New York-based BAT VC to invest $100 million in Indian AI startups

BAT VC will invest in AI and deeptech startups in India from the segments like fintech, B2B SaaS BAT VC, a New York-based early stage venture capital firm has announced plans to invest up to $100 million through its second fund in Indian AI & deeptech startups in segments such as fintech and B2B

BAT VC, a New York-based early-stage venture capital firm, has announced plans to invest up to $100 million through its second fund in Indian AI and deeptech startups operating in segments such as fintech and B2B SaaS.

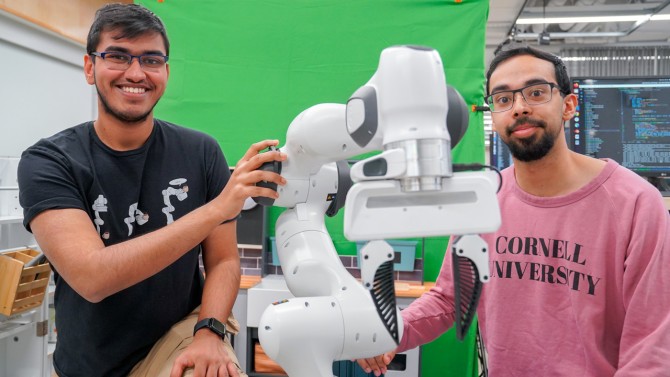

According to a statement, the new India-focused initiative will be led by three general partners of BAT VC—one of them being former India head of Twitter, Manish Maheshwari. The other two members are Aditya Mishra and Ravi Metta.

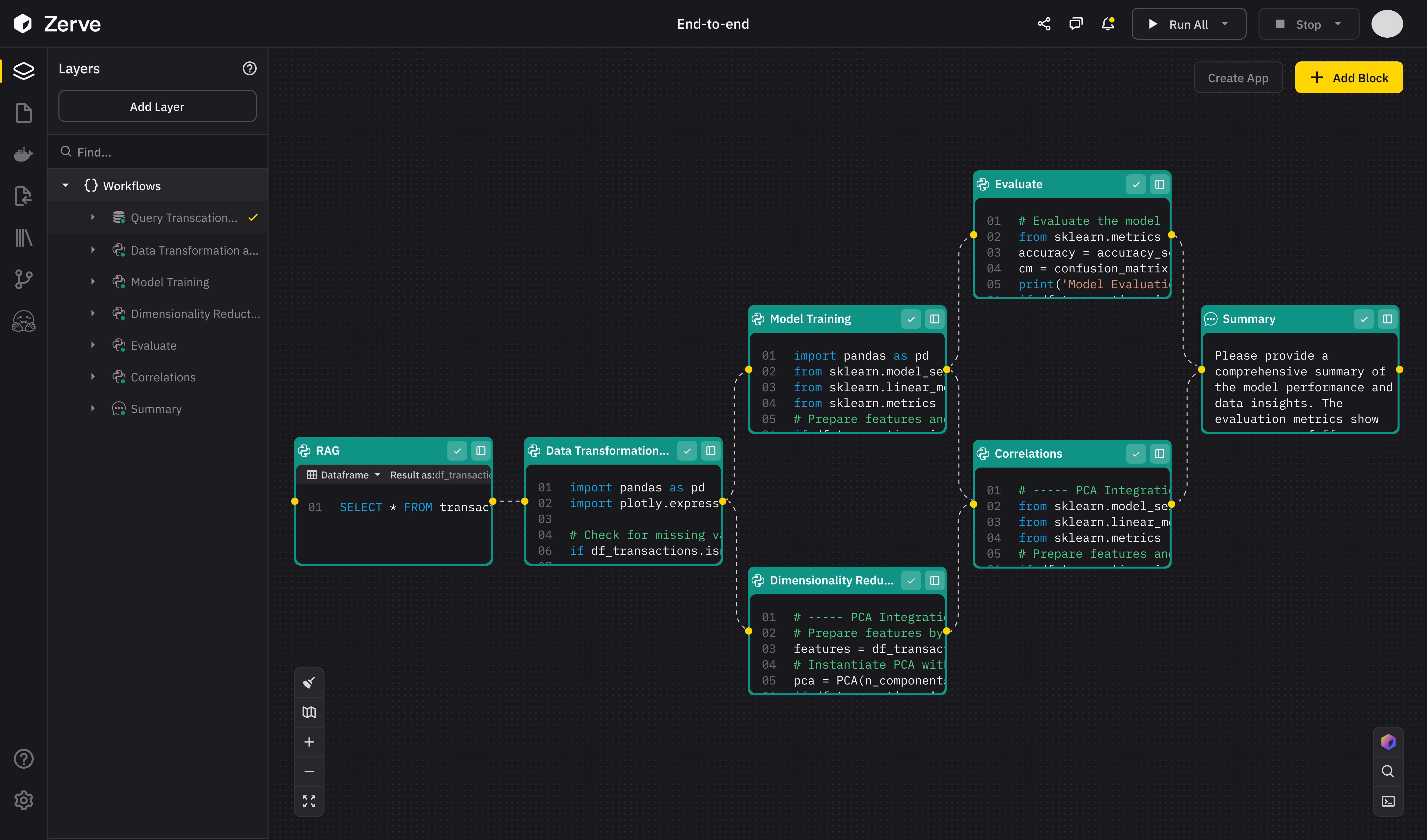

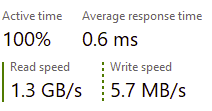

According to BAT VC, the AI sector in India is entering a “golden era,” growing 32% annually and projected to reach $23 billion by 2027. The enterprise SaaS market has touched $8.7 billion, growing at 35% CAGR, which is twice the global average. BAT VC General Partners (from left): Manish Maheshwari, Ravi Metta and Aditya Mishra

The VC firm also mentioned that the US-India cross-border AI investments grew 180% to $4.7 billion in 2023 given the talent, capital and market access, making it a compelling investment landscape.

