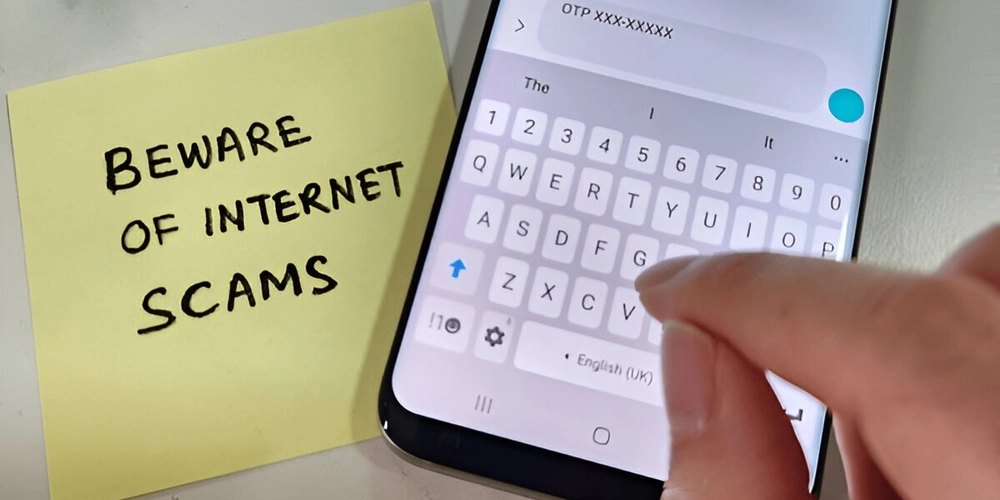

The Rising Threat of OTP Scams and How to Stay Safe

OTP Scam: How to Protect Yourself from Fraud In today's digital world, One-Time Passwords (OTPs) are commonly used as a security measure to verify transactions and logins. However, cybercriminals have found ways to exploit this system through OTP scams. Understanding how these scams work and how to protect yourself is crucial for safeguarding your personal and financial information. Understanding OTP Scams OTP scams occur when fraudsters trick individuals into revealing the one-time passwords sent to their mobile devices. These passwords are typically used for verifying online transactions, logging into accounts, or authorizing changes to account details. Once the scammer obtains the OTP, they can gain unauthorized access to your accounts and carry out fraudulent activities. How OTP Scams Work OTP scams can take various forms, but they generally follow a similar pattern: Impersonation: The scammer poses as a representative from a bank, financial institution, or a trusted service provider. They may contact you via phone call, SMS, or email. Creating Urgency: The scammer creates a sense of urgency, claiming that there is an issue with your account that requires immediate attention. For example, they might say that your account has been compromised or that a suspicious transaction has been detected. Requesting OTP: The scammer asks you to provide the OTP that has been sent to your mobile device. They may claim that they need the OTP to verify your identity or to stop the fraudulent transaction. Unauthorized Access: Once you share the OTP, the scammer uses it to gain access to your account and carry out unauthorized transactions or changes. Common Signs of an OTP Scam Being aware of the common signs of an OTP scam can help you avoid falling victim to fraud: Unsolicited Contact: Be cautious of unsolicited calls, messages, or emails asking for your OTP or personal information. Urgency and Fear Tactics: Scammers often use urgency and fear tactics to pressure you into revealing your OTP. They may threaten to suspend your account or claim that your funds are at risk. Requests for Confidential Information: Legitimate organizations will never ask you to share your OTP, passwords, or other confidential information over the phone or via email. Suspicious Links: Be wary of messages containing links to unfamiliar websites. These links may lead to phishing sites designed to steal your information. How to Protect Yourself from OTP Scams Protecting yourself from OTP scams requires vigilance and awareness. Here are some steps you can take to safeguard your information: Never Share Your OTP: Never share your OTP with anyone, regardless of who they claim to be. Legitimate organizations will never ask for your OTP. Verify the Source: If you receive a suspicious call or message, verify the source by contacting the organization directly using their official contact information. Use Two-Factor Authentication (2FA): Enable 2FA on your accounts to add an extra layer of security. This makes it more difficult for scammers to gain access to your accounts, even if they have your OTP. Monitor Your Accounts: Regularly monitor your bank and financial accounts for any unauthorized transactions. Report any suspicious activity to your bank immediately. Educate Yourself and Others: Stay informed about the latest scams and share this information with friends and family. Awareness is key to preventing fraud. What to Do If You Fall Victim to an OTP Scam If you believe you have fallen victim to an OTP scam, take the following steps immediately: Contact Your Bank: Notify your bank or financial institution about the fraudulent activity. They can help you secure your account and investigate the incident. Change Your Passwords: Change the passwords for your online accounts, especially if you use the same password for multiple accounts. Report the Incident: Report the scam to your local law enforcement agency and any relevant cybercrime reporting platforms. Monitor Your Credit: Keep an eye on your credit report for any unauthorized activity. You can request a free credit report from credit bureaus to check for any suspicious transactions. Conclusion OTP scams are a growing threat in the digital age, but by staying informed and vigilant, you can protect yourself from falling victim to fraud. Remember never to share your OTP with anyone and always verify the source of any suspicious calls or messages. By taking proactive steps to safeguard your information, you can enjoy the convenience of digital transactions while minimizing the risk of fraud. Always try to use authentic software, files, and systems, and educate others about cyber threats. Stay up to date with the latest security practices because, No One Is Ever 100% Safe Online.

