From Credit Gaps to Competition: The Real Issues MSMES Face Today

IDespite contributing 30% to India's GDP, MSMEs face unique hurdles in each sector—from credit and infrastructure gaps to digital delays.

India’s Micro, Small and Medium Enterprises (MSMEs) sector, accounting for over 30% of the country’s GDP and employing more than 11 crore people, is as diverse as it is vital. From traditional manufacturing hubs to modern tech-led startups, the MSME ecosystem encompasses a wide array of industries, each with unique pain points. A closer look reveals that while some issues like credit access are near-universal, others—such as technology adoption, raw material dependency, or export barriers—are deeply sector-specific.

1. Manufacturing MSMEs: A Productivity Puzzle

Manufacturing contributes 35.9% of MSME GVA. Yet, productivity remains low due to:

- Fragmented operations: Many units are informal, family-run, and lack economies of scale.

- Technology gap: The sector lags in automation and modern machinery adoption.

- Infrastructure hurdles: Irregular power supply, poor logistics, and lack of cluster support add to costs.

Sectors like textile, leather, and garments also face competition from cheaper imports and shifting global demand patterns.

2. Service-Based MSMEs: Digital Divide and Formalization Barriers

Service MSMEs—contributing 44.8% of MSME GVA—include everything from retail and hospitality to IT services. Their challenges include:

- Lack of digital penetration: Smaller players often operate offline, missing out on digital sales and payments.

- Skilling issues: The workforce is largely unskilled or semi-skilled, affecting service quality.

- Taxation confusion: Multiple compliances under GST discourage formal registration.

3. Trade MSMEs: Caught in the Compliance Net

Trading MSMEs, such as wholesalers and retailers, especially in Tier 2 and 3 cities, face:

- High working capital needs: Long credit cycles and inventory holding strain liquidity.

- Policy uncertainty: Frequent regulatory shifts—like demonetization or e-commerce FDI changes—disrupt planning.

- Digital competition: Local traders lose ground to e-commerce giants with better logistics and price margins

4. Export-Oriented MSMEs: Battling Global Headwinds

India’s export basket—especially in sectors like apparel, gems and jewelry, and handicrafts—relies heavily on MSMEs. But:

- Global demand fluctuation and geopolitical tensions affect volumes.

- Quality standards and certification compliance remain barriers for many small exporters.

- Currency volatility and lack of hedging awareness increase financial risk exposure.

5. Women-Led MSMEs: Funding and Visibility Gaps

While women-run MSMEs are growing, especially in handloom, food processing, and wellness sectors, they face:

- Credit inaccessibility: Due to lower collateral and informal business operations.

- Lack of market linkages: Limited access to larger markets, both offline and online.

- Low digital adoption: Many operate through word-of-mouth or local networks.

Schemes exist, but awareness and implementation remain inconsistent.

6. Rural and Agro-Based MSMEs: Policy-Linked But Fragmented

These units—spanning dairy, food processing, handicrafts, and agro-tech—deal with:

- Seasonal business models tied to agriculture cycles.

- Raw material volatility and procurement challenges.

- Limited access to cold chains and logistics infrastructure.

Despite strong support from policies like PMFME and SFURTI, integration with national supply chains is weak

