Washington governor approves new business taxes, acknowledges ‘unintended consequences’

Washington Gov. Bob Ferguson on Tuesday approved controversial new taxes on businesses that will help plug the state’s massive $16 billion budget shortfall. The new laws increase business and occupation (B&O) tax rates; expands the state’s sales tax to include companies providing digital services; and raises a computing surcharge on companies such as Microsoft and Amazon, among other changes. Gov. Ferguson, who took office in January, said he aimed to find a balance between cuts and new taxes to address the budget gap. The additional revenue will fund public schools, healthcare, social services, and other programs. Business groups have criticized… Read More

Washington Gov. Bob Ferguson on Tuesday approved controversial new taxes on businesses that will help plug the state’s massive $16 billion budget shortfall.

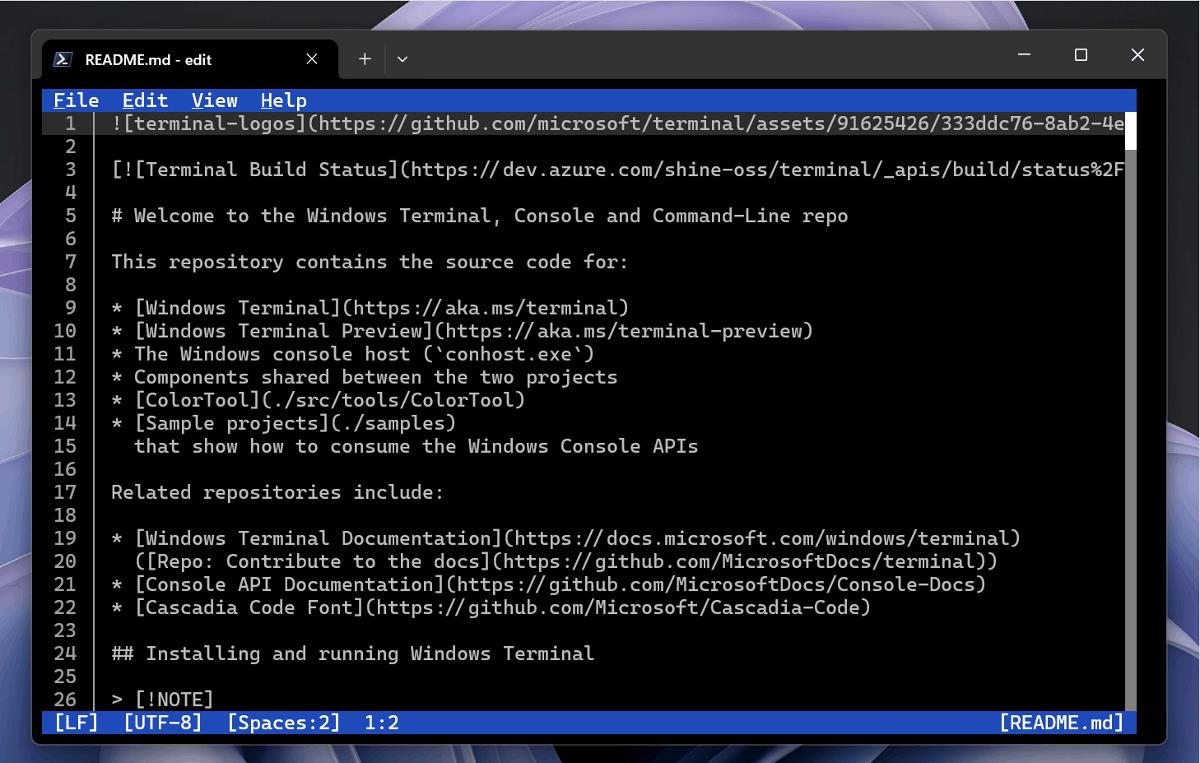

The new laws increase business and occupation (B&O) tax rates; expands the state’s sales tax to include companies providing digital services; and raises a computing surcharge on companies such as Microsoft and Amazon, among other changes.

