Startup news and updates: Daily roundup (February 12, 2025)

YourStory presents the daily news roundup from the Indian startup ecosystem and beyond. Here's the roundup for Wednesday, February 12, 2025.

From SoftBank reporting a Q3 loss due to weak tech investments to ride-hailing app Rapido’s plan to raise Rs 250 crore from global investor Prosus, YourStory brings today’s headlines with the latest developments across sectors.

Featured stories

Aggressive growth, not an IPO, is Zeta’s priority: CEO Bhavin Turakhia

Going public is a top priority for most Indian startup founders, but not for Zeta CEO Bhavin Thurakia. While at least a dozen new-age tech companies have begun discussions with investment bankers for potential listings in the next 12-15 months, Thurakia prefers a more measured approach for Zeta.

The banking technology unicorn has ambitious expansion plans, which may be the reason it's holding off on going public for now.

“We have no plans of any imminent IPO at all, not going to happen for the next several years,” co-founder Bhavin Turakhia told YourStory. “We have fairly aggressive growth plans in terms of client acquisition in the US and India, aggressive growth plans in terms of our revenue,” Turakhia added. Read more.

Jemimah Rodrigues on staying grounded amid the highs and lows of modern-day cricket

India’s star batter Jemimah Rodriguesis elated that women’s cricket is on the rise, and credits the Women’s Premier League (WPL) and the domestic cricket circuit for unearthing exciting new talent and pushing the boundaries.

“The last two WPLs have been a huge success, with new talent and an increasing fan following. Those who are part of the system are getting even better. I remember following domestic cricket this year; it’s gotten even better. 390 runs were chased, which never happened before,” she tells HerStory. Read more.

Latest news

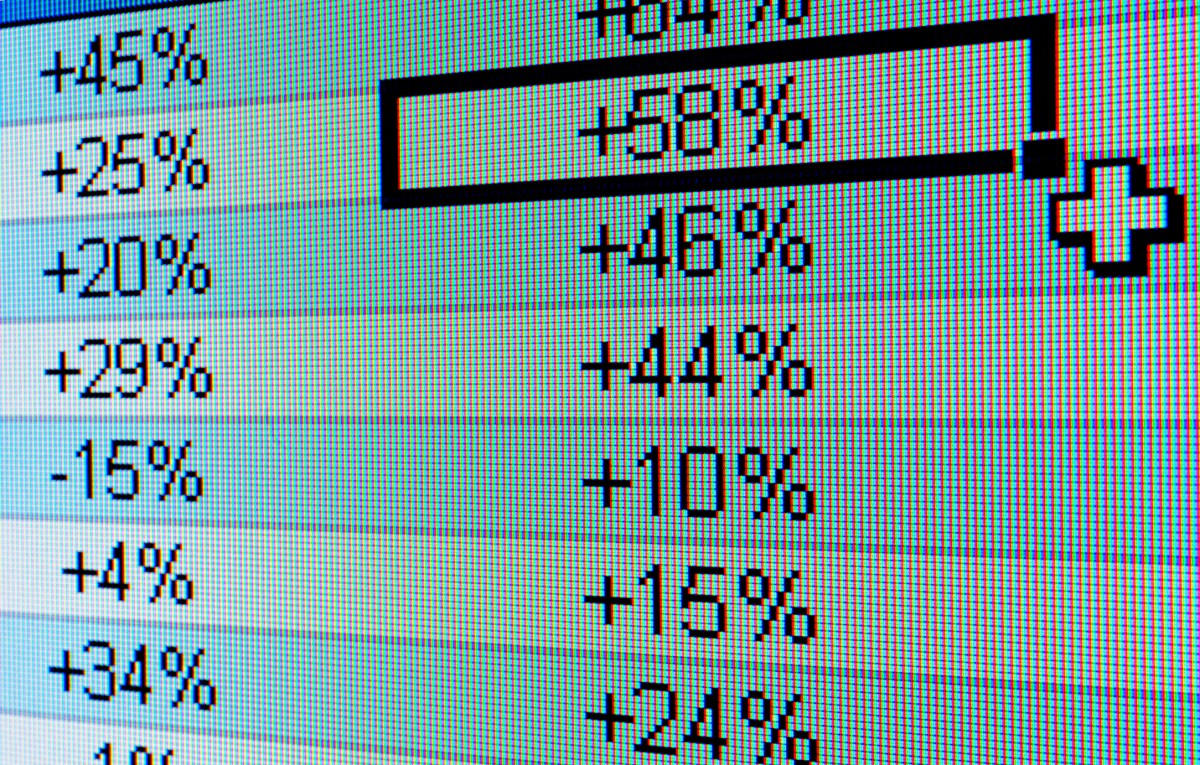

SoftBank swings to loss in Q3 amid lacklustre tech bets

SoftBank Group Corp on Wednesday swung to a loss of 369,165 billion yen ($2.4 billion) in the third quarter of FY24 as shares of some of its top portfolio companies declined sharply during the period.

