Roku is doing what most of its rivals won’t

Roku is spending $185 million to get into a business that most other streaming platforms have avoided. In early May, the company announced that it will acquire Frndly TV, the cheapest of all the live TV streaming services. For $9 per month, Frndly TV offers a bundle of channels you’d typically find in a cable TV package, including Hallmark, A&E, and The Weather Channel. While it’s normal for streaming platforms to offer their own free or premium streaming services, most aren’t selling their own bundles of cable channels with optional DVR service. Roku is doing something pretty unusual here, and while it says it’s just trying to boost subscription revenues on its platform, that doesn’t sound like the whole story to me. How Frndly fits in Frndly TV is what’s known in industry jargon as a “virtual Multichannel Video Programming Distributor,” or vMVPD. You could also use the terms live TV streaming services, streaming channel bundles, or cable replacements. Whatever the nomenclature, the point is that these are essentially cable TV packages delivered over the internet. You get a big bucket of cable channels, a grid-based channel guide to flip through, and DVR functionality for recording live airings and watching them at your leisure. Most major streaming platforms have stayed out of this business, which involves cutting carriage deals with numerous TV programmers (and dealing with the risk of blackouts when renewal negotiations fail). It’s a messy business and one that’s barely profitable, if at all. So while you can access services like Hulu + Live TV and Fubo on a Fire TV Stick or Apple TV 4K, Amazon and Apple haven’t bothered putting together channel bundles of their own. (The only exception is Google, which operates YouTube TV and has its own Google TV/Android TV streaming platform.) Nonetheless, Roku sees an opportunity in Frndly TV, which claimed to be profitable in 2022. While Roku once described itself as an advertising company, lately it’s been talking up its plans to grow subscription revenue as well. The company already gets a cut when users subscribe to services on its platform, but with Frndly TV it can claim 100 percent of the revenue for itself. The near-term playbook, then, will look like it did for the Roku Channel, the ad-supported streaming service Roku launched in 2017. Roku makes more money when people watch the Roku Channel instead of other ad-supported services, so it’s aggressively promoted its own service in practically every corner of its home screen. The company has made no secret of its plans to do the same for Frndly TV. “We’re going to use [the platform] to drive Frndly, which is now part of Roku,” CEO Anthony Wood said during an earnings call. Thinking bigger If all Roku does with Frndly TV is use its home screen to peddle more Frndly TV subscriptions, that’d be pretty boring. And maybe that is the entire strategy. But my theory is that Roku will use Frndly TV as the first step toward offering a broader lineup of pay TV channels. Frndly TV, after all, is a niche within a niche, with channels that focus largely on reality TV and reruns. It carries none of the top 10 cable channels and only eight of the top 50. None of those channels cover news or sports. As of late 2022, Frndly TV had a mere 700,000 subscribers. By entering the vMVPD business, Roku instantly becomes a major player that can negotiate more and better carriage deals on behalf of its 90 million households. It would be weird if those efforts started and ended with whichever programmer has the syndication rights for Columbo and Bonanza. An equally plausible outcome is that Roku expands its channel offerings over time, taking advantage of TV programmers’ newfound willingness to allow for more flexible bundles. It could then tie those offerings into its home screen and live TV guide, with a built-in billing system to manage subscriptions. For folks who still have cable or just want an easy way to access cable channels, Roku could present itself as the simplest solution. I’ve always wondered why no streaming platform has done this—here’s me arguing for Apple to do it in 2017—and now Roku is in the best position to pull it off. Sign up for Jared’s Cord Cutter weekly newsletter to get more streaming advice every Friday

Roku is spending $185 million to get into a business that most other streaming platforms have avoided.

In early May, the company announced that it will acquire Frndly TV, the cheapest of all the live TV streaming services. For $9 per month, Frndly TV offers a bundle of channels you’d typically find in a cable TV package, including Hallmark, A&E, and The Weather Channel.

While it’s normal for streaming platforms to offer their own free or premium streaming services, most aren’t selling their own bundles of cable channels with optional DVR service. Roku is doing something pretty unusual here, and while it says it’s just trying to boost subscription revenues on its platform, that doesn’t sound like the whole story to me.

How Frndly fits in

Frndly TV is what’s known in industry jargon as a “virtual Multichannel Video Programming Distributor,” or vMVPD. You could also use the terms live TV streaming services, streaming channel bundles, or cable replacements.

Whatever the nomenclature, the point is that these are essentially cable TV packages delivered over the internet. You get a big bucket of cable channels, a grid-based channel guide to flip through, and DVR functionality for recording live airings and watching them at your leisure.

Most major streaming platforms have stayed out of this business, which involves cutting carriage deals with numerous TV programmers (and dealing with the risk of blackouts when renewal negotiations fail). It’s a messy business and one that’s barely profitable, if at all.

