Understanding Blockchain Transaction Fees: An In-Depth Exploration

Abstract: This post explores blockchain transaction fees in detail. We discuss their significance in decentralized networks, present historical background and deep dive into core concepts like fee volatility, miner incentives, and adaptive fee algorithms. We also share practical strategies for users, real-world use cases, technical challenges, and emerging trends. Using tables, bullet lists, and clear technical explanations, the post offers an accessible yet expert view on how fees impact blockchain networks like Bitcoin, Ethereum, Cardano, Solana, and more. Introduction Blockchain technology has revolutionized finance and technology worldwide. With assets such as Bitcoin and Ethereum leading the transformation, understanding how blockchain transaction fees work is key to ensuring network security and efficiency. Transaction fees, by design, incentivize network participants and act as a guard against spam. In this post, we expand on the article "Understanding Blockchain Transaction Fees: A Comprehensive Analysis" and add semantically enriched insights that explore definitions, mechanisms, challenges, and innovation trends shaping the future of these fees. Background and Context Blockchain Basics: At its core, a blockchain is a decentralized ledger maintained by a network of nodes or miners who validate transactions. Early in its history, Bitcoin introduced the concept of transaction fees to both reward miners for solving complex cryptographic puzzles and to prioritize faster transaction confirmations when network congestion is high. Defining Transaction Fees: Transaction fees refer to the small amounts of cryptocurrency paid by users to have their transactions verified. Beyond the explicit costs, fees play a vital role in: Incentivizing miners: They supplement block rewards, ensuring network robustness. Preventing network spam: They impose a cost on every transaction, discouraging trivial or malicious transactions. The evolution of fee structures, from Bitcoin’s simple bid mechanism to Ethereum’s sophisticated “gas” model, shows that blockchain documentation and research remain dynamic areas. More details on blockchain fundamentals can be found in the guide What is Blockchain. Historical Evolution: Bitcoin Era: Initially, fees were minimal. Over time, increased network activity led to dynamic fee bidding where users must offer competitive fees during congestion. Ethereum’s Gas System: Introduced to measure computational work. The Ethereum gas documentation explains how fees are structured and how protocol updates like EIP-1559 have created a dual-fee mechanism (a base fee plus miner tips). Core Concepts and Features 1. Role and Mechanism Miner Incentives: Miners spend significant computational power validating transactions. Fees serve as additional rewards beyond block subsidies. For instance, blockchain mining relies on fees to encourage continued network participation even when block rewards decline. Spam Prevention: By attaching a cost to each transaction, blockchain networks deter attackers from overwhelming the system with fake or trivial processes. Adaptive Fee Algorithms: Many networks use adaptive algorithms. These adjust fees automatically depending on network congestion. As usage spikes, so do transactions’ fees—a dynamic equilibrium that helps maintain security and efficiency. 2. Variations Across Networks Different blockchains have unique fee mechanisms based on their architecture: Network Fee Structure Notable Characteristics Bitcoin Variable fees often determined by bid amounts and transaction size. Highly dependent on network congestion and bid competition. Ethereum Uses "gas" to measure computational effort. Fees include a base fee (adjusted dynamically) plus optional miner tip. Recent updates (EIP-1559) provide fee burn and improved predictability. Cardano Relatively low fees designed to scale with the network’s usage patterns. Emphasizes sustainability and decentralization. Solana Minimal fees with emphasis on high throughput. Optimized for speed and large-scale applications. Binance Smart Chain Lower fees compared to Ethereum, using similar structures but with different consensus mechanisms. Positions itself competitively with cost efficiency, although decentralization varies. Note: Many other networks like Polkadot and Avalanche are also testing innovative fee models and interoperability methods (Blockchain Interoperability). 3. Strategies for Managing Fees Users need to apply simple strategies to maximize value. Key strategies include: Optimal Transaction Timing: By monitoring real-time analytics, users can submit transactions during less congested periods. Fee Bidding and Customization: Some networks allow users to adjust fee bids balancing speed and cost. Layer 2 Solutions: Technologies like the Lightning Network integrate off-chain transactions that reduce fees and i