The Japanese investment conglomerate, led by Masayoshi Son, made investment gains on its Vision Funds portfolio of 260.8 billion yen ($1.69 billion). Vision Funds (SVF1 and SVF2) sold investments totalling $2.98 billion during the period, including DoorDash and SenseTime, and partial exits from several others.

While SoftBank-backed foodtech major Swiggy's listing made a strong public market debut in November, the performance of other portfolio companies was lacklustre during the quarter. Read more.

Freshworks pares down loss by 31% in FY24; Q4 revenue jumps 22%

Software-as-a-service (SaaS) major Freshworkshas pared down its loss by 30.6% to $95.36 million in FY24 from a loss of $137.43 million the previous year. The Nasdaq-listed company saw its operating revenue rise by 20.8% to $720.4 million in FY24, up from $596.4 million in the prior fiscal year.

Additionally, total income grew to $99.1 million, compared to $44.5 million in FY23, the company’s SEC filings showed on Wednesday.

For the fourth quarter ending December 31, 2024, Freshworks reported a 22% growth in revenue, reaching $194.6 million, up from $160.1 million in the same period last year. Net loss for the quarter was $22 million, down from $28 million in the previous year. Read more.

Funding news

Rapido to raise Rs 250 Cr in Series E funding from Prosus

Ride-hailing app Rapido is raising Rs 250 crore from global technology investor Prosus, according to a Registrar of Companies filing.

YourStory had earlier reported that Prosus is eyeing a stake in the Bengaluru-based after the company managed to break the duopoly of US-based Uber and Bhavish Aggarwal-led Ola Consumer in the Indian ride-hailing space.

The latest fundraise will grant Prosus, which made the investment through MIH Investments One B.V., a 2.9% stake in the company. Read more.

Nivaan Care secures $4.25M in seed funding

Nivaan Care, a multidisciplinary chronic pain management clinic chain, has raised $4.25 million in seed funding led by Endiya Partners, with participation from existing investor W Health Ventures.

The funding will support the company’s expansion into 10 new clinics across two cities and the introduction of regenerative medicine treatments, including autologous cell therapies and bioactive scaffolds to enhance patient outcomes. The company focuses on non-surgical, evidence-based solutions for chronic pain management, said Nivesh Khandelwal, Co-founder, Nivaan Care, in an interview with YourStory. Read more.

Mysa raises $2.8 M in seed funding round led by Blume Ventures

Mysa, a unified finance and banking platform for mid-sized businesses, has announced its launch with a seed funding of $2.8 million led by Blume Ventures.

The round also saw participation from Emphasis Ventures (EMVC), Antler, Neon Fund, and CIIIE, along with angel investors, including Sriharsha Majety (Swiggy), Mohit Kumar (Ultrahuman), Naiyaa Saagi (MyGlamm), Nitin Gupta (Uni), and Nishith Rastogi (Locus).

The funding will be used to enhance platform capabilities, grow the team, and drive customer expansion, said the company in a statement. Read more.

Future AGI secures $1.6M in pre-seed funding

AI infrastructure company Future AGI has raised $1.6 million in a pre-seed funding round co-led by Powerhouse Ventures and Snow Leopard Ventures.

The round also saw participation from Angellist Quant Fund, Saka Ventures, Swadharma Source Ventures, and a marquee group of more than 30 industry stalwarts and angels.

The company plans to use the capital to scale its AI lifecycle management platform, strengthen its proprietary technology stack, and grow its engineering and growth teams. Read more.

Vidysea bags $1M in seed round led by Zee Learn, Aarvi Family

Vidysea, an AI-driven study abroad platform, has raised about $1 million in a seed investment round led by Zee Learn Limited and Aarvi Family LLP, with additional contributions from the company’s founders and other shareholders.

