From CapEx to OpEx: How asset management as a service is redefining EV ownership in India

As India transitions to electric mobility, success will depend not on ideology, but on practical, flexible, and tech-integrated asset management solutions that minimise risk and maximise operational efficiency.

Electric vehicles in commercial fleet application are going to fundamentally disrupt logistics, financing, and ownership experience. Unlike internal combustion engine (ICE) vehicles, EVs demand a rethink—not just in terms of how we build and power vehicles, but also in how we own, operate, and manage them.

The traditional models that served the auto industry for over a century—large upfront investments, high downtimes, unanticipated servicing costs—will be disrupted by new age ownership models, data enabled preventive and predictive diagnostics and low maintenance EV fleets.

In today’s environment, an integrated product suite is required to optimise the total cost of ownership of the fleet, improving the overall utilisation and vehicle uptime.

Instead of incurring high upfront costs for vehicle purchase (CapEx), fleet operators and logistics businesses can now treat EVs as an operating expense (OpEx) with Fleet as a Service (FaaS) model. This change doesn’t just lighten the financial burden, it gives operators the flexibility to adapt to fast-moving technology cycles. The idea is simple: treat mobility not as a product to own, but as a service to consume with assured performance.

Let us see how this model is unfolding across three distinct stages of an Electric Vehicle’s life—before it hits the road, while it is in operation, and after it retires.

Before delivery

Even with government subsidies and incentive schemes, Electric vehicles are inherently expensive than their ICE counterparts. For logistics operators, this has traditionally meant heavier upfront costs, blocking precious capital that would usually be utilised for expanding the business and meeting operational expenses.

Leasing of EVs, with significantly lower down payments and an all-inclusive model that include vehicle maintenance, tire replacement, and assured service level agreements backed by data, provides a scalable way for fleets to expand in a capital efficient and risk-free manner. With the right leasing models, not only can fleets reduce their CapEx burden, but with the same capital they can now deploy up to 62% more number of vehicles. This is a major unlock for fleet operators chasing scale.

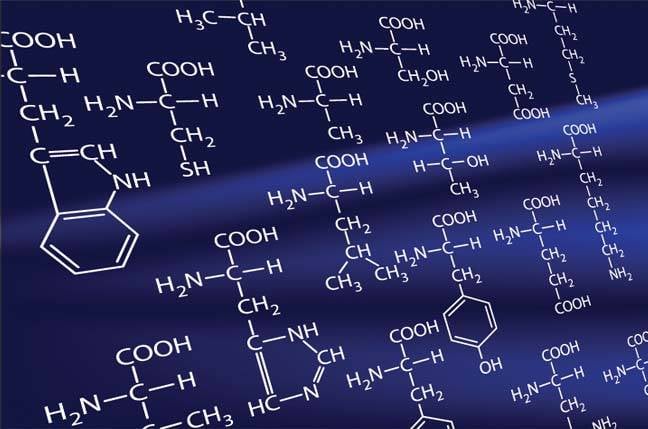

But financing alone is not the point. It is about designing an ecosystem that removes operational blind spots and unpredictable costs. From tailored OEM partnerships with preferred warranties and SLAs to ensuring that the parts used in the vehicle are readily available in market at optimal price, right vehicle selection is a critical benchmark for ensuring return on investment. The right vehicle with proven battery technology can provide desired range over extended periods of time, with minimal battery health degradation, bankable warranties, lifetime servicing and battery replacement costs that ensure business viability in the long run.

The idea is to remove friction at every stage. Whether you are deploying five vehicles or five hundred, the right leasing partner can help evaluate total cost of ownership upfront, assess business usage profiles, and match them with suitable vehicle and tailor-made financing or leasing plan.

During use

Post-delivery, EV ownership has its own rhythm. Unlike ICE vehicles, where mechanical issues tend to be visible and progressive, issues in EVs generally show up in the battery and software layers. Here, the traditional service models fall short and the vast ecosystem of garages cannot handle the problems faced in the drivetrain.

