New bull cycle? Bitcoin's return to $100K hints at ‘significant price move’

Key points:Bitcoin’s realized cap is beating records and has almost reached the $900 billion mark.The market is laying the foundations for a “potentially significant price breakout,” new analysis says.Profit-taking is not hindering the overall bull market rebound.Bitcoin (BTC) is setting new all-time highs in network value as BTC price action eyes a return to six figures.Data from onchain analytics platform CryptoQuant confirms new record highs for Bitcoin’s realized cap.Bitcoin realized cap reflects “growing conviction”Bitcoin is worth more than ever in US dollar terms if its market cap is measured by the value at which the extant supply last moved onchain.Known as realized cap, this figure has seen continued all-time highs since mid-April as BTC/USD stages a sustained recovery, and as of May 7 stood at $891 billion.“Bitcoin has experienced a steady flow of capital inflows in recent weeks, reflecting renewed interest from investors,” CryptoQuant contributor Carmelo Alemán summarized in one of its “Quicktake” blog posts on May 7.Alemán argued that the realized cap uptrend reflects a long-term market shift across the Bitcoin investor spectrum. “This new all-time high in Realized Cap not only reflects a surge in invested capital but also a growing conviction in Bitcoin's long-term potential as a financial asset,” the post concluded. “With sustained accumulation from both LTHs and STHs, the market appears to be building a solid foundation for a potentially significant price breakout. If this trend continues, we could be witnessing the early stages of a new bull cycle for Bitcoin.”Bitcoin realized cap. Source: CryptoQuantBTC capital influx ongoing since 2023As Cointelegraph reported, concerns remain over the fate of the current market rebound.Related: BTC dominance due ‘collapse’ at 71%: 5 things to know in Bitcoin this weekMisgivings over profit-taking in particular form grounds to suspect that higher prices may not last — both LTH and STH entities have seized the opportunity to lock in profits, with these averaging $1 billion daily.In the latest edition of its regular newsletter, “The Week Onchain,” research firm Glassnode nonetheless argues that buy and sell-side conditions are balanced at around $100,000.“A surge in profit taking can be observed in recent weeks, with the recent rally drawing in over $1B/day in net capital inflows,” it wrote. “This points to initial indicators of a return of demand-side strength, allowing sellers to lock in profits, and speaking to buyers willing to pick up coins at the current market price. Generally speaking, this points to a wave of demand which is absorbing the incoming supply.”Bitcoin net realized profit/loss (screenshot). Source: GlassnodeGlassnode added that the quest for profits has, in fact, extended for over 18 months.“Notably, the market has sustained a profit-driven regime since October 2023, with capital inflows consistently exceeding outflows. This steady influx of fresh capital serves as an overall constructive signal,” it stated.This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Key points:

Bitcoin’s realized cap is beating records and has almost reached the $900 billion mark.

The market is laying the foundations for a “potentially significant price breakout,” new analysis says.

Profit-taking is not hindering the overall bull market rebound.

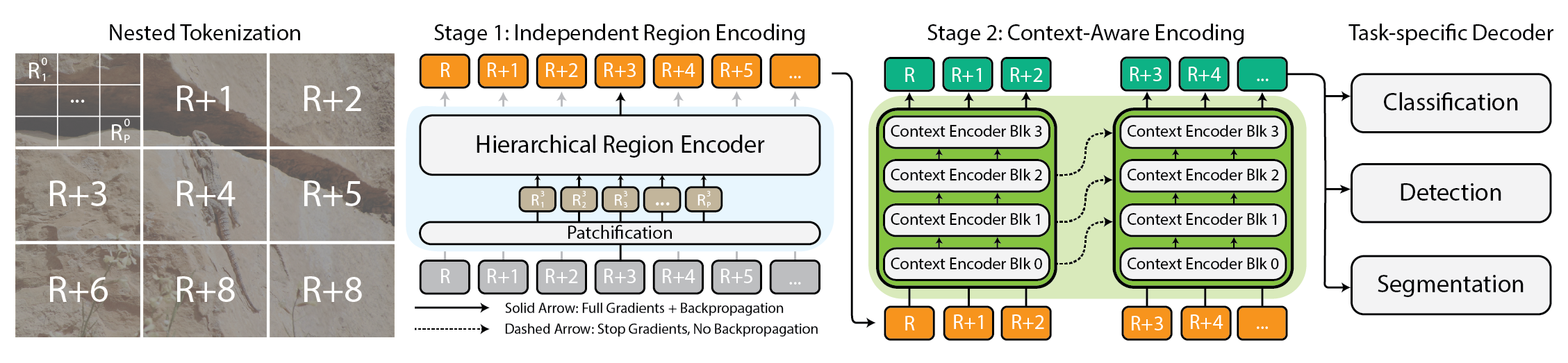

Bitcoin (BTC) is setting new all-time highs in network value as BTC price action eyes a return to six figures.

