Elasticity of Demand

Overview This project simulates how loan application volume might respond to interest rate changes using the economic concept of price elasticity of demand. It visualizes borrower sensitivity under different scenarios and demonstrates how credit unions can use elasticity to guide loan pricing and strategy. Key Features Two demand models: Elastic (-1.5) and Inelastic (-0.5) Realistic simulation of how loan applications decrease as interest rates rise Visual comparison with annotated elasticity classifications Results Elastic Demand: Applications drop sharply when rates rise - borrowers are highly sensitive to pricing Inelastic Demand: Applications decline slowly - borrowers borrow despite rate hikes, possibly due to necessity or loyalty Visual labels ("Elastic", "Inelastic") help interpret behavior over time Repository and Code GitHub Repo: dylanomics/Elasticity

Overview

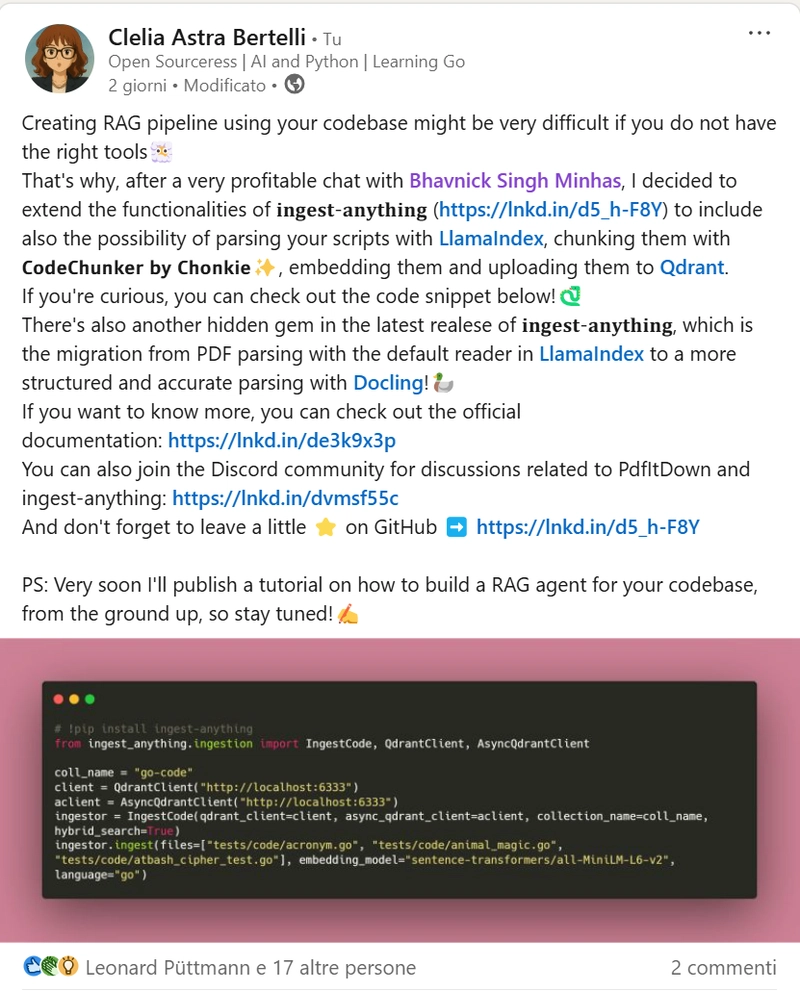

This project simulates how loan application volume might respond to interest rate changes using the economic concept of price elasticity of demand. It visualizes borrower sensitivity under different scenarios and demonstrates how credit unions can use elasticity to guide loan pricing and strategy.

Key Features

- Two demand models: Elastic (-1.5) and Inelastic (-0.5)

- Realistic simulation of how loan applications decrease as interest rates rise

- Visual comparison with annotated elasticity classifications

Results

- Elastic Demand: Applications drop sharply when rates rise - borrowers are highly sensitive to pricing

- Inelastic Demand: Applications decline slowly - borrowers borrow despite rate hikes, possibly due to necessity or loyalty

- Visual labels ("Elastic", "Inelastic") help interpret behavior over time

Repository and Code

GitHub Repo: dylanomics/Elasticity

_courtesy_VERTICAL.jpg)

![[The AI Show Episode 145]: OpenAI Releases o3 and o4-mini, AI Is Causing “Quiet Layoffs,” Executive Order on Youth AI Education & GPT-4o’s Controversial Update](https://www.marketingaiinstitute.com/hubfs/ep%20145%20cover.png)

![[DEALS] Mail Backup X Individual Edition: Lifetime Subscription (72% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![Google reveals NotebookLM app for Android & iPhone, coming at I/O 2025 [Gallery]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2025/05/NotebookLM-Android-iPhone-6-cover.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Apple Reports Q2 FY25 Earnings: $95.4 Billion in Revenue, $24.8 Billion in Net Income [Chart]](https://www.iclarified.com/images/news/97188/97188/97188-640.jpg)