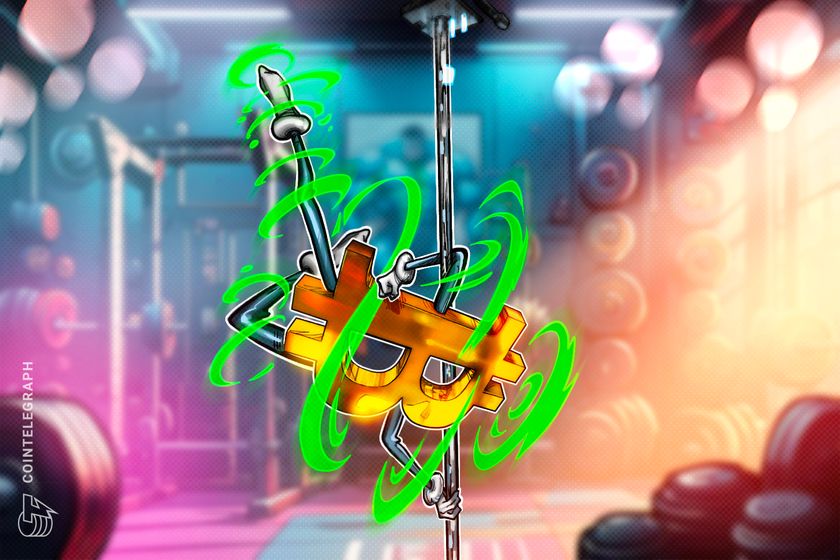

Tether raises Juventus stake above 10%

Tether Investments S.A. de C.V.—the investment arm of the crypto firm—now holds a 6.18% voting stake in Juventus. Tether initially acquired an 8.2% stake in the Italian football giant in February. The stablecoin giant, which posted a $13 billion profit last year, has been deploying capital across a range of sectors. Tether, the issuer of […] The post Tether raises Juventus stake above 10% appeared first on CoinJournal.

- Tether Investments S.A. de C.V.—the investment arm of the crypto firm—now holds a 6.18% voting stake in Juventus.

- Tether initially acquired an 8.2% stake in the Italian football giant in February.

- The stablecoin giant, which posted a $13 billion profit last year, has been deploying capital across a range of sectors.

Tether, the issuer of the world’s largest stablecoin, has expanded its stake in Juventus Football Club to more than 10%, deepening its involvement with one of Europe’s most storied football institutions.

The move underscores Tether’s broader investment strategy that spans digital assets, media, and now, elite sports.

Tether Investments S.A. de C.V.—the investment arm of the crypto firm—now holds a 6.18% voting stake in Juventus, giving it a combined equity interest exceeding 10%.

Tether initially acquired an 8.2% stake in the Italian football giant in February.

Juventus, founded in 1897 and with 36 Italian league titles to its name, remains a powerhouse in both Italian and European football.

The club’s ownership structure now includes Tether as a key shareholder, placing it in a position to influence strategic direction.

Tether CEO Paolo Ardoino framed the investment as a long-term strategic partnership rather than a simple capital deployment.

“We believe Juventus is uniquely positioned to lead both on the field and in embracing technology that can elevate fan engagement, digital experiences, and financial resilience.”

The company also expressed willingness to participate in future capital infusions to preserve and enhance its ownership position.

Tether’s broader investment activity

The Juventus deal is part of a broader wave of investments by Tether.

The stablecoin giant, which posted a $13 billion profit last year, has been deploying capital across a range of sectors, including artificial intelligence, bitcoin mining, and agriculture.

The firm recently partnered with SoftBank, Bitfinex, and Cantor Fitzgerald’s Brandon Lutnick to form a $3 billion crypto acquisition vehicle.

It has also ramped up its presence in Bitcoin mining, deploying hashrate to Ocean’s mining pool and purchasing 8,888 BTC in the first quarter of 2025.

Tether’s Bitcoin holdings now stand at 95,721 BTC, worth roughly $8.89 billion, according to Arkham Intelligence.

Beyond crypto, Tether is making moves in media and digital content. It recently invested €10 million in Italian media firm Be Water and injected $775 million into Canadian video platform Rumble, which has since integrated Tether’s USDT wallet support.

While some analysts point to Tether’s recent investment spree as a hedge against US dollar weakness amid global macroeconomic shifts and rising protectionism, others see it as a calculated bid to secure influence across decentralized finance, infrastructure, and consumer engagement platforms.

The post Tether raises Juventus stake above 10% appeared first on CoinJournal.

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

![[DEALS] Sterling Stock Picker: Lifetime Subscription (85% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

.jpg?#)

_NicoElNino_Alamy.png?width=1280&auto=webp&quality=80&disable=upscale#)

![Apple Shares New Ad for iPhone 16: 'Trust Issues' [Video]](https://www.iclarified.com/images/news/97125/97125/97125-640.jpg)

![At Least Three iPhone 17 Models to Feature 12GB RAM [Kuo]](https://www.iclarified.com/images/news/97122/97122/97122-640.jpg)