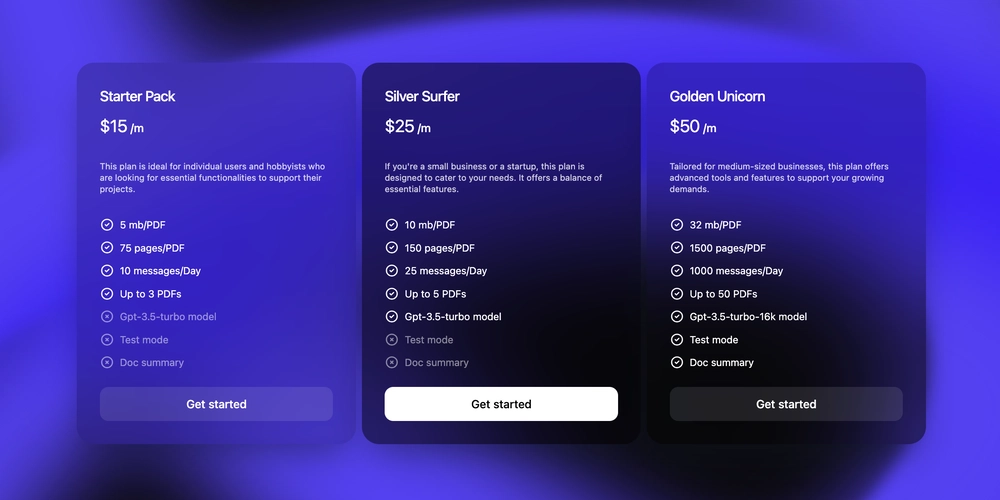

Abstract:

This post explores blockchain transaction fees in detail. We discuss their significance in decentralized networks, present historical background and deep dive into core concepts like fee volatility, miner incentives, and adaptive fee algorithms. We also share practical strategies for users, real-world use cases, technical challenges, and emerging trends. Using tables, bullet lists, and clear technical explanations, the post offers an accessible yet expert view on how fees impact blockchain networks like Bitcoin, Ethereum, Cardano, Solana, and more.

Introduction

Blockchain technology has revolutionized finance and technology worldwide. With assets such as Bitcoin and Ethereum leading the transformation, understanding how blockchain transaction fees work is key to ensuring network security and efficiency. Transaction fees, by design, incentivize network participants and act as a guard against spam. In this post, we expand on the article "Understanding Blockchain Transaction Fees: A Comprehensive Analysis" and add semantically enriched insights that explore definitions, mechanisms, challenges, and innovation trends shaping the future of these fees.

Background and Context

Blockchain Basics:

At its core, a blockchain is a decentralized ledger maintained by a network of nodes or miners who validate transactions. Early in its history, Bitcoin introduced the concept of transaction fees to both reward miners for solving complex cryptographic puzzles and to prioritize faster transaction confirmations when network congestion is high.

Defining Transaction Fees:

Transaction fees refer to the small amounts of cryptocurrency paid by users to have their transactions verified. Beyond the explicit costs, fees play a vital role in:

- Incentivizing miners: They supplement block rewards, ensuring network robustness.

- Preventing network spam: They impose a cost on every transaction, discouraging trivial or malicious transactions.

The evolution of fee structures, from Bitcoin’s simple bid mechanism to Ethereum’s sophisticated “gas” model, shows that blockchain documentation and research remain dynamic areas. More details on blockchain fundamentals can be found in the guide What is Blockchain.

Historical Evolution:

- Bitcoin Era: Initially, fees were minimal. Over time, increased network activity led to dynamic fee bidding where users must offer competitive fees during congestion.

- Ethereum’s Gas System: Introduced to measure computational work. The Ethereum gas documentation explains how fees are structured and how protocol updates like EIP-1559 have created a dual-fee mechanism (a base fee plus miner tips).

Core Concepts and Features

1. Role and Mechanism

Miner Incentives:

Miners spend significant computational power validating transactions. Fees serve as additional rewards beyond block subsidies. For instance, blockchain mining relies on fees to encourage continued network participation even when block rewards decline.Spam Prevention:

By attaching a cost to each transaction, blockchain networks deter attackers from overwhelming the system with fake or trivial processes.Adaptive Fee Algorithms:

Many networks use adaptive algorithms. These adjust fees automatically depending on network congestion. As usage spikes, so do transactions’ fees—a dynamic equilibrium that helps maintain security and efficiency.

