Fintech innovations are reshaping risk management for CFOs

Fintech has altered risk management for CFOs, shifting it from a ‘reactive’ to a ‘proactive’ approach. New-age technologies like machine learning, AI, and data analytics can now anticipate and manage risks efficiently.

In the last decade, fintech has revolutionized the financial landscape, turning it from a traditional space into a dynamic ecosystem. Industry reports suggest that India's FinTech is projected to grow to $150-160 billion in the next five years.

As companies evolve with the latest technologies, CFOs and financial executives are taking more proactive roles in managing risk, aware that the ability to stay ahead of evolving threats is crucial. Over 45% of CFOs currently have audits and compliance reporting to them directly, emphasising the importance of effective risk management practices in the rapidly changing financial sector, according to Deloitte.

From financial guardians to strategic innovators

The CFO's role has been equated with overseeing the financial well-being of an organisation. Traditionally, CFOs focused on optimising cash flows, maintaining balance sheets, and reporting financial performance. However, with organisations increasingly encountering new risks in a hyper-digital and interconnected global environment, the CFO's role is undergoing a drastic change.

Today's CFOs are taking up more strategic roles that extend beyond just managing risks but also anticipating and mitigating them proactively.

According to a recent Gartner CFO survey, CFOs reported that their role has significantly expanded beyond traditional finance to include a combination of enterprise data and analytics (D&A), enterprise risk, corporate strategy, Mergers and Acquisitions (M&A), and procurements. Fintech technologies are helping drive this revolution, allowing CFOs to implement AI, ML, and predictive analytics as tools for real-time risk prevention.

Increased complexity of risks in the digital era

With businesses increasingly adopting digital transformation, the scope and complexity of risks have significantly increased. Cloud computing, online transactions, and networked systems have brought new kinds of vulnerabilities, such as cybersecurity attacks, data breaches, and regulatory issues. According to Statista, the worldwide average per-data breach cost was $4.88 million in 2024, up from $4.45 million in the previous year.

For CFOs, handling such risks involves a transition from conventional risk assessment tools to sophisticated FinTech solutions. These tools anticipate, identify, and mitigate risks in real-time. Risk is no longer just on the balance sheet; it now encompasses technology disruptions, market volatility, and geopolitical risks. CFOs are increasingly turning to data-driven solutions to strengthen risk assessments and protect their organizations from unexpected dangers.

