Understanding the Regulatory Landscape for Tokenized U.S. Equities

Introduction to Tokenization In recent years, the world of finance has seen significant advancements, especially with the introduction of blockchain technology. One of the most exciting developments in this space is the concept of tokenization, particularly the tokenization of U.S. equities (stocks). But what exactly does tokenization mean, and why is it so important for U.S. equities? What is Tokenization? Tokenization refers to the process of converting ownership of an asset, such as stocks, real estate, or artwork, into a digital token on a blockchain. This token represents ownership or a portion of ownership of the underlying asset. In the case of U.S. equities, tokenization means turning traditional company shares into digital tokens that are recorded on a blockchain ledger. Blockchain technology, known for its secure, decentralized nature, allows these digital tokens to be traded, bought, and sold much faster than traditional stock exchanges. A major advantage is that transactions on the blockchain can be conducted without intermediaries, such as brokers or banks, which reduces transaction costs and time delays. Why Tokenize Equities? The primary benefit of tokenizing equities is increased accessibility. Tokenized equities allow investors to buy fractional shares of a stock, which means investors can own parts of high-value stocks for a lower cost. For instance, instead of purchasing an entire share of a company like Amazon, which could cost over $3,000, tokenization allows investors to purchase just a fraction of the stock, reducing the barrier to entry. Additionally, tokenization enables global trading, as blockchain technology works across borders, allowing international investors to purchase U.S. equities without the traditional constraints of currency conversion and international transaction fees. How Tokenization Works The process of tokenizing equities involves several steps that ensure the creation, distribution, and trading of digital tokens representing traditional stocks. Let’s look at these steps in more detail. Creating the Token The first step in tokenizing a stock is the creation of the token itself. This is done by a company or financial institution, which creates a digital token that represents a share or a fraction of a share of a particular company. This token is backed by the real-world asset — in this case, the underlying stock. Blockchain Platform Once the tokens are created, they are stored on a blockchain, which is essentially a digital ledger. Popular blockchains for tokenized equities include Ethereum, Binance Smart Chain, and others that support smart contracts. Smart contracts are self-executing contracts where the terms are directly written into code. These contracts automatically execute the terms when the pre-set conditions are met, which makes token transactions more efficient and secure. Trading Tokens After tokens are created and stored on a blockchain, they can be traded. These tokens can be bought and sold on various digital exchanges, just like regular stocks. However, the key difference is that the exchange is often decentralized, meaning it operates without a central authority controlling the trading process. Settlement The settlement of tokenized equities happens much faster than traditional stock exchanges. For example, in traditional stock markets, it can take up to two business days for a trade to settle (T+2). However, in the case of tokenized equities, the transaction can settle almost instantly due to the nature of blockchain technology, which records each transaction immediately on the ledger. Regulatory Landscape Overview The regulatory environment for tokenized U.S. equities is crucial for ensuring that this new technology works within the legal frameworks designed to protect investors, uphold market integrity, and foster innovation. Understanding these regulations is essential for both companies looking to tokenize their equities and investors interested in participating in this new form of trading. What Are Regulations and Why Do They Matter? Regulations are legal frameworks set by governmental bodies to ensure that markets operate fairly, transparently, and without fraud or manipulation. In the context of tokenized equities, regulations help determine how digital tokens can be issued, traded, and managed. Without clear regulations, tokenized equities could lead to confusion and risks for investors. Key Regulatory Bodies in the U.S. In the United States, there are several important regulatory bodies that oversee the trading of traditional stocks. These same bodies are beginning to extend their oversight to tokenized equities, although some regulatory aspects are still being developed. Securities and Exchange Commission (SEC): The SEC is the primary regulatory body responsible for overseeing securities, including stocks, bonds, and other financial products. The SEC ensures that investors are protected from fraud and manipulati

Introduction to Tokenization

In recent years, the world of finance has seen significant advancements, especially with the introduction of blockchain technology. One of the most exciting developments in this space is the concept of tokenization, particularly the tokenization of U.S. equities (stocks). But what exactly does tokenization mean, and why is it so important for U.S. equities?

What is Tokenization?

Tokenization refers to the process of converting ownership of an asset, such as stocks, real estate, or artwork, into a digital token on a blockchain. This token represents ownership or a portion of ownership of the underlying asset. In the case of U.S. equities, tokenization means turning traditional company shares into digital tokens that are recorded on a blockchain ledger.

