How AI and Python Helped Modernize a Legacy Insurance System

Modernizing a legacy platform is never easy – especially in industries like insurance, where decades-old systems and processes are deeply ingrained. In this post, I’ll share how our development team tackled a real-world challenge at an insurance company by injecting some AI, APIs, and Python-powered automation into a claims handling workflow. We’ll walk through the problem we faced, our solution architecture, some code snippets illustrating key pieces (yes, actual Python code!), and the lessons we learned along the way. By the end, you’ll see how even a monolithic legacy system can be augmented with modern tech – and hopefully be inspired to try something similar in your own projects. The Legacy Challenge Our starting point was a painfully manual claims process. When customers submitted insurance claims (often as PDF forms or emails), a team of staff would manually review each one, extract relevant information, enter it into our core system, and assign the claim to the appropriate department. This slow process often led to delays, errors, and frustrated customers. For example, mis-typing a policy number or mis-categorizing a claim could result in payout errors or lengthy back-and-forth corrections. Industry-wide, these kinds of errors (known as claims leakage, such as overpaying or underpaying claims) are estimated to cost U.S. insurers between $30 and $67 billion every year. Beyond the monetary loss, there was a growing expectation for faster, digital service – one survey found 41% of insurance customers might switch providers if digital capabilities are lacking. In short, our legacy process was costly on multiple fronts. The mission was clear: we needed to streamline and automate this workflow without “rip-and-replacing” the entire legacy system. The challenge was how to introduce modern technology – specifically AI and automation – in a way that would play nice with our old platform (which wasn’t exactly built with AI in mind!). As an added twist, we had to ensure any automated decisions were accurate and fair, because in insurance, a mistake can hurt real people and erode trust. Architecting an AI-Powered Solution To tackle the problem, we decided to bolt on a new microservice alongside the legacy system to handle the heavy lifting of document processing and initial claim triage. This approach let us leave the core system largely untouched (reducing risk) while offloading new capabilities to the side. We broke down the solution into a few key components: Data Ingestion: First, we needed to get claim data out of incoming documents. We used OCR and parsing tools to automatically extract text from PDF claim forms and email bodies. This turned unstructured documents into structured text data we could work with. AI Analysis: Next came the smart part – using AI to analyze the extracted text. We focused on two things: (1) categorizing the claim (e.g. auto accident, property damage, medical, etc.), and (2) detecting any red flags (like potential fraud indicators or urgent cases). Recent advances in AI meant this was quite feasible: machine learning and NLP techniques can automate routine tasks like document classification and data extraction with high accuracy [researchgate.net]. They can even perform tasks like fraud detection by spotting patterns humans might miss researchgate.net. Integration via API: Finally, the results of the AI needed to flow back into our legacy system. We built a lightweight REST API endpoint on the legacy side (essentially an adapter) that our new Python service could call to update the claims system with the classification results or trigger certain workflows. This API layer acted as a bridge between old and new – a safe interface to push our AI’s insights into the old claims software. Brainstorming the architecture with the team. We designed the solution to run asynchronously: as new claims came in, the OCR and AI service would process them in the background, and the legacy system would be updated via API calls. This way, from a user perspective, claims started getting categorized and routed almost in real-time, without staff needing to intervene in most cases. Importantly, we decided early on to keep humans in the loop for critical or uncertain cases – if the AI wasn’t confident or flagged something unusual, we’d defer to a human adjuster. This balance was crucial to maintain fairness and trust; even the best automation needs oversight in sensitive domains. Choosing the Tech Stack Given our needs, Python was an easy choice for the new service. Its rich ecosystem of AI libraries and straightforward HTTP capabilities made it ideal for quickly building this as a proof-of-concept and later a production service. We also leveraged existing AI models instead of building our own from scratch. In fact, our first prototype used an external NLP API (OpenAI’s GPT-3) to classify text – this let us validate the idea in a single afternoon by writing a few lin

Modernizing a legacy platform is never easy – especially in industries like insurance, where decades-old systems and processes are deeply ingrained. In this post, I’ll share how our development team tackled a real-world challenge at an insurance company by injecting some AI, APIs, and Python-powered automation into a claims handling workflow. We’ll walk through the problem we faced, our solution architecture, some code snippets illustrating key pieces (yes, actual Python code!), and the lessons we learned along the way. By the end, you’ll see how even a monolithic legacy system can be augmented with modern tech – and hopefully be inspired to try something similar in your own projects.

