Bitcoin Pepe price to jump soon as institutional interest in BTC returns

The surge in inflows signals rising investor confidence in Bitcoin as a strategic hedge amid persistent geopolitical instability and macroeconomic uncertainty. The substantial net inflows into spot Bitcoin ETFs coincided with Bitcoin’s resilience in the face of broader market uncertainty and macroeconomic pressures. As of publication time, Bitcoin is trading at $93,580, up 5.4% over […] The post Bitcoin Pepe price to jump soon as institutional interest in BTC returns appeared first on CoinJournal.

- Ten US-listed Bitcoin ETFs posted positive flows for the day, underscoring broad-based institutional demand.

- A rally in Bitcoin could act as a catalyst for Bitcoin Pepe, as broader crypto market sentiment often tracks Bitcoin’s performance.

- The Bitcoin Pepe presale is set to enter its tenth stage once funding surpasses $7.78 million.

US spot Bitcoin exchange-traded funds (ETFs) recorded their highest single-day net inflows since January 17 on Tuesday, pulling in $936 million.

The surge in inflows signals rising investor confidence in Bitcoin as a strategic hedge amid persistent geopolitical instability and macroeconomic uncertainty.

The substantial net inflows into spot Bitcoin ETFs coincided with Bitcoin’s resilience in the face of broader market uncertainty and macroeconomic pressures.

As of publication time, Bitcoin is trading at $93,580, up 5.4% over the past 24 hours.

Growing institutional interest in Bitcoin could fuel a broader rally across the crypto market, potentially extending gains to emerging projects such as Bitcoin Pepe.

As capital flows into established assets like BTC through spot ETFs, risk appetite may spill over into smaller-cap and meme-focused tokens, amplifying upside potential for speculative plays.

