Sharpen Your Strategy: Blending Budget Models with Smart Analysis

In today's rapidly growing markets, successful business is more than just instinct-it is about accurate strategy and numbers. If you are serious about becoming a smarter businessman in 2025, mastery of financial proportions and using the evaluation model can give you a final lead. What Does "Merge Model" Mean in Trading? The merging model refers to combining various financial analysis methods, such as Discounted Cash Flow (DCF), comparable company analysis (CCA), and price/income (P/E) to create multidimensional views of evaluation, stock or asset. For example, while DCF focuses on future cash flows, CCA compares similar companies in the industry. By merging both, you avoid the tunnel point of view and make more balanced, accurate business decisions. Why Financial Ratios Are a Merchant's Secret Weapon? Financial ratio breaks the company's performance into easy-to-manipulate insights. Major ratios such as: P/E ratio - This indicates how the market earns. Debt-to-equity (D/E) - Manifests the financial leverage of the company. Return on Equity (ROE) - measures profitability against equity. Current ratio assesses liquidity. By monitoring these ratios, you achieve insight into evaluation, solvency, and efficiency - all important when purchasing, holding, or making decisions to sell. Pro Tip: Models Help, but Reference Matters Markets are emotional. News cycles, economic indicators, and global events can move prices unpredictably. That’s why it’s important to pair your financial models and ratios with macro analysis and technical indicators. Merging models = smart analysis. Mastering ratios = smarter execution. Together? You’re trading with clarity. Tools to Help You Merge Models & Master Ratios Looking for a few powerful tools to help with your trading game? TradingView – Great for technical and sentiment analysis. Finbox & GuruFocus – Perfect for valuation modeling. Yahoo Finance / Google Finance – Quick ratio snapshots. Excel or Google Sheets – Customize your own DCF or ratio tracking system. Final Thoughts Want to stand out in the market? Start treating trading like a business, not a bet. By merging models and mastering financial ratios, you shift from guesswork to strategy. It's time to elevate your trading game—with data, discipline, and deeper insight.

In today's rapidly growing markets, successful business is more than just instinct-it is about accurate strategy and numbers. If you are serious about becoming a smarter businessman in 2025, mastery of financial proportions and using the evaluation model can give you a final lead.

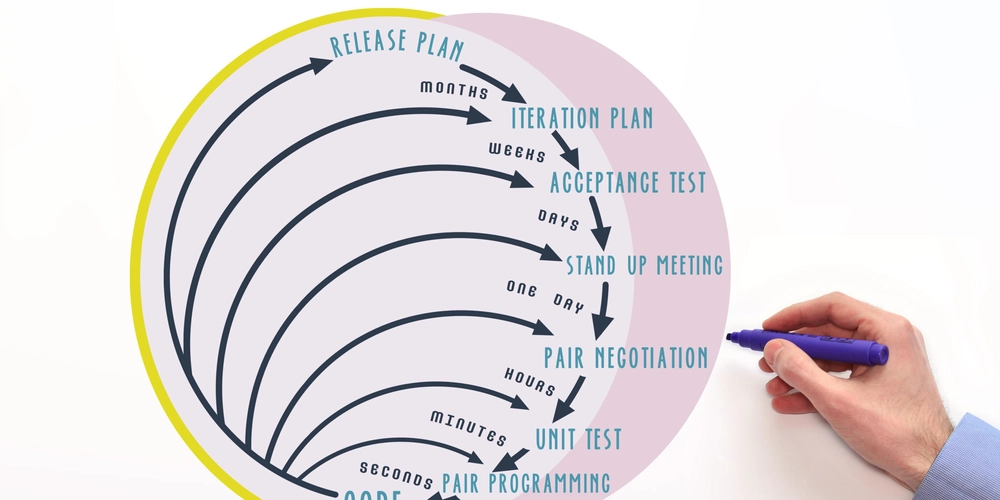

What Does "Merge Model" Mean in Trading?

The merging model refers to combining various financial analysis methods, such as Discounted Cash Flow (DCF), comparable company analysis (CCA), and price/income (P/E) to create multidimensional views of evaluation, stock or asset.

For example, while DCF focuses on future cash flows, CCA compares similar companies in the industry. By merging both, you avoid the tunnel point of view and make more balanced, accurate business decisions.

Why Financial Ratios Are a Merchant's Secret Weapon?

Financial ratio breaks the company's performance into easy-to-manipulate insights. Major ratios such as:

- P/E ratio - This indicates how the market earns.

- Debt-to-equity (D/E) - Manifests the financial leverage of the company.

- Return on Equity (ROE) - measures profitability against equity.

- Current ratio assesses liquidity.

By monitoring these ratios, you achieve insight into evaluation, solvency, and efficiency - all important when purchasing, holding, or making decisions to sell.

Pro Tip: Models Help, but Reference Matters

Markets are emotional. News cycles, economic indicators, and global events can move prices unpredictably. That’s why it’s important to pair your financial models and ratios with macro analysis and technical indicators.

Merging models = smart analysis.

Mastering ratios = smarter execution.

Together? You’re trading with clarity.

Tools to Help You Merge Models & Master Ratios

Looking for a few powerful tools to help with your trading game?

- TradingView – Great for technical and sentiment analysis.

- Finbox & GuruFocus – Perfect for valuation modeling.

- Yahoo Finance / Google Finance – Quick ratio snapshots.

- Excel or Google Sheets – Customize your own DCF or ratio tracking system.

Final Thoughts

Want to stand out in the market? Start treating trading like a business, not a bet. By merging models and mastering financial ratios, you shift from guesswork to strategy.

It's time to elevate your trading game—with data, discipline, and deeper insight.

![[The AI Show Episode 146]: Rise of “AI-First” Companies, AI Job Disruption, GPT-4o Update Gets Rolled Back, How Big Consulting Firms Use AI, and Meta AI App](https://www.marketingaiinstitute.com/hubfs/ep%20146%20cover.png)

_Alexey_Kotelnikov_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

_Brian_Jackson_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![iPhone spyware company NSO must pay Meta $167M for WhatsApp attack [U]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2024/03/iPhone-spyware-company-NSO-must-reveal-code.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Roku clarifies how ‘Pause Ads’ work amid issues with some HDR content [U]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2025/05/roku-pause-ad-1.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Apple Seeds visionOS 2.5 RC to Developers [Download]](https://www.iclarified.com/images/news/97240/97240/97240-640.jpg)

![Apple Seeds tvOS 18.5 RC to Developers [Download]](https://www.iclarified.com/images/news/97243/97243/97243-640.jpg)