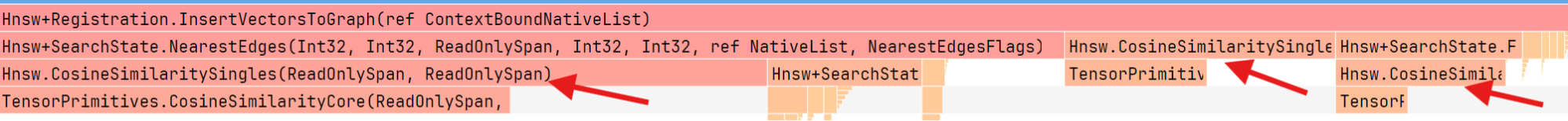

Data from onchain analytics platform CryptoQuant confirms new record highs for Bitcoin’s realized cap.

Bitcoin realized cap reflects “growing conviction”

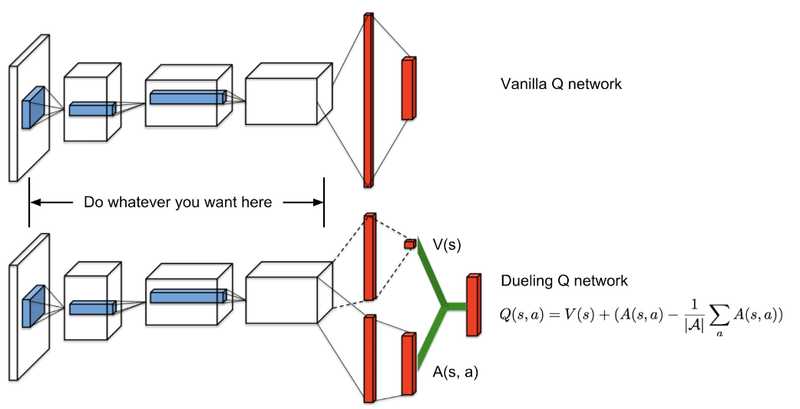

Bitcoin is worth more than ever in US dollar terms if its market cap is measured by the value at which the extant supply last moved onchain.

Known as realized cap, this figure has seen continued all-time highs since mid-April as BTC/USD stages a sustained recovery, and as of May 7 stood at $891 billion.

“Bitcoin has experienced a steady flow of capital inflows in recent weeks, reflecting renewed interest from investors,” CryptoQuant contributor Carmelo Alemán summarized in one of its “Quicktake” blog posts on May 7.

Alemán argued that the realized cap uptrend reflects a long-term market shift across the Bitcoin investor spectrum.

“This new all-time high in Realized Cap not only reflects a surge in invested capital but also a growing conviction in Bitcoin's long-term potential as a financial asset,” the post concluded.

“With sustained accumulation from both LTHs and STHs, the market appears to be building a solid foundation for a potentially significant price breakout. If this trend continues, we could be witnessing the early stages of a new bull cycle for Bitcoin.”

BTC capital influx ongoing since 2023

As Cointelegraph reported, concerns remain over the fate of the current market rebound.

Related: BTC dominance due ‘collapse’ at 71%: 5 things to know in Bitcoin this week