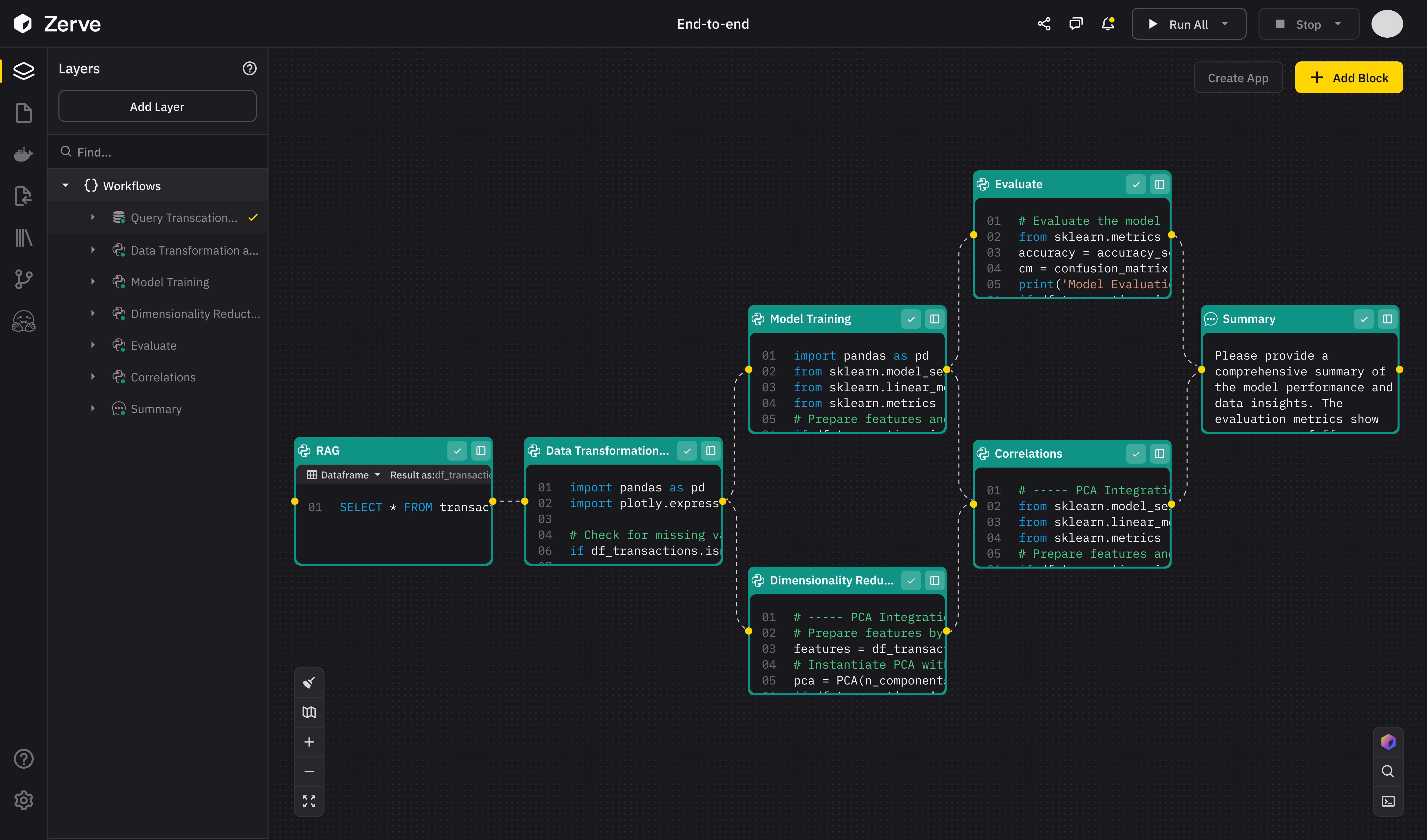

With Asset Management as a Service, both the vehicle as well as battery warranties are traceable, SLAs are proactive, and service is not a patchwork—it is integrated. Instead of waiting for a breakdown, fleet operators can act on predictive alerts generated through advanced telematics. Predictive diagnostics track battery and vehicle health, monitor battery degradation, and issue alerts much before a potential breakdown occurs.

This is also not just about technology. It is about economics. With structured service plans and dedicated support teams, operators can reduce total cost of ownership by 15% compared to conventional financing. Real-time fleet visibility helps ensure optimal asset utilisation, whether it is monitoring idle time, scheduling preventive maintenance, or fine-tuning charging patterns. In a business where margins are tight and uptime is everything, this kind of operational edge makes all the difference.

After-life

What happens to the EV when it is past its prime? In the ICE world, resale value is mostly a function of mileage and age. With EVs, battery condition is just as critical. That means residual value isn’t a guessing game anymore—it is a calculated outcome, based on actual usage data.

AMaaS providers bring transparency to this part of the lifecycle too. By monitoring battery health over the entire vehicle lifecycle, ‘remaining useful battery health’ can be estimated and benchmarked against OEM warranties. Batteries can then be refurbished for extended life or replaced to give the vehicle an entirely new life. Operators have options to choose from—upgrade paths, trade-ins, or redeployment—all with the assurance that the asset value is not a shot in the dark.

Battery refurbishment plays a key role in extending life while lowering environmental impact. By planning for second-life use or responsible recycling, fleet operators can meet sustainability goals without absorbing the complexity of managing it all in-house.

Final thought

India’s electric mobility transition cannot be driven by ideology—it needs to be driven by practical economics. Asset Management as a Service respects this truth. It does not require a logistics operator to gamble on fast-changing battery chemistries or bet the business on unknown residual values. It offers a model that keeps pace with innovation without locking businesses into long-term risks.

This approach does not just serve fleet operators—it supports a broader ecosystem. When more drivers can access vehicles through flexible lease models, when battery risks are absorbed by specialised partners, and when financiers see clearer asset value, the whole chain gets stronger.

As we contribute towards building the future of mobility in India, the goal should not be to replicate ICE-era models for EVs. There has never been a stakeholder in the vehicle ecosystem who’s taken the responsibility for vehicle uptime–a critical performance metric that dominates all others–be it for an individual driver, a fleet operator, or a business. With smart and connected electric vehicles, controlling and optimising vehicle uptime becomes a reality. OEMs, fleet operators, and traditional financiers lack the expertise or the financial incentives to own this metric. Traditional software companies and advanced telematics’ platforms can build great software but lack the technical insights on batteries or reliable vehicle data. A specialised partner is needed with expertise in the intersection of battery, financing, and technology to truly provide value to EV asset management

(Dev Arora is the Founder & CEO at Alt Mobility)

Edited by Megha Reddy

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)

![[The AI Show Episode 147]: OpenAI Abandons For-Profit Plan, AI College Cheating Epidemic, Apple Says AI Will Replace Search Engines & HubSpot’s AI-First Scorecard](https://www.marketingaiinstitute.com/hubfs/ep%20147%20cover.png)

.jpeg?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

![Apple Working on Brain-Controlled iPhone With Synchron [Report]](https://www.iclarified.com/images/news/97312/97312/97312-640.jpg)