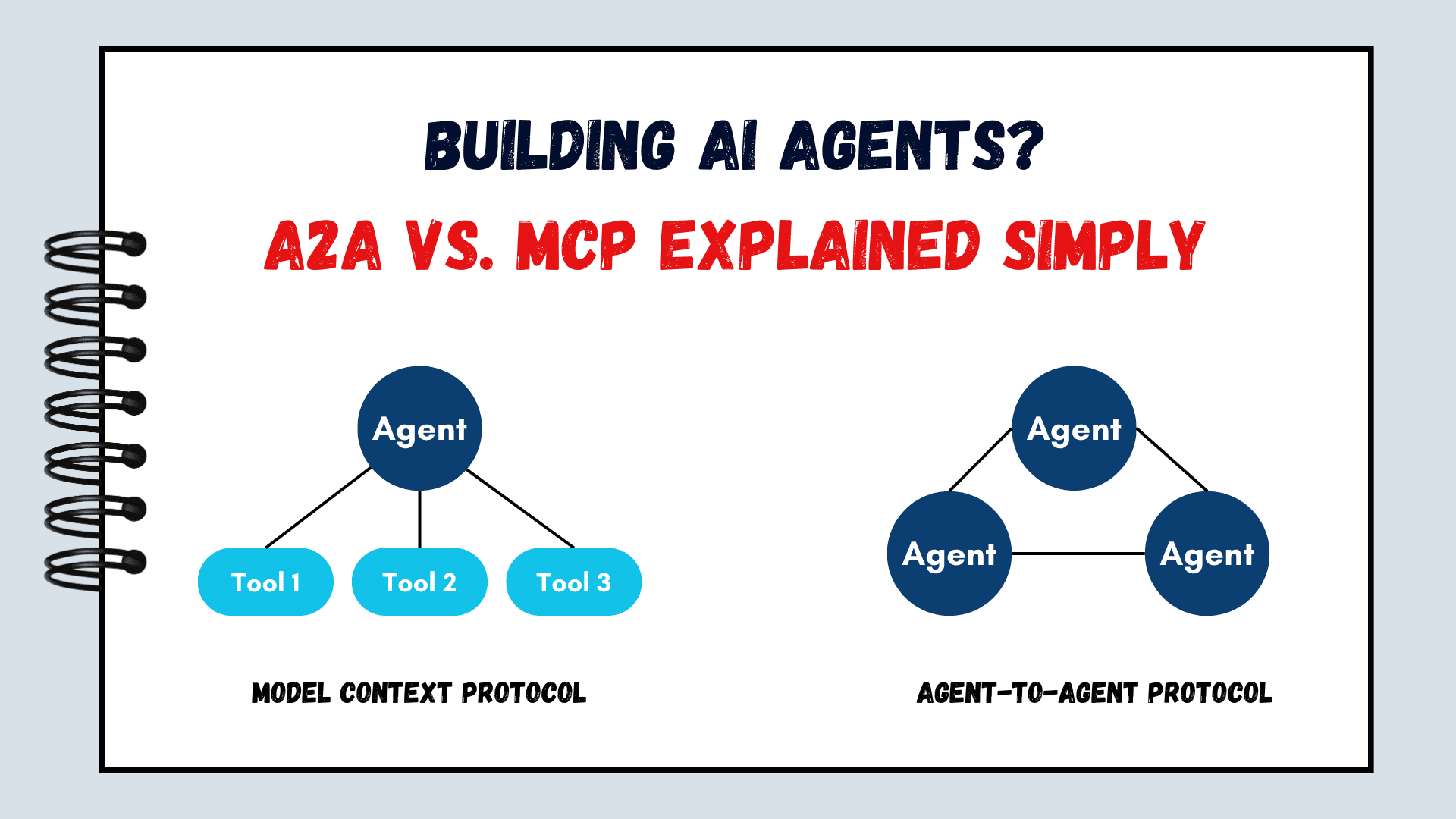

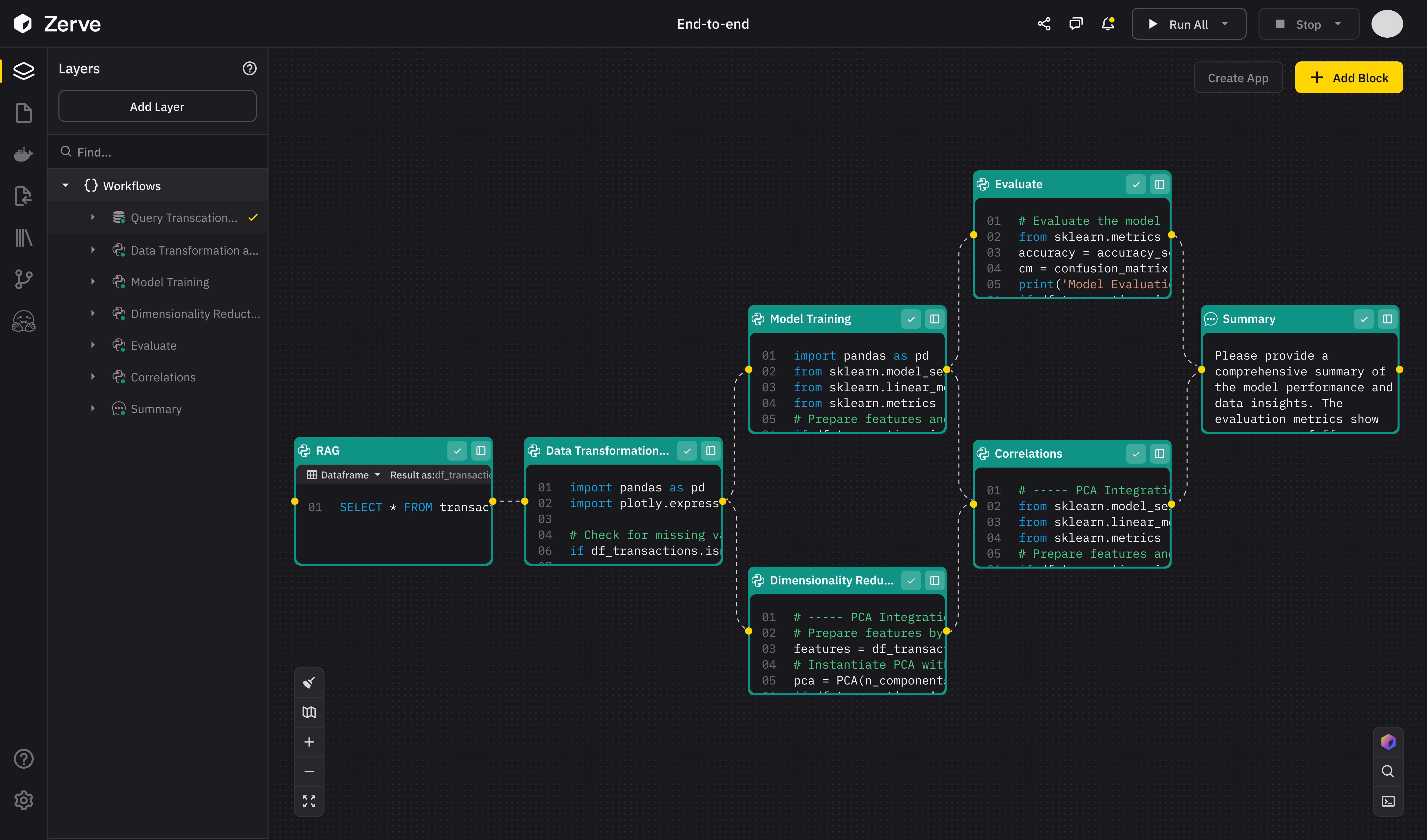

7. Tech Startups and Innovation-Led MSMEs: Scaling Barriers

Though not traditional MSMEs, newer tech-driven businesses fall under this umbrella. Their struggles are:

- Angel and seed funding gaps for early-stage ideas.

- Talent retention as larger firms offer better packages.

- IPR and patent complexities that are costly and time-consuming.

Startups in health-tech, agritech, and deep tech are particularly affected, despite the government’s push through schemes like SIDBI Fund of Funds and Startup India.

Conclusion: One Sector, Many Realities

MSMEs form a complex, layered ecosystem. While schemes like ECLGS, Udyam registration, and the ONDC platform aim to create a uniform support structure, sector-specific interventions remain the need of the hour. Tailoring policy—be it through targeted credit, tech upgrades, or skilling—will be critical to unleash the full potential of India’s MSMEs.

![89 million Steam accounts reportedly leaked. Change your password now. [Updated]](https://helios-i.mashable.com/imagery/articles/05mKEv2HKG7EgiHKtximy17/hero-image.fill.size_1200x675.v1747231462.jpg)