Gov. Ferguson, who took office in January, said he aimed to find a balance between cuts and new taxes to address the budget gap. The additional revenue will fund public schools, healthcare, social services, and other programs.

Business groups have criticized the new taxes, saying they could harm the state’s economy and drive companies away.

“We’re very concerned about how this will impact our companies, and if folks will make decisions to either grow outside of Washington state, or whether or not they’ll even start a company here,” said Kelly Fukai, CEO of the Washington Technology Industry Association.

Fukai said she expects the new taxes to slow Washington’s tech sector, which makes up 22% of the state’s economy.

“We think Washington state is the place where innovation should happen,” she said. “We have all of the ingredients, and we want to make sure we retain them.”

Gov. Ferguson acknowledged that the bills moved through the legislative process quickly and said that he would review potential changes for the supplemental budget that allow lawmakers to adjust two-year budgets.

“We already know there may be unintended consequences that need to be addressed,” he said at a press conference Tuesday. He added: “The business community can expect that I’ll be reaching out to have conversations about the impacts on these taxes.”

More details on the new taxes:

- Senate Bill 5814 expands the state’s retail sales tax to include digital and professional services such as advertising agencies, software development firms, and IT support providers. Companies must begin collecting sales tax from customers starting in October 2025.

- House Bill 2081 increases the state’s B&O (business & occupation) tax rate and adds a new surcharge on companies with more than $250 million in annual taxable income.

- HB 2081 also increases the “advanced computing surcharge” — paid by major tech companies such as Microsoft and Amazon — from 1.22% to 7.5%, with a new cap of $75 million per year, up from $9 million. Companies paying the advanced computing surcharge are exempt from the new B&O surcharge.

- SB 5814 is projected to generate more than $1.1 billion in revenue over the next two years. HB 2081 is projected to generate more than $2 billion in revenue over the next two years.

Kris Johnson, president and CEO of the Association of Washington Business, said the new sales tax change will put small businesses at a competitive disadvantage with out-of-state firms.

“The budget signed into law today doesn’t help make Washington more affordable,” he said in a statement to GeekWire. “It makes Washington more expensive.”

Lawmakers previously proposed a wealth tax and a payroll tax that drew intense pushback from tech companies including Microsoft. Both of those taxes did not ultimately pass.

Washington is one of a few states without a personal or corporate income tax. Most state revenue comes from sales, property, and B&O taxes — a system critics say disproportionately burdens lower-income residents.

Gov. Ferguson also signed Senate Bill 5813, which increases the state’s capital gains tax by creating a progressive rate structure — 7% on gains up to $1 million, and 9.9% on gains above $1 million. The tax passed in 2021 and sparked a divide within the tech industry, as compensation can include stocks and equity.

“The gaps between working families and the gains by the wealthiest in our state have resulted in not enough funding for our schools, a safety net that is at risk every time revenue collection drops or costs go up, and working Washingtonians struggling to make ends meet,” Rep. April Berg (D-Mill Creek), chair of the House Finance Committee, said in a press release last month.

“This revenue package finds a balance to meet our short-term need of addressing the budget shortfall and protecting the critical services on which our communities rely, as well as our long-term goal of reforming our outdated, unfair tax code.”

Gov. Ferguson also on Tuesday signed House Bill 2077, a new tax on electric vehicle credits that will impact Tesla.

The governor said he vetoed some items in the budget that totaled around $25 million.

Previously: ‘A real blow’: Washington state sales tax on tech and digital services rattles industry

![[The AI Show Episode 148]: Microsoft’s Quiet AI Layoffs, US Copyright Office’s Bombshell AI Guidance, 2025 State of Marketing AI Report, and OpenAI Codex](https://www.marketingaiinstitute.com/hubfs/ep%20148%20cover%20%281%29.png)

![[The AI Show Episode 146]: Rise of “AI-First” Companies, AI Job Disruption, GPT-4o Update Gets Rolled Back, How Big Consulting Firms Use AI, and Meta AI App](https://www.marketingaiinstitute.com/hubfs/ep%20146%20cover.png)

.jpg?#)

_Prostock-studio_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)