The seed funding will support Vidysea in enhancing its product and expanding its team to improve service quality. It will also help advance the platform’s goal of providing unbiased, data-driven insights to assist students in making informed academic and career decisions

“The need for personalised career guidance has never been greater, and we see immense potential in what Vidysea is building. By leveraging technology to provide accurate, unbiased, and personalised recommendations, they are addressing a crucial gap in the industry,” said Manish Rastogi, CEO of ZLL.

Founded in September 2024. Noida startup Vidysea is developing an AI-powered platform to streamline the decision-making process for students seeking further education.

GoRally secures $750,000 pre-seed funding

GoRally, a pickleball chain, has raised Rs 6.6 crore (~$750,000) in a pre-seed funding round led by Sujeet Kumar, Co-founder of Udaan.

The round also saw participation from investors, including Mohit Kumar and Vatsal Singhal (Founders, Ultrahuman), Viren Singhvi (former CFO, American Razor Safety Co), Kartik Kapoor (East Africa Racquet Sports), Abhishek Goyal (Founder and CEO, Tracxn), Deepak Singh (Founder and CEO, Gameskraft and AnzyGlobal), Arjun Vaidya (Founder, V3 Ventures and Dr Vaidya’s), Bharat Founders Fund, an IIT Delhi syndicate, and several US-based investors.

GoRally will use the funding to expand to eight centres with 40 pickleball and two paddle courts by April 2025, including the 40,000 sq. ft. GoRally Whitefield arena. It will launch a tech platform to enhance community engagement, expand coaching with top-ranked players, and grow its equipment retail business.

The company also plans to enter Delhi and Chennai through strategic partnerships while staying operationally profitable.

StepOut raises $500,000 in a seed round led by Rainmatter

StepOut, a sports performance analysis and ecosystem technology startup, raised $500,000 in a seed round led by Rainmatter, the investment fund founded by Zerodha CEO Nithin Kamath. Misfits Capital, founded by Amit Singh, IndigoEdge, and Marwah Sports Group also participated in this seed round.

It will use the funds primarily for international expansion in the US, Australia, the Middle East, and Spain, along with product and AI development.

Founded by Jeet Karmakar and Sayak Ghosh, StepOut is a sports technology company focused on enhancing player and team performance through data and video analysis.

The startup’s AI-powered platform automates data collection and provides insights for all levels of football, from grassroots to elite. By making data more accessible and affordable, StepOut aims to support talent identification and development within the sport. (L to R): Jeet Karmakar, Co-founder & CTO, StepOut; Nithin Kamath, CEO of Zerodh; Sayak Ghosh, Co-founder & CEO, StepOut

Rapture Innovation Labs secures Rs 50 lakh from Peyush Bansal

Rapture Innovation Labs, a deeptech audio startup, secured Rs 50 lakh in funding from Peyush Bansal on Shark Tank India Season 4. This investment, which includes Rs 50 lakh for 1% equity and 1% advisory shares, values the company at Rs 50 crore.

The investment will support Rapture’s expansion by scaling manufacturing to meet demand for Sonic Lamb headphones, advancing hybrid driver technology for headsets and automotive applications, strengthening global marketing with a focus on the US, developing next-generation headphones, and expanding into the premium and luxury automotive audio market.

The startup focuses on innovation, research, and design to develop advanced audio products, including its flagship Sonic Lamb Headphones, which use patented technology.

(This article will be updated with the latest news throughout the day.)

Edited by Suman Singh

![[The AI Show Episode 143]: ChatGPT Revenue Surge, New AGI Timelines, Amazon’s AI Agent, Claude for Education, Model Context Protocol & LLMs Pass the Turing Test](https://www.marketingaiinstitute.com/hubfs/ep%20143%20cover.png)

.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

-Nintendo-Switch-2-Hands-On-Preview-Mario-Kart-World-Impressions-&-More!-00-10-30.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

_Araki-Illustrations-Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

_Andriy_Popov_Alamy.jpg?#)

.png?#)

![Apple Watch to Get visionOS Inspired Refresh, Apple Intelligence Support [Rumor]](https://www.iclarified.com/images/news/96976/96976/96976-640.jpg)

![New Apple Watch Ad Features Real Emergency SOS Rescue [Video]](https://www.iclarified.com/images/news/96973/96973/96973-640.jpg)