How AI Is Quietly Taking Over Global Markets

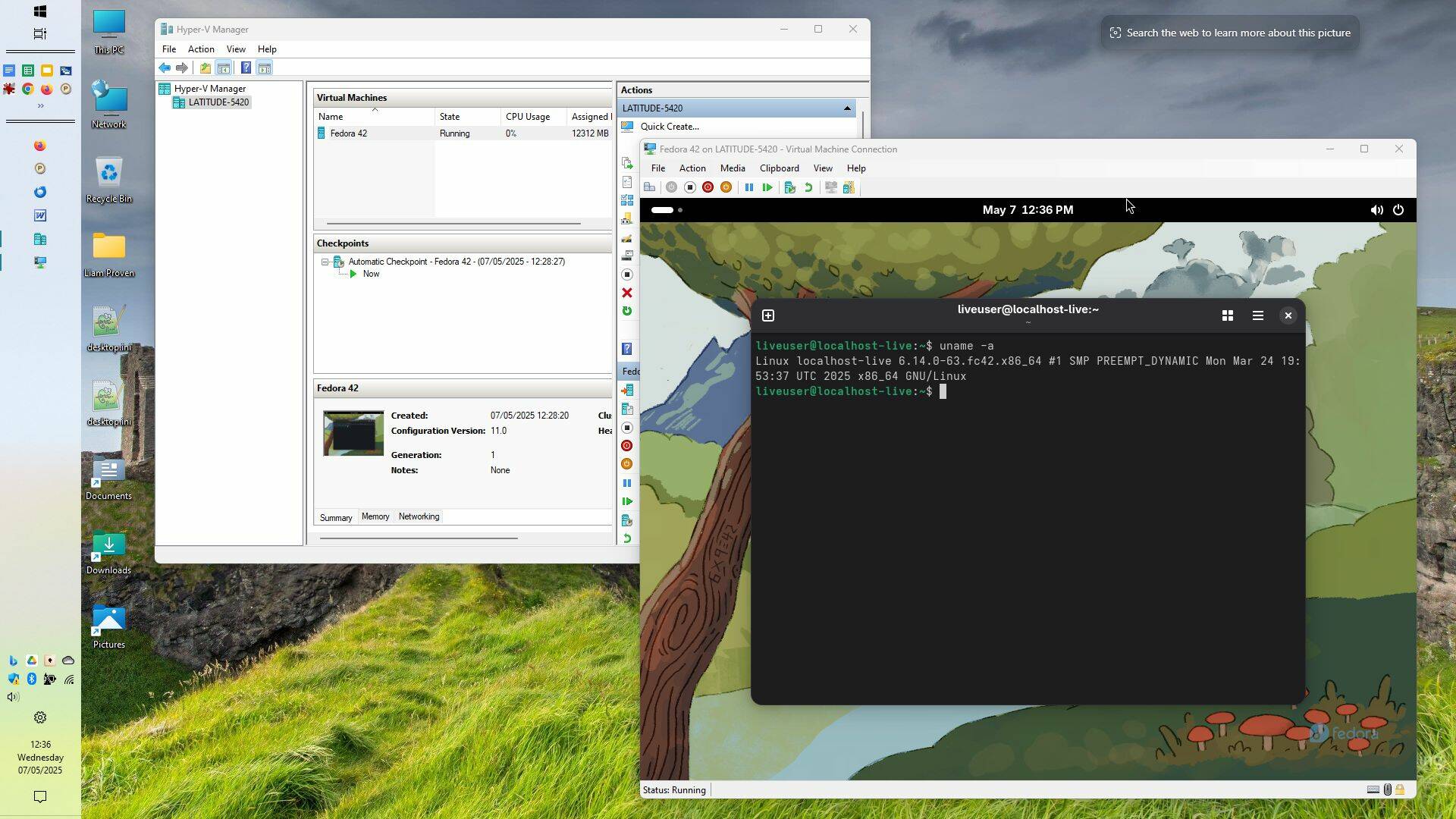

In the ever-evolving tapestry of global finance and commodity exchange, artificial intelligence (AI) and machine learning (ML) have emerged not merely as technological enhancements, but as transformative forces reshaping market dynamics at their core. The traditional structures of trade—rooted in human judgment, historical trends, and institutional policy—are increasingly augmented and, in some cases, redefined by intelligent algorithms capable of processing data and making decisions at a scale and speed previously unimaginable. The Rise of Intelligent Decision-Making At the heart of AI-driven market mechanisms is the ability to process vast volumes of structured and unstructured data in real time. Unlike legacy models reliant on periodic analysis and manual intervention, modern AI systems operate continuously, absorbing market signals, news sentiment, economic indicators, and even social media discourse to identify trading opportunities or risks. Machine learning models, particularly those employing deep learning and reinforcement learning, are trained on historical data but adapt dynamically to new inputs. This continuous learning loop allows for real-time strategy adjustments, reducing latency in decision-making and increasing portfolio responsiveness. Sentiment Analysis: The Digital Gut Feeling One of the most profound applications of AI in modern finance is sentiment analysis—the automated process of analyzing text data to determine public attitude toward particular securities, commodities, or economic conditions. By mining data from financial news portals, analyst reports, and social platforms, AI can gauge market sentiment and factor these insights into risk assessments or trade executions. This sentiment-driven intelligence has become a cornerstone in the construction of hedge fund strategies, particularly in high-volatility environments where investor psychology significantly influences asset prices. Real-Time Risk Modeling and Prediction Traditionally, risk modeling was an exercise in statistical forecasting and historical data regression. Today, AI-powered risk engines integrate real-time feeds—market volatility, geopolitical events, credit spreads, and counterparty behaviors—to forecast and mitigate potential losses instantly. These systems are not only reactive but predictive. By analyzing patterns across asset classes and global markets, AI models can foresee potential systemic risks and suggest portfolio rebalancing or hedging strategies in advance, empowering financial institutions with a proactive risk posture. Autonomous Trading Bots and Algorithmic Execution Autonomous trading bots, often powered by deep reinforcement learning, are now standard components of modern investment portfolios. These bots operate on pre-defined rules or adaptive models, capable of executing thousands of trades within milliseconds, across multiple markets and asset types. Their impact is twofold: Efficiency Gains: Human errors and emotional biases are eliminated, enabling more disciplined and data-driven strategies. Market