Types of Quantitative Trading on Solana

Quantitative trading on Solana generally falls into two categories: Atomic Arbitrage and Looping Arbitrage (Leverage Arbitrage). Atomic Arbitrage Leverages Solana’s parallel processing and low-latency features to perform both buy and sell operations within a single transaction (typically a transaction bundle). Ensures atomicity, meaning the transaction either fully succeeds or fully fails—no partial execution—thus avoiding risks from price fluctuations in between. Commonly used for arbitrage between DEXs such as Orca, Raydium, and Jupiter. Looping Arbitrage / Leverage Arbitrage Example: Stake SOL on a protocol for a 12% annual return. Use the staking certificate as collateral to borrow USDC at a 10% annual cost. Swap the borrowed USDC back into SOL to stake again… By repeating this cycle, you effectively leverage your initial capital to amplify the yield spread. Let's Start with Basic Arbitrage on Solana Core Logic of On-chain Arbitrage On-chain arbitrage exploits price differences of the same token across different liquidity pools (LPs). For example, if one pool's price fluctuates sharply due to a trade while another lags behind, an arbitrage opportunity arises. This often occurs with common tokens like wSOL, USDC, and USDT across various AMMs. Basic Arbitrage Flow: Monitor price changes / arbitrage opportunities. Calculate whether a positive profit exists. Construct the transaction (usually as an atomic transaction). Bundle and execute the transaction on-chain. Getting the Best Quotes with Jupiter and Jito To ensure the optimal arbitrage path and maximum profit, most strategies combine Jupiter (Jup) and Jito. How it works: Use Jupiter to get quotes for two reverse trades (e.g., A → B → A). Calculate potential profit based on the price difference. Merge both trades into a single atomic transaction and simulate it. Jito allows you to submit bundled transactions and simulate them before sending on-chain. Failed simulations incur no cost. ⚠️ Note: Frequent API calls to Jito can trigger rate-limiting (like DDoS protection). In quantitative deployment, it's crucial to design a rate control strategy—which we’ll cover later. Optimization Strategies To increase the success rate and profitability of arbitrage, consider optimizing in these areas: Use Flash Loans Amplify returns with borrowed capital. Because of atomicity, borrowing and repaying happen within a single transaction—no risk or cost if the transaction fails. Optimize Compute Unit (CU) Usage Solana limits CU per transaction. Lower CU consumption increases the chance of successful execution—especially in high-concurrency environments. Custom Quote & Routing Logic Jupiter API requests can be slow. Implementing your own quoting algorithm and pathfinding logic can dramatically improve speed and increase arbitrage success. Faster RPC Node Responses Use high-performance RPC nodes (e.g., private or optimized nodes) to avoid frontrunning and reduce latency. Why Top Arbitrageurs Don't Use Jupiter Many users rely on Jupiter Aggregator for optimal swap paths across DEXs, but serious atomic arbitrageurs avoid it. Atomic arbitrage involves executing all operations within a single atomic transaction, which demands high speed and priority. Professionals typically build their own paths and custom transaction bundles to achieve higher frequency and lower latency. For example, Wintermute, a leading market maker, sends hundreds of arbitrage transactions per minute. Jupiter isn’t fast or flexible enough for this kind of high-frequency trading. However, Solana has some randomness—like congestion, dropped requests, and competition in transaction ordering—so even Wintermute doesn’t always win.

Quantitative trading on Solana generally falls into two categories: Atomic Arbitrage and Looping Arbitrage (Leverage Arbitrage).

Atomic Arbitrage

- Leverages Solana’s parallel processing and low-latency features to perform both buy and sell operations within a single transaction (typically a transaction bundle).

- Ensures atomicity, meaning the transaction either fully succeeds or fully fails—no partial execution—thus avoiding risks from price fluctuations in between.

- Commonly used for arbitrage between DEXs such as Orca, Raydium, and Jupiter.

Looping Arbitrage / Leverage Arbitrage

Example:

- Stake SOL on a protocol for a 12% annual return.

- Use the staking certificate as collateral to borrow USDC at a 10% annual cost.

- Swap the borrowed USDC back into SOL to stake again…

- By repeating this cycle, you effectively leverage your initial capital to amplify the yield spread.

Let's Start with Basic Arbitrage on Solana

Core Logic of On-chain Arbitrage

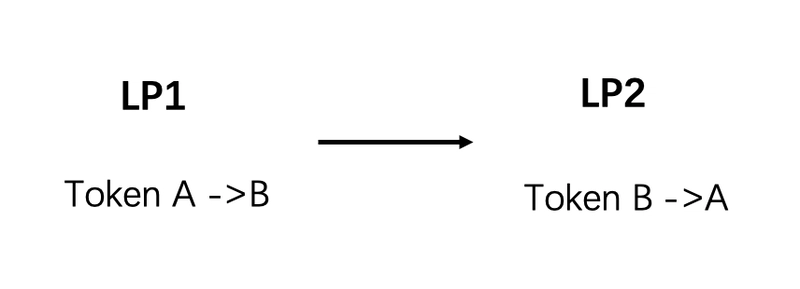

On-chain arbitrage exploits price differences of the same token across different liquidity pools (LPs). For example, if one pool's price fluctuates sharply due to a trade while another lags behind, an arbitrage opportunity arises.

