US dollar facing growing competition for stablecoin dominance: Tether co-founder

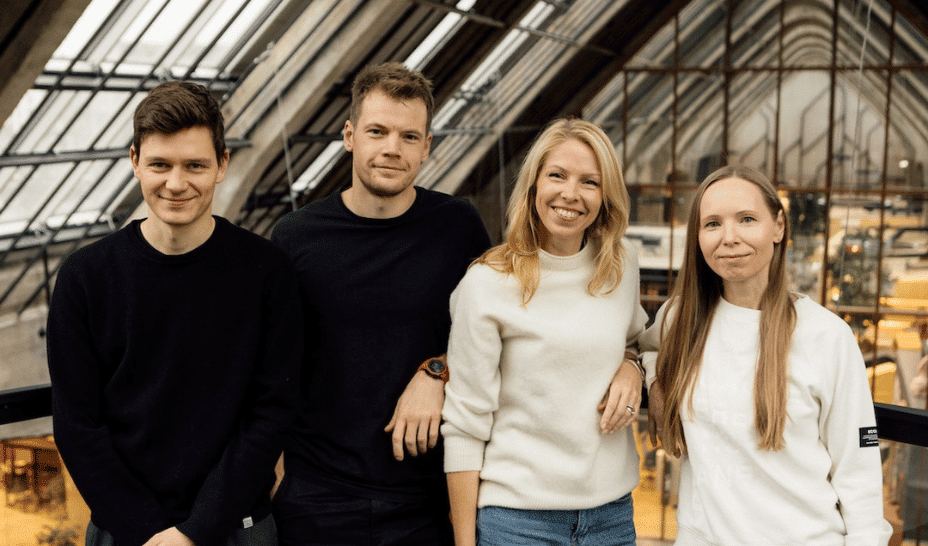

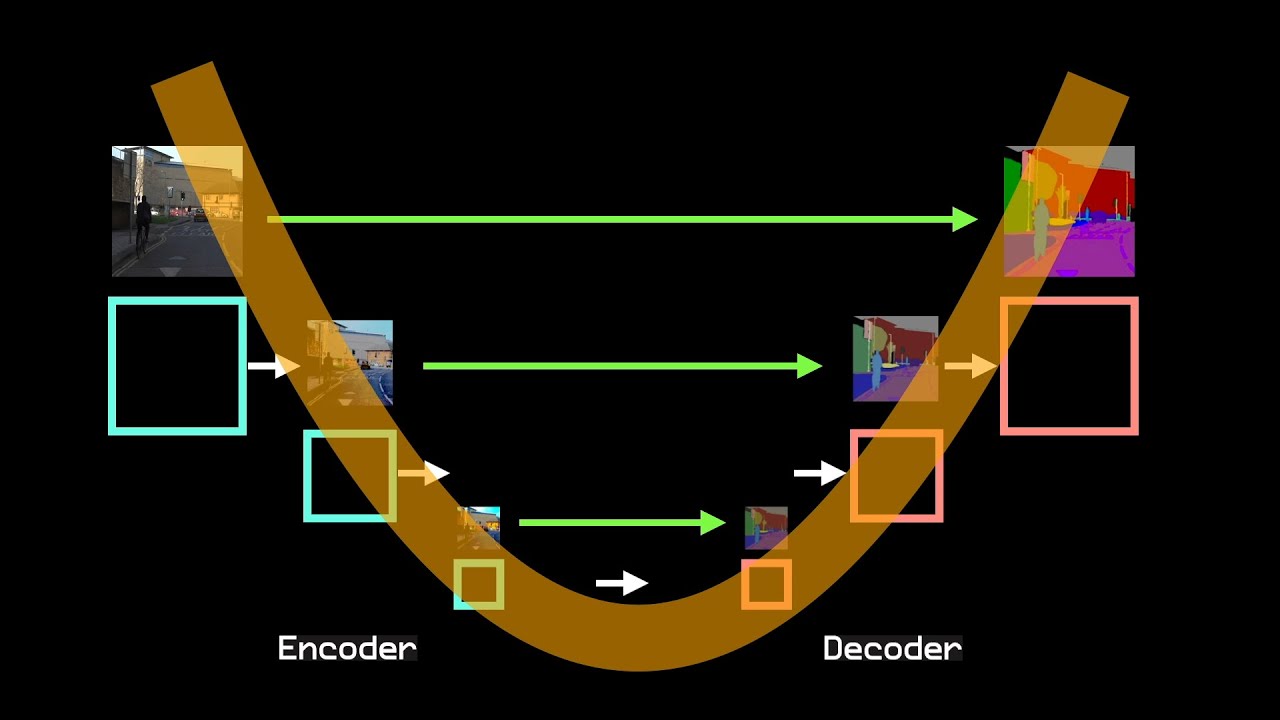

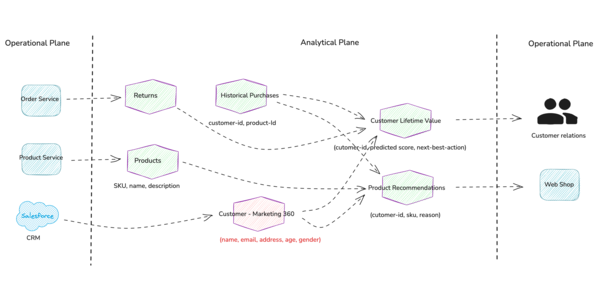

While United States dollar-denominated stablecoins dominate the stablecoin and real-world asset (RWA) tokenization game, other competitors are coming into play, according to Tether co-founder Reeve Collins. Speaking to Cointelegraph in Dubai, Collins said that while dollar-backed stablecoins may be dominant, other currencies and assets may compete to back stablecoins.“The stablecoin definitely helps preserve the dollar dominance, especially in the crypto space,” Collins said. “The dollar is kind of the reserve currency of crypto. But now there are other currencies coming into play. But more importantly, it’s not currencies. It’s other types of backing,” he added.Collins said that other assets used to back stablecoins may compete with US dollars by bringing a higher yield to users. Interview with Tether co-founder Reeve Collins in Dubai, UAE. Source: Cointelegraph Tether co-founder says tokenized assets can back stablecoinsCollins, who works bringing stablecoin yield for users through Pi Protocol, told Cointelegraph that apart from currencies, money-market funds, other commodities and gold could back stablecoins in the future. “When you can back it with money market funds, for instance, that generate a higher yield than T-bills and other things like that that are coming onchain, where there’s a lot of yield that will be generated. Those will take precedence,” Collins said. Collins said these will “start winning” because they bring higher user returns. Furthermore, the executive also said RWA tokenization could play a role in stablecoin backing. The executive told Cointelegraph that since all types of assets can be tokenized, these can be used to back stablecoins in the future. “You’re going to have a lot of choices other than just dollars,” he added. Related: Tether boosts Juventus stake to 10% in latest strategic buyTrump-linked stablecoin lays foundation for the rest of the worldIn March, the World Liberty Financial (WLFI) project, backed by US President Donald Trump, launched its stablecoin on BNB Chain and Ethereum. However, the project said that the tokens were not tradable yet. According to Collins, the stablecoin entry of a Trump-backed project means that stablecoins are now “fully accepted.” The executive believes everyone will get involved in stablecoins because of the move. This includes institutions, governments and financial technology companies. “The President of the United States launched a stablecoin. It’s impressive. It lays the foundation for the rest of the world to do it as well,” he said. Magazine: Ethereum is destroying the competition in the $16.1T TradFi tokenization race

While United States dollar-denominated stablecoins dominate the stablecoin and real-world asset (RWA) tokenization game, other competitors are coming into play, according to Tether co-founder Reeve Collins.

Speaking to Cointelegraph in Dubai, Collins said that while dollar-backed stablecoins may be dominant, other currencies and assets may compete to back stablecoins.