OTP Scam: How to Protect Yourself from Fraud

In today's digital world, One-Time Passwords (OTPs) are commonly used as a security measure to verify transactions and logins. However, cybercriminals have found ways to exploit this system through OTP scams. Understanding how these scams work and how to protect yourself is crucial for safeguarding your personal and financial information.

Understanding OTP Scams

OTP scams occur when fraudsters trick individuals into revealing the one-time passwords sent to their mobile devices. These passwords are typically used for verifying online transactions, logging into accounts, or authorizing changes to account details. Once the scammer obtains the OTP, they can gain unauthorized access to your accounts and carry out fraudulent activities.

How OTP Scams Work

OTP scams can take various forms, but they generally follow a similar pattern:

- Impersonation: The scammer poses as a representative from a bank, financial institution, or a trusted service provider. They may contact you via phone call, SMS, or email.

- Creating Urgency: The scammer creates a sense of urgency, claiming that there is an issue with your account that requires immediate attention. For example, they might say that your account has been compromised or that a suspicious transaction has been detected.

- Requesting OTP: The scammer asks you to provide the OTP that has been sent to your mobile device. They may claim that they need the OTP to verify your identity or to stop the fraudulent transaction.

- Unauthorized Access: Once you share the OTP, the scammer uses it to gain access to your account and carry out unauthorized transactions or changes.

Common Signs of an OTP Scam

Being aware of the common signs of an OTP scam can help you avoid falling victim to fraud:

- Unsolicited Contact: Be cautious of unsolicited calls, messages, or emails asking for your OTP or personal information.

- Urgency and Fear Tactics: Scammers often use urgency and fear tactics to pressure you into revealing your OTP. They may threaten to suspend your account or claim that your funds are at risk.

- Requests for Confidential Information: Legitimate organizations will never ask you to share your OTP, passwords, or other confidential information over the phone or via email.

- Suspicious Links: Be wary of messages containing links to unfamiliar websites. These links may lead to phishing sites designed to steal your information.

How to Protect Yourself from OTP Scams

Protecting yourself from OTP scams requires vigilance and awareness. Here are some steps you can take to safeguard your information:

- Never Share Your OTP: Never share your OTP with anyone, regardless of who they claim to be. Legitimate organizations will never ask for your OTP.

- Verify the Source: If you receive a suspicious call or message, verify the source by contacting the organization directly using their official contact information.

- Use Two-Factor Authentication (2FA): Enable 2FA on your accounts to add an extra layer of security. This makes it more difficult for scammers to gain access to your accounts, even if they have your OTP.

- Monitor Your Accounts: Regularly monitor your bank and financial accounts for any unauthorized transactions. Report any suspicious activity to your bank immediately.

- Educate Yourself and Others: Stay informed about the latest scams and share this information with friends and family. Awareness is key to preventing fraud.

What to Do If You Fall Victim to an OTP Scam

If you believe you have fallen victim to an OTP scam, take the following steps immediately:

- Contact Your Bank: Notify your bank or financial institution about the fraudulent activity. They can help you secure your account and investigate the incident.

- Change Your Passwords: Change the passwords for your online accounts, especially if you use the same password for multiple accounts.

