Founders and investors reveal the do’s and don’ts of D2C brand building at Rajasthan IT Day 2025

At Rajasthan IT Day 2025, speakers cracked the code on building a successful D2C brand. Revisit the highlights of the panel discussion.

Rajasthan has long been considered a cradle of innovation. Home to a thriving startup ecosystem, the state has now become ground zero for some of the most inspiring businesses in the country. Rajasthan IT Day 2025, a two-day event at the Rajasthan International Centre in Jaipur, was a celebration and showcase of the technological advancements, entrepreneurial ambitions, and ingenuity of the youth, startups, investors, leaders, academics and government representatives from across the state. The event featured panel discussions, workshops, pitch battles, a startup bazaar and expo, game jams, and much more.

iStart, one of India’s largest and most inclusive startup platforms, played an important role in organising the event. Operating across every district of Rajasthan, the initiative provides comprehensive support including incubation, mentorship, and funding opportunities of up to Rs 25 lakh without traditional tendering requirements. With over 5,700 registered startups, including more than 2000 women-led ventures, iStart continues to catalyse entrepreneurial growth in the region.

The new playbook for D2C Success

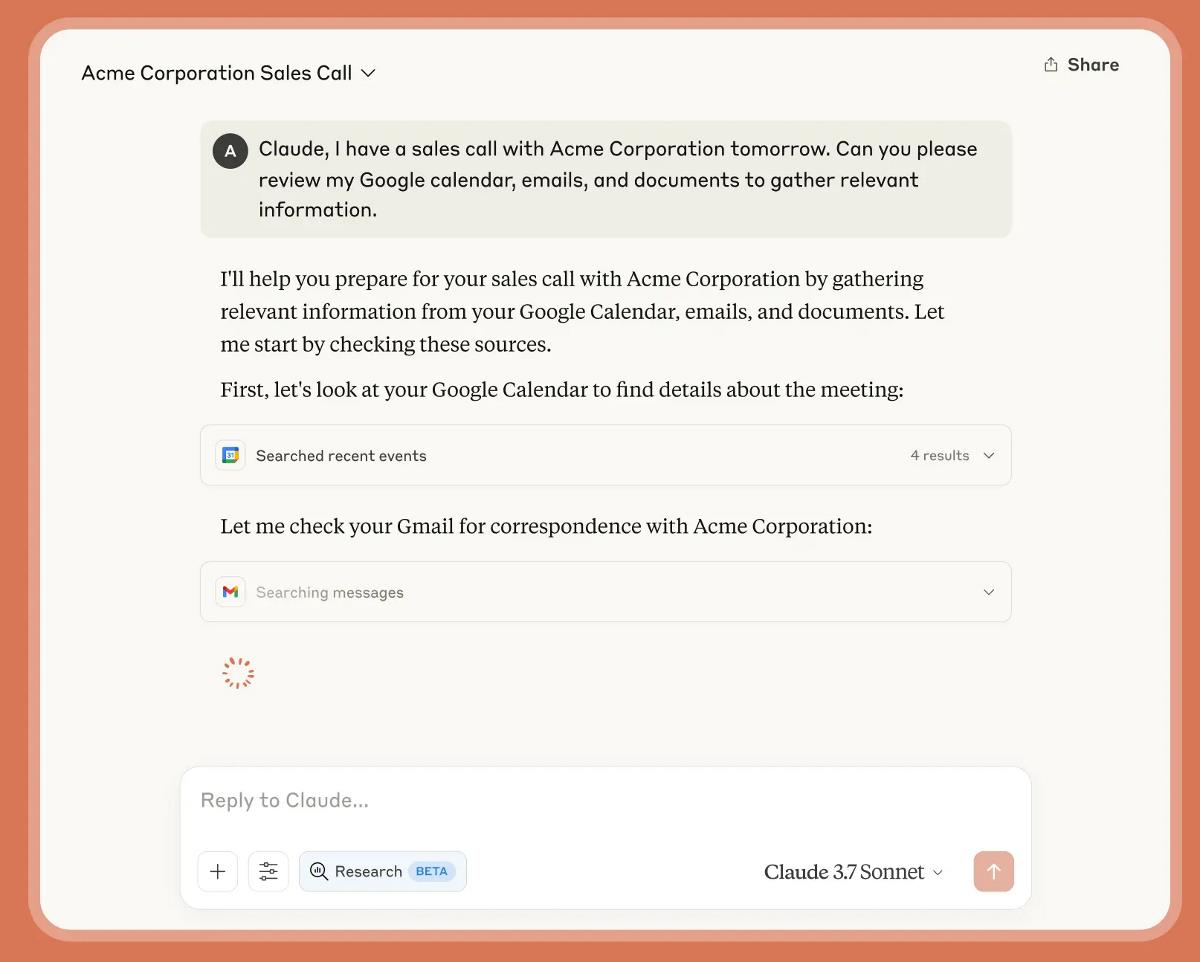

One of the panel discussions at Rajasthan IT Day 2025 — ‘Made in India, Made for India: The New Playbook for D2C Success’ — dove deep into what it takes to create a successful D2C brand in India. Moderator Ramakrishnan M, Managing Director, Primus Partners, was joined by speakers Bharat Sethi, Founder and CEO, Rage Coffee, and Mahavir Pratap Sharma, Chairman, TiE India Angels, for a conversation that spanned topics such as product-market fit, founder-market fit, investment hurdles, founder challenges, the importance of omnichannel strategies and more.

Ramakrishnan opened the conversation with an observation and a question for the speakers. As an angel investor, he said he often asked himself, “What is so special about a particular D2C founder, product or brand? What factors set them up for success?”

