How KrishiFin Is Making Village Farmers Credit-Ready in 10 Minutes

KrishiFin is a tech-driven agri-fintech platform simplifying rural credit for small farmers, transforming Bharat’s agricultural economy.

In India's vast agricultural landscape, small and marginal farmers—who constitute over 85% of the farming community—often grapple with limited access to formal credit. This financial exclusion hampers their ability to invest in quality inputs, adopt modern technologies, and enhance productivity. Bridging this credit gap is KrishiFin, a Nagpur-based agri-fintech platform launched in November 2023, aiming to revolutionize rural lending through technology-driven solutions.

Empowering 'Bharat' Through Digital Credit Infrastructure

KrishiFin, developed by Finasyst, is an award-winning next-generation credit infrastructure tech stack tailored to agri and rural lending. It serves as a one-stop solution for farmers, agri enterprises, and financial institutions, facilitating seamless credit access in rural and semi-urban India.

The platform's mission is to empower farmers, agri, and rural enterprises with access to formal credit, thereby driving financial prosperity for 'Bharat'—a term often used to represent rural India. KrishiFin's vision aligns with the broader goal of fostering inclusive financial ecosystems, enabling individuals and businesses across rural and semi-urban regions to thrive.

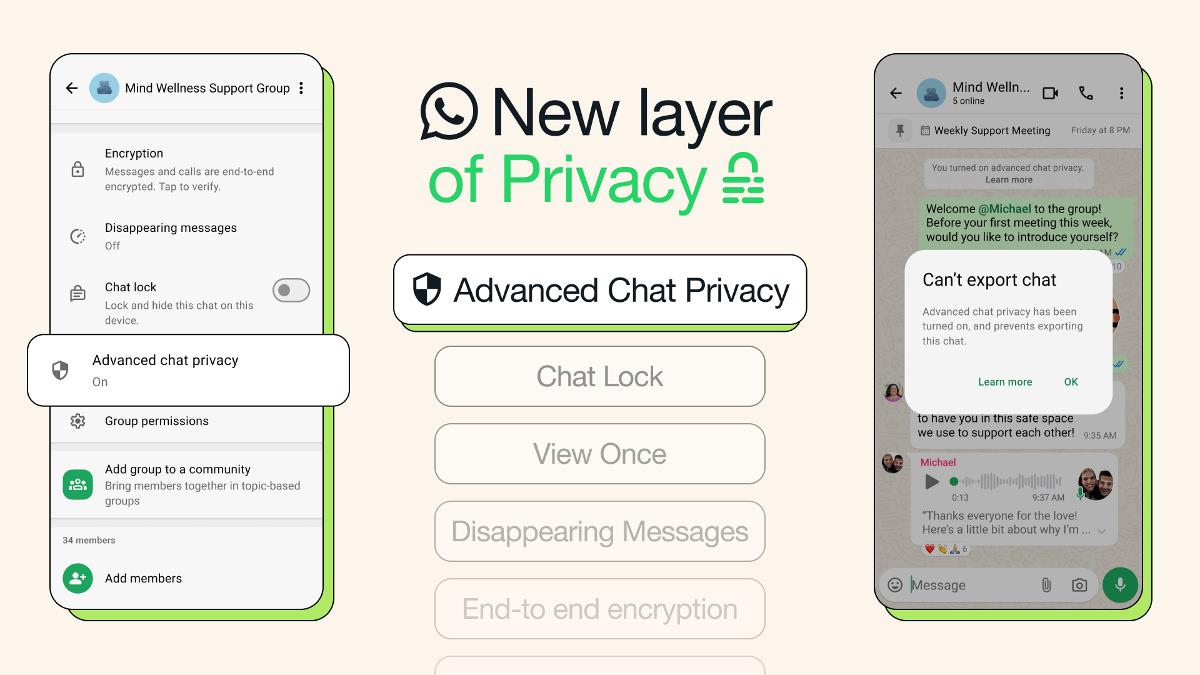

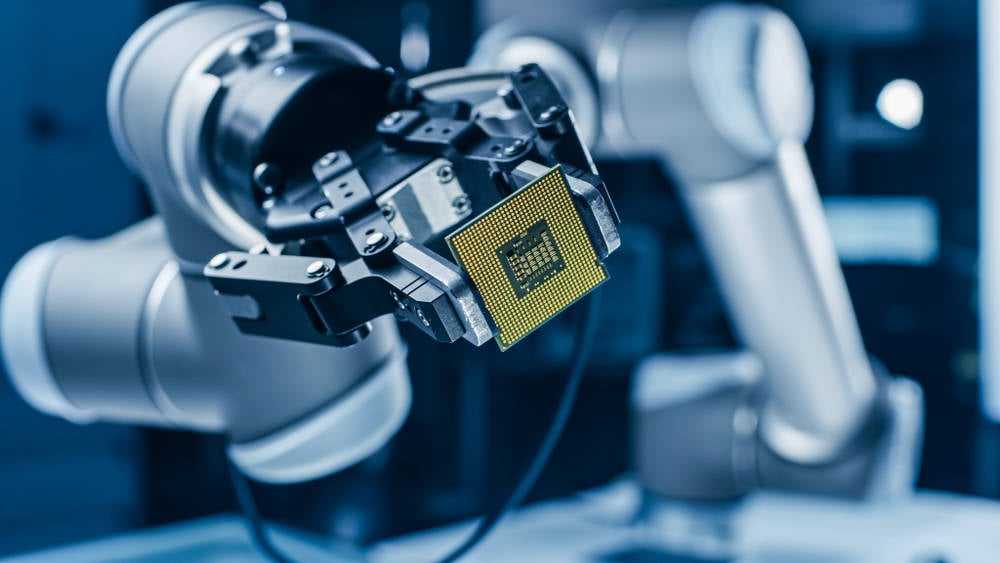

Innovative Technology for Seamless Credit Access

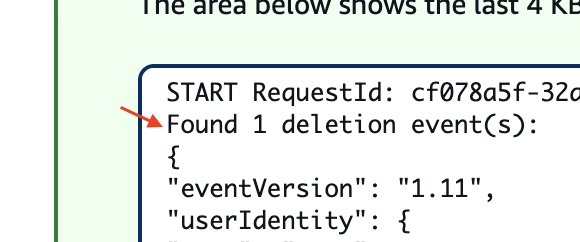

KrishiFin's platform is designed with cutting-edge technology and a deep understanding of sectoral and local dynamics. Its API-ready, cloud-based, no-code, plug-and-play model ensures easy and uncomplicated integration for partners. The platform boasts lightning-fast algorithms for seamless processing and is adaptable and customizable to meet diverse needs.

Key modules and unique selling propositions include agri and rural lending credit facilitation platforms, proprietary APIs, agri and rural credit assessment-specific business rule engines (BRE) and assessment reports, credit product and lender match engines, and various other agri and rural credit modules.

Strategic Partnerships and Market Operations

Since commencing market operations in November 2023, KrishiFin has onboarded multiple lending partners and forged partnerships with various agri and rural enterprises to enable credit access for their user base . The platform's innovative tech stack and strategic go-to-market approach have diversified its business across multiple segments, fostering a robust array of revenue streams.

