USDT returns to Bitcoin Lightning Network for faster payments

Integration uses Taproot Assets for token issuance. Lightning Labs announced the partnership on 30 January. Ardoino highlights Ethereum L2 privacy and validator issues. Tether’s USDT stablecoin is heading back to where it all began—Bitcoin. CEO Paolo Ardoino has confirmed that the stablecoin will soon launch on the Bitcoin Lightning Network, a move that revives USDT’s […] The post USDT returns to Bitcoin Lightning Network for faster payments appeared first on CoinJournal.

- Integration uses Taproot Assets for token issuance.

- Lightning Labs announced the partnership on 30 January.

- Ardoino highlights Ethereum L2 privacy and validator issues.

Tether’s USDT stablecoin is heading back to where it all began—Bitcoin. CEO Paolo Ardoino has confirmed that the stablecoin will soon launch on the Bitcoin Lightning Network, a move that revives USDT’s original blockchain association.

First issued on Bitcoin’s Omni Layer protocol, USDT expanded to Ethereum, Tron, and other blockchains as market demands evolved.

However, with growing appetite for fast, low-fee stablecoin transfers, Tether is bringing USDT back to Bitcoin through its layer-2 scaling system, powered by Lightning Labs’ Taproot Assets protocol.

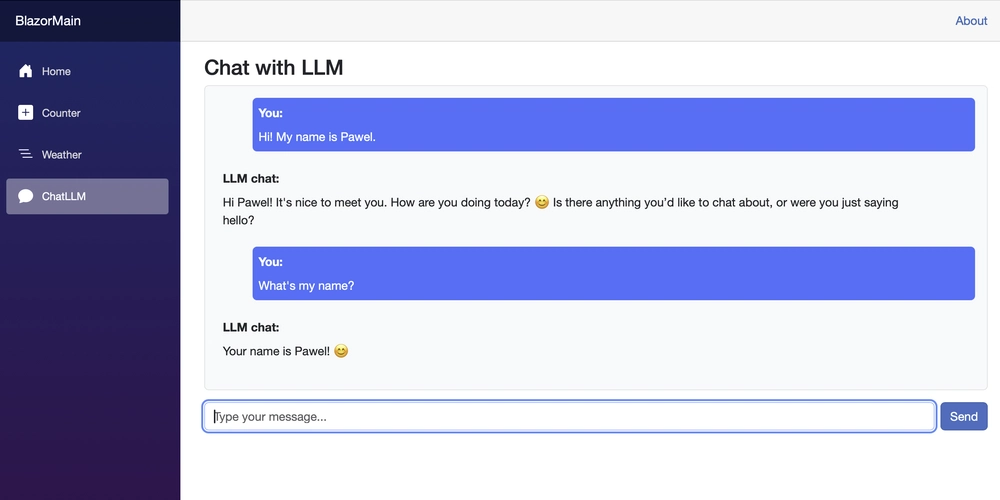

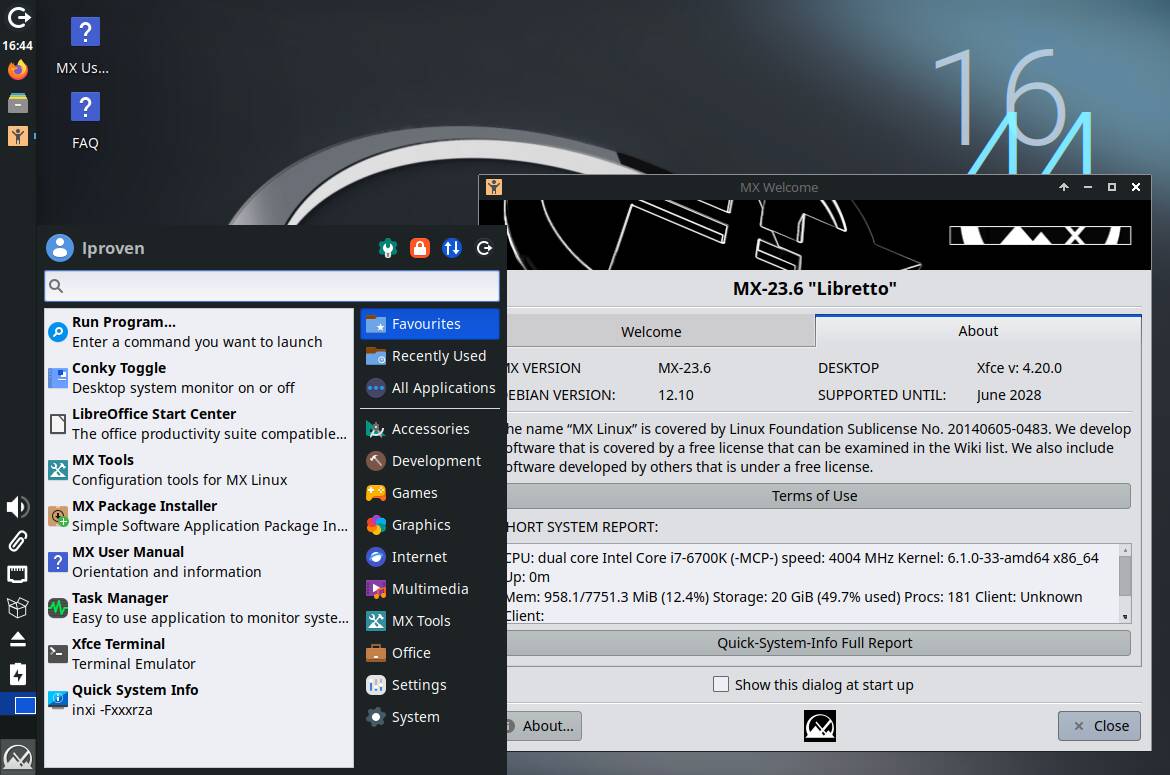

USDT to launch on Bitcoin Lightning

In a recent interview with The Wolf of All Streets host Scott Melker, Ardoino confirmed that Tether is integrating USDT on the Bitcoin Lightning Network.

He described it as a return to the token’s “natural habitat”, referencing its original issuance on Omni—a Bitcoin-based layer that eventually fell out of use due to low activity.

USDT issuance on Omni was discontinued, but Taproot Assets has now created an alternative mechanism for USDT to run natively on Bitcoin, enabling faster and cheaper transactions.

Lightning Labs, a core contributor to Bitcoin’s scaling infrastructure, first revealed the collaboration on 30 January.

The integration will allow users to send and receive USDT on the Lightning Network using payment channels rather than standard on-chain transactions, preserving network speed and reducing costs.

Lightning’s edge over Ethereum L2s

Ardoino made a strong case for choosing Bitcoin’s Lightning Network over Ethereum-based layer 2 networks. He said many Ethereum L2s are limited by centralised validator models, which can restrict decentralisation and increase latency.

Some also rely on a single-share state, where all validators have access to complete transaction data—raising privacy concerns.

In contrast, the Lightning Network’s node-based structure enables peer-to-peer transfers with enhanced confidentiality. Ardoino argued that Lightning’s architecture is more suitable for large-scale USDT transfers, as it avoids bottlenecks and supports real-time settlements.

