Navigating Blockchain Project Funding and Regulatory Compliance

Abstract This post delves deep into blockchain project funding and regulatory compliance, offering a comprehensive look at funding strategies such as venture capital, ICOs, STOs, IEOs, and crowdfunding. It also highlights the importance of robust compliance measures amidst evolving regulatory frameworks worldwide. By exploring historical context, core concepts, key challenges, practical applications, and future trends, this article provides actionable insights for entrepreneurs, developers, and blockchain innovators. Additionally, the post features comparative tables, bullet lists, and links to authoritative sources like License Token’s comprehensive guide, ensuring technical clarity and SEO-friendly content. Introduction Blockchain technology is revolutionizing not just tech industries but also the financial and legal landscapes. For entrepreneurs venturing into blockchain, understanding the nuances of project funding and regulatory compliance is crucial for long-term success. This blog post explores how various funding models—including venture capital, ICOs, STOs, IEOs, and crowdfunding—integrate with compliance frameworks to create resilient, scalable blockchain ecosystems. As regulatory bodies continuously update policies amid rapid digital transformation, continuous learning and robust legal consultation are vital. Background and Context Blockchain ecosystems have evolved significantly over the past decade. Initially heralded as the technology behind Bitcoin, blockchain has now expanded into fields such as decentralized finance (DeFi), supply chain management, digital identity, and much more. Understanding blockchain funding and compliance includes a brief exploration of the following: Historical Perspective: Early blockchain projects largely relied on community-driven funding and innovation, but as the industry matured, venture capital and institutional investors stepped in. Key Definitions: Blockchain Project Funding refers to the capital raised to initiate, develop, and scale blockchain ventures using models like ICOs, STOs, and crowdfunding. Regulatory Compliance ensures that blockchain projects adhere to international and local laws, such as those enforced by the SEC, CFTC, or regional bodies in the EU and Asia. Ecosystem Overview: The explosion of startups in the blockchain space has prompted a mix of traditional and innovative funding methods, making it essential for entrepreneurs to align financial strategies with regulatory demands. Core Concepts and Features Exploring Funding Strategies Blockchain projects need reliable financing channels. Here are the primary funding strategies with their key features: Venture Capital (VC): Overview: VCs invest in early-stage startups in exchange for equity. Benefits: Access to extensive networks and expertise. Considerations: VC deals usually involve a dilution of ownership, so understanding equity implications is crucial. For more details, check out Venture Capital in Blockchain. Initial Coin Offerings (ICOs): Overview: ICOs allow projects to raise funds by issuing their own digital tokens. Benefits: Democratizes fundraising and attracts a wide range of investors. Challenges: Increasing regulatory oversight makes legal compliance a priority. Stay updated with the latest on ICOs and Blockchain. Security Token Offerings (STOs): Overview: STOs combine blockchain innovation with traditional securities regulations, offering enhanced legal protections. Benefits: Require rigorous financial disclosures and meet higher investor protection standards. Considerations: They often come with stricter compliance requirements compared to ICOs. Learn more at STOs. Initial Exchange Offerings (IEOs): Overview: IEOs take place on cryptocurrency exchanges, providing a layer of trust through exchange vetting. Benefits: They offer enhanced transparency and investor confidence. Challenges: High fees and strict exchange requirements can limit flexibility. Explore the mechanics of IEOs. Crowdfunding: Overview: This model leverages both traditional and decentralized platforms to raise funds from a broad community. Benefits: Democratizes investment by engaging a diverse investor base. Challenges: Requires a robust marketing strategy and adherence to evolving digital fundraising regulations. More on Blockchain Crowdfunding. Regulatory Compliance Essentials As blockchain projects grow, the importance of compliance increases. The regulatory landscape varies widely: United States: Projects must navigate through regulatory bodies like the SEC and CFTC. Staying current with SEC guidelines on cybersecurity is essential. More details can be found at the SEC’s Cybersecurity page. European Union: The Markets in Crypto-Assets (MiCA) regulation and GDPR guidelines shape blockchain operations in Europe. In-depth information

Abstract

This post delves deep into blockchain project funding and regulatory compliance, offering a comprehensive look at funding strategies such as venture capital, ICOs, STOs, IEOs, and crowdfunding. It also highlights the importance of robust compliance measures amidst evolving regulatory frameworks worldwide. By exploring historical context, core concepts, key challenges, practical applications, and future trends, this article provides actionable insights for entrepreneurs, developers, and blockchain innovators. Additionally, the post features comparative tables, bullet lists, and links to authoritative sources like License Token’s comprehensive guide, ensuring technical clarity and SEO-friendly content.