The Legacy Challenge

Our starting point was a painfully manual claims process. When customers submitted insurance claims (often as PDF forms or emails), a team of staff would manually review each one, extract relevant information, enter it into our core system, and assign the claim to the appropriate department. This slow process often led to delays, errors, and frustrated customers. For example, mis-typing a policy number or mis-categorizing a claim could result in payout errors or lengthy back-and-forth corrections. Industry-wide, these kinds of errors (known as claims leakage, such as overpaying or underpaying claims) are estimated to cost U.S. insurers between $30 and $67 billion every year. Beyond the monetary loss, there was a growing expectation for faster, digital service – one survey found 41% of insurance customers might switch providers if digital capabilities are lacking. In short, our legacy process was costly on multiple fronts. The mission was clear: we needed to streamline and automate this workflow without “rip-and-replacing” the entire legacy system. The challenge was how to introduce modern technology – specifically AI and automation – in a way that would play nice with our old platform (which wasn’t exactly built with AI in mind!). As an added twist, we had to ensure any automated decisions were accurate and fair, because in insurance, a mistake can hurt real people and erode trust.

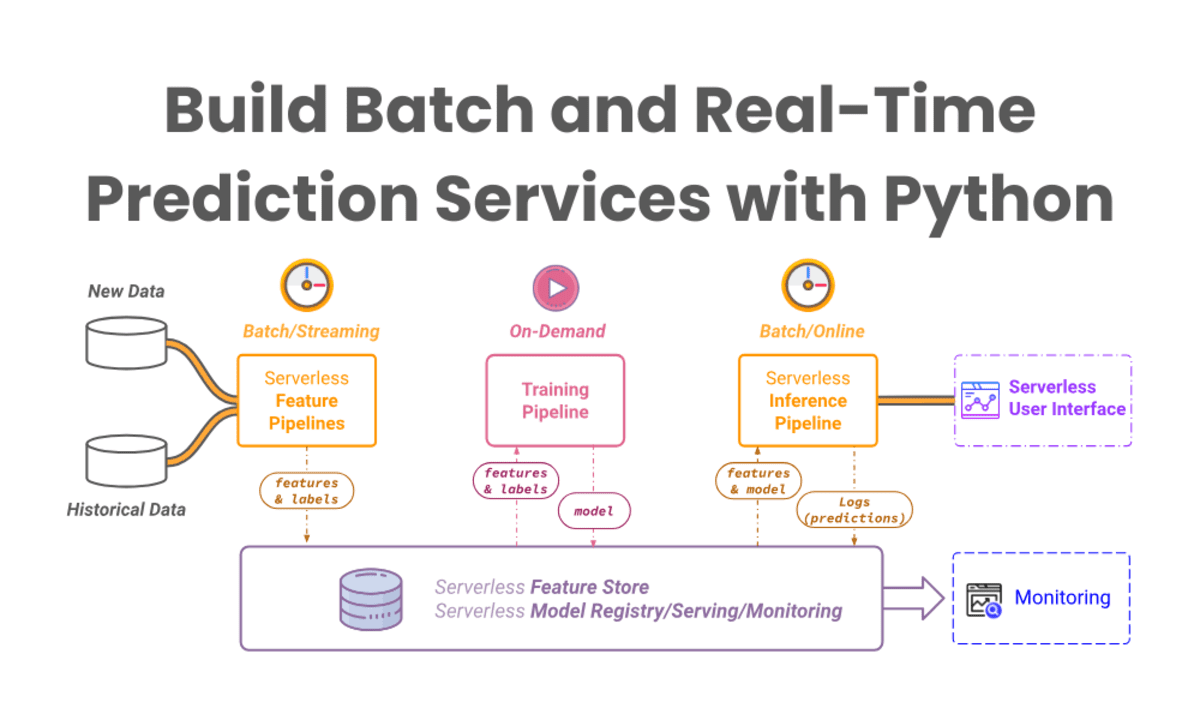

Architecting an AI-Powered Solution

To tackle the problem, we decided to bolt on a new microservice alongside the legacy system to handle the heavy lifting of document processing and initial claim triage. This approach let us leave the core system largely untouched (reducing risk) while offloading new capabilities to the side. We broke down the solution into a few key components:

Data Ingestion: First, we needed to get claim data out of incoming documents. We used OCR and parsing tools to automatically extract text from PDF claim forms and email bodies. This turned unstructured documents into structured text data we could work with.

