Meet the YCombinator of Tamil Nadu; Roadmap to India’s deeptech dreams

Chennai-based MudhalVC is investing Rs 25 crore across 50 idea-stage startups, by mentoring founders, helping them build core competencies, achieve early product-market fit, and survive long enough to attract larger investments.

Hello,

Investors are gaining big returns from Indian bets.

VC firm Elevation Capital netted a 25X return from further trimming down its stake in travel tech company ixigo. It sold 21.5 lakh equity shares for Rs 178 apiece, which it had purchased from the company at Rs 7.14 apiece.

Last week was busy too with investors cashing in on their stakes.

growX Ventures Fund made a partial exit from space tech company Pixxel, generating a 17X multiple on invested capital. This comes right on the heels of Peak XV Partners’ Rs 1,200 crore windfall and 11X return from exiting logistics startup Porter.

Speaking of big numbers, ecommerce enablement platform Shiprocket is expected to file confidential draft papers with SEBI for its upcoming IPO as it aims to raise Rs 2,000-2,500 crore.

However, not everyone is happy with their balance sheets.

Digital financial services platform Mobikwik swung to a loss of Rs 121 crore in FY25, compared with a profit of Rs 14 crore in FY24. Growth in its payments business failed to offset mounting expenses and a slowdown in its credit distribution segment.

It’s all a numbers game.

In today’s newsletter, we will talk about

- MudhalVC’s grassroots startup push

- Roadmap to India’s deeptech dreams

- Breakfast with a twist

Here’s your trivia for today: Queen Elizabeth II owned a branch of which fast food brand?

Interview

MudhalVC’s grassroots startup push

When Y Combinator was launched in 2005, little did its founders—Paul Graham and Jessica Livingston—know that nurturing scrappy startups early on would lay the foundation for a whole ecosystem.

Chennai-based MudhalVC is bringing that same spirit to Tamil Nadu. The VC firm is now investing Rs 25 crore across 50 idea-stage startups, by mentoring founders, helping them build core competencies, achieve early product-market fit, and survive long enough to attract larger investments.

Idea-stage investments:

- As of now, the firm has a Rs 25 crore idea-stage fund, has already invested in 15 companies and plans to deploy the rest over the next two-plus years. Afterwards, it intends to raise Rs 100 crore from limited partners for its second-stage growth fund.

- MudhalVC is sector-agnostic but geographically focused towards founders building from Tamil Nadu. The state has strong talent, policies, and mentors—but lacks risk capital. As a result, startups often migrate to Bengaluru in search of funding.

- The VC firm also runs monthly founder workshops through its founder-driven community, Idea Pattarai, in cities like Chennai, Madurai, Tiruchi, and Coimbatore. The workshops involve a knowledge-sharing session on startup basics, followed by a pitch teardown.

Funding Alert

Startup: CureBay

Amount: $21M

Round: Series B

Startup: CloudSEK

Amount: $19M

Round: Series A2 and B1

Startup: Biostate AI

Amount: $12M

Round: Series A

Interview

Roadmap to India’s deeptech dreams

In a highly competitive landscape dominated by fast-moving, heavily funded ecommerce brands, deeptech startups like Agnikul are following a different playbook—building for strategic, long-term impact, not just market shares.

What would it take for India to lead the world in building deeptech capabilities? That question was at the heart of a wide-ranging conversation between YourStory Founder and CEO Shradha Sharma, Vishesh Rajaram, Managing Partner at the deeptech-focused, early-stage fund Speciale Invest, and Prabhu Rangarajan, co-founder of fintech infrastructure platform, M2P Fintech.

Deeptech dreams:

- For Prabhu, the fundamental question is whether India is a product country, and can build products which become household names. One of the benefits of developing a product mindset, he believes, is the ability and inclination to look ahead and build something for the future, which India needs to pursue deeptech.

- According to Vishesh, deeptech is about creating things that don’t exist, which often don’t exist because something has changed in the industry which is altering the status quo.

- For Vishesh, solving the capital question is vital as AI “can supercharge national productivity.” Policies like the AI mission require capital for infrastructure, which needs to be disbursed over a long period of time.

Startup

Breakfast with a twist

Despite the rising awareness around fitness and wellness, one core challenge persists: healthy food often doesn’t taste good enough to keep people coming back.

The leap from comfort food to clean eating is usually too steep, making it hard to build lasting habits. GOAT Life, a new-age food startup founded by 25-year-old Yash Kalra, is attempting to take this problem head-on—with oats.

Healthy habits:

- GOAT Life (formerly known as GoOAT) is a ready-to-consume oatmeal-based product that can be consumed in both drinkable and eatable formats. It is quick to prepare—ready in about 30 seconds.