Introduction

Blockchain technology is revolutionizing not just tech industries but also the financial and legal landscapes. For entrepreneurs venturing into blockchain, understanding the nuances of project funding and regulatory compliance is crucial for long-term success. This blog post explores how various funding models—including venture capital, ICOs, STOs, IEOs, and crowdfunding—integrate with compliance frameworks to create resilient, scalable blockchain ecosystems. As regulatory bodies continuously update policies amid rapid digital transformation, continuous learning and robust legal consultation are vital.

Background and Context

Blockchain ecosystems have evolved significantly over the past decade. Initially heralded as the technology behind Bitcoin, blockchain has now expanded into fields such as decentralized finance (DeFi), supply chain management, digital identity, and much more. Understanding blockchain funding and compliance includes a brief exploration of the following:

- Historical Perspective: Early blockchain projects largely relied on community-driven funding and innovation, but as the industry matured, venture capital and institutional investors stepped in.

-

Key Definitions:

- Blockchain Project Funding refers to the capital raised to initiate, develop, and scale blockchain ventures using models like ICOs, STOs, and crowdfunding.

- Regulatory Compliance ensures that blockchain projects adhere to international and local laws, such as those enforced by the SEC, CFTC, or regional bodies in the EU and Asia.

- Ecosystem Overview: The explosion of startups in the blockchain space has prompted a mix of traditional and innovative funding methods, making it essential for entrepreneurs to align financial strategies with regulatory demands.

Core Concepts and Features

Exploring Funding Strategies

Blockchain projects need reliable financing channels. Here are the primary funding strategies with their key features:

-

Venture Capital (VC):

- Overview: VCs invest in early-stage startups in exchange for equity.

- Benefits: Access to extensive networks and expertise.

- Considerations: VC deals usually involve a dilution of ownership, so understanding equity implications is crucial.

- For more details, check out Venture Capital in Blockchain.

-

Initial Coin Offerings (ICOs):

- Overview: ICOs allow projects to raise funds by issuing their own digital tokens.

- Benefits: Democratizes fundraising and attracts a wide range of investors.

- Challenges: Increasing regulatory oversight makes legal compliance a priority.

- Stay updated with the latest on ICOs and Blockchain.

-

Security Token Offerings (STOs):

- Overview: STOs combine blockchain innovation with traditional securities regulations, offering enhanced legal protections.

- Benefits: Require rigorous financial disclosures and meet higher investor protection standards.

- Considerations: They often come with stricter compliance requirements compared to ICOs.

- Learn more at STOs.

-

Initial Exchange Offerings (IEOs):

- Overview: IEOs take place on cryptocurrency exchanges, providing a layer of trust through exchange vetting.

- Benefits: They offer enhanced transparency and investor confidence.

- Challenges: High fees and strict exchange requirements can limit flexibility.

- Explore the mechanics of IEOs.

-

Crowdfunding:

- Overview: This model leverages both traditional and decentralized platforms to raise funds from a broad community.

- Benefits: Democratizes investment by engaging a diverse investor base.

- Challenges: Requires a robust marketing strategy and adherence to evolving digital fundraising regulations.

- More on Blockchain Crowdfunding.

Regulatory Compliance Essentials

As blockchain projects grow, the importance of compliance increases. The regulatory landscape varies widely:

-

United States:

- Projects must navigate through regulatory bodies like the SEC and CFTC.

- Staying current with SEC guidelines on cybersecurity is essential. More details can be found at the SEC’s Cybersecurity page.

-

European Union:

- The Markets in Crypto-Assets (MiCA) regulation and GDPR guidelines shape blockchain operations in Europe.

- In-depth information on MiCA is available here.

-

Asia:

- Countries like Japan and Singapore set the pace with their progressive regulatory frameworks, making regional adaptability a key consideration.

- Learn more about the evolving regulatory environment in Asia via Tech in Asia’s blockchain insights.

Strategic Approaches to Compliance

Key compliance-building strategies include:

- Legal Consultation: Collaborating with legal experts who specialize in blockchain is essential for risk mitigation. Explore Legal Aspects of NFTs for further insights.