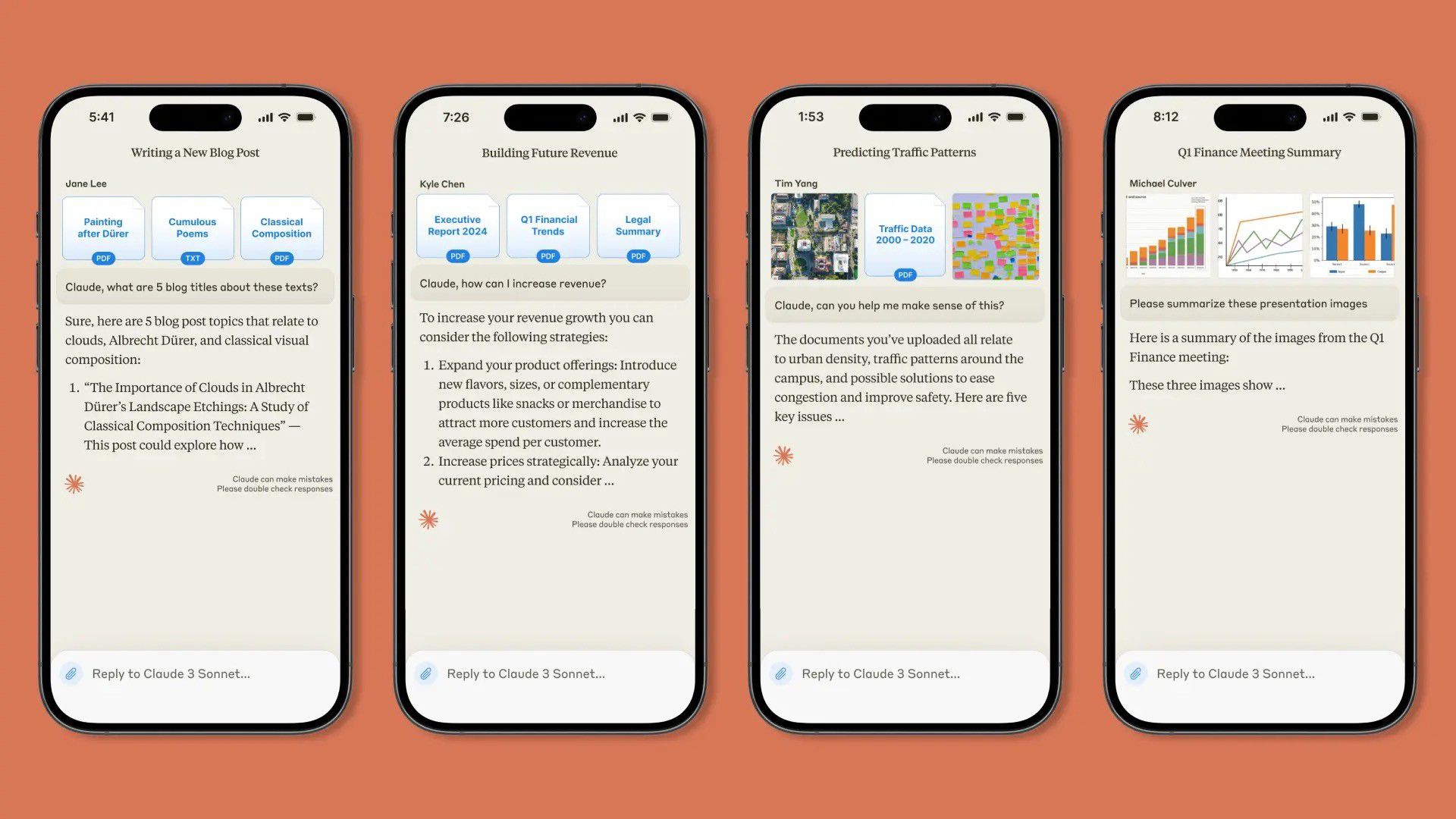

He put forth these questions to the speakers. According to Sethi, a founder and investor, the success of an aspiring D2C brand is rooted in founder-market fit (FMF). How do a founder's skill, experience, and passion align with the needs and dynamics of their target market? What factors lead a founder to set up a brand, solve a problem in a particular category, or create a product? If both the reason and FMF are strong, Sethi said he looks at how founders envision their growth journey and how quickly they can find their product-market fit (PMF).

Sethi said in the early stages, investors look at the team primarily, and the market secondarily. He also cited confidence as a crucial factor in investor pitches.

Sharma emphasised that as an investor he looks beyond the pedigree of a founder and seeks out their inherent potential. While degrees from Indian Institutes of Management (IIMs) and Indian Institutes of Technology (IITs) are important, he said founders are better served by using their street smarts.

“If India has to grow, we cannot depend on education, on a few institutions. We cannot depend on startups founded by the alumni of prominent institutions. We have to move fast and spread deep. I believe education is overhyped. I have invested in students from IIT, and I have invested in non-IIT founders. My returns are better on non-IIT students,” he said.

The D2C debate: Single or omnichannel presence?

Although conventional wisdom dictates that an omnichannel strategy is beneficial for D2C brands, both Sethi and Sharma contested this.

Sethi said the omnichannel story is for growing companies. Fledgling D2C brands must crack both sales and advertising on a single channel before opting for a second or third channel. Founders are often misguided, choosing trendy channels instead of focusing on their strengths.

“If Instagram works for you, double down on Instagram as much as possible. If Google leads work for you, double down on Meta advertising. If influencer creators are working for you, double down on that. Spend your money on finding more depth in one channel,” Sethi said.

Sharma advised founders to invest in a single channel, preferably online as the possibility of growth and scale was significantly easier.

Who can founders invest in?

Ramakrishnan reflected that many founders struggle in their journeys and are unsure of who to approach (angel groups or investors), how to pitch, and where to find the right support systems.

