Klarna enlists AI-generated CEO video to deliver its earnings as BNPL firm racks up losses

Klarna just announced its first quarter 2025 financial results, and they show that a larger chunk of customers are buying now and not paying later. This morning, the Swedish “buy now, pay later” (BNPL) fintech company gave consumers a look at its performance for the first three months of 2025. The news came in the form of a press release and an accompanying AI-generated video of CEO Sebastian Siemiatkowski (likely as a play to emphasize Klarna’s all-in approach to AI.) In the video, Siemiatkowski’s look-alike shared that Klarna has “started the year strong,” hitting 100 active users in the first quarter and $701 million in revenue, a 15% year-over-year increase. But there’s a caveat: Although Klarna has grown this year, it’s also doubled its net losses from $47 million in Q1 2024 to $99 million in Q1 2025. One factor driving the spike in losses appears to be the fact that more of Klarna’s consumer base, which relies on the company’s fast-credit loans to pay for goods in bite-size installments, is failing to pay off their purchases. The results come as, amid a global trade war and increasing economic uncertainty, U.S. consumers are turning to BNPL services to pay for everything from electronics to groceries. Buy now, don’t pay later? A University of Michigan survey, released last week, found that U.S. consumer sentiment dropped to its second-lowest reading on record this month amid fears that the Trump administration’s tariffs will lead to a spike in inflation. Between tariff concerns and the current elevated cost of living, it’s been a difficult few months for American consumers. Now, it seems, Klarna’s customers are beginning to show the strain. According to a press release detailing its Q1 results, Klarna’s consumer credit losses have jumped 17%—from $117 million last year to $136 million this year—as more users fail to make their payments on time. That data is on track with an April survey from LendingTree that found that 41% of BNPL users in the U.S. paid late over the last 12 months, up from 34% a year ago. Still, for BNPL providers like Klarna, it’s not a bad time to be in the business. A report from Grand View Research found the U.S. BNPL market is expected to see a 26.1% annual compound growth rate between 2023 and 2030. And, based on the aforementioned LendingTree data, that market prediction is already beginning to play out: Consumers are increasingly relying on BNPL services for quotidian purchases like groceries and food delivery. (As of that survey, 25% of users had purchased groceries with a BNPL loan, up 14% from 2024.) Klarna, specifically, has recently announced major deals with DoorDash, Walmart, and eBay to cash in on the growing demand for BNPL services. Experts warn that this reliance on BNPL is a worrisome sign. Last month, Matt Schulz, LendingTree’s chief consumer finance analyst, told CNBC that high interest rates, inflation, and tariff uncertainty were leading consumers to look “for ways to extend their budget however they can.” Still, in the fintech world, Klarna is becoming a more prominent player. Investors are waiting with bated breath for the company to move ahead with an IPO, a process that Klarna moved to begin in March but ultimately put on hold in order to await a clearer tariff outlook.

Klarna just announced its first quarter 2025 financial results, and they show that a larger chunk of customers are buying now and not paying later.

