Global stocks rise after Trump says he has ‘no intention’ of firing Fed chair

Global shares mostly rose Wednesday, with markets showing relief after President Donald Trump indicated he won’t dismiss the head of the U.S. Federal Reserve.France’s CAC 40 jumped 2.1% in early trading to 7,480.99, while Germany’s DAX rose 2.5% to 21,820.14. Britain’s FTSE 100 gained 1.6% to 8,461.24. U.S. shares were set to drift higher with Dow futures up 1.5% at 39,960.00. S&P 500 futures rose 2.0% to 5,421.75.In Asia, Japan’s benchmark Nikkei 225 gained 1.9% to finish at 34,868.63. Australia’s S&P/ASX 200 surged 1.3% to 7,920.50. South Korea’s Kospi gained 1.6% to 2,525.56. Hong Kong’s Hang Seng added 2.4% to 222,072.62, while the Shanghai Composite edged down 0.1% to 3,296.36.Trump had previously said he could fire Fed chair Jerome Powell after the Fed paused cuts to short-term interest rates. But Trump told reporters Tuesday, “I have no intention of firing him.”Investors were also cheered by comments from U.S. Treasury Secretary Scott Bessent in a Tuesday speech. He said the ongoing tariffs showdown with China is unsustainable and he expects a “de-escalation” in the trade war.“Of course, markets will continue to listen out for the latest White House rhetoric on tariffs and any hints of upcoming trade deals. As such, market direction will more likely than not continue to be dictated by Trump’s latest whims regarding tariffs and trade,” said Tim Waterer, chief market analyst at KCM Trade.The only prediction many Wall Street strategists are willing to make is that financial markets will likely continue to veer up and down as hopes rise and fall that Trump may negotiate deals with other countries to lower his tariffs. If no such deals come quickly enough, many investors expect the economy to fall into a recession.The International Monetary Fund on Tuesday slashed its forecast for global economic growth this year to 2.8%, down from 3.3%. A suite of better-than-expected profit reports from big U.S. companies, meanwhile, helped drive U.S. stocks higher.Also helping market sentiment was the announcement from Elon Musk that he will spend less time in Washington and more time running Tesla after his electric vehicle company reported a big drop in profits. Its results have been hurt by vandalism, widespread protests and calls for a consumer boycott amid a backlash to Musk’s oversight of cost-cutting efforts for the U.S. government.Tesla reported earnings after U.S. trading closed. Tesla’s quarterly profits fell from $1.39 billion to $409 million, far below analyst estimates.In energy trading, benchmark U.S. crude added 80 cents to $64.47 a barrel. Brent crude, the international standard added 81 cents to $68.25 a barrel.In currency trading, the U.S. dollar declined to 141.87 Japanese yen from 142.37 yen. The euro cost $1.1390, up from $1.1379. _AP Business Writer Stan Choe contributed. —Yuri Kageyama, AP Business Writer

Global shares mostly rose Wednesday, with markets showing relief after President Donald Trump indicated he won’t dismiss the head of the U.S. Federal Reserve.

France’s CAC 40 jumped 2.1% in early trading to 7,480.99, while Germany’s DAX rose 2.5% to 21,820.14. Britain’s FTSE 100 gained 1.6% to 8,461.24. U.S. shares were set to drift higher with Dow futures up 1.5% at 39,960.00. S&P 500 futures rose 2.0% to 5,421.75.

In Asia, Japan’s benchmark Nikkei 225 gained 1.9% to finish at 34,868.63. Australia’s S&P/ASX 200 surged 1.3% to 7,920.50. South Korea’s Kospi gained 1.6% to 2,525.56. Hong Kong’s Hang Seng added 2.4% to 222,072.62, while the Shanghai Composite edged down 0.1% to 3,296.36.