Sharma spoke about the variety of routes an investor can take to support founders. For D2C brands, investors will often request growth numbers for six to nine months before investing in and expanding the brand. For a unique product that comes with the potential to be patented, investors will invest in the Proof of Concept (POC). Founders with a stellar record in a similar sector, or those that have been part of a unicorn founding team, will also play a large role in investor considerations.

Sharma said college students and graduates have various avenues to explore. “From programs in colleges to the Wadhwani foundations, platforms like iStart to state government-sanctioned incubation centres, there are plenty of spaces where students can seek out mentorship.”

What founders need: patience and partnership

The speakers also discussed what D2C founders should avoid in their brand-building journey. Sethi advised founders to shift their focus from acquiring capital to creating a solid plan for growth. “Consumer brands do not need too much capital. To build a large business, you need patience and time more than capital. In the consumer brand segment, patience is critical - you will start seeing results in seven to 10 years,” he said.

Sharma stated that choosing the first employees of the company can make all the difference in the early days. “Choose your first few employees, your co-founder very, very carefully because they will be your pillars of strength. Don’t choose based on money. You may need to dilute some equity to your top management; it’s not a bad idea,” he said.

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

![Blue Archive tier list [April 2025]](https://media.pocketgamer.com/artwork/na-33404-1636469504/blue-archive-screenshot-2.jpg?#)

.png?#)

.webp?#)

![CVE security program used by Apple and others has funding removed [U]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2025/04/CVE-security-program-used-by-Apple-and-others-under-immediate-threat.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Apple to Split Enterprise and Western Europe Roles as VP Exits [Report]](https://www.iclarified.com/images/news/97032/97032/97032-640.jpg)

![Nanoleaf Announces New Pegboard Desk Dock With Dual-Sided Lighting [Video]](https://www.iclarified.com/images/news/97030/97030/97030-640.jpg)

![Apple's Foldable iPhone May Cost Between $2100 and $2300 [Rumor]](https://www.iclarified.com/images/news/97028/97028/97028-640.jpg)

![Daredevil Born Again season 1 ending explained: does [spoiler] show up, when does season 2 come out, and more Marvel questions answered](https://cdn.mos.cms.futurecdn.net/i8Lf25QWuSoxWKGxWMLaaA.jpg?#)