Blockchain technology, known for its secure, decentralized nature, allows these digital tokens to be traded, bought, and sold much faster than traditional stock exchanges. A major advantage is that transactions on the blockchain can be conducted without intermediaries, such as brokers or banks, which reduces transaction costs and time delays.

Why Tokenize Equities?

The primary benefit of tokenizing equities is increased accessibility. Tokenized equities allow investors to buy fractional shares of a stock, which means investors can own parts of high-value stocks for a lower cost. For instance, instead of purchasing an entire share of a company like Amazon, which could cost over $3,000, tokenization allows investors to purchase just a fraction of the stock, reducing the barrier to entry.

Additionally, tokenization enables global trading, as blockchain technology works across borders, allowing international investors to purchase U.S. equities without the traditional constraints of currency conversion and international transaction fees.

How Tokenization Works

The process of tokenizing equities involves several steps that ensure the creation, distribution, and trading of digital tokens representing traditional stocks. Let’s look at these steps in more detail.

Creating the Token

The first step in tokenizing a stock is the creation of the token itself. This is done by a company or financial institution, which creates a digital token that represents a share or a fraction of a share of a particular company. This token is backed by the real-world asset — in this case, the underlying stock.

Blockchain Platform

Once the tokens are created, they are stored on a blockchain, which is essentially a digital ledger. Popular blockchains for tokenized equities include Ethereum, Binance Smart Chain, and others that support smart contracts. Smart contracts are self-executing contracts where the terms are directly written into code. These contracts automatically execute the terms when the pre-set conditions are met, which makes token transactions more efficient and secure.

Trading Tokens

After tokens are created and stored on a blockchain, they can be traded. These tokens can be bought and sold on various digital exchanges, just like regular stocks. However, the key difference is that the exchange is often decentralized, meaning it operates without a central authority controlling the trading process.