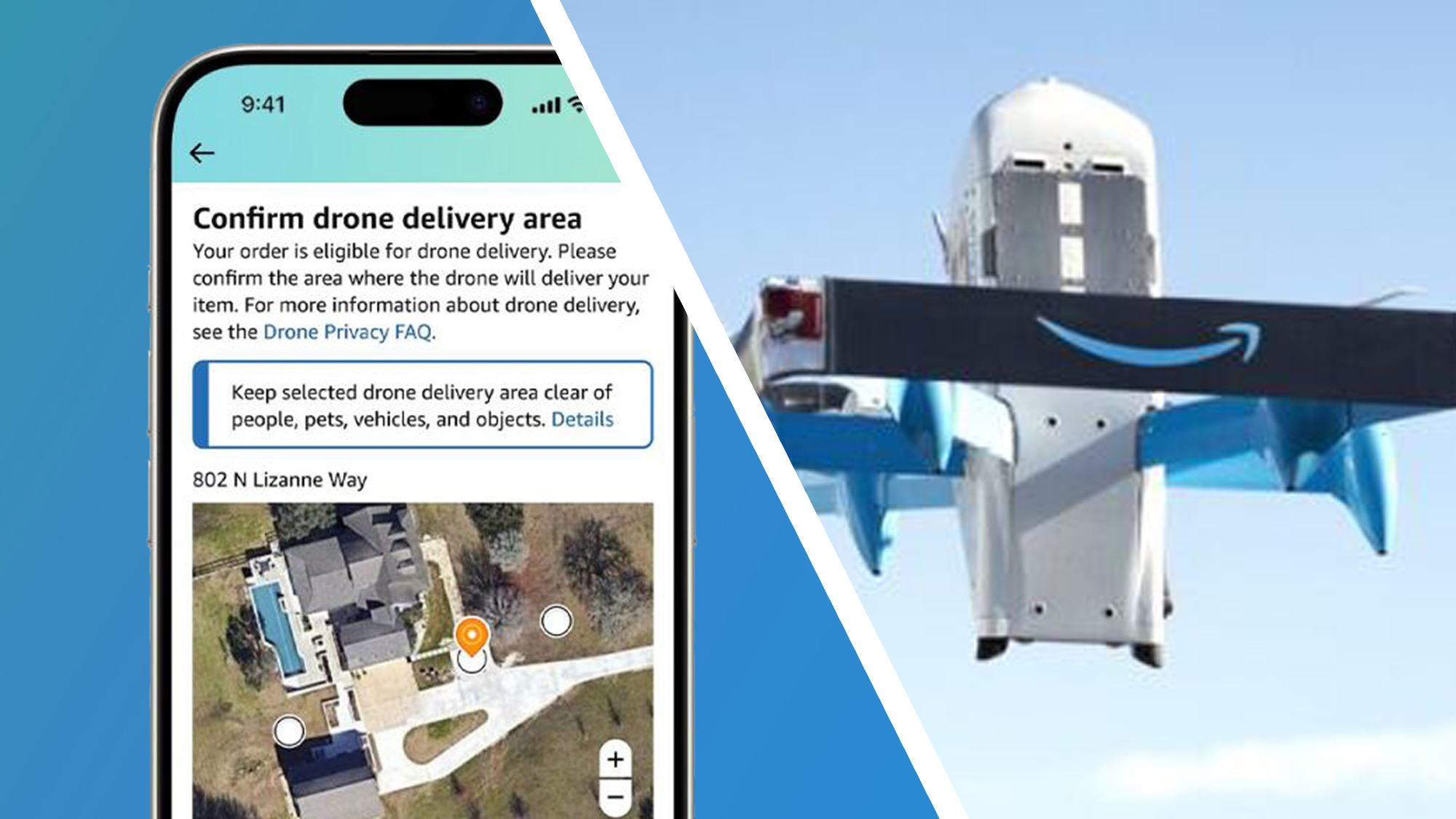

- The startup operates its own facility in Kota, Rajasthan, where the team manages the entire process—from sourcing raw materials to manufacturing and fulfilling orders for Amazon and its own website.

- The startup’s current revenue comes from marketplaces like Amazon, its own website, and B2B channels. At the moment, the company is clocking about Rs 10 lakh in monthly revenue, growing 2-3X from last month, claims the founder.

News & updates

- Shifting focus: Elon Musk said he plans to significantly cut political spending and is committed to staying on as Tesla's CEO for another five years, aiming to address concerns about balancing his role at the automaker with his involvement in the Trump administration.

- Stellar debut: Contemporary Amperex Technology Co Ltd jumped in its Hong Kong trading debut after the Chinese battery giant wrapped up the world’s biggest listing this year by raising $4.6 billion despite grinding through geopolitical storms.

- Upbeat outlook: Vodafone Group plans about $2.3 billion in share buybacks and forecasts a return to top-line growth in Germany, as the company works to dial up its performance in its biggest market.

Queen Elizabeth II owned a branch of which fast food brand?

Answer: McDonald’s.

We would love to hear from you! To let us know what you liked and disliked about our newsletter, please mail nslfeedback@yourstory.com.

If you don’t already get this newsletter in your inbox, sign up here. For past editions of the YourStory Buzz, you can check our Daily Capsule page here.

![[The AI Show Episode 148]: Microsoft’s Quiet AI Layoffs, US Copyright Office’s Bombshell AI Guidance, 2025 State of Marketing AI Report, and OpenAI Codex](https://www.marketingaiinstitute.com/hubfs/ep%20148%20cover%20%281%29.png)

![[The AI Show Episode 146]: Rise of “AI-First” Companies, AI Job Disruption, GPT-4o Update Gets Rolled Back, How Big Consulting Firms Use AI, and Meta AI App](https://www.marketingaiinstitute.com/hubfs/ep%20146%20cover.png)

.jpg?#)

.jpg?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

_pichetw_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Apple Leads Global Wireless Earbuds Market in Q1 2025 [Chart]](https://www.iclarified.com/images/news/97394/97394/97394-640.jpg)

![OpenAI Acquires Jony Ive's 'io' to Build Next-Gen AI Devices [Video]](https://www.iclarified.com/images/news/97399/97399/97399-640.jpg)

![Apple Shares Teaser for 'Chief of War' Starring Jason Momoa [Video]](https://www.iclarified.com/images/news/97400/97400/97400-640.jpg)