“The stablecoin definitely helps preserve the dollar dominance, especially in the crypto space,” Collins said. “The dollar is kind of the reserve currency of crypto. But now there are other currencies coming into play. But more importantly, it’s not currencies. It’s other types of backing,” he added.

Collins said that other assets used to back stablecoins may compete with US dollars by bringing a higher yield to users.

Tether co-founder says tokenized assets can back stablecoins

Collins, who works bringing stablecoin yield for users through Pi Protocol, told Cointelegraph that apart from currencies, money-market funds, other commodities and gold could back stablecoins in the future.

“When you can back it with money market funds, for instance, that generate a higher yield than T-bills and other things like that that are coming onchain, where there’s a lot of yield that will be generated. Those will take precedence,” Collins said.

Collins said these will “start winning” because they bring higher user returns. Furthermore, the executive also said RWA tokenization could play a role in stablecoin backing.

The executive told Cointelegraph that since all types of assets can be tokenized, these can be used to back stablecoins in the future. “You’re going to have a lot of choices other than just dollars,” he added.

Related: Tether boosts Juventus stake to 10% in latest strategic buy

Trump-linked stablecoin lays foundation for the rest of the world

In March, the World Liberty Financial (WLFI) project, backed by US President Donald Trump, launched its stablecoin on BNB Chain and Ethereum. However, the project said that the tokens were not tradable yet.

According to Collins, the stablecoin entry of a Trump-backed project means that stablecoins are now “fully accepted.” The executive believes everyone will get involved in stablecoins because of the move. This includes institutions, governments and financial technology companies.

“The President of the United States launched a stablecoin. It’s impressive. It lays the foundation for the rest of the world to do it as well,” he said.

Magazine: Ethereum is destroying the competition in the $16.1T TradFi tokenization race

![[The AI Show Episode 145]: OpenAI Releases o3 and o4-mini, AI Is Causing “Quiet Layoffs,” Executive Order on Youth AI Education & GPT-4o’s Controversial Update](https://www.marketingaiinstitute.com/hubfs/ep%20145%20cover.png)

.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

_Vladimir_Stanisic_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Standalone Meta AI App Released for iPhone [Download]](https://www.iclarified.com/images/news/97157/97157/97157-640.jpg)

![AirPods Pro 2 With USB-C Back On Sale for Just $169! [Deal]](https://www.iclarified.com/images/news/96315/96315/96315-640.jpg)

![Apple Releases iOS 18.5 Beta 4 and iPadOS 18.5 Beta 4 [Download]](https://www.iclarified.com/images/news/97145/97145/97145-640.jpg)

![Did T-Mobile just upgrade your plan again? Not exactly, despite confusing email [UPDATED]](https://m-cdn.phonearena.com/images/article/169902-two/Did-T-Mobile-just-upgrade-your-plan-again-Not-exactly-despite-confusing-email-UPDATED.jpg?#)