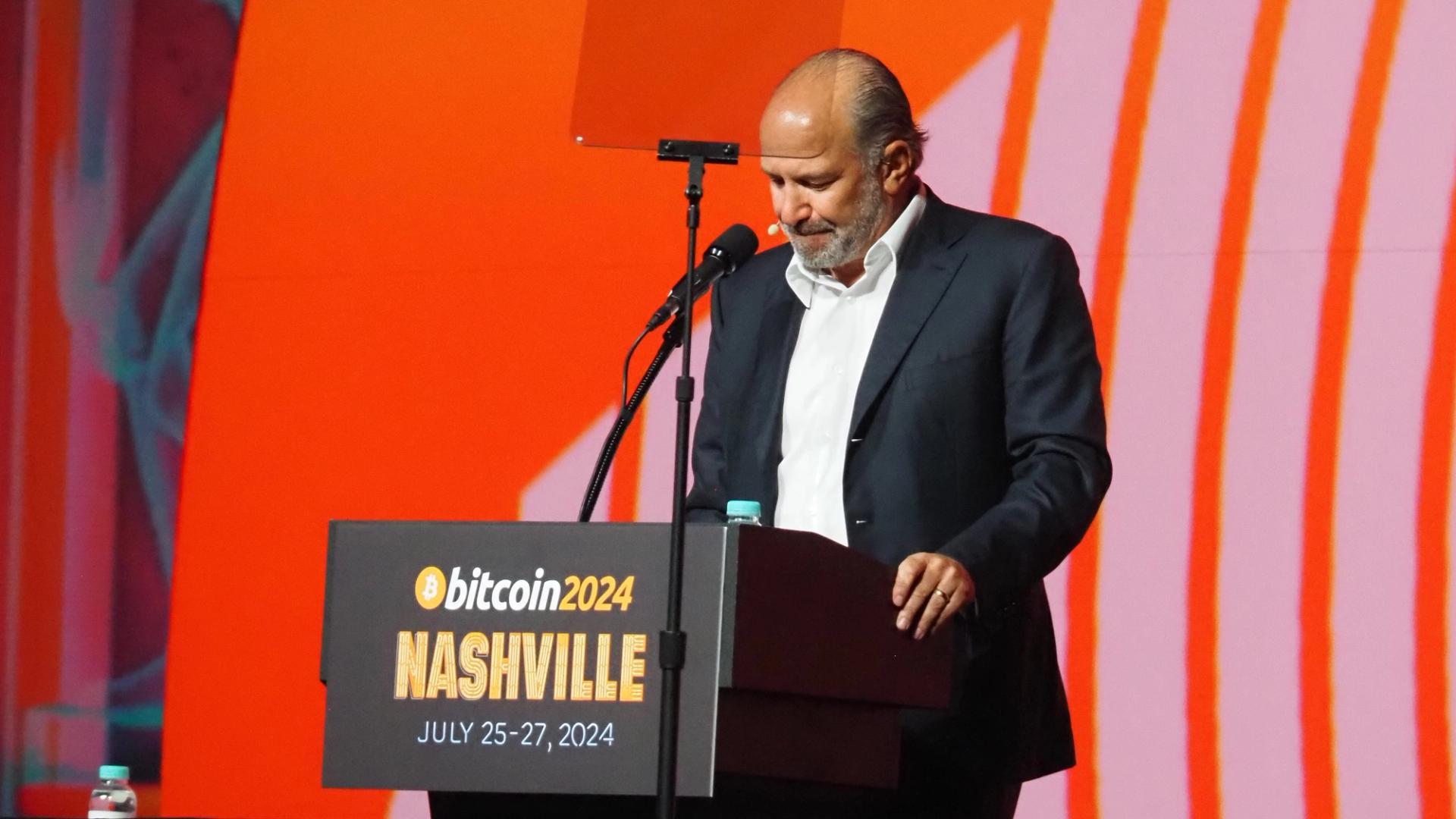

Bitcoin ETF inflows stay strong

Ten US-listed Bitcoin ETFs posted positive flows for the day, underscoring broad-based institutional demand.

Leading the charge was the Ark & 21Shares fund, which attracted $267.1 million in net inflows.

Fidelity’s FBTC followed with $253.8 million, while BlackRock’s IBIT drew $193.5 million, according to data from SoSoValue.

Over the past three consecutive sessions, US Bitcoin ETFs have amassed more than $1.4 billion in net inflows, reinforcing the narrative that digital assets, particularly bitcoin, are regaining institutional favor amid global market turbulence.

The recent shift in market sentiment appears to have been driven by renewed optimism on the geopolitical front.

Treasury Secretary Scott Bessent signaled a potential softening in the US-China tariff standoff, calling the ongoing trade trajectory “unsustainable” and suggesting that de-escalation may be imminent.

President Donald Trump echoed the sentiment, telling reporters he plans to strike a deal with China to lower tariffs, characterizing the current 145% rate as excessively high and unsustainable in the long term.

How a Bitcoin rally helps Bitcoin Pepe

A rally in Bitcoin could act as a catalyst for Bitcoin Pepe, as broader crypto market sentiment often tracks Bitcoin’s performance.

Meme coins typically see increased retail activity during such periods, given their low entry costs and speculative appeal.

As the only Bitcoin meme ICO, Bitcoin Pepe stands to benefit from this momentum, leveraging its association with the leading cryptocurrency.

The project aims to build the primary blockchain for meme assets, positioning itself as the first meme-centric Layer 2 on Bitcoin and combining Bitcoin’s security with Solana-like scalability.

Bitcoin Pepe prices are set to go up soon

The Bitcoin Pepe presale continues to gain pace, with over $6.8 million raised so far and demand accelerating rapidly.

The project introduces the PEP-20 token standard, enabling meme coin deployment directly on the Bitcoin network—a unique proposition that has helped fuel its momentum.

Structured over 30 stages with approximately 5% price increases per round, the BPEP token has already moved from $0.021 at launch to $0.031 by stage 9, delivering more than 40% returns for early participants.

The offering is set to enter its tenth stage once funding surpasses $7.78 million. Each round has been closing quicker than the last, a reflection of growing speculative appetite.

If the current trajectory holds, BPEP is expected to reach $0.0864 by the final presale stage, potentially delivering triple-digit gains for early backers.

The post Bitcoin Pepe price to jump soon as institutional interest in BTC returns appeared first on CoinJournal.

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

![Did I Discover A New Programming Paradigm? [closed]](https://miro.medium.com/v2/resize:fit:1200/format:webp/1*nKR2930riHA4VC7dLwIuxA.gif)

-Classic-Nintendo-GameCube-games-are-coming-to-Nintendo-Switch-2!-00-00-13.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

_Wavebreakmedia_Ltd_FUS1507-1_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![New iPhone 17 Dummy Models Surface in Black and White [Images]](https://www.iclarified.com/images/news/97106/97106/97106-640.jpg)

![Hands-On With 'iPhone 17 Air' Dummy Reveals 'Scary Thin' Design [Video]](https://www.iclarified.com/images/news/97100/97100/97100-640.jpg)