Scoop 2.0: How Ankit Chona’s Hocco is stirring up India’s ice cream market

Hocco is betting on logistics infrastructure, in-home consumption, and product innovation to grow its presence in India’s competitive ice cream segment.

Ankit Chona remembers feeling uncertain at the start of his new venture—not because he feared failure, but because he was stepping into an industry where he was already known.

“I was very nervous,” he says, reflecting on his decision to return to the ice cream segment after selling Havmor, a legacy ice cream brand, to South Korea’s Lotte in 2017.

The idea for Hocco emerged organically. “At our restaurants, we were serving other people’s ice cream. One day, we just thought—why not make our own?” he recalls. What began as a small, in-house operation supplying the family’s restaurants gradually evolved into a consumer-facing brand.

Incorporated in 2019, Hocco began commercial operations in 2023.

The startup, based in Gujarat, currently produces 40,000–50,000 litres of ice cream per day, and plans to increase that to 1.3 lakh litres daily by next summer. In FY24, Hocco posted a revenue of ₹200 crore, with a target of ₹400 crore by FY26.

Going back to first principles

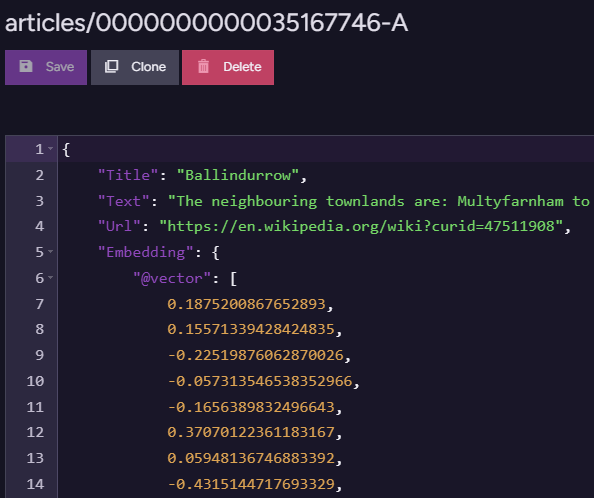

A key part of Hocco’s strategy has been to invest in its own cold chain infrastructure rather than relying on third-party logistics providers. The company operates GPS-enabled, temperature-controlled trucks, in-house cold rooms, and a dedicated logistics team to manage distribution.

“We track every delivery, every freezer, every minute,” Chona says. “If a driver switches off the cooling to save fuel, our system flags it immediately.” Approximately 70% of the company’s total investment so far has gone into backend and supply chain infrastructure, he adds.

This focus on control over logistics, Chona says, has helped Hocco minimise wastage, maintain product quality, and scale efficiently across geographies.

Since launch, Hocco has introduced over 150 SKUs (stock keeping units), including BIX, a house-baked cake sandwich, and the Oh-Cone, a cone topped with a chocolate-coated ball.

To meet the growing demand, the company recently installed an automated cone-making line at its facility.

In June 2024, Hocco launched a premium sub-brand called Huber & Holly, with products such as Salted Caramel Popcorn, Pondicherry Vanilla, and Sicilian Pistachio. These products, which were available only in select parlours, have now been expanded into packaged retail.

Hocco remains strongly rooted in Gujarat, but has expanded to markets such as Delhi-NCR, Maharashtra, Rajasthan, and parts of Uttar Pradesh. Delhi NCR has become a key market, with over 1,400 pushcarts carrying its products.

The quick commerce play

In other regions, where the company does not have an on-ground team, Hocco distributes ice cream solely through quick commerce platforms like Blinkit, Zepto, and Instamart.

Quick commerce currently contributes 7–8% of Hocco’s revenue. Chona expects this figure to rise to around 20% by the next financial year. He credits the format for helping brands like Hocco test markets and expand without the capital-intensive setup traditionally required for new geographies.

“Five years ago, you had to build infrastructure to test a market. Now you can test it on Blinkit,” he says.

He adds that changing consumer habits have also influenced demand. “Most Indian households either don’t have a freezer or have just one. Quick commerce enables in-home and impulse consumption—ice cream can be ordered during or after dinner, without pre-planning or storage.”

The year-round nature of quick commerce has also helped address the seasonality challenge ice cream brands typically face. In colder regions, general trade deep freezers are often turned off in winter months, impacting sales. Quick commerce circumvents this by operating independently of physical retail conditions.

However, Chona acknowledges that working with these platforms involves higher operational costs, including platform fees and discounting requirements. “But the logistics are simpler, platforms manage their own backend,” he says.

Second innings

Though Hocco is a relatively new brand, Chona and his team bring years of experience from their time operating Havmor. He says this familiarity with trade dynamics, manufacturing, and distribution has helped ease the brand’s entry into a competitive market.