- Engagement with Regulators: Maintaining open dialogue with regulatory bodies helps preempt issues and build trust.

- Internal Controls: Establishing comprehensive internal frameworks with robust audits ensures adherence to compliance standards. More on internal controls is provided in Blockchain Security Resources.

- Continuous Learning: With shifting regulations, continuous learning through blockchain forums and compliance modules is essential. Read more on Continuous Learning in Blockchain.

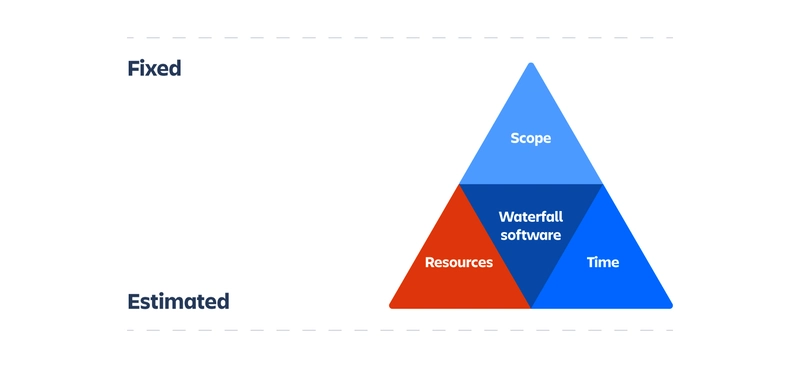

Comparative Table of Funding Models

| Funding Model | Key Benefits | Primary Challenges | Regulatory Considerations |

|---|---|---|---|

| Venture Capital (VC) | Network access, expertise | Equity dilution | Adherence to equity rules and investor rights |

| ICO | Wide participation, speed | Increased regulatory scrutiny | Must comply with securities laws |

| STO | Legal clarity, investor protection | Stricter disclosure requirements | Adherence to traditional securities regulations |

| IEO | Exchange vetting, trust building | High fees, exchange rules | Dependence on exchange standards |

| Crowdfunding | Democratized funding, community engagement | Requires marketing, scalability issues | Must align with digital fundraising regulations |

Applications and Use Cases

The synergy of funding models and compliance frameworks has led to several practical applications:

Decentralized Finance (DeFi):

DeFi platforms have leveraged IEOs and STOs to gain trust. For instance, some projects use IEOs on reputable exchanges to raise funds swiftly while ensuring compliance with regulatory standards. This guarantees both liquidity and robust investor protection measures.Supply Chain Management:

Blockchain projects in supply chain management often opt for a combination of VC funding and crowdfunding. This hybrid approach allows the projects to secure initial investment from seasoned investors while engaging the public for further funding. Robust regulatory compliance helps in ensuring data integrity and cybersecurity.

For example, a supply chain blockchain might implement internal controls, regular audits, and continuous learning strategies, thus managing both funding and compliance seamlessly.Digital Identity Verification:

Projects in digital identity utilize security tokens to fund their platform while ensuring that every phase of operation complies with regional data protection regulations. By merging STO funding with strict legal consultation, these projects can achieve both investor trust and user data security.

Challenges and Limitations

While the integration of innovative funding strategies with regulatory compliance opens new opportunities, several challenges persist:

Complex Regulatory Environments:

Navigating the regulations across different regions (US, EU, Asia) can be intricate. Project innovators must adapt their strategy to comply with shifting government policies, potentially increasing the project’s complexity and cost.Technical Barriers:

Implementing internal controls and audit mechanisms demands technical expertise and consistent updates to security protocols. Additionally, the fast pace of blockchain innovation sometimes outstrips regulatory clarity, placing projects in a state of cautious progress.Adoption Challenges:

Public uncertainty and an evolving legal framework may deter potential investors. Moreover, factors such as high exchange fees in IEOs or the dilution offered by venture capital might not be appealing to all startups, particularly those aiming for decentralized models.Interoperability Issues:

As blockchain projects operate across networks, achieving smooth integration between differing systems while complying with regional standards can be a hurdle.

