Is a rally brewing? XRP flashes key rebound signal

XRP forms a double bottom pattern signaling a possible rebound. Resistance lies at $1.90, which if cleared could lead to a major breakout above the $1.96 neckline. Ripple’s acquisition of Hidden Road supports the bullish outlook. XRP is stirring excitement among traders as technical patterns and market developments hint at a possible turnaround. Currently hovering […] The post Is a rally brewing? XRP flashes key rebound signal appeared first on CoinJournal.

- XRP forms a double bottom pattern signaling a possible rebound.

- Resistance lies at $1.90, which if cleared could lead to a major breakout above the $1.96 neckline.

- Ripple’s acquisition of Hidden Road supports the bullish outlook.

XRP is stirring excitement among traders as technical patterns and market developments hint at a possible turnaround.

Currently hovering around $1.82 after a sharp decline from above $2.00, the Ripple (XRP) is showing signs of resilience despite persistent selling pressure.

Analysts are eyeing a potential rebound, driven by a forming double bottom pattern and Ripple’s recent acquisition of Hidden Road.

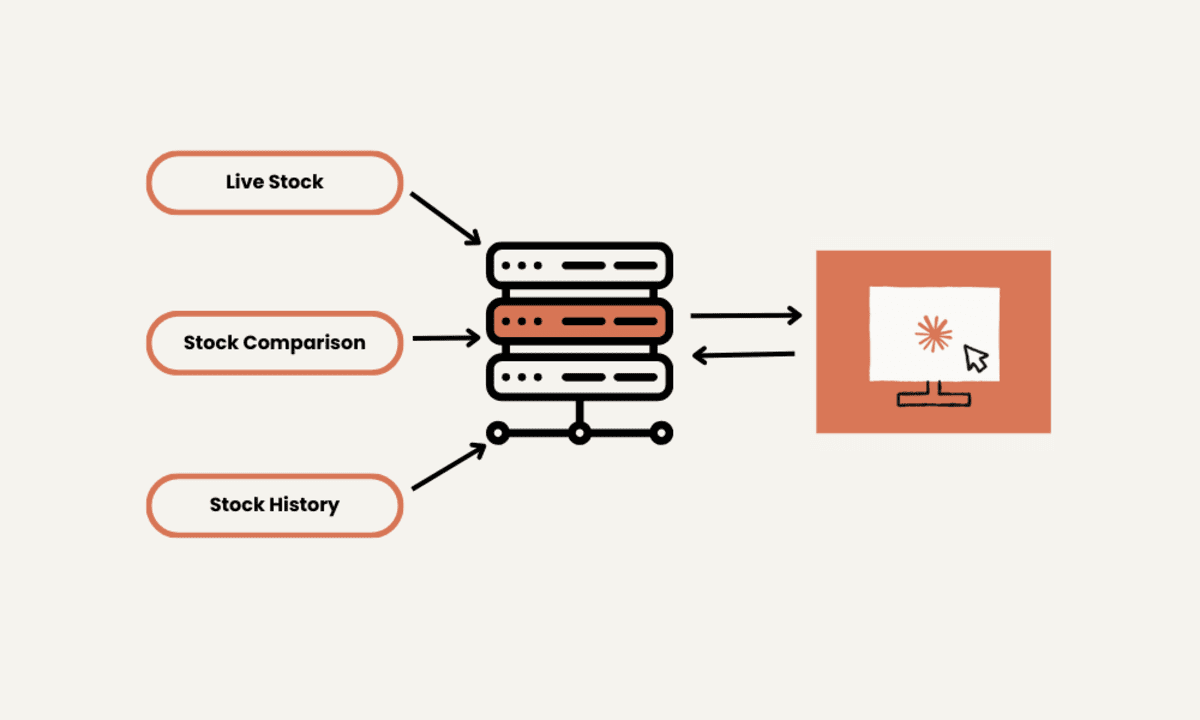

Technical analysis points to a possible XRP rebound

XRP’s price action is painting a compelling picture on the charts.

After tumbling to a low of $1.61 on April 7, XRP has quickly recovered to $1.8217, jumping by 13.15% in 48 hours.

Despite facing resistance at the current price level, analysts like Blockchain Backer on April 7 noted that XRP is in the final leg of an ABC correction, with Wave C targeting a bottom between $1.40 and $1.50—a zone tied to historical support and the 0.786 Fibonacci retracement.

In addition to completing the ABC correction, a double bottom is around $1.74 on the 4-hour chart.

This pattern, coupled with oversold conditions near the lower Bollinger Band, suggests that bearish momentum may be exhausting.

If the $1.74 support holds and the MACD shows bullish divergence on shorter timeframes, a bounce toward $1.85 or $1.90 could unfold.

However, previously, the XRP price has faced rejection at the $1.90 resistance, where a bearish trend line and the 61.8% Fibonacci retracement of its recent drop from $2.168 to $1.61 loom large.

And seeing that the altcoin is currently trading below the 100-SMA and the MACD is firmly in a bearish territory, it remains vulnerable to another decline if $1.90 holds firm.

Nevertheless, XRP’s swift recovery from $1.61 and a 13.14% surge in trading volume reveal underlying strength.

This resilience and the formation of a double bottom hint that buyers are stepping in, potentially countering the bears if key levels break in their favor.

Recent acquisition of Hidden Road supports the rebound

Beyond the charts, Ripple’s acquisition of Hidden Road for $1.25 billion is igniting hope for XRP’s utility and price.

This deal positions Ripple as the first crypto firm to own a prime brokerage, merging traditional finance with the XRP Ledger’s fast, scalable infrastructure.

Hidden Road, which clears $3 trillion annually, plans to use XRPL for trade settlements and RLUSD as collateral, enhancing efficiency in cross-asset trading.

CEO Brad Garlinghouse sees this as a game-changer for institutional adoption, a view echoed by the crypto community.

Following the announcement, XRP spiked 2% in hourly trading, defying market-wide selloffs.

This real-world catalyst could amplify technical signals, pushing XRP toward a sustained rebound if momentum builds.

Though the resistance at $1.90 and current bear momentum pose risks, XRP’s recent price action and growing utility suggest a major rebound may be near, especially if it breaks through the double bottom’s neckline at $1.96.

The post Is a rally brewing? XRP flashes key rebound signal appeared first on CoinJournal.

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

.jpg?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

.png?#)

.webp?#)

![Leaker vaguely comments on under-screen camera in iPhone Fold [U]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2025/04/iPhone-Fold-will-have-Face-ID-embedded-in-the-display-%E2%80%93-leaker.webp?resize=1200%2C628&quality=82&strip=all&ssl=1)

![[Fixed] Gemini app is failing to generate Audio Overviews](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2025/03/Gemini-Audio-Overview-cover.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Apple Seeds tvOS 18.5 Beta 2 to Developers [Download]](https://www.iclarified.com/images/news/97011/97011/97011-640.jpg)

![Apple Releases macOS Sequoia 15.5 Beta 2 to Developers [Download]](https://www.iclarified.com/images/news/97014/97014/97014-640.jpg)