Bitcoin gains momentum as US dollar falls 5.84%

Reciprocal tariffs targeting deficit-heavy partners began on April 9. The US Dollar Index has dropped 5.84% since January 1. Bitcoin now trading at $77,260, down 17.57% in 2024. A wave of uncertainty sparked by US President Donald Trump’s global tariff policy is reshaping investor behaviour. Bitcoin is emerging as an unexpected safe haven amid growing […] The post Bitcoin gains momentum as US dollar falls 5.84% appeared first on CoinJournal.

- Reciprocal tariffs targeting deficit-heavy partners began on April 9.

- The US Dollar Index has dropped 5.84% since January 1.

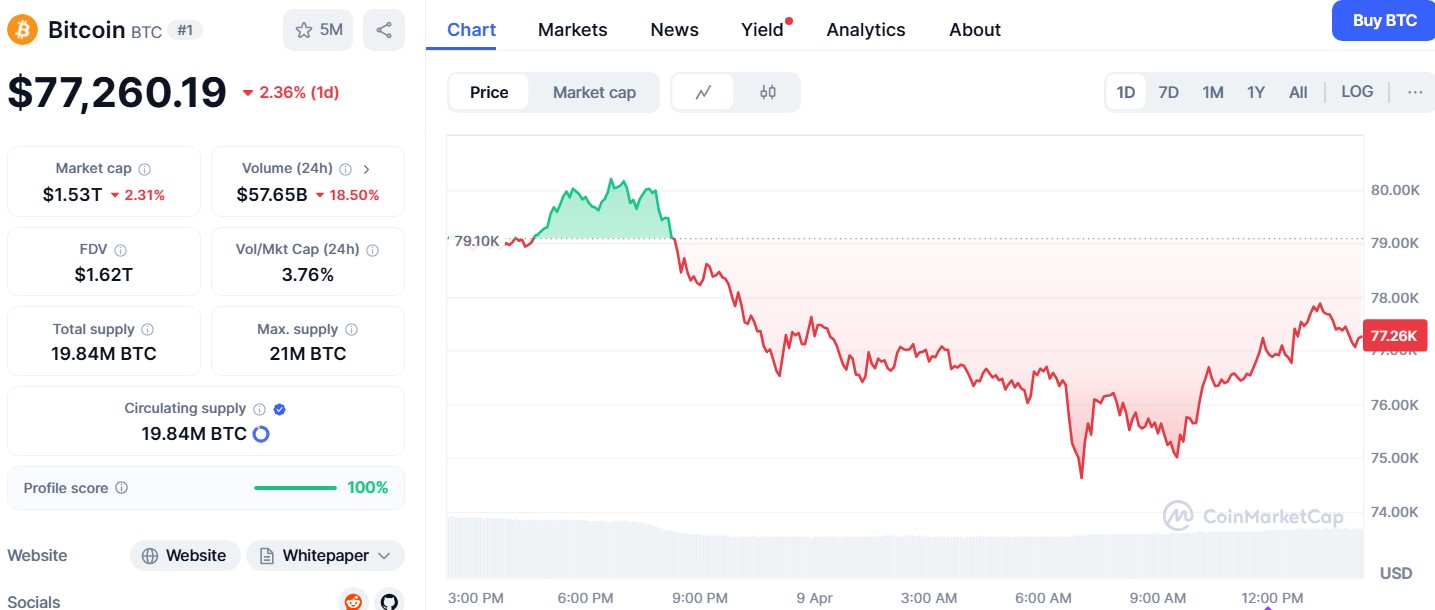

- Bitcoin now trading at $77,260, down 17.57% in 2024.

A wave of uncertainty sparked by US President Donald Trump’s global tariff policy is reshaping investor behaviour.

Bitcoin is emerging as an unexpected safe haven amid growing concerns over the dollar’s long-term strength.

On April 2, Trump signed an executive order imposing a 10% baseline tariff on all imports, regardless of origin.

The policy, which took effect on April 5, introduced additional reciprocal tariffs targeting major trade deficit partners from April 9.

This shift has led to financial market turbulence, prompting crypto investors and analysts to reassess the US dollar’s global position and Bitcoin’s role as a store of value.

Dollar drops 5.84% as Bitcoin gains attention

The US Dollar Index has declined 5.84% since the beginning of the year, trading at 102.193 as of April 9, according to TradingView data.

Contrary to earlier Wall Street projections, Trump’s tariffs have not strengthened the dollar.

Instead, the policy has triggered risk aversion and declining sentiment towards the US currency.

In response, several crypto market participants have voiced renewed confidence in Bitcoin’s longevity.

Bitwise Invest’s Jeff Parks wrote in an April 9 post on X that there is now a “higher chance Bitcoin survives over the dollar in our lifetime.”

This shift in perception was echoed by Bitwise CEO Hunter Horsley, who noted that with both the dollar and other global currencies appearing fragile, Bitcoin is being seen as a last resort.

Gold, traditionally used during times of financial uncertainty, has also come under scrutiny for its practical limitations, such as high storage and transport costs, especially in cross-border investment scenarios.

In contrast, Bitcoin’s decentralised digital format appeals to investors seeking liquidity, portability, and a hedge against central bank policy shifts.

