Rs 30 Lakh Crore MSME Credit Gap: Who’s getting left behind?

India’s MSMEs face a Rs.30 lakh crore credit gap despite reforms. Why is access still broken—and who’s falling through the cracks?

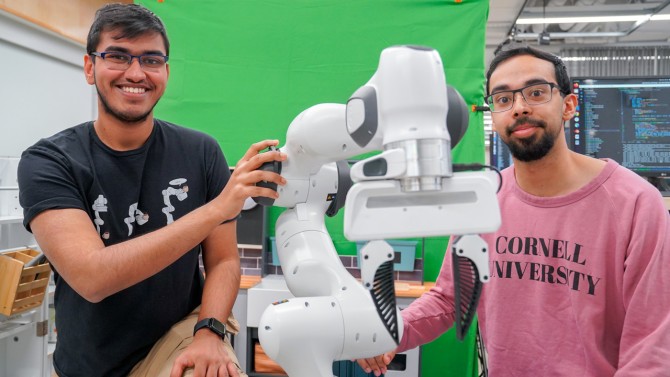

India’s Micro, Small, and Medium Enterprises (MSMEs) are the unsung workhorses of the economy—contributing around 30% to the GDP, generating over 26 crore jobs, and accounting for nearly 46% of exports. Yet, behind these impressive numbers lies a troubling reality: MSMEs face an estimated credit gap of ₹30 lakh crore, according to a recent SIDBI-Crisil report.

Despite increased credit flow and targeted government schemes, access to timely and adequate formal credit remains a persistent challenge, especially for micro enterprises and women-led businesses.

Why Does the Credit Gap Exist?

Several factors have created this yawning chasm between credit demand and supply:

- Lack of formalisation: 35% of MSMEs surveyed remain unregistered, cutting themselves off from formal financial systems and government schemes.

- Collateral and credit history: Most MSMEs, especially micro enterprises, lack the assets or financial records required by traditional lenders.

- Low financial literacy: Many entrepreneurs are unaware of available credit schemes or struggle to navigate complex loan application processes.

- Risk aversion among lenders: Banks often hesitate to lend to small businesses perceived as high-risk, despite mechanisms like the Credit Guarantee Fund.

These issues are more pronounced in rural areas, where the credit gap touches 32%, compared to 20% in urban regions. The gap is also sector-specific—highest in trading MSMEs (33%), followed by services (27%) and manufacturing (20%).

Women Entrepreneurs Face an Even Steeper Climb

Although 26.2% of proprietary MSMEs are now women-led—a notable sign of social progress—these businesses remain financially disadvantaged. The credit offtake for women-owned MSMEs stands at 76%, compared to 84% for men. Worse, they face a higher dependency on informal credit and have the highest addressable credit gap at 35%.

Lack of networking opportunities, social barriers, and limited access to collateral amplify their financial challenges.

Digital lending shows promise—but is still nascent

Digital lending is emerging as a potential solution. Over 90% of MSMEs surveyed accept digital payments, suggesting high readiness. Yet, only 18% have availed digital loans so far.

Fintechs, NBFCs, and government initiatives like the new digital credit assessment model (announced in Budget 2024-25) aim to bridge this divide. Sectors like food processing, hotels, and RMG show strong digital presence and are ripe for credit via digital channels.

What Do MSMEs Need? Simplification, Subsidies, and Awareness

MSMEs surveyed asked for:

- Subsidies and grants (22%)

- Reduced documentation requirements (19%)

- Awareness of schemes (14%)

- Lower interest rates and easier digital credit access

Alternative financing models like TReDS, capital markets, and crowdfunding are also gaining traction—but need better awareness and policy support.

The Road Ahead

Bridging the ₹30 lakh crore credit gap is not just about economic arithmetic—it’s about unlocking the potential of over 7 crore enterprises that power India’s grassroots growth. Strengthening credit infrastructure, enabling collateral-free lending, and prioritising gender and regional equity are essential if India wants its MSMEs to be the drivers of a $5 trillion economy.

![89 million Steam accounts reportedly leaked. Change your password now. [Updated]](https://helios-i.mashable.com/imagery/articles/05mKEv2HKG7EgiHKtximy17/hero-image.fill.size_1200x675.v1747231462.jpg)

![[The AI Show Episode 147]: OpenAI Abandons For-Profit Plan, AI College Cheating Epidemic, Apple Says AI Will Replace Search Engines & HubSpot’s AI-First Scorecard](https://www.marketingaiinstitute.com/hubfs/ep%20147%20cover.png)

![How to Enable Remote Access on Windows 10 [Allow RDP]](https://bigdataanalyticsnews.com/wp-content/uploads/2025/05/remote-access-windows.jpg)

![[DEALS] The 2025 Ultimate GenAI Masterclass Bundle (87% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![Legends Reborn tier list of best heroes for each class [May 2025]](https://media.pocketgamer.com/artwork/na-33360-1656320479/pg-magnum-quest-fi-1.jpeg?#)

-Olekcii_Mach_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

_Brian_Jackson_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Watch Aston Martin and Top Gear Show Off Apple CarPlay Ultra [Video]](https://www.iclarified.com/images/news/97336/97336/97336-640.jpg)

![Trump Tells Cook to Stop Building iPhones in India and Build in the U.S. Instead [Video]](https://www.iclarified.com/images/news/97329/97329/97329-640.jpg)