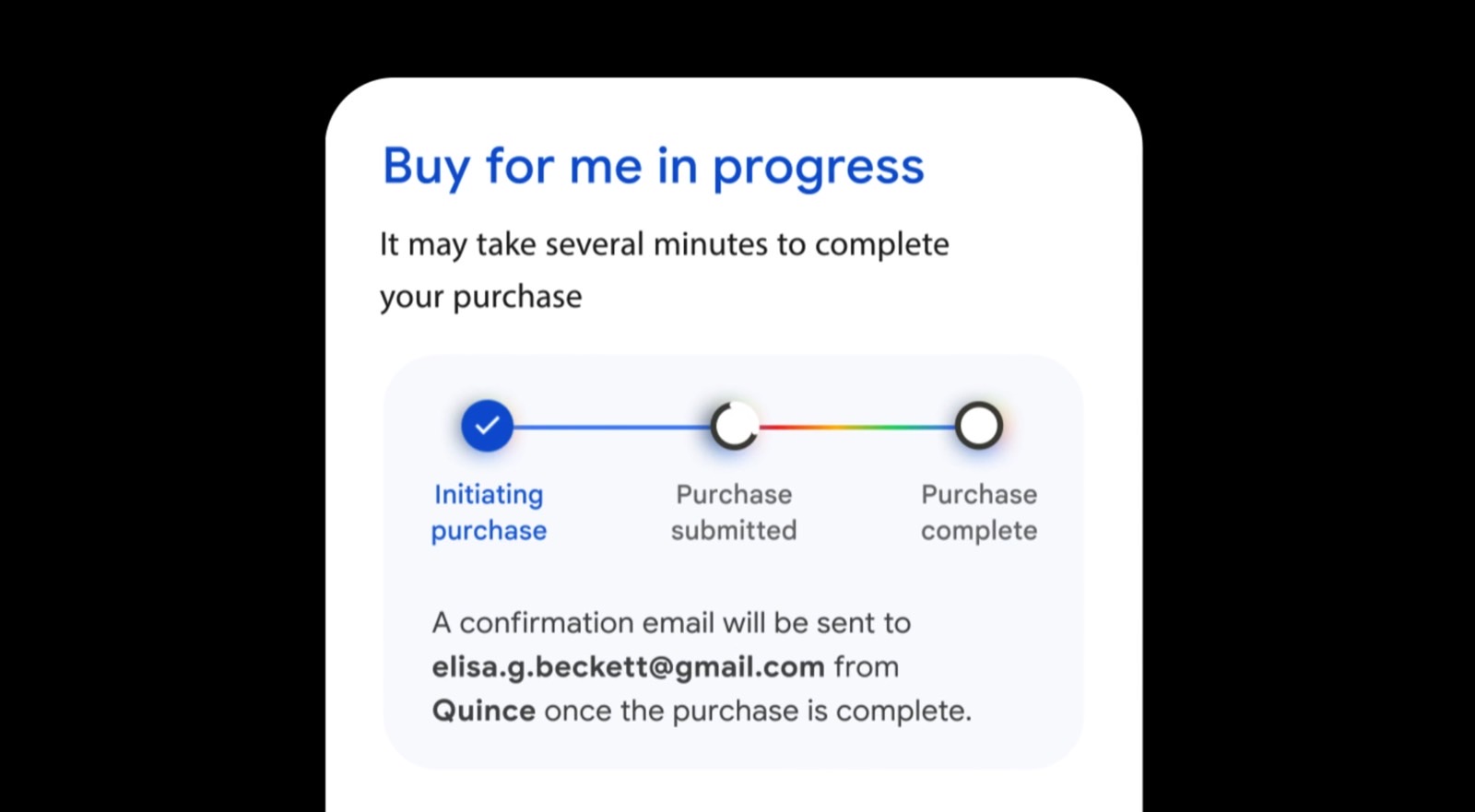

A shift to proactive risk management

Fintech has altered risk management for CFOs, shifting it from a ‘reactive’ to a ‘proactive’ approach. New-age technologies like machine learning, AI, and data analytics can now anticipate and manage risks efficiently. Real-time information and predictive analytics enable them to anticipate and manage risks, making them more prepared and less susceptible to financial crises.

As per the latest PwC Global Risk Survey, 73% of business leaders indicated that advanced analytics and AI greatly improve their capacity to detect and reduce risk.

AI-based solutions are capable of reviewing enormous amounts of financial information and identifying anomalies and patterns that may reflect developing risks. Credit risk, market fluctuation, or operational inefficiencies, these solutions can offer CFOs advance warnings and usable information that did not exist previously.

From gut-feel to data-driven precision

In the past, most CFOs made risk-related decisions based on intuition and gut feeling. Although experience was a factor, this approach was riddled with uncertainty and the possibility of costly errors. Today, data-driven decision-making is no longer a luxury but a necessity. FinTech solutions can analyze large amounts of data in real-time, giving CFOs precise information about the financial well-being of their organizations and the impending risks.

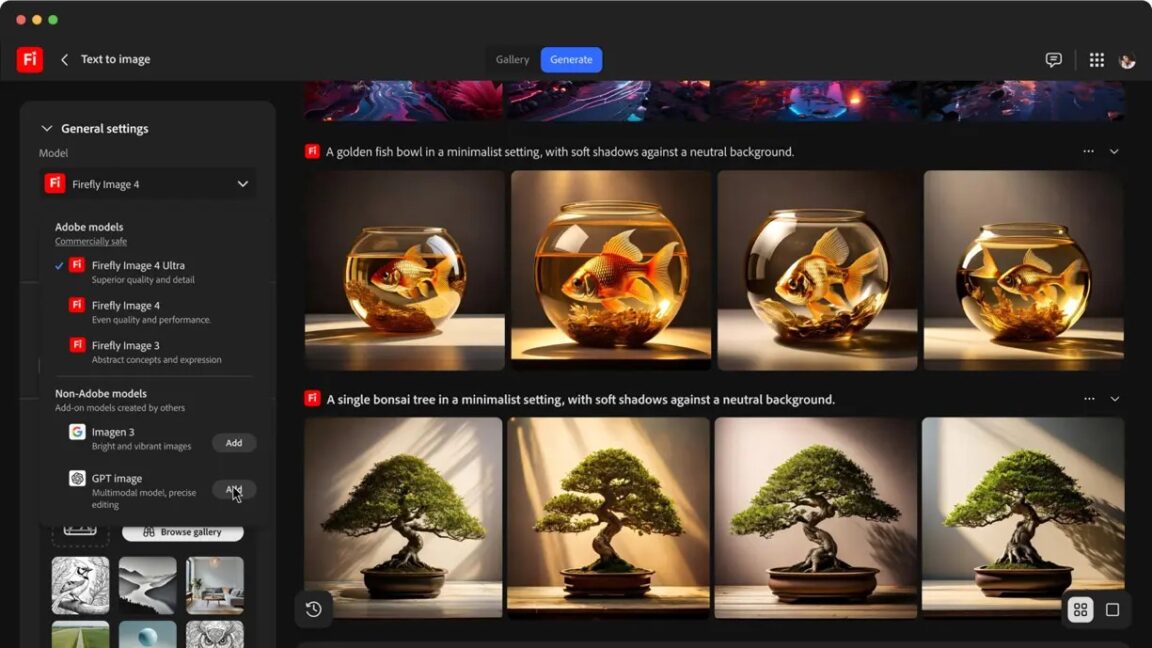

Emerging technologies such as artificial intelligence (AI) and machine learning (ML) enable automation, facilitate pattern recognition, and support real-time responses to potential threats. Risk analytics tools powered by AI analyze market conditions, financial information, and external sources such as geopolitical developments to offer in-depth risk analysis.