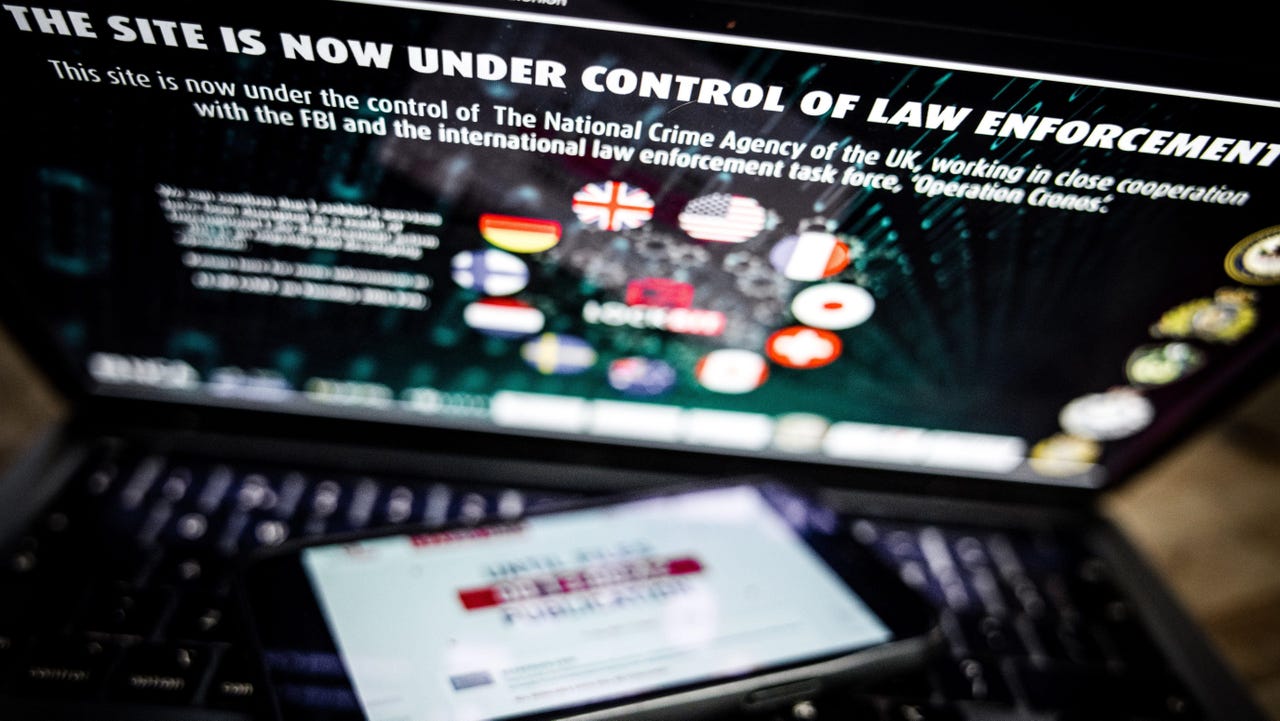

- Report the Incident: Report the scam to your local law enforcement agency and any relevant cybercrime reporting platforms.

- Monitor Your Credit: Keep an eye on your credit report for any unauthorized activity. You can request a free credit report from credit bureaus to check for any suspicious transactions.

Conclusion

OTP scams are a growing threat in the digital age, but by staying informed and vigilant, you can protect yourself from falling victim to fraud. Remember never to share your OTP with anyone and always verify the source of any suspicious calls or messages. By taking proactive steps to safeguard your information, you can enjoy the convenience of digital transactions while minimizing the risk of fraud.

Always try to use authentic software, files, and systems, and educate others about cyber threats. Stay up to date with the latest security practices because, No One Is Ever 100% Safe Online.

![[The AI Show Episode 146]: Rise of “AI-First” Companies, AI Job Disruption, GPT-4o Update Gets Rolled Back, How Big Consulting Firms Use AI, and Meta AI App](https://www.marketingaiinstitute.com/hubfs/ep%20146%20cover.png)

![[DEALS] The ChatGPT & AI Super Bundle (91% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![How to make Developer Friends When You Don't Live in Silicon Valley, with Iraqi Engineer Code;Life [Podcast #172]](https://cdn.hashnode.com/res/hashnode/image/upload/v1747360508340/f07040cd-3eeb-443c-b4fb-370f6a4a14da.png?#)

![Seven tech accessories I keep coming back to [Video]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2025/05/7-tech-accessories-FI-1.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![iPhone 17 Air Could Get a Boost From TDK's New Silicon Battery Tech [Report]](https://www.iclarified.com/images/news/97344/97344/97344-640.jpg)

![Vision Pro Owners Say They Regret $3,500 Purchase [WSJ]](https://www.iclarified.com/images/news/97347/97347/97347-640.jpg)

![Apple Showcases 'Magnifier on Mac' and 'Music Haptics' Accessibility Features [Video]](https://www.iclarified.com/images/news/97343/97343/97343-640.jpg)