2. Variations Across Networks

Different blockchains have unique fee mechanisms based on their architecture:

| Network | Fee Structure | Notable Characteristics |

|---|---|---|

| Bitcoin | Variable fees often determined by bid amounts and transaction size. | Highly dependent on network congestion and bid competition. |

| Ethereum | Uses "gas" to measure computational effort. Fees include a base fee (adjusted dynamically) plus optional miner tip. | Recent updates (EIP-1559) provide fee burn and improved predictability. |

| Cardano | Relatively low fees designed to scale with the network’s usage patterns. | Emphasizes sustainability and decentralization. |

| Solana | Minimal fees with emphasis on high throughput. | Optimized for speed and large-scale applications. |

| Binance Smart Chain | Lower fees compared to Ethereum, using similar structures but with different consensus mechanisms. | Positions itself competitively with cost efficiency, although decentralization varies. |

Note: Many other networks like Polkadot and Avalanche are also testing innovative fee models and interoperability methods (Blockchain Interoperability).

3. Strategies for Managing Fees

Users need to apply simple strategies to maximize value. Key strategies include:

Optimal Transaction Timing:

By monitoring real-time analytics, users can submit transactions during less congested periods.Fee Bidding and Customization:

Some networks allow users to adjust fee bids balancing speed and cost.Layer 2 Solutions:

Technologies like the Lightning Network integrate off-chain transactions that reduce fees and increase speed.Alternate Networks:

Switching to platforms with inherently lower fee structures (e.g., Solana or Binance Smart Chain) might be more cost-effective.

A bullet list summarizing these management techniques:

- Monitor fee charts: Use tools to find low-congestion periods.

- Adjust fees: Tailor your bid to balance speed and economics.

- Layer 2 adoption: Utilize scaling solutions for lower fees.

- Look for alternatives: Consider alternative networks as needed.

Applications and Use Cases

Blockchain transaction fees influence a variety of practical applications:

Use Case 1: Decentralized Finance (DeFi)

In DeFi projects, fee mechanisms are crucial for:

- Liquidity Pools: Users deposit funds to earn rewards. Lower transaction fees enhance user participation.

- Automated Market Makers (AMMs): Fast and inexpensive transactions ensure efficient trading pairs. Platforms built on Ethereum carefully manage gas fees to support smooth operations.

Use Case 2: NFT Marketplaces

NFT platforms rely on the cost efficiency of underlying blockchain networks:

- Minting NFTs: High fees can deter artists during peak times. Networks like Solana and Binance NFT Marketplaces offer attractive low-fee alternatives.

- Secondary Sales: Smart contracts governing royalties and resale fees must consider base fee volatility.

Use Case 3: Cross-Chain Interoperability

As blockchain projects strive for interconnected ecosystems:

- Interoperability Solutions: Projects such as Arbitrum focus on minimizing fees while ensuring compatibility between multiple blockchains, enhancing user experience and broadening adoption.

For more innovative studies, you might check out related posts on Dev.to such as Understanding Arbitrum Gas Fees: A Comprehensive Guide and The Power of Sponsorship in Open Source Projects.

Challenges and Limitations

Despite technological advancements, there remain challenges and limitations:

Fee Volatility

Network Congestion:

During peak activities, fees can spike unpredictably. This volatility can make budgeting for transactions problematic.Limited Block Capacity:

Networks that restrict block size may see rapid surges in demand, pushing fees higher.

Technical and Adoption Challenges

Adaptive Fee Algorithms:

Though these algorithms aim to create balance, sudden changes or market speculation can lead to unexpected fee spikes.Protocol Changes:

Frequent updates (e.g., Ethereum’s transition to proof-of-stake via Ethereum 2.0) introduce uncertainties. While intended to stabilize fees, the transition period may suffer from unforeseen issues.User Education:

Many users still struggle to understand fee mechanisms fully, complicating their ability to optimize costs. Initiatives that educate users on effective fee management can mitigate this.

Technical Infrastructure:

Below is a bullet list summarizing key challenges:

- Fee volatility due to network congestion.

- Limited block capacity leading to spikes.

- User education gaps and interface complexity.

- Frequent protocol changes that require adaptation.

Security Concerns

- Miners and Validators: The fee structure must maintain a balance between incentivizing miners and not overly burdening users.

- Spam and Fraud Detection: Low fees might allow spam transactions, while excessive fees can even encourage fraudulent fee manipulation techniques.