The off-chain transaction model also ensures that only the final channel state is settled on the main chain, helping users maintain privacy and network efficiency.

Taproot Assets powering the integration

The technical foundation for USDT’s return to Bitcoin lies in Taproot Assets, introduced by Lightning Labs to enable asset issuance on the Lightning Network.

The protocol allows tokens like USDT to function on Bitcoin without requiring smart contract layers, making the process leaner and more compatible with Bitcoin’s minimalist design.

By using Taproot Assets, Tether can deploy its stablecoin in a way that aligns with Bitcoin’s core principles—decentralisation, security, and censorship resistance.

It also positions USDT as one of the first major stablecoins to re-establish itself on Bitcoin’s growing layer 2 ecosystem.

The development highlights a broader shift in the crypto landscape as more projects explore building on Bitcoin’s foundation rather than Ethereum or Solana.

Returning to Bitcoin for stability

This integration reflects a larger industry movement back toward Bitcoin.

Ardoino noted that many innovations initially launched on other chains are now pivoting to Bitcoin-based implementations.

One example is EMURGO’s BOS Grail bridge, which links Cardano’s DeFi infrastructure with Bitcoin users.

By enabling cross-chain functionality, these efforts aim to expand Bitcoin’s use beyond payments into areas like decentralised finance and smart contracts.

For Tether, the decision also has regulatory implications.

As scrutiny intensifies on stablecoin issuers worldwide, aligning USDT with Bitcoin—a protocol considered more decentralised and jurisdictionally neutral—may offer some insulation from future restrictions.

Bitcoin’s reputation as the most censorship-resistant blockchain provides a more resilient environment for large-value transactions.

Tether’s market dominance in the stablecoin sector remains unchallenged for now.

With the upcoming integration, USDT could become more accessible to Bitcoin-native users and institutions seeking faster, more secure transactions.

The move positions Lightning not just as a scaling tool but as a potential backbone for global stablecoin infrastructure.

The post USDT returns to Bitcoin Lightning Network for faster payments appeared first on CoinJournal.

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

![GrandChase tier list of the best characters available [April 2025]](https://media.pocketgamer.com/artwork/na-33057-1637756796/grandchase-ios-android-3rd-anniversary.jpg?#)

.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

.webp?#)

![New Beats USB-C Charging Cables Now Available on Amazon [Video]](https://www.iclarified.com/images/news/97060/97060/97060-640.jpg)

![Apple M4 13-inch iPad Pro On Sale for $200 Off [Deal]](https://www.iclarified.com/images/news/97056/97056/97056-640.jpg)