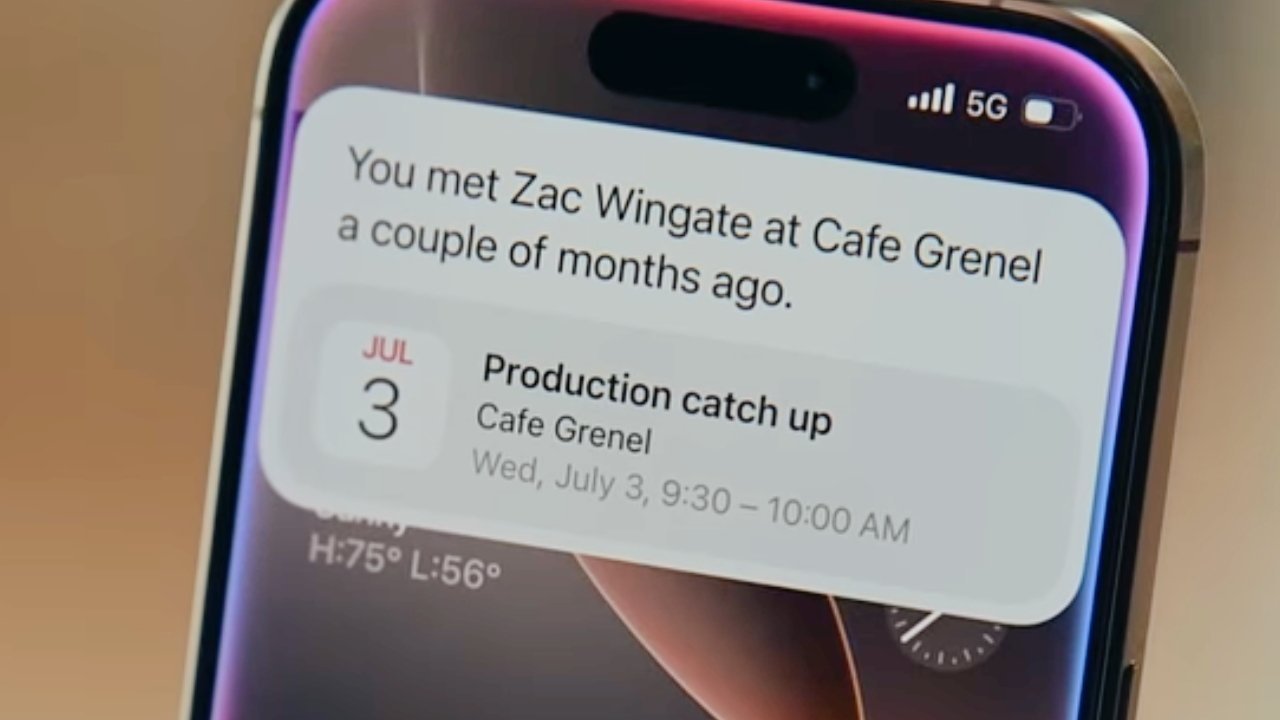

So while you can access services like Hulu + Live TV and Fubo on a Fire TV Stick or Apple TV 4K, Amazon and Apple haven’t bothered putting together channel bundles of their own. (The only exception is Google, which operates YouTube TV and has its own Google TV/Android TV streaming platform.)

Nonetheless, Roku sees an opportunity in Frndly TV, which claimed to be profitable in 2022. While Roku once described itself as an advertising company, lately it’s been talking up its plans to grow subscription revenue as well. The company already gets a cut when users subscribe to services on its platform, but with Frndly TV it can claim 100 percent of the revenue for itself.

The near-term playbook, then, will look like it did for the Roku Channel, the ad-supported streaming service Roku launched in 2017. Roku makes more money when people watch the Roku Channel instead of other ad-supported services, so it’s aggressively promoted its own service in practically every corner of its home screen.

The company has made no secret of its plans to do the same for Frndly TV. “We’re going to use [the platform] to drive Frndly, which is now part of Roku,” CEO Anthony Wood said during an earnings call.

Thinking bigger

If all Roku does with Frndly TV is use its home screen to peddle more Frndly TV subscriptions, that’d be pretty boring. And maybe that is the entire strategy. But my theory is that Roku will use Frndly TV as the first step toward offering a broader lineup of pay TV channels.

Frndly TV, after all, is a niche within a niche, with channels that focus largely on reality TV and reruns. It carries none of the top 10 cable channels and only eight of the top 50. None of those channels cover news or sports. As of late 2022, Frndly TV had a mere 700,000 subscribers.

By entering the vMVPD business, Roku instantly becomes a major player that can negotiate more and better carriage deals on behalf of its 90 million households. It would be weird if those efforts started and ended with whichever programmer has the syndication rights for Columbo and Bonanza.

An equally plausible outcome is that Roku expands its channel offerings over time, taking advantage of TV programmers’ newfound willingness to allow for more flexible bundles. It could then tie those offerings into its home screen and live TV guide, with a built-in billing system to manage subscriptions. For folks who still have cable or just want an easy way to access cable channels, Roku could present itself as the simplest solution.

I’ve always wondered why no streaming platform has done this—here’s me arguing for Apple to do it in 2017—and now Roku is in the best position to pull it off.

Sign up for Jared’s Cord Cutter weekly newsletter to get more streaming advice every Friday

![[The AI Show Episode 147]: OpenAI Abandons For-Profit Plan, AI College Cheating Epidemic, Apple Says AI Will Replace Search Engines & HubSpot’s AI-First Scorecard](https://www.marketingaiinstitute.com/hubfs/ep%20147%20cover.png)

_Gang_Liu_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Review: Sonnet Echo 13 Thunderbolt 5 SSD Dock – 140W MacBook charging, 2.5GbE, up to 6000 MB/s SSD speed [Video]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2025/05/Sonnet-Echo-13-Thunderbolt-5-SSD-Dock-Review-1.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Apple Planning Bezel-Free iPhone With 'Four-Sided Bending' Display [Report]](https://www.iclarified.com/images/news/97321/97321/97321-640.jpg)

![Apple Working on Brain-Controlled iPhone With Synchron [Report]](https://www.iclarified.com/images/news/97312/97312/97312-640.jpg)