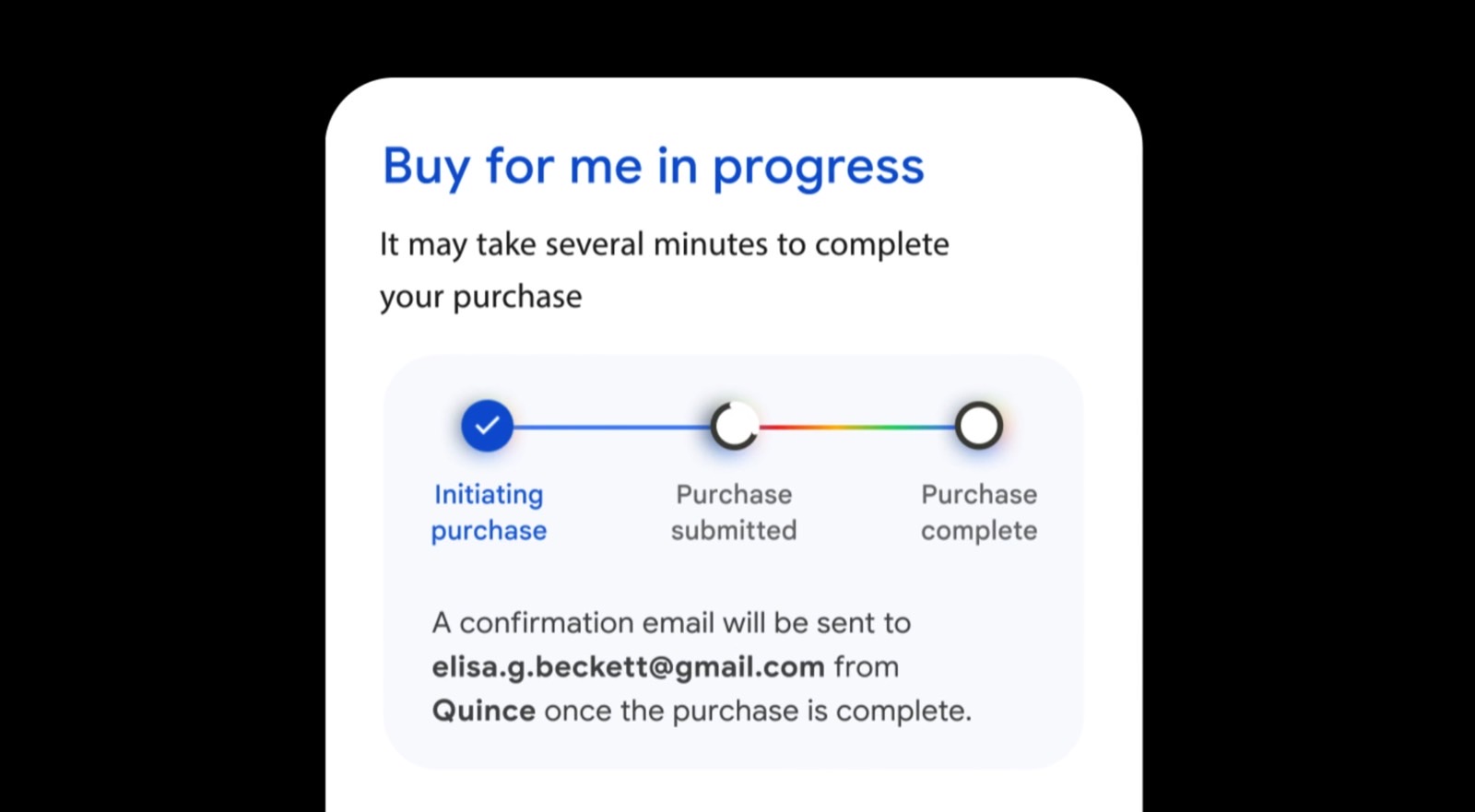

This morning, the Swedish “buy now, pay later” (BNPL) fintech company gave consumers a look at its performance for the first three months of 2025. The news came in the form of a press release and an accompanying AI-generated video of CEO Sebastian Siemiatkowski (likely as a play to emphasize Klarna’s all-in approach to AI.) In the video, Siemiatkowski’s look-alike shared that Klarna has “started the year strong,” hitting 100 active users in the first quarter and $701 million in revenue, a 15% year-over-year increase.

But there’s a caveat: Although Klarna has grown this year, it’s also doubled its net losses from $47 million in Q1 2024 to $99 million in Q1 2025. One factor driving the spike in losses appears to be the fact that more of Klarna’s consumer base, which relies on the company’s fast-credit loans to pay for goods in bite-size installments, is failing to pay off their purchases.

The results come as, amid a global trade war and increasing economic uncertainty, U.S. consumers are turning to BNPL services to pay for everything from electronics to groceries.

Buy now, don’t pay later?

A University of Michigan survey, released last week, found that U.S. consumer sentiment dropped to its second-lowest reading on record this month amid fears that the Trump administration’s tariffs will lead to a spike in inflation. Between tariff concerns and the current elevated cost of living, it’s been a difficult few months for American consumers. Now, it seems, Klarna’s customers are beginning to show the strain.

According to a press release detailing its Q1 results, Klarna’s consumer credit losses have jumped 17%—from $117 million last year to $136 million this year—as more users fail to make their payments on time. That data is on track with an April survey from LendingTree that found that 41% of BNPL users in the U.S. paid late over the last 12 months, up from 34% a year ago. Still, for BNPL providers like Klarna, it’s not a bad time to be in the business.

A report from Grand View Research found the U.S. BNPL market is expected to see a 26.1% annual compound growth rate between 2023 and 2030. And, based on the aforementioned LendingTree data, that market prediction is already beginning to play out: Consumers are increasingly relying on BNPL services for quotidian purchases like groceries and food delivery. (As of that survey, 25% of users had purchased groceries with a BNPL loan, up 14% from 2024.)

Klarna, specifically, has recently announced major deals with DoorDash, Walmart, and eBay to cash in on the growing demand for BNPL services. Experts warn that this reliance on BNPL is a worrisome sign. Last month, Matt Schulz, LendingTree’s chief consumer finance analyst, told CNBC that high interest rates, inflation, and tariff uncertainty were leading consumers to look “for ways to extend their budget however they can.”

Still, in the fintech world, Klarna is becoming a more prominent player. Investors are waiting with bated breath for the company to move ahead with an IPO, a process that Klarna moved to begin in March but ultimately put on hold in order to await a clearer tariff outlook.

![[The AI Show Episode 148]: Microsoft’s Quiet AI Layoffs, US Copyright Office’s Bombshell AI Guidance, 2025 State of Marketing AI Report, and OpenAI Codex](https://www.marketingaiinstitute.com/hubfs/ep%20148%20cover%20%281%29.png)

![[The AI Show Episode 146]: Rise of “AI-First” Companies, AI Job Disruption, GPT-4o Update Gets Rolled Back, How Big Consulting Firms Use AI, and Meta AI App](https://www.marketingaiinstitute.com/hubfs/ep%20146%20cover.png)

.jpg?#)

_Prostock-studio_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)