Settlement

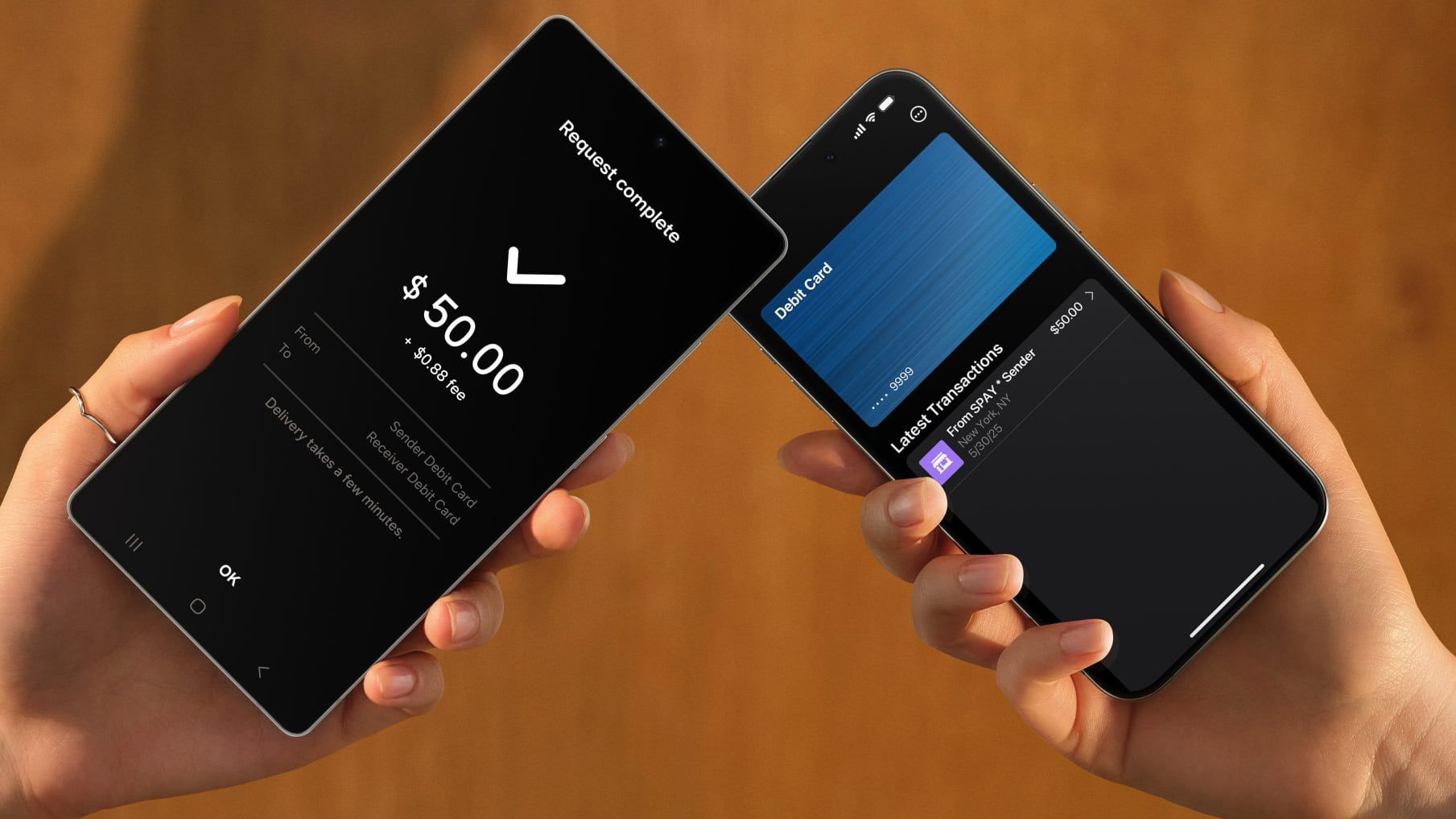

The settlement of tokenized equities happens much faster than traditional stock exchanges. For example, in traditional stock markets, it can take up to two business days for a trade to settle (T+2). However, in the case of tokenized equities, the transaction can settle almost instantly due to the nature of blockchain technology, which records each transaction immediately on the ledger.

Regulatory Landscape Overview

The regulatory environment for tokenized U.S. equities is crucial for ensuring that this new technology works within the legal frameworks designed to protect investors, uphold market integrity, and foster innovation. Understanding these regulations is essential for both companies looking to tokenize their equities and investors interested in participating in this new form of trading.

What Are Regulations and Why Do They Matter?

Regulations are legal frameworks set by governmental bodies to ensure that markets operate fairly, transparently, and without fraud or manipulation. In the context of tokenized equities, regulations help determine how digital tokens can be issued, traded, and managed. Without clear regulations, tokenized equities could lead to confusion and risks for investors.

Key Regulatory Bodies in the U.S.

In the United States, there are several important regulatory bodies that oversee the trading of traditional stocks. These same bodies are beginning to extend their oversight to tokenized equities, although some regulatory aspects are still being developed.

Securities and Exchange Commission (SEC): The SEC is the primary regulatory body responsible for overseeing securities, including stocks, bonds, and other financial products. The SEC ensures that investors are protected from fraud and manipulation and that markets operate efficiently and transparently.

FINRA (Financial Industry Regulatory Authority): FINRA is a non-governmental organization that regulates broker-dealers in the U.S. It ensures that those who facilitate the trading of financial products, such as tokenized equities, adhere to proper standards and practices.

CFTC (Commodity Futures Trading Commission): The CFTC oversees markets related to commodities and derivatives. While its main focus is not equities, it could play a role in regulating certain types of tokenized products, particularly those tied to commodities or futures.

Securities and Exchange Commission (SEC)

The SEC is the most important regulatory body when it comes to overseeing the regulation of tokenized equities. The SEC’s mission is to protect investors, maintain fair and efficient markets, and facilitate capital formation.

SEC’s Role in Regulating Tokenized Equities

The SEC regulates tokenized equities in much the same way it regulates traditional securities. This means that companies looking to tokenize their shares must ensure that their tokenized stocks comply with SEC rules. These rules include registering the tokens, providing regular reports to investors, and ensuring that the tokens meet the requirements of U.S. securities laws.

The Howey Test

One important tool the SEC uses to determine whether a particular asset is considered a security is the Howey Test. This test, established in the 1946 U.S. Supreme Court case SEC v. W.J. Howey Co., determines whether an investment is a security based on four criteria:

- An investment of money.

- In a common enterprise.

- With an expectation of profits.

- Derived from the efforts of others.

If a tokenized equity passes the Howey Test, it will be considered a security and must comply with SEC regulations. This means that tokenized equities must meet the same standards as traditional stocks in terms of transparency and investor protection.