Sophisticated machine learning forecasting models can predict future financial trends and determine potential risk areas. With these tools, CFOs can steer clear of the pitfalls of relying solely on historical data and take smarter decisions for financial stability and growth. It's not about responding to risk anymore but anticipating it with the accuracy of modern technology.

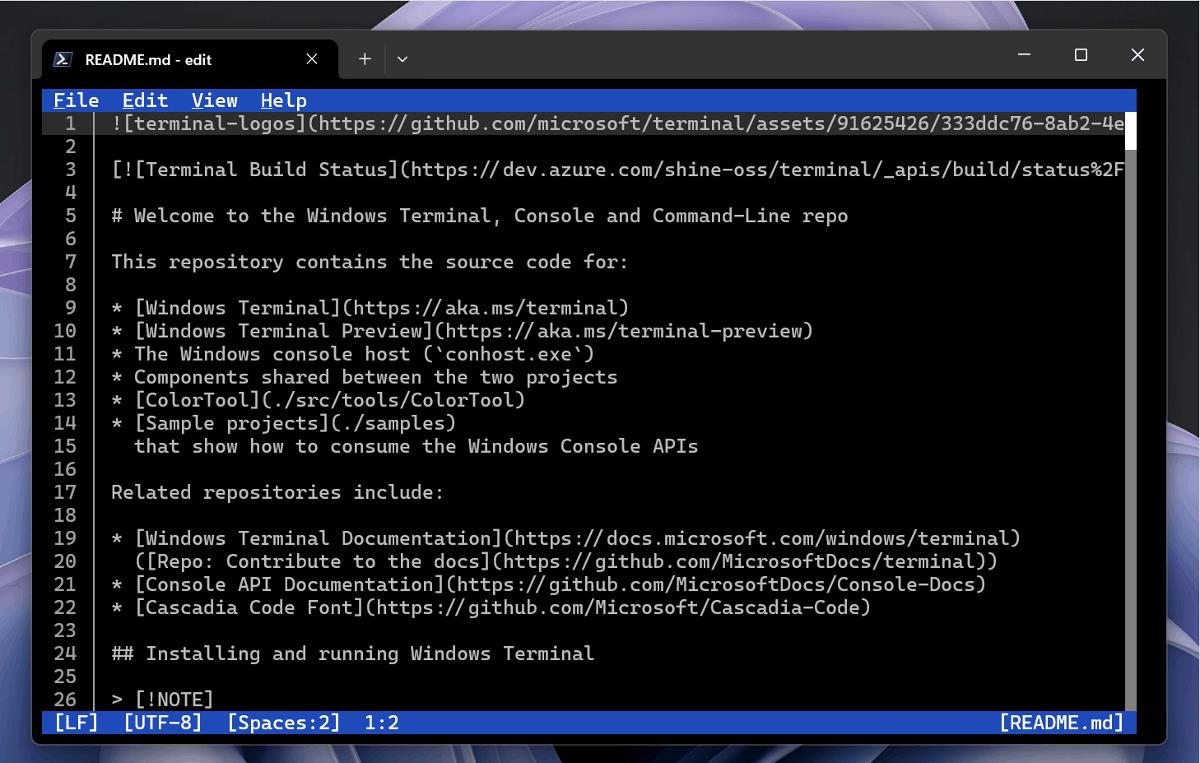

In addition, Fintech platforms are transforming compliance with RegTech (regulatory technology). RegTech automates cumbersome compliance processes, enabling CFOs to stay ahead of changes in regulations and ensuring compliance with local and international regulations. RegTech prevents expensive penalties, simplifies reporting, and minimises the risk of non-compliance, streamlining the compliance processes for the finance teams.

The path forward for CFOs

The future of risk management for CFOs extends beyond merely keeping up with technology but spearheading the move towards innovative solutions that will drive proactive decision-making. In the coming years, emerging technologies such as AI, blockchain, and cloud solutions will continue to integrate into even deeper risk management strategies that are smarter and quicker.

CFOs will concentrate on rolling out these technologies in all areas of finance to build end-to-end solutions to manage uncertainty. As the digital environment continues to evolve, technology will continue to be the centre of enabling CFOs to safeguard organizations while driving growth and innovation, keeping them competitive in a more intricate financial world.

Avinash Godkhindi is the Co-Promoter, MD & CEO of Zaggle

![[The AI Show Episode 148]: Microsoft’s Quiet AI Layoffs, US Copyright Office’s Bombshell AI Guidance, 2025 State of Marketing AI Report, and OpenAI Codex](https://www.marketingaiinstitute.com/hubfs/ep%20148%20cover%20%281%29.png)

![[The AI Show Episode 146]: Rise of “AI-First” Companies, AI Job Disruption, GPT-4o Update Gets Rolled Back, How Big Consulting Firms Use AI, and Meta AI App](https://www.marketingaiinstitute.com/hubfs/ep%20146%20cover.png)

.jpg?#)

_Prostock-studio_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)