AI Analysis: Next came the smart part – using AI to analyze the extracted text. We focused on two things: (1) categorizing the claim (e.g. auto accident, property damage, medical, etc.), and (2) detecting any red flags (like potential fraud indicators or urgent cases). Recent advances in AI meant this was quite feasible: machine learning and NLP techniques can automate routine tasks like document classification and data extraction with high accuracy [researchgate.net]. They can even perform tasks like fraud detection by spotting patterns humans might miss researchgate.net.

Integration via API: Finally, the results of the AI needed to flow back into our legacy system. We built a lightweight REST API endpoint on the legacy side (essentially an adapter) that our new Python service could call to update the claims system with the classification results or trigger certain workflows. This API layer acted as a bridge between old and new – a safe interface to push our AI’s insights into the old claims software.

Brainstorming the architecture with the team. We designed the solution to run asynchronously: as new claims came in, the OCR and AI service would process them in the background, and the legacy system would be updated via API calls. This way, from a user perspective, claims started getting categorized and routed almost in real-time, without staff needing to intervene in most cases. Importantly, we decided early on to keep humans in the loop for critical or uncertain cases – if the AI wasn’t confident or flagged something unusual, we’d defer to a human adjuster. This balance was crucial to maintain fairness and trust; even the best automation needs oversight in sensitive domains.

Choosing the Tech Stack

Given our needs, Python was an easy choice for the new service. Its rich ecosystem of AI libraries and straightforward HTTP capabilities made it ideal for quickly building this as a proof-of-concept and later a production service. We also leveraged existing AI models instead of building our own from scratch. In fact, our first prototype used an external NLP API (OpenAI’s GPT-3) to classify text – this let us validate the idea in a single afternoon by writing a few lines of code to call a cloud AI service. The prototype worked (it could correctly tell apart an auto accident vs. a home insurance claim from the description), which gave us confidence. However, for production we had to consider data privacy and costs, so we switched to an open-source NLP model that we could run in-house. Using Hugging Face’s Transformers library, we deployed a pre-trained model that could do zero-shot classification – meaning it can classify text into user-defined categories without explicit retraining.

Implementation: Bringing AI into the Workflow

Let’s look at a simplified version of how we implemented the AI classification in code. Below is a Python snippet that sets up a zero-shot classifier and uses it on a sample claim description:

from transformers import pipeline

# Load a pre-trained zero-shot classification model

classifier = pipeline("zero-shot-classification", model="facebook/bart-large-mnli")

# Define possible claim categories (we can adjust these as needed)

labels = ["auto accident", "home property damage", "medical claim", "fraud risk"]

# Example claim description text

text = "I was involved in a car accident on the highway and my rear bumper is smashed."

# Use the classifier to predict which label fits best

result = classifier(text, candidate_labels=labels)

print(result)

In the code above, we initialize a transformer-based classifier and provide a list of candidate labels that are relevant to our business. The text we feed it is a description of a claim (for example, what a customer might write on a claim form or tell an agent). The model will return a score for each label, basically saying how likely the text fits that category. The output from print(result) would look something like this (abridged for clarity):

{

"sequence": "I was involved in a car accident on the highway and my rear bumper is smashed.",

"labels": ["auto accident", "fraud risk", "home property damage", "medical claim"],

"scores": [0.98, 0.40, 0.05, 0.01]

}

In this example, the model correctly identified “auto accident” as the top category with very high confidence (98%). It also gave a lower secondary score to “fraud risk” (40%) – meaning there might be a hint of suspiciousness, but not as much as a clear car accident. These predictions enabled us to automate triage: the claim would be automatically tagged as an auto claim and routed to an auto claims specialist team. If the “fraud risk” score had been above a certain threshold, we could also alert our fraud investigation unit for a closer look. This approach, using NLP, allowed us to sift routine vs. risky claims automatically, something impossible to do at scale manually.

With the AI piece in place, the next step was integrating it with the rest of the system. We wrote a simple loop (within a scheduled job) that pulls new claims and pushes back the AI-generated classifications. Here’s a pseudo-code illustration of that integration:

import requests

# Imagine we have an API endpoint to fetch pending (newly submitted) claims

pending_claims = requests.get("http://legacy-system.local/api/claims?status=pending").json()

for claim in pending_claims:

desc = claim["description_text"]

# Use the same classifier and labels defined earlier

result = classifier(desc, candidate_labels=labels)

top_label = result["labels"][0]

# Prepare the data to send back – e.g., update claim with category (and maybe priority)

update_data = {"claimId": claim["id"], "predictedCategory": top_label}

resp = requests.post("http://legacy-system.local/api/claims/route", json=update_data)

if resp.status_code == 200:

print(f"Claim {claim['id']} categorized as '{top_label}' and updated successfully!")