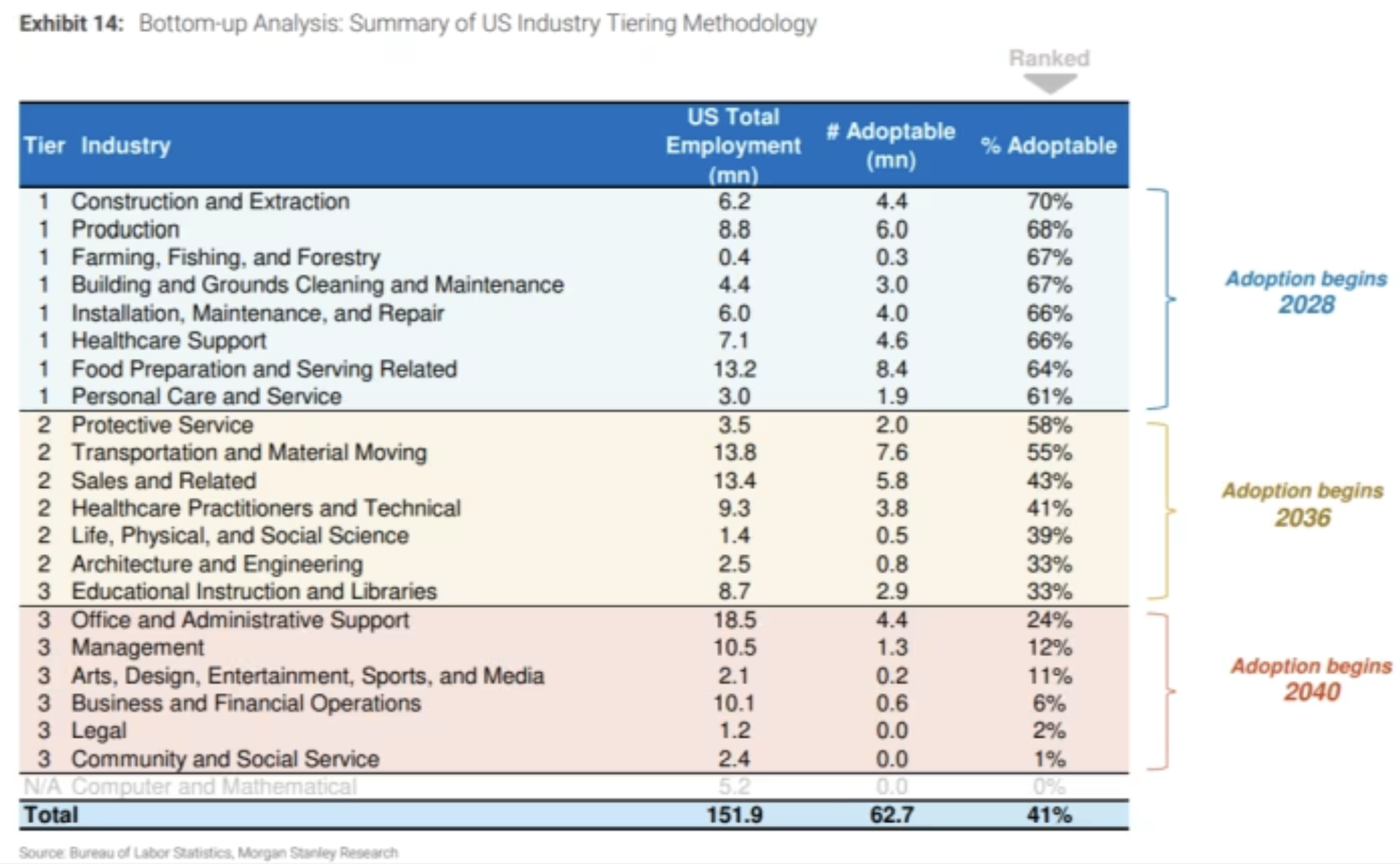

At the same time, the ice industry is also going through a shift. In FY25, the industry is projected to be worth north of $5 billion, according to the Wazir Advisors report, driven by domestic brands expanding beyond metro cities and the growing presence of international players. To capitalise on this momentum, HUL is spinning off its ice cream business, which includes brands like Kwality Wall’s, into a separately listed entity.

To support expansion, the company has focused on building a professional team and culture. Hocco offers long-term ESOPs and has brought in senior managers from outside the family business. “The same 200-member team that once sold ₹1 crore a month is now doing ₹10 crore,” Chona says.

In June 2024, Hocco raised ₹100 crore (approximately $12 million) in a funding round led by its promoter group and existing investor Sauce.vc, with participation from angel investors including film producers Ritesh Sidhwani and Farhan Akhtar. The round valued the company at ₹600 crore post-investment.

Manu Chandra, Founder of Sauce.vc, says, Hocco’s growth trajectory reflects a combination of institutional knowledge and nimble execution. “Ankit is running a traditional business with a startup mindset,” he says. “What stood out was the decision to launch in Gujarat, a region long dominated by legacy brands like Amul and Vadilal.”

According to Chandra, Hocco’s manufacturing expertise and ability to operate efficiently have helped it remain CM2-positive while growing rapidly.

Hocco is not attempting to replicate the Havmor brand, but it is drawing from its legacy. Chona believes that familiarity with the trade, combined with investments in infrastructure and new distribution models, has positioned the company for scale.

Whether the brand can sustain this momentum remains to be seen, but the early signs point to a business that is applying lessons from the past while responding to the demands of a changing consumer landscape.

Edited by Megha Reddy

![[The AI Show Episode 146]: Rise of “AI-First” Companies, AI Job Disruption, GPT-4o Update Gets Rolled Back, How Big Consulting Firms Use AI, and Meta AI App](https://www.marketingaiinstitute.com/hubfs/ep%20146%20cover.png)

![[DEALS] The ChatGPT & AI Super Bundle (91% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![How to make Developer Friends When You Don't Live in Silicon Valley, with Iraqi Engineer Code;Life [Podcast #172]](https://cdn.hashnode.com/res/hashnode/image/upload/v1747360508340/f07040cd-3eeb-443c-b4fb-370f6a4a14da.png?#)

![Apple May Not Update AirPods Until 2026, Lighter AirPods Max Coming in 2027 [Kuo]](https://www.iclarified.com/images/news/97350/97350/97350-640.jpg)

![iPhone 17 Air Could Get a Boost From TDK's New Silicon Battery Tech [Report]](https://www.iclarified.com/images/news/97344/97344/97344-640.jpg)

![Vision Pro Owners Say They Regret $3,500 Purchase [WSJ]](https://www.iclarified.com/images/news/97347/97347/97347-640.jpg)