Challenges in Complying with SEC Regulations

The challenge for companies that want to tokenize their equities lies in the fact that the regulatory framework for tokenized assets is still evolving. Many aspects of tokenization, such as the use of blockchain technology and smart contracts, are not fully understood by regulators. This creates some uncertainty for companies looking to ensure compliance.

Other Regulatory Bodies

In addition to the SEC, other regulatory bodies also play an important role in overseeing tokenized equities.

FINRA (Financial Industry Regulatory Authority)

FINRA regulates the brokers and dealers who facilitate trading in tokenized equities. It ensures that these market participants operate fairly and adhere to legal standards. FINRA’s role is crucial in maintaining the integrity of the market and protecting investors.

CFTC (Commodity Futures Trading Commission)

The CFTC, while primarily concerned with commodities and futures contracts, could become involved in the regulation of tokenized equities, particularly if tokenized products are bundled with derivative contracts such as options or futures.

State vs. Federal Regulations

In addition to federal regulations, individual states in the U.S. may have their own laws that govern the sale and trading of tokenized assets. These state-level regulations add another layer of complexity for companies and investors, as they must navigate both state and federal legal requirements.

Legal Challenges in Tokenized Equities

Tokenized equities are still a relatively new concept, and there are several legal challenges that need to be addressed for this market to grow.

Grey Areas in Current Regulations

Despite the SEC’s guidance, there are still many grey areas in the regulation of tokenized equities. For example, while the Howey Test helps determine if an asset is a security, blockchain-based tokens often have unique characteristics that traditional securities do not. This has created ambiguity in how tokenized equities should be classified and regulated.

Security Tokens vs. Utility Tokens

Another challenge is distinguishing between security tokens and utility tokens. Security tokens represent ownership of an asset and are subject to securities regulations, while utility tokens are used to access a service or platform and are not classified as securities. Tokenized equities clearly fall under the category of security tokens, but this distinction may not always be clear to regulators.

New Laws and Regulations

As the market for tokenized equities grows, new laws and regulations may be introduced to address these challenges. These could help clarify the legal status of tokenized equities, making it easier for companies to tokenize their stocks and for investors to participate in the market.

Opportunities for Tokenized U.S. Equities

Despite the regulatory challenges, there are several opportunities presented by tokenized equities.

Increased Liquidity

One of the major advantages of tokenizing equities is increased liquidity. By allowing investors to buy fractional shares of stocks, tokenization opens up the market to a larger pool of investors. Smaller investors can participate in stock markets that were previously out of reach due to the high cost of individual shares.

Lower Costs

Tokenized equities can also lower transaction costs. By removing intermediaries like brokers and banks, the cost of trading stocks decreases. Blockchain technology allows for peer-to-peer trading, eliminating fees typically associated with traditional stock exchanges.

Cross-Border Investment

Tokenized equities have the potential to enable cross-border investments. Blockchain technology works globally, making it easier for international investors to buy U.S. equities without worrying about currency conversions or high fees.

Conclusion

The tokenization of U.S. equities represents an exciting and transformative shift in the world of finance. While regulatory hurdles remain, the opportunities that tokenization presents for increased accessibility, liquidity, and efficiency are undeniable. As the regulatory landscape continues to evolve, tokenized equities have the potential to reshape the investment landscape, making it more inclusive and innovative than ever before.

![[The AI Show Episode 146]: Rise of “AI-First” Companies, AI Job Disruption, GPT-4o Update Gets Rolled Back, How Big Consulting Firms Use AI, and Meta AI App](https://www.marketingaiinstitute.com/hubfs/ep%20146%20cover.png)

.jpg?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

_Alexey_Kotelnikov_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

_Brian_Jackson_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

Stolen 884,000 Credit Card Details on 13 Million Clicks from Users Worldwide.webp?#)

![Roku clarifies how ‘Pause Ads’ work amid issues with some HDR content [U]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2025/05/roku-pause-ad-1.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Look at this Chrome Dino figure and its adorable tiny boombox [Gallery]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2025/05/chrome-dino-youtube-boombox-1.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Apple Seeds visionOS 2.5 RC to Developers [Download]](https://www.iclarified.com/images/news/97240/97240/97240-640.jpg)

![Apple Seeds tvOS 18.5 RC to Developers [Download]](https://www.iclarified.com/images/news/97243/97243/97243-640.jpg)