In practice, our real code was more robust (handling authentication, error cases, batching, etc.), but the idea is the same. This script runs periodically (say every few minutes), fetches new claims from the legacy system (via an API we added), processes each with the AI classifier, and then uses another API call to update the legacy system with the classification or routing decision. Essentially, we automated the workflow from end to end: as soon as a claim comes in, it gets read, understood, and acted upon without a person in the loop for the majority of cases. A few points on the integration: because we were dealing with a legacy platform, we had to be careful about how we updated it. In our case, the legacy system was extended with a new microservice that could accept these updates – it wasn’t trivial to modify the old codebase itself. If a direct API wasn’t an option, another strategy we considered was using a message queue or even robotic process automation (RPA) to input data into the old UI. Thankfully, adding an API layer was feasible and turned out to be very useful not just for this project but as a general modernization approach. (Pro tip: wrapping a legacy system with APIs is a great way to extend its life while you modernize piece by piece.)

Challenges and Surprises Along the Way

No project is without its hiccups! We encountered several challenges during implementation:

Data Quality & OCR Errors: Getting clean text from the claim documents was tricky. OCR isn’t perfect – sometimes “$1,000” would be read as “1000” or “l/O” confusion in policy IDs. We had to put in validation rules and even some post-processing (e.g., regex fixes) to clean up the extracted data before feeding it to the AI. Garbage in, garbage out, as they say.

Model Tuning and Edge Cases: The pre-trained NLP model was a great starting point, but we did need to tune it for our context. We fine-tuned the model on a small dataset of past claims to improve its accuracy on our specific jargon. Certain edge cases, like distinguishing a “theft” claim from a “vandalism” claim, required adding more sample data or additional logic. We also added a threshold for the model’s confidence – if it wasn’t, say, at least 80% confident in any category, we’d mark that claim for manual review. This human fallback ensured we didn’t mis-classify when the AI was uncertain.

System Integration Issues: As expected with any legacy system, integration testing revealed some quirks. For instance, the API endpoint we built to update the legacy system initially couldn’t handle high volumes (we forgot that the old database had some locks causing slowdowns). We addressed this by queuing updates and processing them in smaller batches, and by optimizing the legacy DB indexes for the fields we were querying/updating. We also had to coordinate with the ops team to ensure our new service had proper access and didn’t violate any security policies.

Fairness and Transparency: On the business side, we had to reassure stakeholders (and ourselves) that the AI wasn’t a “black box” making unchecked decisions. We logged the model’s decisions and important factors, and created an internal dashboard to explain and monitor the AI suggestions. This was important because** maintaining fairness and transparency in automated decision-making is crucial** in insurance.

By keeping a human-in-the-loop for anomalies and providing explanations, we built trust in the system. In fact, after a few months of observing the AI doing well, the adjusters became more confident in its recommendations – it turned from a suspicious new thing to a helpful assistant in their eyes.

Results: A Leap Forward for Legacy

After deploying our AI-powered automation, the impact was dramatic. What used to take an entire team a full day of work could now be done in minutes. Routine claims were getting classified and routed to the right team almost instantly, reducing the average processing time by over 70%. The manual workload on our team dropped correspondingly – instead of spending time on data entry and triage, they focused on complex or high-value cases that truly needed human judgment. This not only improved efficiency but also morale (let’s face it, nobody enjoys mindlessly copying data all day). Quality and accuracy saw improvements too. The combination of automation and targeted human review led to fewer errors in claim handling. The AI never gets tired or careless, and it was catching mistakes that humans might overlook. For example, within the first month, the system flagged a handful of claims as “fraud risk” that turned out to indeed be fraudulent, potentially saving us a significant amount in wrongful payouts. It was like we gave our legacy system a new superpower – one that operates in real-time and at scale in a way the original designers could never have imagined. Perhaps the best part was the feedback from other departments. Customer service reps reported that customers were pleasantly surprised at how quickly their claims were being processed now. And our management loved the KPIs coming in: faster cycle times, higher customer satisfaction, and a tangible reduction in processing costs. This success has sparked more interest in modernizing other parts of our platform (there’s even talk of using chatbots for customer inquiries and more AI for underwriting). It’s safe to say this project was a gateway to broader digital transformation.

Key Takeaways for Developers

For those of you looking to bring AI or automation into a legacy project, here are some lessons and tips from our experience:

Start Small, Aim Big: We began with a narrow problem (automating claim triage) that was achievable in a reasonable time. Delivering a quick win is crucial to get buy-in for larger modernization efforts. Once people see success, it’s easier to expand to more use cases.