Future Outlook and Innovations

The blockchain ecosystem continues to innovate in various ways, promising to mitigate current challenges and open new horizons:

Layer 2 and Layer 3 Solutions

Layer 2 Adoption:

Continued advancements in sidechains and off-chain transaction methods, like the Lightning Network, will likely play a key role in reducing fees and increasing transaction speeds.Emergence of Layer 3:

Projects are exploring additional protocol layers focused solely on improving user experience and further optimizing fee structures.

Protocol Enhancements and Upgrades

Modern fee algorithms, such as those implemented post-EIP-1559 in Ethereum, show promising signs in fee stability. Future upgrades might include:

- Dynamic Fee Markets: Mechanisms that automatically adjust parameters can further stabilize fees during unexpected surges.

- Refined Governance Models: Community-driven models, as seen in some Arbitrum governance proposals, could better manage fee structures based on collective insights and market signals.

Blockchain Interoperability and Multi-Chain Support

As interoperability crawls to the forefront, networks will be increasingly connected, enabling fee optimization across chains:

- Cross-Chain Transactions: Emerging projects are devising methods for seamless asset transfers at minimal fees, leveraging the strengths of each blockchain.

- Multi-Chain Ecosystems: These ecosystems enable a choice between networks, fostering fee competition that could drive average fees down. More on this can be found in discussions about blockchain consensus mechanisms.

For further reading on cutting-edge developments, consult related perspectives on platforms like Dev.to. For instance, Exploring the Arbitrum DAO: A New Era of Decentralized Governance offers insightful parallels into decentralized protocol upgrades.

Sustainable and Environment-Friendly Practices

The interplay between fee structures and sustainability is increasingly significant:

Eco-Friendly Upgrades:

As blockchain networks shift toward environmentally sustainable practices, fee models may need to account for energy consumption. Projects like Sustainable Blockchain Practices provide insights into aligning economic incentives with environmental targets.Regulatory Adaptations:

Future regulatory clarity may encourage models that balance user cost, miner rewards, and sustainability—ensuring that blockchain remains a responsible technology choice.

Summary

Blockchain transaction fees are much more than a cost for sending cryptocurrencies. They are the lifeblood that maintains miner incentives, prevents spam, and ensures rigorous network security. In this post, we have explored:

- Background & Context: Understanding the history, definitions, and initial motivations behind fee structures.

- Core Concepts & Features: The mechanism behind fee dynamics, variations across platforms like Bitcoin, Ethereum, Cardano, and Solana, and strategies for fee management.

- Real-World Applications & Challenges: Practical use cases in DeFi, NFT marketplaces, and interoperability, alongside challenges like fee volatility, network congestion, and user education barriers.

- Future Outlook: How innovations—including Layer 2 solutions, dynamic fee algorithms, and sustainable practices—are shaping tomorrow’s fee models.

Overall, as blockchain evolves, transaction fees will remain central to its development. By understanding these dynamics—supported by ongoing innovations and community governance—users and developers alike can navigate the ecosystem with greater confidence.

For additional insights on blockchain fee structures and related topics, check out these authoritative resources and related posts:

- Understanding Blockchain Transaction Fees (Original Article)

- Ethereum Gas System Documentation

- Bitcoin Fees Analytics

- Unveiling the Haiku License: A New Chapter in Fair Code Innovation

- The Power of Sponsorship in Open Source Projects

By staying informed and leveraging best practices, the blockchain community can continue refining fee structures to support robust, secure, and scalable decentralized networks.

Embracing the challenges and opportunities inherent in blockchain transaction fees will be key to unlocking future innovation and ensuring sustenance in the ever-evolving digital finance landscape.

![[The AI Show Episode 145]: OpenAI Releases o3 and o4-mini, AI Is Causing “Quiet Layoffs,” Executive Order on Youth AI Education & GPT-4o’s Controversial Update](https://www.marketingaiinstitute.com/hubfs/ep%20145%20cover.png)

![[DEALS] Mail Backup X Individual Edition: Lifetime Subscription (72% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![Google reveals NotebookLM app for Android & iPhone, coming at I/O 2025 [Gallery]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2025/05/NotebookLM-Android-iPhone-6-cover.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Apple Reports Q2 FY25 Earnings: $95.4 Billion in Revenue, $24.8 Billion in Net Income [Chart]](https://www.iclarified.com/images/news/97188/97188/97188-640.jpg)