Liquidity: High-frequency bots contribute to tighter bid-ask spreads and improved liquidity, although they also necessitate new safeguards to prevent flash crashes or unintended volatility surges. Ethical Considerations and Regulatory Foresight While the promise of AI in market mechanisms is vast, it also calls for measured oversight. The opacity of black-box models, potential for unintended bias, and systemic risk concentration in algorithmic strategies pose significant regulatory challenges. Policymakers and financial institutions must collaborate to ensure that innovation does not outpace accountability. Conclusion: A Hybrid Future of Human and Machine Synergy AI-driven market mechanisms are not replacing traditional finance—they are augmenting it. The future lies in a hybrid model, where seasoned human insight coexists with machine precision. As AI continues to

In the ever-evolving tapestry of global finance and commodity exchange, artificial intelligence (AI) and machine learning (ML) have emerged not merely as technological enhancements, but as transformative forces reshaping market dynamics at their core. The traditional structures of trade—rooted in human judgment, historical trends, and institutional policy—are increasingly augmented and, in some cases, redefined by intelligent algorithms capable of processing data and making decisions at a scale and speed previously unimaginable.

The Rise of Intelligent Decision-Making

At the heart of AI-driven market mechanisms is the ability to process vast volumes of structured and unstructured data in real time. Unlike legacy models reliant on periodic analysis and manual intervention, modern AI systems operate continuously, absorbing market signals, news sentiment, economic indicators, and even social media discourse to identify trading opportunities or risks.

Machine learning models, particularly those employing deep learning and reinforcement learning, are trained on historical data but adapt dynamically to new inputs. This continuous learning loop allows for real-time strategy adjustments, reducing latency in decision-making and increasing portfolio responsiveness.

Sentiment Analysis: The Digital Gut Feeling

One of the most profound applications of AI in modern finance is sentiment analysis—the automated process of analyzing text data to determine public attitude toward particular securities, commodities, or economic conditions. By mining data from financial news portals, analyst reports, and social platforms, AI can gauge market sentiment and factor these insights into risk assessments or trade executions.

This sentiment-driven intelligence has become a cornerstone in the construction of hedge fund strategies, particularly in high-volatility environments where investor psychology significantly influences asset prices.

Real-Time Risk Modeling and Prediction

Traditionally, risk modeling was an exercise in statistical forecasting and historical data regression. Today, AI-powered risk engines integrate real-time feeds—market volatility, geopolitical events, credit spreads, and counterparty behaviors—to forecast and mitigate potential losses instantly.