Leverage Existing Tools and APIs: Don’t reinvent the wheel. We saved time by using pre-built AI models and cloud services for our prototype. Likewise, if your legacy system has any form of API or can be given one, use it! Wrapping legacy functionality with modern APIs can extend its life and make integration much easier.

Mind the Data (Garbage In, Garbage Out): Invest time in data preparation. Clean your input text, handle edge cases, and gather some historical data to tune your models. In domains like insurance, domain-specific data makes all the difference. Engage domain experts to understand the nuances of the data and results.

Keep Humans in the Loop: Automation works best when it augments humans, not blindly replaces them. We set thresholds and manual review steps for a reason – to catch the things the AI might get wrong or isn’t sure about. This safety net is important for fairness and building trust in the system

. Over time the balance might shift more toward automation as confidence grows, but human oversight remains valuable.

Transparency and Monitoring: It’s not just about building the system – think about how you’ll monitor and explain it. We built internal dashboards to track the AI’s performance (e.g., agreement rate with humans, turnaround times) and to help explain its decisions. This was key for stakeholder trust and for debugging issues. When the AI made a weird prediction, we could investigate and improve the model or rules accordingly.

Conclusion (What’s Your Story?)

Modernizing a legacy system with AI and automation was an incredibly rewarding journey. We took an old, sluggish process and turned it into something smart and efficient – almost like turning a flip phone into a smartphone. And we did it without breaking the existing system or the bank, by cleverly bridging old and new technologies. For developers, projects like this are a chance to make a real impact by mixing innovation (AI, cloud APIs, new code) with pragmatism (respecting the old system’s constraints). I hope this story gave you some ideas and insights into how to approach similar challenges. If you’ve ever modernized a legacy system, or if you’re thinking about injecting AI/automation into a project, I’d love to hear from you! What challenges are you facing, and how are you solving them? Share your thoughts, experiences, or questions in the comments – let’s discuss and learn from each other. Happy coding!

![Epic Games: Fortnite is offline for Apple devices worldwide after app store rejection [updated]](https://helios-i.mashable.com/imagery/articles/00T6DmFkLaAeJiMZlCJ7eUs/hero-image.fill.size_1200x675.v1747407583.jpg)

![[The AI Show Episode 146]: Rise of “AI-First” Companies, AI Job Disruption, GPT-4o Update Gets Rolled Back, How Big Consulting Firms Use AI, and Meta AI App](https://www.marketingaiinstitute.com/hubfs/ep%20146%20cover.png)

![How to make Developer Friends When You Don't Live in Silicon Valley, with Iraqi Engineer Code;Life [Podcast #172]](https://cdn.hashnode.com/res/hashnode/image/upload/v1747360508340/f07040cd-3eeb-443c-b4fb-370f6a4a14da.png?#)

.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

![[Virtual Event] Strategic Security for the Modern Enterprise](https://eu-images.contentstack.com/v3/assets/blt6d90778a997de1cd/blt55e4e7e277520090/653a745a0e92cc040a3e9d7e/Dark_Reading_Logo_VirtualEvent_4C.png?width=1280&auto=webp&quality=80&disable=upscale#)

-xl-(1)-xl-xl.jpg)

![How to upgrade the M4 Mac mini SSD and save hundreds [Video]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2025/05/M4-Mac-mini-SSD-Upgrade-Tutorial-2TB.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![‘Apple in China’ book argues that the iPhone could be killed overnight [Updated]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2025/05/Apple-in-China-review.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![iPhone 17 Air Could Get a Boost From TDK's New Silicon Battery Tech [Report]](https://www.iclarified.com/images/news/97344/97344/97344-640.jpg)

![Vision Pro Owners Say They Regret $3,500 Purchase [WSJ]](https://www.iclarified.com/images/news/97347/97347/97347-640.jpg)

![Apple Showcases 'Magnifier on Mac' and 'Music Haptics' Accessibility Features [Video]](https://www.iclarified.com/images/news/97343/97343/97343-640.jpg)

![Sony WH-1000XM6 Unveiled With Smarter Noise Canceling and Studio-Tuned Sound [Video]](https://www.iclarified.com/images/news/97341/97341/97341-640.jpg)

![Apple Stops Signing iPadOS 17.7.7 After Reports of App Login Issues [Updated]](https://images.macrumors.com/t/DoYicdwGvOHw-VKkuNvoxYs3pfo=/1920x/article-new/2023/06/ipados-17.jpg)