SEC charges Ramil Palafox in $198M crypto Ponzi case

SEC says $57 million spent on luxury goods and homes. Iranian national indicted for operating dark web market Nemesis. Over 400,000 orders processed using only cryptocurrency. The US Securities and Exchange Commission (SEC) has filed charges against Ramil Palafox, a dual citizen of the United States and the Philippines, accusing him of orchestrating a $198 […] The post SEC charges Ramil Palafox in $198M crypto Ponzi case appeared first on CoinJournal.

- SEC says $57 million spent on luxury goods and homes.

- Iranian national indicted for operating dark web market Nemesis.

- Over 400,000 orders processed using only cryptocurrency.

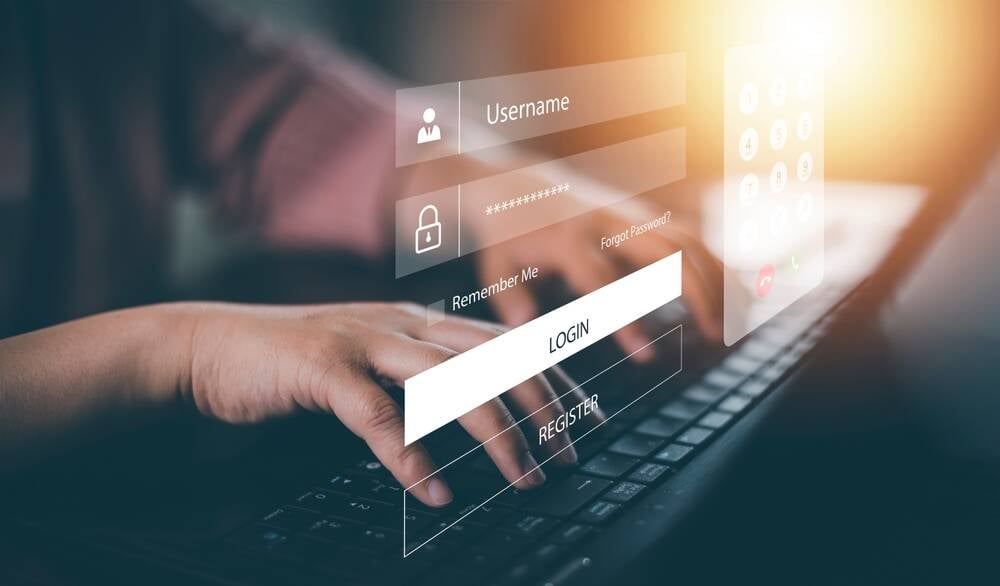

The US Securities and Exchange Commission (SEC) has filed charges against Ramil Palafox, a dual citizen of the United States and the Philippines, accusing him of orchestrating a $198 million crypto investment fraud through his company, PGI Global.

The case highlights ongoing risks in decentralised finance, where investors continue to fall prey to schemes promising guaranteed profits from unverified cryptocurrency and forex ventures.

Palafox allegedly ran a global multi-level marketing operation from January 2020 to October 2021 before the scheme collapsed, leaving investors with substantial losses.

SEC claims $57 million used for personal spending

According to the SEC’s filing in the Eastern District of Virginia, Palafox presented PGI Global as an AI-powered crypto and foreign exchange trading platform.

However, the regulator alleges there was no real trading activity.

Instead, over $57 million in investor funds were diverted to purchase luxury goods and real estate for Palafox and his family.

The SEC’s complaint seeks the return of misappropriated funds, civil penalties, and a permanent injunction to prevent Palafox from operating future schemes.

The structure of PGI Global mirrored that of a classic Ponzi scheme, where older investors were paid returns using capital from new entrants.

Operating as an MLM business, it expanded globally by offering recruitment-based commissions and falsely portraying Palafox as a seasoned crypto expert.

Criminal proceedings escalate with DOJ involvement

In parallel to the SEC’s civil complaint, the US Attorney’s Office has filed criminal charges against Palafox.

While specific charges have not been detailed in the SEC press release, the Department of Justice is pursuing the case in federal court, indicating the possibility of significant penalties, including imprisonment.

The proceedings mark another chapter in US efforts to crack down on large-scale cryptocurrency fraud.

The SEC’s action comes amid growing concerns about the misuse of crypto platforms to mask fraudulent activity and bypass traditional financial regulation.

While some enforcement actions focus on platform compliance or token offerings, this case highlights individual accountability and the misuse of investor trust.

Iranian national indicted in separate dark web case

In a related development, the US Department of Justice has indicted Behrouz Parsarad, an Iranian national, for running a dark web marketplace named Nemesis.

The site processed over 400,000 transactions between 2021 and 2024, dealing primarily in fentanyl, other controlled substances, malware, and stolen financial data.

Parsarad also allegedly used cryptocurrency to launder proceeds from these sales, concealing the origin of the funds and operating exclusively in digital assets.

Nemesis reportedly prohibited all transactions in fiat currencies, effectively forcing users to use cryptocurrency to ensure anonymity.

If convicted, Parsarad faces a minimum prison sentence of 10 years and could be sentenced to life.

His indictment follows a series of similar crackdowns, including the FBI’s recent arrest of Anurag Pramod Murarka for laundering $24 million through the dark web.

The back-to-back developments involving Palafox and Parsarad demonstrate a widening net cast by US authorities to address the dual threat of financial fraud and criminal use of decentralised technologies.

With cryptocurrency use expanding across borders, regulatory bodies are intensifying enforcement to deter abuse, enhance investor protection, and bring more transparency to the ecosystem.

The post SEC charges Ramil Palafox in $198M crypto Ponzi case appeared first on CoinJournal.

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

![Did I Discover A New Programming Paradigm? [closed]](https://miro.medium.com/v2/resize:fit:1200/format:webp/1*nKR2930riHA4VC7dLwIuxA.gif)

-Classic-Nintendo-GameCube-games-are-coming-to-Nintendo-Switch-2!-00-00-13.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

_Wavebreakmedia_Ltd_FUS1507-1_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![New iPhone 17 Dummy Models Surface in Black and White [Images]](https://www.iclarified.com/images/news/97106/97106/97106-640.jpg)

![Hands-On With 'iPhone 17 Air' Dummy Reveals 'Scary Thin' Design [Video]](https://www.iclarified.com/images/news/97100/97100/97100-640.jpg)