![[The AI Show Episode 147]: OpenAI Abandons For-Profit Plan, AI College Cheating Epidemic, Apple Says AI Will Replace Search Engines & HubSpot’s AI-First Scorecard](https://www.marketingaiinstitute.com/hubfs/ep%20147%20cover.png)

![How to Enable Remote Access on Windows 10 [Allow RDP]](https://bigdataanalyticsnews.com/wp-content/uploads/2025/05/remote-access-windows.jpg)

![[DEALS] The 2025 Ultimate GenAI Masterclass Bundle (87% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![Legends Reborn tier list of best heroes for each class [May 2025]](https://media.pocketgamer.com/artwork/na-33360-1656320479/pg-magnum-quest-fi-1.jpeg?#)

-Olekcii_Mach_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

_Brian_Jackson_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Top Gear gives us a detailed look at Apple CarPlay Ultra [Video]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2025/05/Top-Gear-gives-us-a-first-look-at-Apple-CarPlay-Ultra-Video.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![YouTube will use Gemini to insert ads around the parts of a video you care about most [Video]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2025/05/gemini-youtube-ads-1.png?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Trump Tells Cook to Stop Building iPhones in India and Build in the U.S. Instead [Video]](https://www.iclarified.com/images/news/97329/97329/97329-640.jpg)