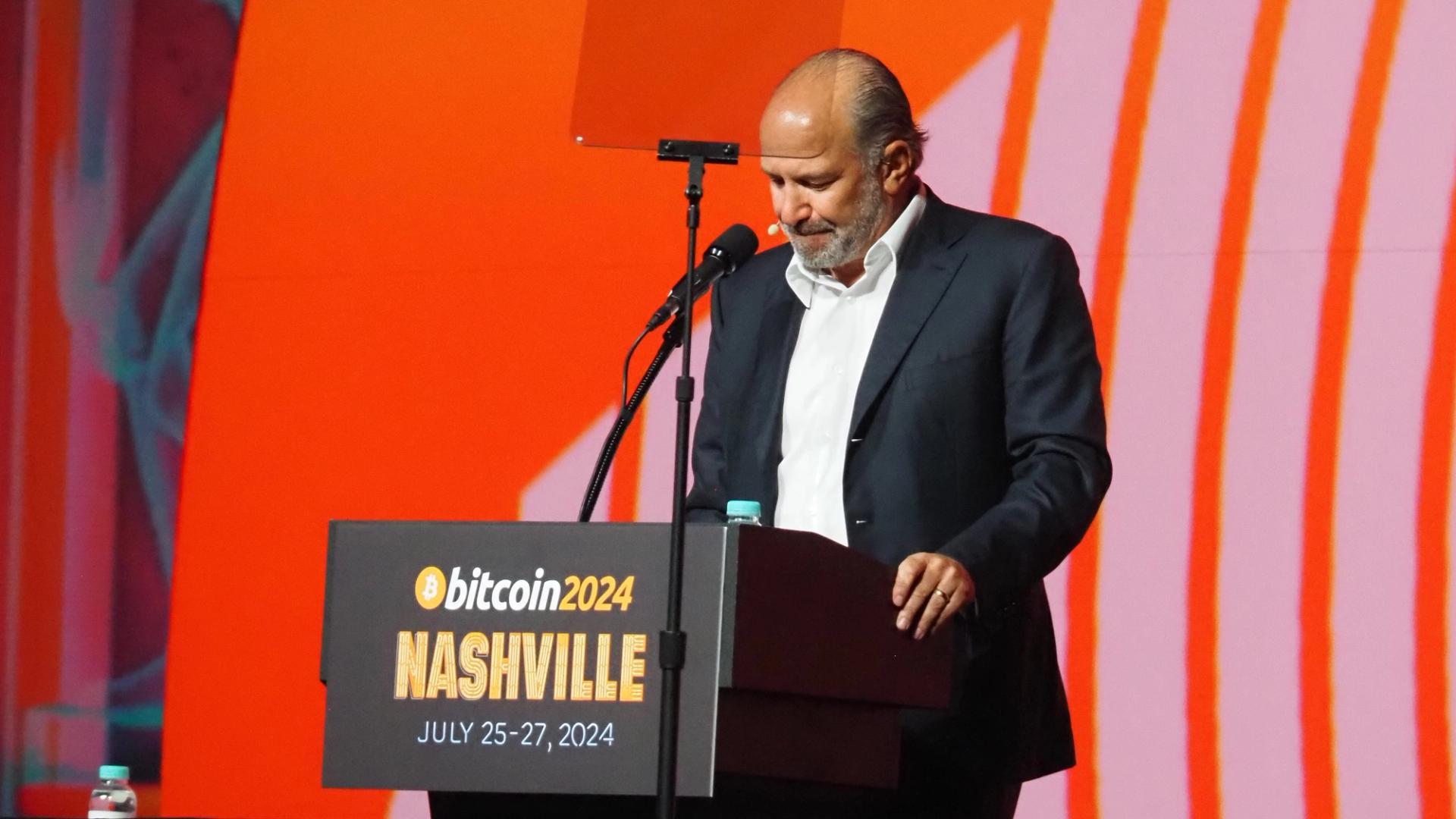

Trump had previously said he could fire Fed chair Jerome Powell after the Fed paused cuts to short-term interest rates. But Trump told reporters Tuesday, “I have no intention of firing him.”

Investors were also cheered by comments from U.S. Treasury Secretary Scott Bessent in a Tuesday speech. He said the ongoing tariffs showdown with China is unsustainable and he expects a “de-escalation” in the trade war.

“Of course, markets will continue to listen out for the latest White House rhetoric on tariffs and any hints of upcoming trade deals. As such, market direction will more likely than not continue to be dictated by Trump’s latest whims regarding tariffs and trade,” said Tim Waterer, chief market analyst at KCM Trade.

The only prediction many Wall Street strategists are willing to make is that financial markets will likely continue to veer up and down as hopes rise and fall that Trump may negotiate deals with other countries to lower his tariffs. If no such deals come quickly enough, many investors expect the economy to fall into a recession.

The International Monetary Fund on Tuesday slashed its forecast for global economic growth this year to 2.8%, down from 3.3%. A suite of better-than-expected profit reports from big U.S. companies, meanwhile, helped drive U.S. stocks higher.

Also helping market sentiment was the announcement from Elon Musk that he will spend less time in Washington and more time running Tesla after his electric vehicle company reported a big drop in profits. Its results have been hurt by vandalism, widespread protests and calls for a consumer boycott amid a backlash to Musk’s oversight of cost-cutting efforts for the U.S. government.

Tesla reported earnings after U.S. trading closed. Tesla’s quarterly profits fell from $1.39 billion to $409 million, far below analyst estimates.

In energy trading, benchmark U.S. crude added 80 cents to $64.47 a barrel. Brent crude, the international standard added 81 cents to $68.25 a barrel.

In currency trading, the U.S. dollar declined to 141.87 Japanese yen from 142.37 yen. The euro cost $1.1390, up from $1.1379.

_

AP Business Writer Stan Choe contributed.

—Yuri Kageyama, AP Business Writer

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

![Did I Discover A New Programming Paradigm? [closed]](https://miro.medium.com/v2/resize:fit:1200/format:webp/1*nKR2930riHA4VC7dLwIuxA.gif)

-Classic-Nintendo-GameCube-games-are-coming-to-Nintendo-Switch-2!-00-00-13.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

_Wavebreakmedia_Ltd_FUS1507-1_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![New iPhone 17 Dummy Models Surface in Black and White [Images]](https://www.iclarified.com/images/news/97106/97106/97106-640.jpg)

![Hands-On With 'iPhone 17 Air' Dummy Reveals 'Scary Thin' Design [Video]](https://www.iclarified.com/images/news/97100/97100/97100-640.jpg)