This often occurs with common tokens like wSOL, USDC, and USDT across various AMMs.

Basic Arbitrage Flow:

- Monitor price changes / arbitrage opportunities.

- Calculate whether a positive profit exists.

- Construct the transaction (usually as an atomic transaction).

- Bundle and execute the transaction on-chain.

Getting the Best Quotes with Jupiter and Jito

To ensure the optimal arbitrage path and maximum profit, most strategies combine Jupiter (Jup) and Jito.

How it works:

- Use Jupiter to get quotes for two reverse trades (e.g., A → B → A).

- Calculate potential profit based on the price difference.

- Merge both trades into a single atomic transaction and simulate it.

Jito allows you to submit bundled transactions and simulate them before sending on-chain. Failed simulations incur no cost.

⚠️ Note: Frequent API calls to Jito can trigger rate-limiting (like DDoS protection). In quantitative deployment, it's crucial to design a rate control strategy—which we’ll cover later.

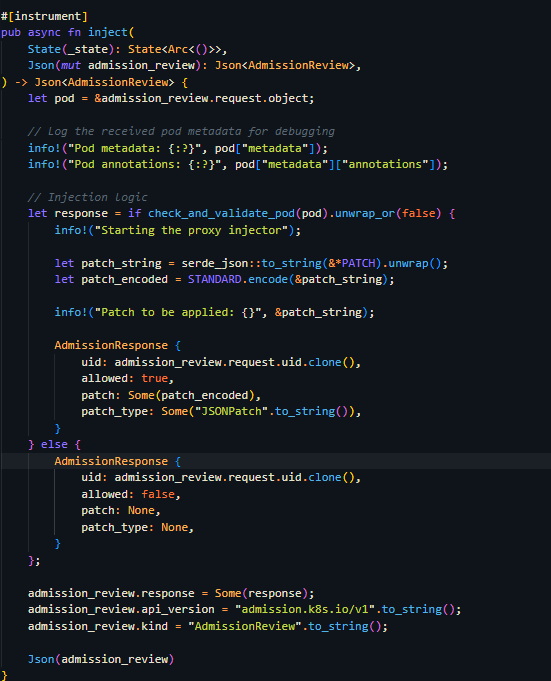

Optimization Strategies

To increase the success rate and profitability of arbitrage, consider optimizing in these areas:

Use Flash Loans

- Amplify returns with borrowed capital.

- Because of atomicity, borrowing and repaying happen within a single transaction—no risk or cost if the transaction fails.

Optimize Compute Unit (CU) Usage

- Solana limits CU per transaction.

- Lower CU consumption increases the chance of successful execution—especially in high-concurrency environments.

Custom Quote & Routing Logic

- Jupiter API requests can be slow.

- Implementing your own quoting algorithm and pathfinding logic can dramatically improve speed and increase arbitrage success.

Faster RPC Node Responses

- Use high-performance RPC nodes (e.g., private or optimized nodes) to avoid frontrunning and reduce latency.

Why Top Arbitrageurs Don't Use Jupiter

Many users rely on Jupiter Aggregator for optimal swap paths across DEXs, but serious atomic arbitrageurs avoid it.

Atomic arbitrage involves executing all operations within a single atomic transaction, which demands high speed and priority. Professionals typically build their own paths and custom transaction bundles to achieve higher frequency and lower latency.

For example, Wintermute, a leading market maker, sends hundreds of arbitrage transactions per minute. Jupiter isn’t fast or flexible enough for this kind of high-frequency trading.

However, Solana has some randomness—like congestion, dropped requests, and competition in transaction ordering—so even Wintermute doesn’t always win.

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

![Is This Programming Paradigm New? [closed]](https://miro.medium.com/v2/resize:fit:1200/format:webp/1*nKR2930riHA4VC7dLwIuxA.gif)

-Classic-Nintendo-GameCube-games-are-coming-to-Nintendo-Switch-2!-00-00-13.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

![M4 MacBook Air Drops to New All-Time Low of $912 [Deal]](https://www.iclarified.com/images/news/97108/97108/97108-640.jpg)

![New iPhone 17 Dummy Models Surface in Black and White [Images]](https://www.iclarified.com/images/news/97106/97106/97106-640.jpg)