"My move to Bengaluru underscores our conviction in India's potential to lead the next wave of AI-driven global growth," said Manish Maheshwari, General Partner and India Head at BAT VC.

BAT VC has invested in startups such as Wand AI, StockGro, Nickelytics, Accern, and Uptiq AI.

"We aim to back Indian founders building globally relevant AI products, supported by capital and perspective from both the US and India," said Aditya Mishra, Managing Director and General Partner, BAT VC.

The VC firm claimed that it has garnered substantial interest from institutional investors and family offices in both the US and India. Fund II reflects its belief that India is no longer a frontier, but a core allocation for forward-looking global LPs.

“Our technical depth enables us to identify high-impact AI startups early and guide them through global scale-up," said Ravi Metta, General Partner, BAT VC.

Edited by Kanishk Singh

![[The AI Show Episode 147]: OpenAI Abandons For-Profit Plan, AI College Cheating Epidemic, Apple Says AI Will Replace Search Engines & HubSpot’s AI-First Scorecard](https://www.marketingaiinstitute.com/hubfs/ep%20147%20cover.png)

_Gang_Liu_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

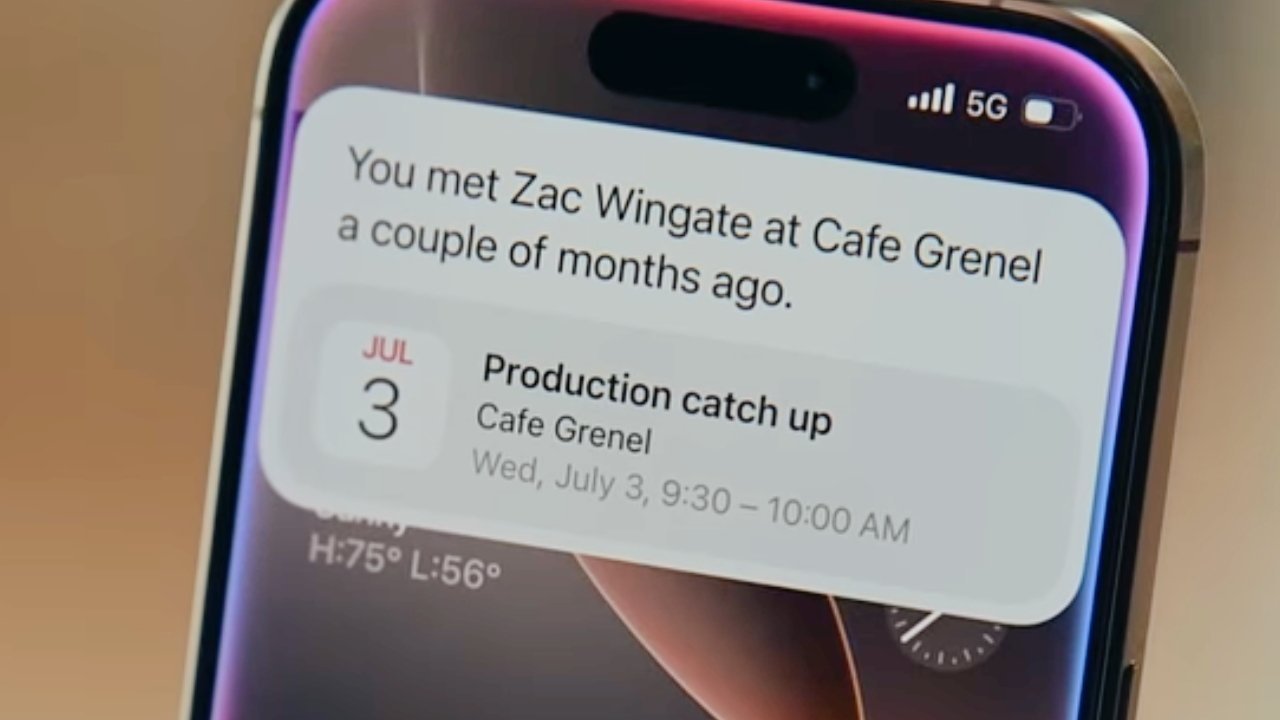

![Apple's 20th Anniversary iPhone May Feature Bezel-Free Display, AI Memory, Silicon Anode Battery [Report]](https://www.iclarified.com/images/news/97323/97323/97323-640.jpg)

![Apple Planning Bezel-Free iPhone With 'Four-Sided Bending' Display [Report]](https://www.iclarified.com/images/news/97321/97321/97321-640.jpg)