanisms heralds a new era in which financial and technological innovation go hand in hand. Whether you are an investor, developer, or enthusiast, staying updated on these trends—and supporting the evolution of transparent, secure, and community-governed systems—will be crucial as we collectively shape the decentralized future.

Further Reading and Resources

For those interested in deepening their understanding, here are some additional links and resources:

-

Industry Insights:

-

Arbitrum-Focused Innovations:

-

Developer Community Perspectives from Dev.to:

By keeping pace with these evolving trends, stakeholders can contribute to a more inclusive, efficient, and secure financial future powered by blockchain.

In this rapidly changing ecosystem, understanding and adapting to the myriad innovations is not just beneficial—it’s essential for staying ahead in the evolving landscape of decentralized finance.

![[The AI Show Episode 145]: OpenAI Releases o3 and o4-mini, AI Is Causing “Quiet Layoffs,” Executive Order on Youth AI Education & GPT-4o’s Controversial Update](https://www.marketingaiinstitute.com/hubfs/ep%20145%20cover.png)

_NicoElNino_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Standalone Meta AI App Released for iPhone [Download]](https://www.iclarified.com/images/news/97157/97157/97157-640.jpg)