Neo Asset Management raises Rs 2,000 Cr for second private credit fund

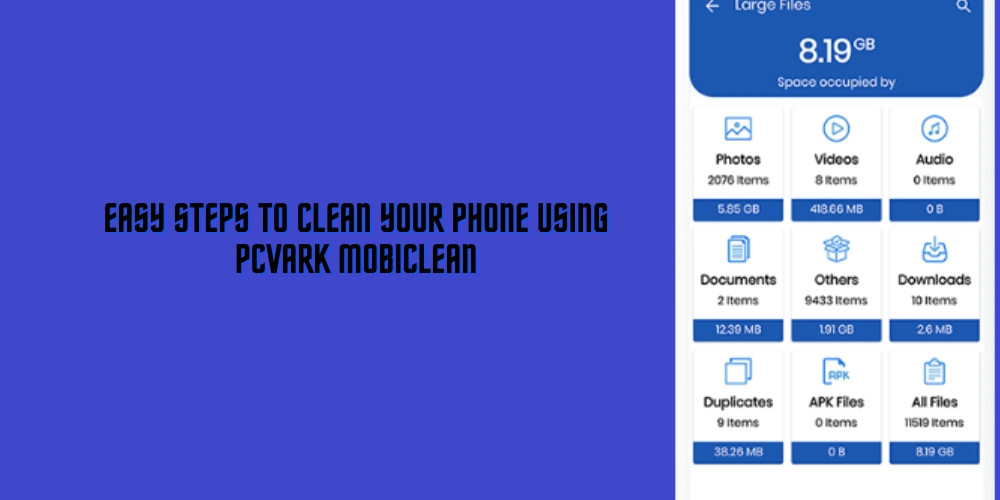

The Neo Special Credit Opportunities Fund-II (NSCOF-II) provides structured credit to mid-market, EBITDA-positive companies, backed by hard asset collateral and regular coupon payments.

Neo Asset Management announced the first close of its second flagship private credit fund, Neo Special Credit Opportunities Fund-II (NSCOF-II), at Rs 2,000 crore, the alternative asset manager said in a statement on Tuesday.

Launched three months ago, NSCOF-II—a SEBI-registered Category II Alternative Investment Fund (AIF)—aims to shore up a total corpus of Rs 5,000 crore. The fund provides structured credit to mid-market, EBITDA-positive companies, backed by hard asset collateral and regular coupon payments.

“With a strong pipeline in place, we look forward to deploying capital efficiently in Fund-II. Our objective is to create a well-diversified portfolio with 25–30 investments, each ranging between Rs 150–300 crore,” said Puneet Jain, Co-founder and Chief Investment Officer of Neo Asset Management.

The first close has attracted investments from a mix of family offices, ultra-high net-worth individuals (UHNIs), and institutional investors.

NSCOF-II builds on the success of Neo’s debut private credit fund, NSCOF-I, which closed in June 2024 after raising Rs 2,575 crore. The fund deployed 100% of its capital across 23 transactions and has already exited from seven of those, according to the company.

“Mid-market special situations credit is an untapped opportunity, and Neo Asset Management is focused on this space. Our disciplined investment approach and risk framework have enabled us to deliver risk-adjusted returns,” said Rubin Chheda, Managing Director and Head – Special Situations Strategy at Neo Asset Management.

At present, the firm manages over Rs 10,000 crore in alternative assets. The broader Neo Group, which counts Peak XV Partners, MUFG Bank, and Euclidean Capital among its backers, manages more than Rs 40,000 crore in assets under advisory and aims to build one of India’s leading platforms in alternatives.

In a recent funding round, Neo raised Rs 400 crore led by MUFG Bank and Euclidean Capital, with continued participation from Peak XV, which had invested Rs 300 crore in October 2023.

Edited by Suman Singh

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

.png?#)

.jpeg?#)

.jpg?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

![Leaker vaguely comments on under-screen camera in iPhone Fold [U]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2025/04/iPhone-Fold-will-have-Face-ID-embedded-in-the-display-%E2%80%93-leaker.webp?resize=1200%2C628&quality=82&strip=all&ssl=1)

![[Fixed] Gemini app is failing to generate Audio Overviews](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2025/03/Gemini-Audio-Overview-cover.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Apple Seeds tvOS 18.5 Beta 2 to Developers [Download]](https://www.iclarified.com/images/news/97011/97011/97011-640.jpg)

![Apple Releases macOS Sequoia 15.5 Beta 2 to Developers [Download]](https://www.iclarified.com/images/news/97014/97014/97014-640.jpg)