These systems are not only reactive but predictive. By analyzing patterns across asset classes and global markets, AI models can foresee potential systemic risks and suggest portfolio rebalancing or hedging strategies in advance, empowering financial institutions with a proactive risk posture.

Autonomous Trading Bots and Algorithmic Execution

Autonomous trading bots, often powered by deep reinforcement learning, are now standard components of modern investment portfolios. These bots operate on pre-defined rules or adaptive models, capable of executing thousands of trades within milliseconds, across multiple markets and asset types.

Their impact is twofold:

- Efficiency Gains: Human errors and emotional biases are eliminated, enabling more disciplined and data-driven strategies.

- Market Liquidity: High-frequency bots contribute to tighter bid-ask spreads and improved liquidity, although they also necessitate new safeguards to prevent flash crashes or unintended volatility surges.

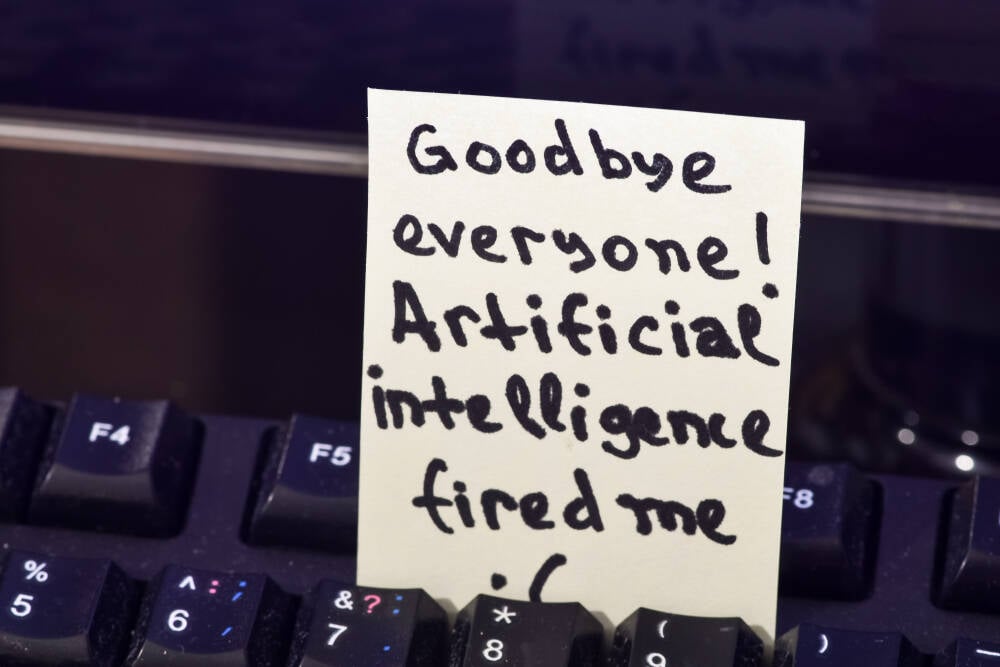

Ethical Considerations and Regulatory Foresight

While the promise of AI in market mechanisms is vast, it also calls for measured oversight. The opacity of black-box models, potential for unintended bias, and systemic risk concentration in algorithmic strategies pose significant regulatory challenges. Policymakers and financial institutions must collaborate to ensure that innovation does not outpace accountability.

Conclusion: A Hybrid Future of Human and Machine Synergy

AI-driven market mechanisms are not replacing traditional finance—they are augmenting it. The future lies in a hybrid model, where seasoned human insight coexists with machine precision. As AI continues to

![[The AI Show Episode 146]: Rise of “AI-First” Companies, AI Job Disruption, GPT-4o Update Gets Rolled Back, How Big Consulting Firms Use AI, and Meta AI App](https://www.marketingaiinstitute.com/hubfs/ep%20146%20cover.png)

![[DEALS] The Premium Python Programming PCEP Certification Prep Bundle (67% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

.jpg?#)

-Mafia-The-Old-Country---The-Initiation-Trailer-00-00-54.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

-Nintendo-Switch-2---Reveal-Trailer-00-01-52.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

_Aleksey_Funtap_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

_Sergey_Tarasov_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Apple Shares Official Trailer for 'Stick' Starring Owen Wilson [Video]](https://www.iclarified.com/images/news/97264/97264/97264-640.jpg)

![Beats Studio Pro Wireless Headphones Now Just $169.95 - Save 51%! [Deal]](https://www.iclarified.com/images/news/97258/97258/97258-640.jpg)