KrishiFin's leadership team brings deep experience in agriculture, technology, financial services, and infrastructure sectors. Co-founder and CEO Vikrant Bawane, with over 16 years in agri and rural financing, and Co-founder and Managing Director Sanjog Bawane, with 22 years in transaction advisory, lead the company with a vision to transform rural credit access.

Addressing the Rural Credit Challenge

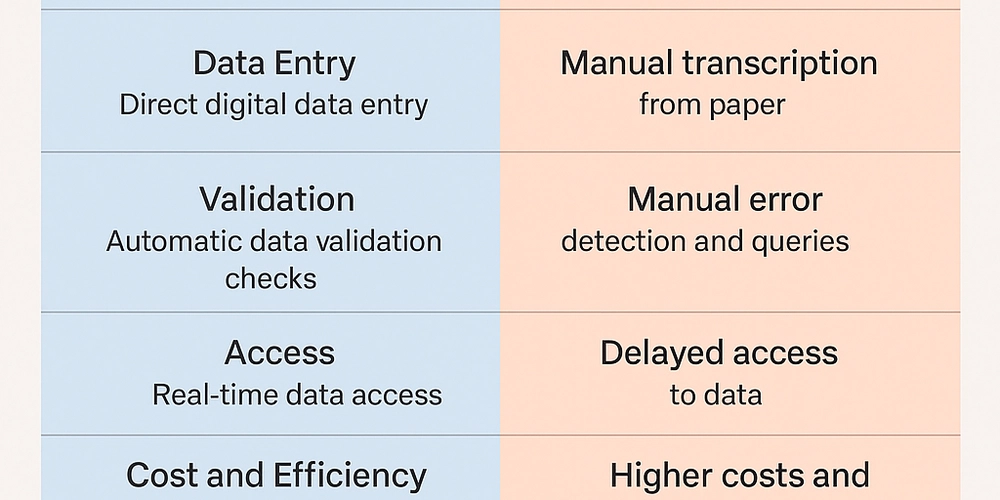

Access to credit remains a significant challenge for small and marginal farmers in India. Traditional lending practices often fall short in meeting the unique needs of the agriculture sector, which is inherently seasonal with delayed or reduced returns. Innovative financial solutions, like those offered by KrishiFin, are necessary—ones that are flexible and tailored to the specific needs of farmers.

By leveraging technology and a deeper use of data, agri-fintech startups are expanding their lending services to small farmers despite the risks involved, helping boost agriculture-sector loans to record levels . KrishiFin's approach aligns with this trend, offering a comprehensive digital solution to bridge the credit gap in rural India.

The Road Ahead

As India continues to digitize its agricultural sector, platforms like KrishiFin play a crucial role in transforming the rural credit landscape. By providing a seamless, technology-driven solution for credit access, KrishiFin empowers small and marginal farmers to invest in their livelihoods, adopt modern agricultural practices, and contribute to the nation's food security.

With its innovative approach and commitment to financial inclusion, KrishiFin stands as a beacon of hope for rural India, bridging the credit gap and paving the way for a more prosperous and equitable agricultural economy.

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

![[DEALS] Sterling Stock Picker: Lifetime Subscription (85% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

.jpg?#)

_NicoElNino_Alamy.png?width=1280&auto=webp&quality=80&disable=upscale#)

![Apple Shares New Ad for iPhone 16: 'Trust Issues' [Video]](https://www.iclarified.com/images/news/97125/97125/97125-640.jpg)

![At Least Three iPhone 17 Models to Feature 12GB RAM [Kuo]](https://www.iclarified.com/images/news/97122/97122/97122-640.jpg)