Future Outlook and Innovations

The future of blockchain project funding and regulatory compliance looks promising, with several trends on the horizon:

Integration of AI and Blockchain:

Combining AI-based data analytics with blockchain compliance frameworks could provide real-time monitoring of transaction integrity and security. This evolution may further streamline compliance mechanisms.Enhanced Regulatory Frameworks:

With regulators like the SEC, MiCA in the EU, and stringent guidelines in Asia, future policies will likely offer clearer pathways for funding blockchain projects. These improvements will reduce uncertainty while fostering innovation.Decentralized Governance Models:

Projects like Arbitrum are exploring community governance models to combine funding and regulation effectively. Learn more about innovative strategies in Arbitrum Smart Contracts Revolutionizing the Blockchain Landscape.Open Source Funding Innovations:

The blockchain space is also witnessing new funding paradigms where open source projects gain support through mechanisms like GitHub Sponsors and community donations. These methods are empowering developers while ensuring that legal and ethical standards remain at the forefront. Discussions on innovative funding approaches can be found in Blockchain for Open Source Funding: A New Paradigm and License Token: A New Dawn in Open Source Funding.Standardization of Funding Protocols:

Industry bodies are working towards standardizing token sales, audits, and compliance certifications, fostering an environment where blockchain startups can reliably secure funding and scale operations.

Summary and Conclusion

Navigating the intricate maze of blockchain project funding and regulatory compliance is challenging yet essential. By leveraging innovative funding strategies such as venture capital, ICOs, STOs, IEOs, and crowdfunding, blockchain projects can secure the financial backing they need. At the same time, stringent compliance measures—through legal consultation, regulator engagement, and internal audits—ensure that these projects operate within legal boundaries while building investor trust.

Key highlights include:

- A comprehensive review of funding models with their benefits and regulatory challenges.

- The importance of legal consultation and continuous learning in maintaining robust compliance.

- Practical use cases illustrating how blockchain funding and regulatory compliance function in real-world applications like DeFi and supply chain management.

- Emerging trends and innovations, such as the integration of AI, decentralized governance models, and standardization efforts, pointing to a future where funding and compliance are more seamlessly integrated.

Entrepreneurs venturing into blockchain must balance innovative funding with rigorous compliance practices. By staying informed through trusted resources, such as License Token’s detailed guides and reputable industry sources like CoinDesk, one can mitigate risks and seize growth opportunities.

For developers and innovators, embracing these strategies not only secures financial backing but also reinforces the trust necessary to thrive in an increasingly competitive and regulated digital landscape.

Bullet List of Key Takeaways:

- Diverse Funding Options: Venture capital, ICOs, STOs, IEOs, and crowdfunding each carry unique benefits and challenges.

- Regulatory Compliance: Ensuring adherence to global standards through legal consultation, proactive regulator engagement, and robust internal controls.

- Practical Applications: Real-world examples in DeFi, supply chain, and digital identity showcase the fusion of funding and compliance.

- Future Trends: The role of AI, decentralized governance, and standardized protocols in enhancing both funding strategies and regulatory adherence.

Final Thoughts

The journey to launching and scaling a successful blockchain project is as exciting as it is challenging. A key takeaway for blockchain entrepreneurs is the need for a dual-focused strategy: robust financial backing paired with stringent regulatory compliance. As the industry evolves—guided by technological advancements and clearer regulatory pathways—projects that invest in both areas will set themselves apart and drive the next wave of blockchain innovation.

Staying up-to-date and continuously engaging with the latest community insights, such as those shared on Arbitrum and Regulatory Challenges in DeFi and Open Source Funding Strategies, will ensure that innovators are prepared to navigate this dynamic space with confidence.

By harmonizing effective funding models with a proactive approach to regulatory compliance, blockchain projects can not only achieve sustainability but also lead the charge in transforming global financial and technological landscapes.

Embrace the challenge, stay compliant, and keep innovating—your success in the blockchain space depends on it.

Happy innovating!

![[The AI Show Episode 145]: OpenAI Releases o3 and o4-mini, AI Is Causing “Quiet Layoffs,” Executive Order on Youth AI Education & GPT-4o’s Controversial Update](https://www.marketingaiinstitute.com/hubfs/ep%20145%20cover.png)

.jpg?#)

_NicoElNino_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Craft adds Readwise integration for working with book notes and highlights [50% off]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2025/04/craft3.jpg.png?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Standalone Meta AI App Released for iPhone [Download]](https://www.iclarified.com/images/news/97157/97157/97157-640.jpg)