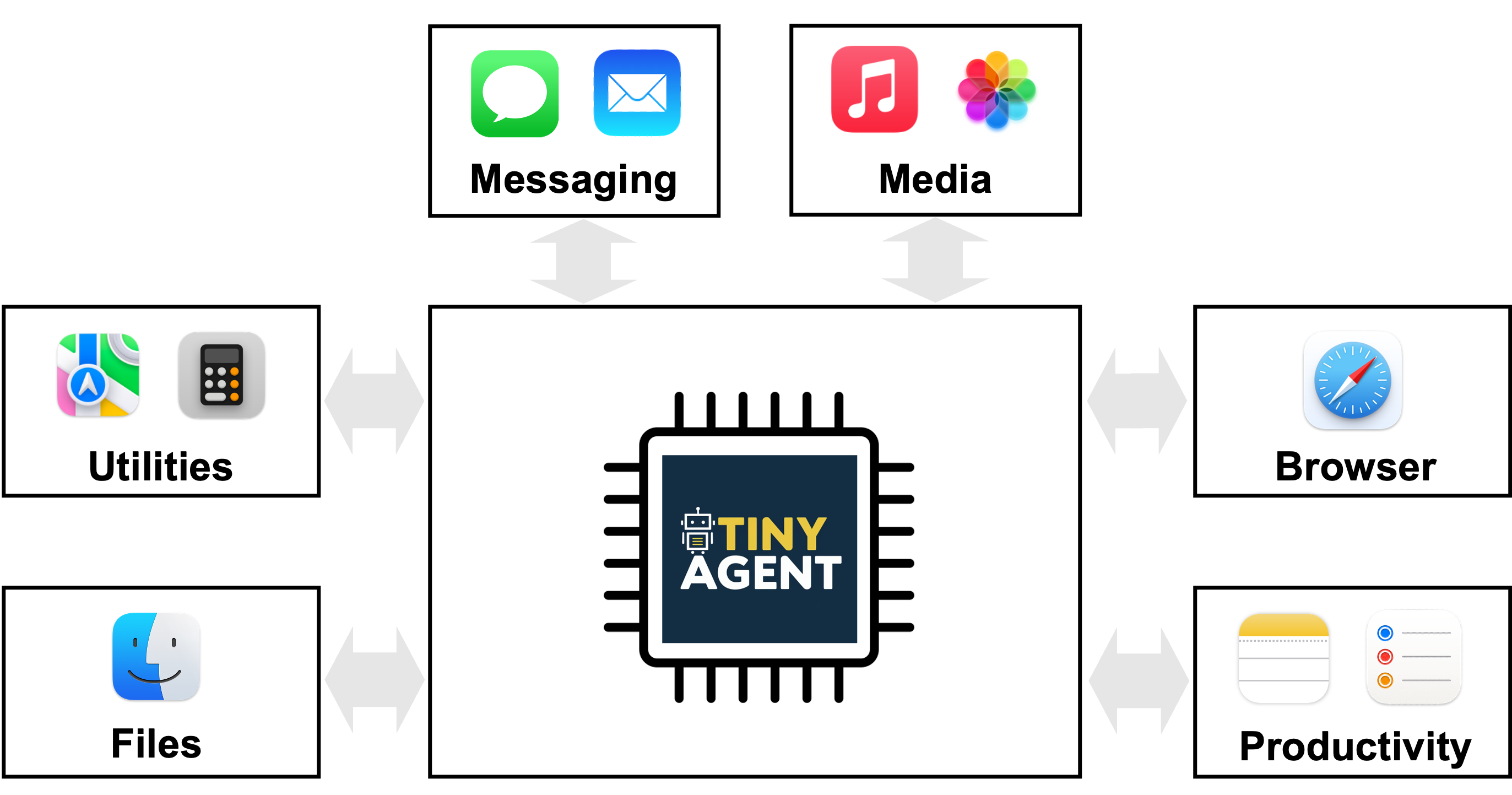

Misgivings over profit-taking in particular form grounds to suspect that higher prices may not last — both LTH and STH entities have seized the opportunity to lock in profits, with these averaging $1 billion daily.

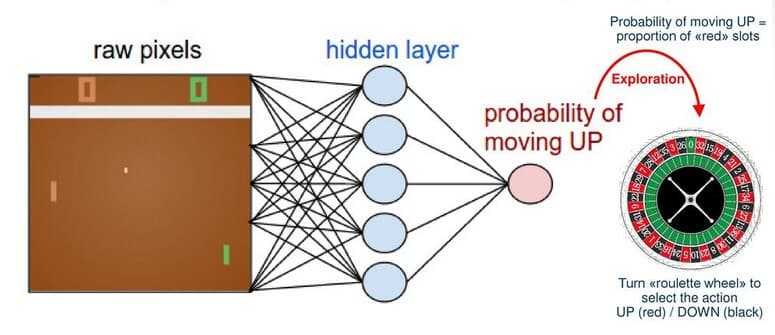

In the latest edition of its regular newsletter, “The Week Onchain,” research firm Glassnode nonetheless argues that buy and sell-side conditions are balanced at around $100,000.

“A surge in profit taking can be observed in recent weeks, with the recent rally drawing in over $1B/day in net capital inflows,” it wrote.

“This points to initial indicators of a return of demand-side strength, allowing sellers to lock in profits, and speaking to buyers willing to pick up coins at the current market price. Generally speaking, this points to a wave of demand which is absorbing the incoming supply.”

Glassnode added that the quest for profits has, in fact, extended for over 18 months.

“Notably, the market has sustained a profit-driven regime since October 2023, with capital inflows consistently exceeding outflows. This steady influx of fresh capital serves as an overall constructive signal,” it stated.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

![[The AI Show Episode 146]: Rise of “AI-First” Companies, AI Job Disruption, GPT-4o Update Gets Rolled Back, How Big Consulting Firms Use AI, and Meta AI App](https://www.marketingaiinstitute.com/hubfs/ep%20146%20cover.png)

![[DEALS] The Premium Python Programming PCEP Certification Prep Bundle (67% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

.jpg?#)

-Mafia-The-Old-Country---The-Initiation-Trailer-00-00-54.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

-Nintendo-Switch-2---Reveal-Trailer-00-01-52.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

_Aleksey_Funtap_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

_Sergey_Tarasov_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Apple Shares Official Trailer for 'Stick' Starring Owen Wilson [Video]](https://www.iclarified.com/images/news/97264/97264/97264-640.jpg)

![Beats Studio Pro Wireless Headphones Now Just $169.95 - Save 51%! [Deal]](https://www.iclarified.com/images/news/97258/97258/97258-640.jpg)