Tariffs spark selloff across markets

The timeline of the US import tariff rollout has aligned with a broader correction across both traditional and digital asset markets.

On April 2, the executive order was signed, announcing a flat 10% tariff on all goods entering the US.

This universal baseline was quickly followed by more aggressive reciprocal tariffs targeting countries with large trade deficits with the US.

These retaliatory measures, enforced from April 9, have further escalated concerns over a looming trade war and potential economic slowdown.

As fears of a global recession intensify, crypto markets have not been spared.

Bitcoin is now trading at $77,260, down 17.57% year-to-date, based on CoinMarketCap data.

Still, the decline has not dampened interest in Bitcoin’s use as a hedge.

Rather, it has highlighted a growing divide between short-term price movements and long-term utility.

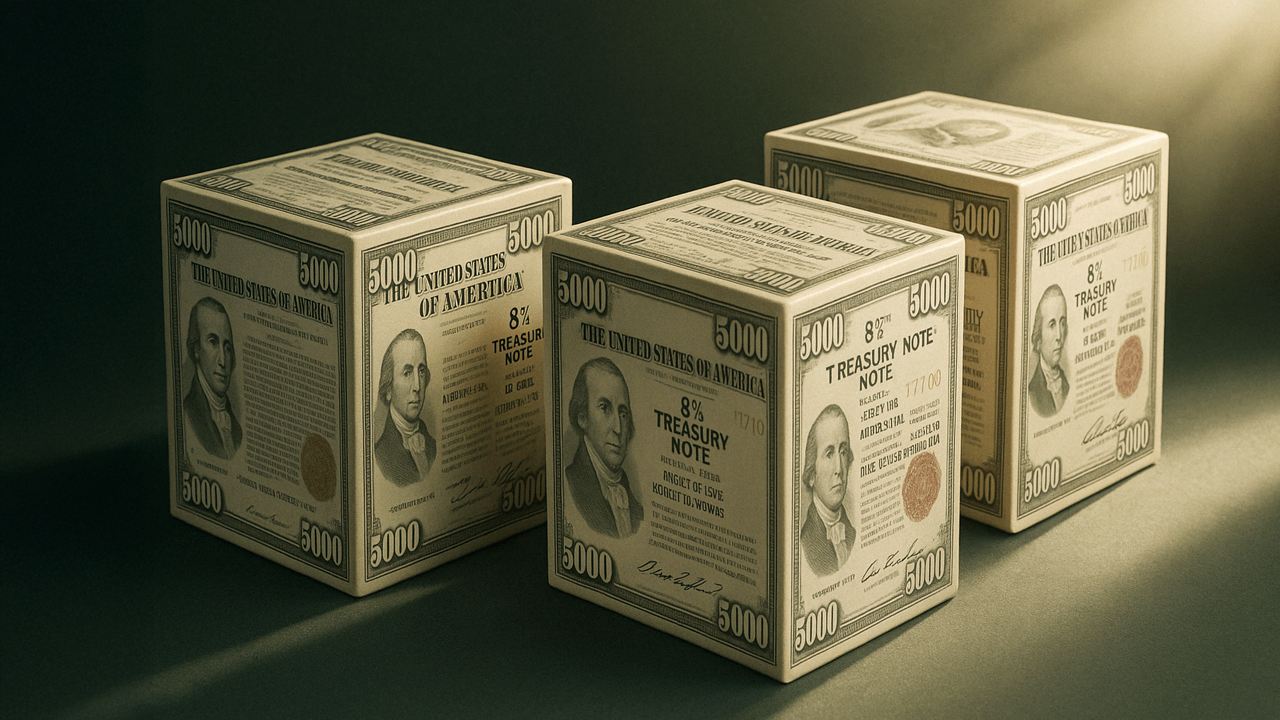

Bitcoin is seen as a hard money alternative

Saifedean Ammous, known for his writing on Bitcoin economics, weighed in on the wider implications of the tariff regime.

In an April 8 post on X, he said the real issue was not bilateral deficits but the cumulative impact of US reliance on fiat currency.

Ammous argued that an increasing number of Americans benefit from the global use of the US dollar, supported by monetary expansion or “money printing.”

He advocated a shift to a “hard money” framework, naming gold and Bitcoin as viable options to offset economic imbalances and address the structural trade deficits Trump’s policies aim to resolve.

Ammous also pointed out that replacing fiat currency with assets like Bitcoin could lead to the trade surpluses the administration desires.

This view reflects a growing sentiment among digital asset proponents that Bitcoin may serve not only as a technological innovation or investment vehicle but also as a political and monetary counterweight to conventional systems.

The post Bitcoin gains momentum as US dollar falls 5.84% appeared first on CoinJournal.

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

![GrandChase tier list of the best characters available [April 2025]](https://media.pocketgamer.com/artwork/na-33057-1637756796/grandchase-ios-android-3rd-anniversary.jpg?#)

.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

.webp?#)

![New Beats USB-C Charging Cables Now Available on Amazon [Video]](https://www.iclarified.com/images/news/97060/97060/97060-640.jpg)

![Apple M4 13-inch iPad Pro On Sale for $200 Off [Deal]](https://www.iclarified.com/images/news/97056/97056/97056-640.jpg)